Lesson 12: The Elite Trader's Mental Game

🎧 Lesson Podcast

🎬 Video Overview

Lesson 12: The Elite Trader's Mental Game

🎯 Core Concept: Mastery is a Journey, Not a Destination

You now possess the complete psychological toolkit for DeFi success. This final lesson integrates everything into a cohesive elite performance system and provides the roadmap for continuous improvement and mastery development.

📚 The Hierarchy of Trading Mastery

The Five Levels of Mastery:

Level 1: Survival (Months 1-6) 🌱 You're learning basic DeFi mechanics and protocols while making expensive psychological mistakes regularly. Emotional decision-making dominates rational analysis as you focus on short-term gains over long-term wealth building. Key development: Establish basic discipline and risk management to survive the learning curve.

Level 2: Competence (Months 6-18) 📚 Consistent application of learned principles emerges with reduced frequency of major psychological errors. You begin developing personal trading style and approach while focusing on process improvement over outcome obsession. Key development: Build systematic approach and emotional regulation that creates consistency.

Level 3: Proficiency (Years 1-3) 💪 Reliable execution of your trading system with few deviations becomes natural. Strong emotional control during volatile periods distinguishes you from amateurs. You adapt strategy to different market conditions while building a track record of consistent performance. Key development: Refine system and develop specialized expertise that creates edge.

Level 4: Expertise (Years 3-7) 🎓 Deep understanding of DeFi ecosystem and market dynamics sets you apart. Intuitive feel for market psychology and sentiment shifts guides decisions. You identify unique opportunities others miss while teaching and mentoring developing traders. Key development: Innovation and unique edge development that can't be copied.

Level 5: Mastery (Years 7+) 👑 Effortless execution with unconscious competence defines your trading. Consistent performance across all market conditions becomes your signature. Your unique insights and approaches become what others study. Focus shifts to legacy and contribution beyond personal wealth. Key development: Continuous learning and adaptation without ego.

⏰ Livermore's Ultimate Lesson: Time and Money "Losing money is the least of my troubles. A man can always come back and make money. But I don't know of any man who ever got back time."

The Elite Perspective Wealth is renewable, time is not — prioritize accordingly. Focus on sustainable, long-term approaches over quick gains that cost years of progress. Build systems that free up time while building wealth automatically. Invest time in learning and relationships, not just returns, because compound knowledge beats compound interest.

