Lesson 1: Understanding Your Trading DNA

🎧 Lesson Podcast

🎬 Video Overview

Lesson 1: Understanding Your Trading DNA

🎯 Core Concept: Know Thyself Before You Trade

Your trading psychology is like your financial DNA — unique patterns that determine how you react under pressure, process information, and make decisions. Most DeFi traders lose money not because they lack intelligence, but because they don't understand their psychological wiring.

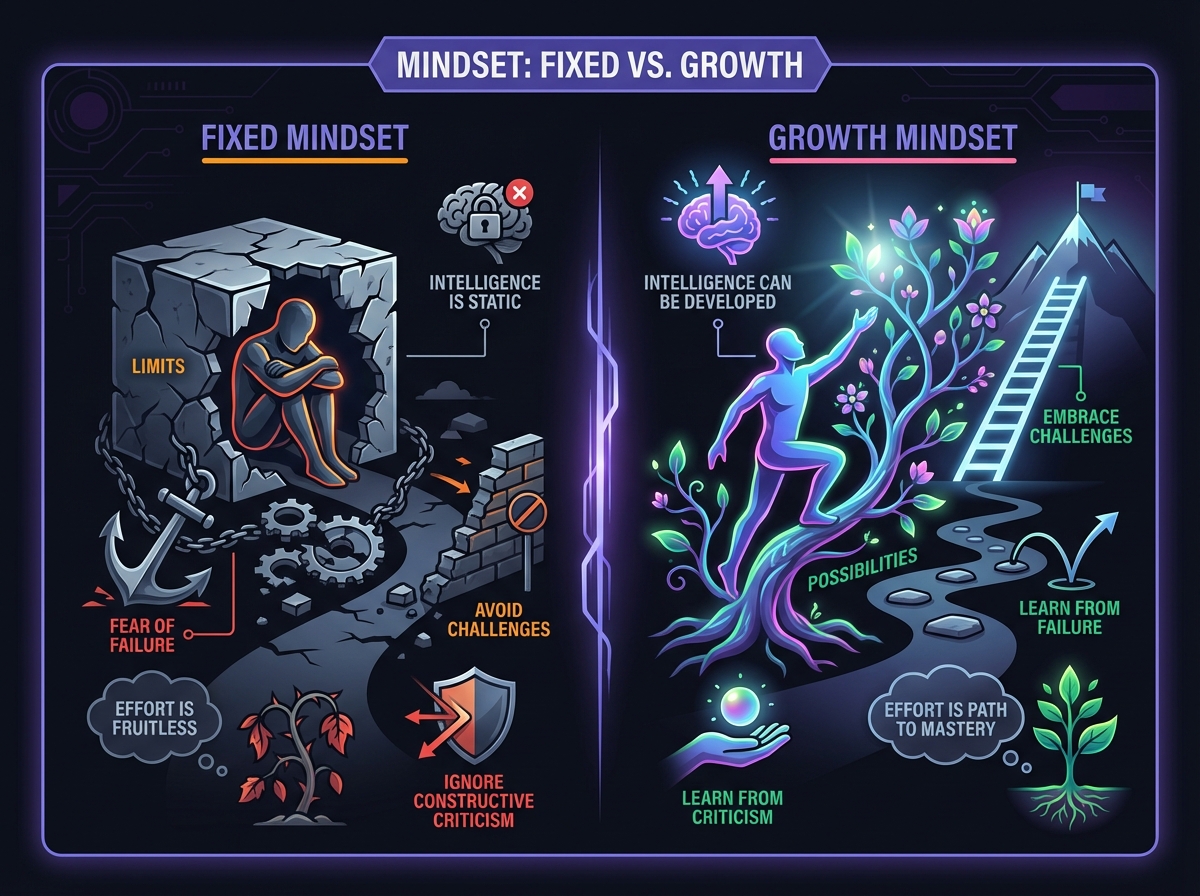

📚 The Two Mindsets That Determine Your DeFi Success

❌ The Fixed Mindset Trader This trader views losses as personal failures and avoids challenging DeFi opportunities to protect their ego. They believe trading ability is innate talent — you either have it or you don't. When the market proves them wrong, they become defensive rather than adaptive. Their mantra is "I should have known better" rather than "What can I learn from this?"

