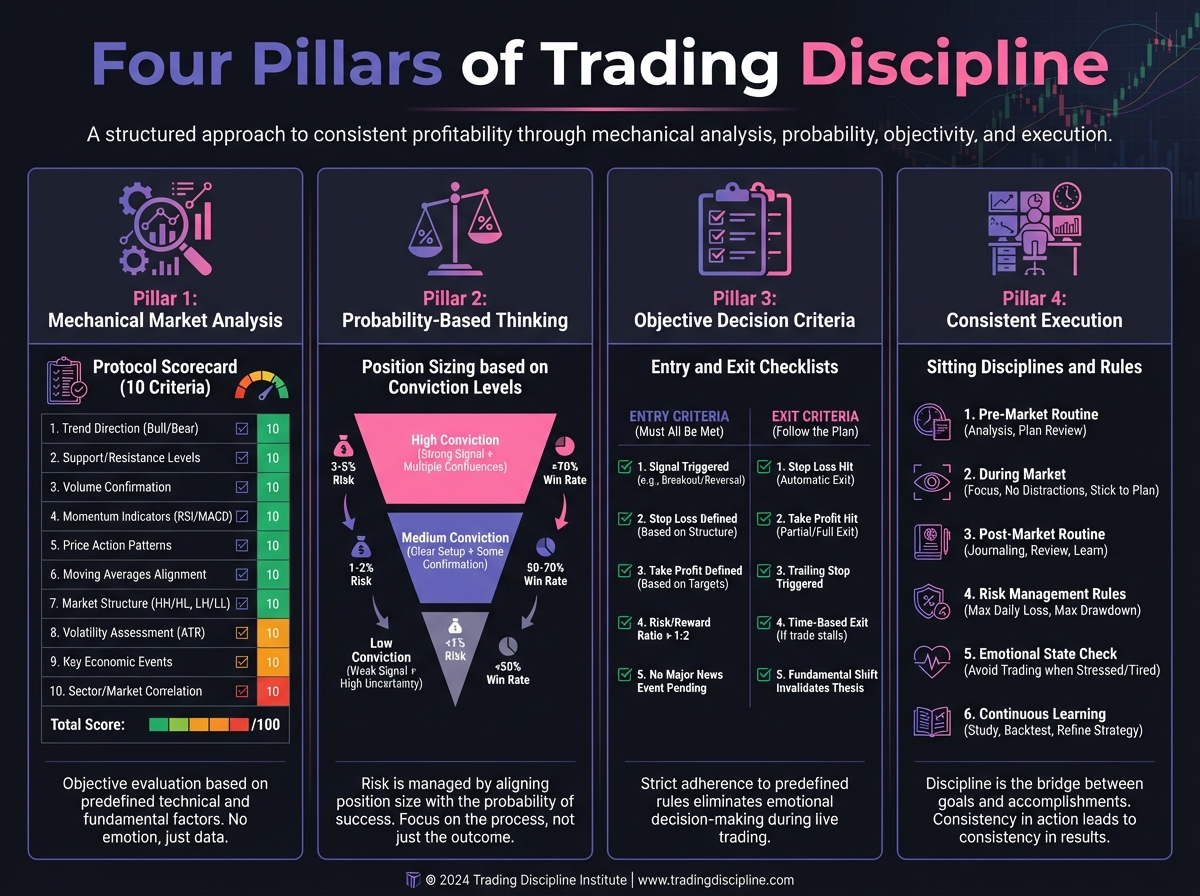

Lesson 2: The 4 Pillars of Trading Discipline

🎧 Lesson Podcast

🎬 Video Overview

Lesson 2: The 4 Pillars of Trading Discipline

🎯 Core Concept: Discipline Beats Intelligence Every Time

Smart people lose money in DeFi every day. Disciplined people build wealth consistently. The difference isn't IQ — it's following a systematic approach that removes emotions from decision-making.

📚 The Four Pillars Framework

Pillar 1: Mechanical Market Analysis 📊 Remove emotions from your research process through systematic evaluation. In DeFi, objectivity is your shield against FOMO and FUD.

DeFi Application Framework:

Your analysis should follow a structured approach — Protocol Scorecards that rate each protocol on specific criteria, TVL Growth Analysis tracking 30/60/90-day trends objectively, Team Assessment using standardized evaluation methods, and Risk Assessment through comprehensive checklists.