✅ The Growth Mindset Trader This trader sees losses as expensive but valuable education. They embrace complex DeFi protocols as learning opportunities and believe skills improve through deliberate practice. When market conditions change, they adapt quickly rather than stubbornly holding onto outdated strategies. Their response to failure is curiosity, not condemnation.

The fundamental difference: Fixed mindset traders protect their ego. Growth mindset traders protect their capital while expanding their capabilities.

📚 Livermore's Self-Analysis Framework

Jesse Livermore famously said: "I never argue with the tape." Before you can stop arguing with DeFi markets, you must understand what makes you want to argue in the first place.

The Four Questions That Matter • Question 1: What emotions drive my worst DeFi decisions? Fear of missing out on the next 100x? Anger after watching profits evaporate? Pride that prevents you from admitting a protocol choice was wrong?

• Question 2: When do I fight the market instead of flowing with it? Do you double down when prices move against you? Hold onto narratives when the market has clearly moved on?

• Question 3: What patterns do I repeat that cost me money? The same mistakes appearing in different protocols, timeframes, and market conditions reveal your core psychological weaknesses.

• Question 4: How does my ego interfere with profitable decisions? Are you more concerned with being right or being profitable? The market doesn't care about your opinions — only your discipline.

Your DeFi Psychology Profile

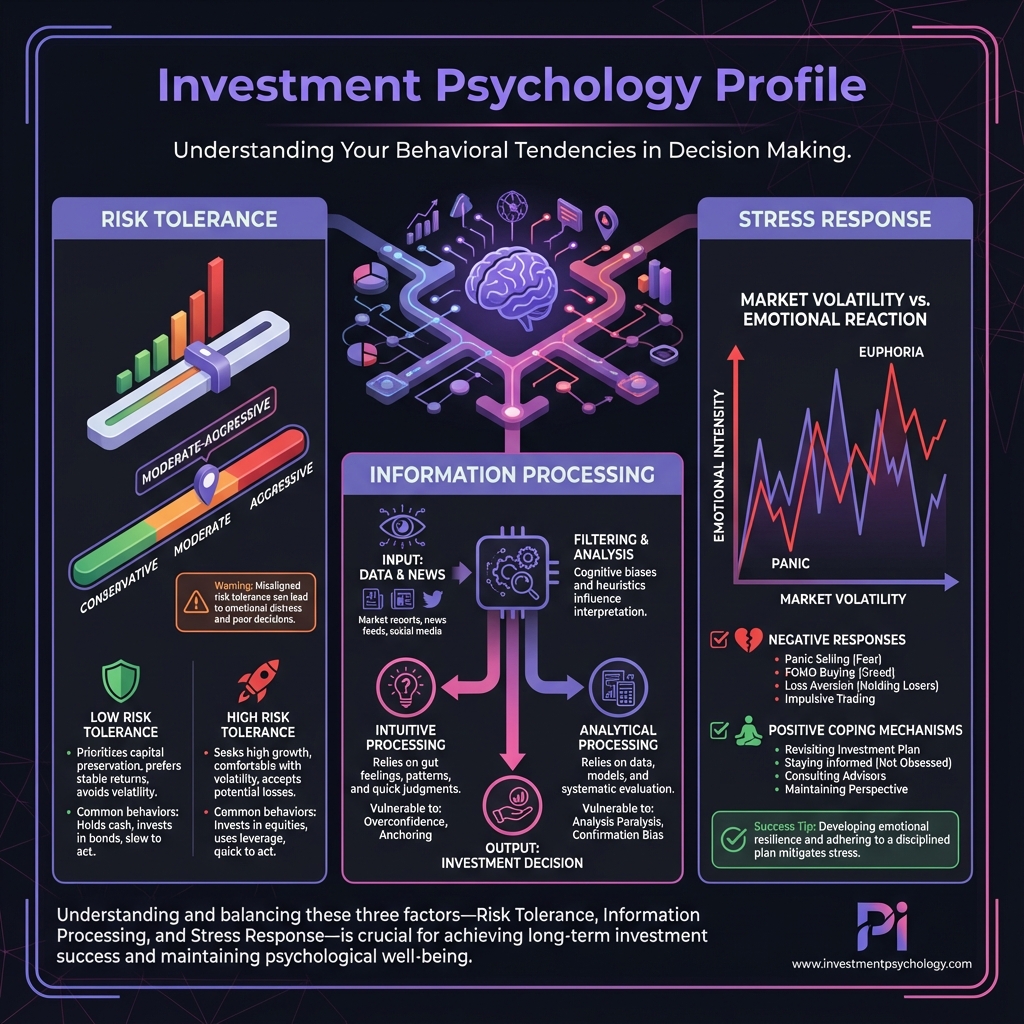

Risk Profile Types:

Conservative traders gravitate toward established protocols like Aave and Compound, prioritizing capital preservation over explosive gains.

Moderate traders create a balanced mix of blue chips and emerging protocols, seeking growth without excessive exposure.

Aggressive traders chase early protocol adoption and high-APY farming opportunities, accepting significant risk for potentially outsized returns.

Information Processing Style Some traders are analytical, requiring deep protocol research and tokenomics analysis before committing capital. Others are intuitive, relying on pattern recognition and market feel developed through experience. A third group follows a social approach, navigating through community sentiment and influencer guidance.

Stress Response Patterns Under pressure, traders typically exhibit one of three responses:

Freeze Response: Analysis paralysis during volatility, unable to execute even well-planned trades.

Fight Response: Revenge trading after losses, trying to "get even" with the market through increasingly risky positions.

Flight Response: Panic selling during drawdowns, crystallizing losses at the worst possible moments.

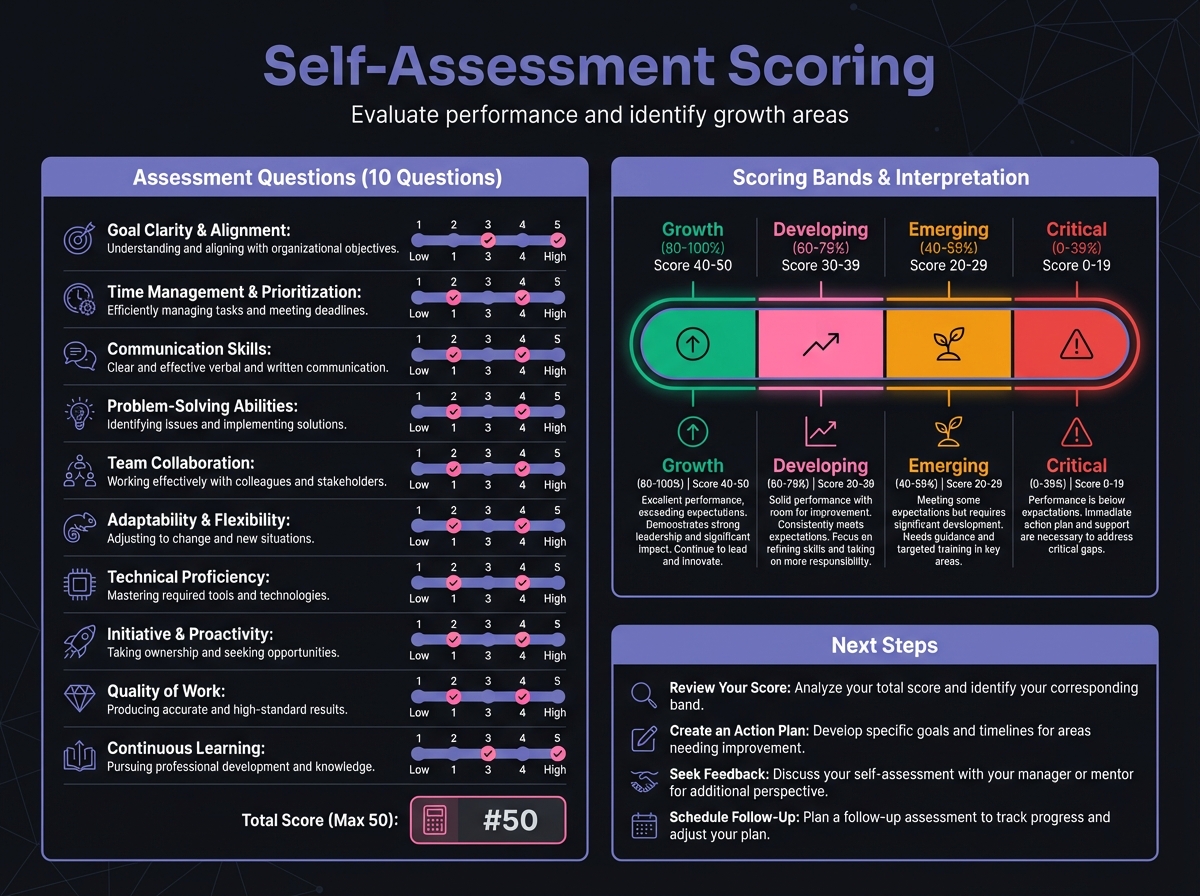

📚 Practical Exercise: The Trading DNA Test

Complete the interactive Trading DNA Assessment below to discover your trading psychology profile:

Launch Trading DNA Assessment →

Understanding Your Score

56-80 points: Growth mindset dominant. You have the psychological foundation for DeFi success but must maintain vigilance against complacency.

40-55 points: Mixed mindset requiring focused work. You show promise but need to address specific psychological gaps holding you back.

Below 40 points: Fixed mindset currently limiting your success. This isn't a life sentence — it's a starting point for transformation.

📚 DeFi-Specific Applications

Fixed Mindset Traps in DeFi The fixed mindset manifests in DeFi through specific behaviors that destroy capital. Holding failing tokens to "prove you're right" transforms investments into expensive ego exercises. Avoiding new protocols because "I don't understand them" limits growth opportunities. Blaming "whales" or "manipulation" for losses prevents learning from mistakes. Refusing to take profits because "it could go higher" reveals greed overriding strategy.

Growth Mindset Advantages The growth mindset transforms every DeFi experience into education. Learning from rug pulls improves due diligence for future investments. Adapting strategies as DeFi evolves keeps you relevant in a rapidly changing landscape. Viewing volatility as opportunity rather than threat opens doors others fear to enter. Building knowledge through experimentation with small amounts creates expertise without catastrophic risk.

📚 This Week's Challenge

Your 7-Day Transformation Plan Days 1-2: Self-Discovery Complete the Trading DNA Test with brutal honesty. Identify your dominant patterns without judgment — awareness precedes change.

Days 3-4: Historical Analysis Journal about your worst DeFi decision in detail. What mindset drove it? What would you do differently with a growth mindset?