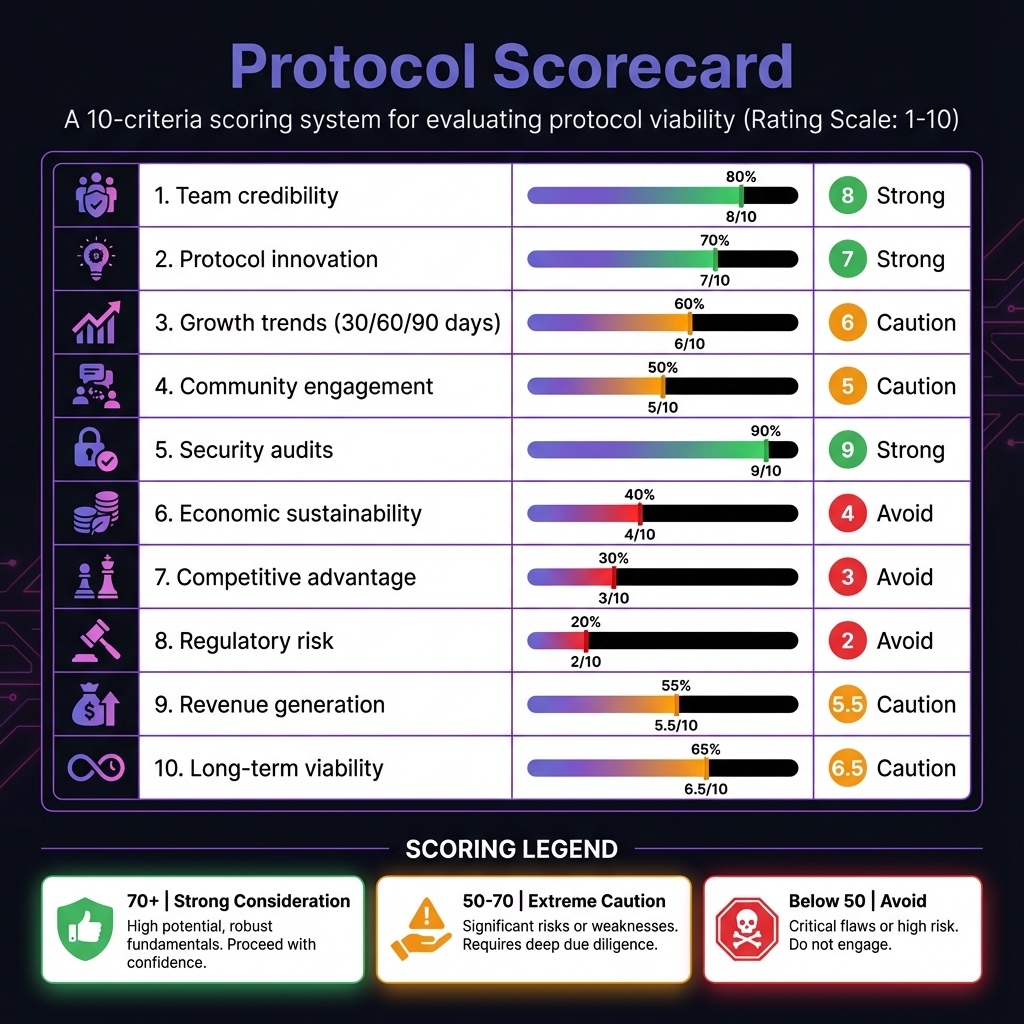

📋 The DeFi Protocol Scorecard (Rate 1-10):

Scoring Guide:

70+ = Strong consideration - Proceed with due diligence and position sizing rules

50-70 = Proceed with caution - Consider smaller position sizes

Below 50 = Avoid - Focus on other opportunities

Evaluation Criteria:

Team credibility and track record

Protocol innovation and utility

Total Value Locked growth trend

Community size and engagement

Smart contract audit quality

Tokenomics sustainability

Competitive moat strength

Regulatory compliance positioning

Revenue generation model

Long-term protocol viability

Pillar 2: Probability-Based Thinking 🎲 Every DeFi decision has odds. Think in probabilities, not certainties. The market doesn't deal in absolutes — neither should you.

⚖️ The 60/40 Position Sizing Rule:

The Rule:

60%+ conviction: Position up to 5% of your portfolio

40-60% conviction: Limit positions to 1-3% of portfolio

Below 40% conviction: No position — period. Hope is not a strategy.

DeFi Probability Assessment Matrix:

Probability Factors to Consider:

Protocol success probability based on historical data

Where you are in the market cycle (bull/bear/accumulation phases)

Regulatory outcome probabilities

Technology adoption curve positioning

Each factor should inform your conviction level, not your emotions. The calculator weights these factors and recommends appropriate position sizing based on your overall conviction percentage.

Pillar 3: Objective Decision Criteria ✅ Pre-decided rules eliminate emotional decision-making in the moment. Your future self, under pressure, cannot be trusted. Your current self must set the rules.

🎯 Entry Criteria Checklist:

The Five Criteria:

Protocol scores 70+ on evaluation scorecard

Position size fits risk management rules

Market conditions align with strategy

Have clear exit strategy defined

Portfolio allocation limits respected

🚪 Exit Criteria Checklist:

The Five Exit Triggers:

Stop-loss level hit (20% for speculative, 30% for experimental)

Fundamental thesis broken (protocol exploit, team departure)

Profit target achieved (2x for core holdings, 5x for moonshots)

Portfolio rebalancing required

Better opportunity identified

Pillar 4: Consistent Execution 🔄 The rules only work if you follow them every single time. No exceptions. No "just this once."

Livermore's Wisdom: "It was never my thinking that made big money for me. It was my sitting."

🧘 The Sitting Disciplines for DeFi:

• Don't check prices more than 3x per day • No trading decisions during high emotional states • Weekly portfolio review only (not daily panic adjustments) • Stick to position sizing rules even when "this one is different"