Days 5-6: Language Transformation Practice growth mindset language throughout your day. Replace "I don't understand DeFi" with "I don't understand this YET." Notice how this shift changes your approach to challenges.

Day 7: Mission Statement Creation Craft your Personal Psychology Mission Statement — a one-page document outlining your psychological goals, identified weaknesses, and commitment to growth.

Success Metrics Your success this week isn't measured in profits but in psychological progress:

✓ Completed self-assessment with honest scoring — no sugarcoating your weaknesses

✓ Identified top 3 psychological patterns affecting your trading decisions

✓ Created specific plan for shifting toward growth mindset with measurable milestones

✓ Established baseline for measuring psychological improvement over coming weeks

🔑 Key Takeaways

Your trading psychology is your financial DNA - Unique patterns determine how you react under pressure and make decisions

Fixed mindset vs Growth mindset - Fixed mindset traders protect their ego; growth mindset traders protect their capital while expanding capabilities

Self-awareness precedes change - Understanding your psychological wiring is the foundation of trading success

The Trading DNA Test - Complete the assessment to discover your trading psychology profile and identify areas for improvement

DeFi-specific applications - Fixed mindset manifests through specific behaviors that destroy capital; growth mindset transforms every experience into education

Looking Ahead Next week, we'll take your psychology profile and build unbreakable trading discipline around it. You'll learn how the world's best traders transform psychological awareness into consistent profitability.

Remember: The market is a mirror that reflects your psychological state. Master your mind, master the markets.

Assignment: Before next lesson, observe your emotional reactions to every DeFi price movement. Don't judge — just observe. This awareness is the foundation of everything that follows.

Exercise

Complete the Exercise 1

Last updated