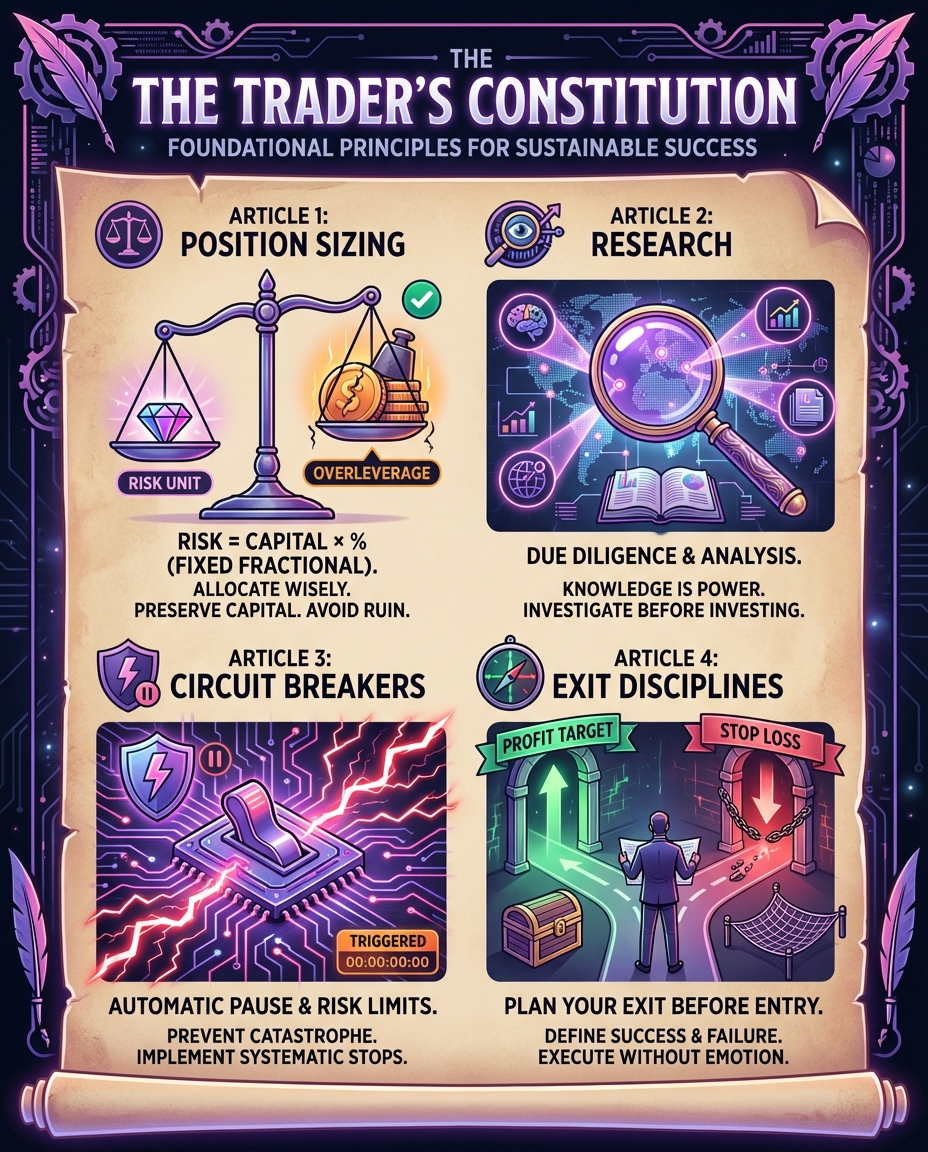

📜 Your Personal DeFi Trading Constitution

Create your unbreakable set of trading laws. This is your contract with yourself.

Article 1: Position Sizing 💰 Maximum 5% in any single protocol. Maximum 20% in experimental DeFi. Always keep 20% cash for opportunities. These aren't guidelines — they're laws.

Article 2: Research Requirements 🔍 Minimum 5 hours research before any investment. Always read smart contract audits. Check team backgrounds on LinkedIn and Twitter. No shortcuts, no exceptions.

Article 3: Emotional Circuit Breakers 🛑 No trading decisions after 20% portfolio moves in either direction. Enforce a 24-hour cooling period after any major loss. No revenge trading — ever.

Article 4: Exit Disciplines 📈 Take 25% profits at 2x, let the rest run with the house's money. Cut losses at predetermined levels without hesitation. Rebalance monthly regardless of performance.

🧪 The Discipline Testing Exercise Week 2 Challenge: The Paper Trading Discipline Test 📝 Your Mission:

Select 5 current DeFi opportunities

Apply your four-pillar analysis to each

Decide position sizing based on conviction levels

Track decisions for 7 days without actually investing

Measure how often you wanted to deviate from your rules

⚠️ Common Discipline Failures in DeFi:

The most expensive mistakes come from increasing position size mid-trade because "it's working," skipping research because "everyone else is buying," holding losing positions hoping for recovery, and taking profits too early due to fear of giving back gains.

💪 Building Your Discipline Muscle Daily Practice Routine 🌅 Morning: Review your trading constitution before markets open

🤔 Pre-decision: Run through your four-pillar checklist systematically

📓 Post-decision: Journal why you followed or broke your rules

🌙 Evening: Grade your discipline for the day (1-10 score)

Weekly Review Questions • What rules did I follow consistently? • Where did emotions override discipline? • How can I strengthen weak areas? • What environmental changes would help?

Interactive Discipline Checklist

Use this interactive checklist to track your discipline across all four pillars:

🔑 Key Takeaways

Discipline beats intelligence - Smart people lose money; disciplined people build wealth consistently

The Four Pillars Framework - Mechanical Market Analysis, Probability-Based Thinking, Objective Decision Criteria, and Consistent Execution

The DeFi Protocol Scorecard - Systematic evaluation removes emotions from research process

The 60/40 Position Sizing Rule - Think in probabilities, not certainties

Your Personal DeFi Trading Constitution - Create unbreakable trading laws that eliminate emotional decision-making

✅ Success Metrics Your progress this week will be measured by:

• Created personal DeFi Trading Constitution with specific, measurable rules

• Completed 7-day paper trading discipline test with full documentation

• Identified top 3 areas where your discipline typically breaks down

• Established daily/weekly discipline tracking system that you'll actually use

🔮 Looking Ahead Next week, we'll learn to recognize and neutralize the emotions that destroy even the best trading plans. You'll discover how fear and greed manifest in DeFi markets and build specific countermeasures.

💎 Remember: In DeFi, the protocol with the best technology doesn't always win. The trader with the best discipline does.

📌 Assignment: This week, document every moment you want to break your rules. Don't judge — just observe. These moments reveal where your discipline needs reinforcement.

Exercise

Complete the Exercise 2

Last updated