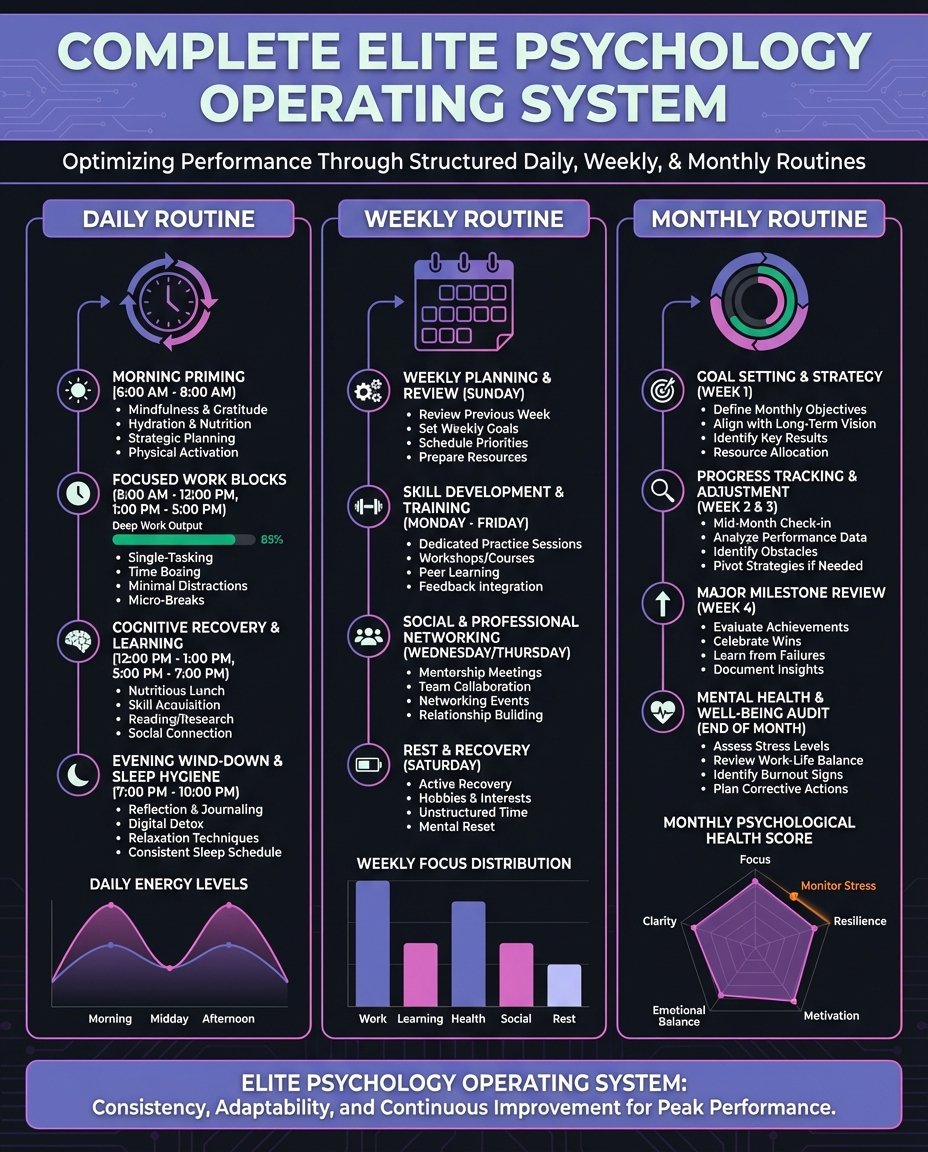

🧠 The Complete Elite Psychology Operating System

Daily Elite Routines Morning Excellence Protocol (20 minutes) begins with physical preparation through hydration, movement, and optimal environment setup. Mental preparation follows with meditation, affirmations, and intention setting for the day. Market preparation involves reviewing your portfolio, conditions, and priorities. System alignment confirms adherence to trading rules and objectives before markets test you.

Peak Performance Work Session (90-120 minutes) starts with flow state creation by eliminating distractions and focusing on single tasks. Deep work execution involves research, analysis, or strategic decisions made with full cognitive resources. Quality control applies checklists and bias-checking frameworks to every decision. Documentation records decisions, reasoning, and learning opportunities for future reference.

Evening Excellence Review (15 minutes) includes performance assessment rating decision quality and system adherence. Learning extraction identifies lessons from the day's activities for continuous improvement. Gratitude practice acknowledges progress and opportunities, maintaining abundance mindset. Tomorrow's preparation sets priorities and intentions while your subconscious processes overnight.

Weekly Elite Practices Strategic Portfolio Review (60 minutes) involves complete performance analysis across all positions with brutal honesty. Market condition assessment ensures strategy alignment with current reality. Risk management review makes necessary adjustments before problems emerge. Opportunity pipeline development prioritizes next investments systematically.

System Optimization Session (45 minutes) reviews the week's decision quality and process adherence objectively. Pattern identification in successful versus unsuccessful choices reveals improvement areas. Tool and framework refinement based on results keeps your edge sharp. Planning improvements for the upcoming week's execution maintains momentum.

Learning and Development (120 minutes) includes deep study of your specialized knowledge area for competitive advantage. Review of elite trader biographies and case studies provides vicarious experience. Skill development in weak areas identified during review prevents blind spots. Network building and mastermind participation accelerates learning through collaboration.

Monthly Elite Assessments Complete Psychology Audit reviews all psychological metrics and tracking data to measure progress. Identify dominant emotional patterns and their market impact on returns. Assess progress against psychological development goals set previously. Calibrate confidence levels and prediction accuracy to maintain realistic self-assessment.

System Performance Analysis backtests system performance across different market conditions for robustness. Compare systematic versus discretionary decision outcomes to reinforce discipline. Identify systematic improvements and edge optimizations based on data. Update system based on market evolution and learning to stay relevant.

Mastery Development Planning assesses current mastery level and development trajectory honestly. Identify next level skills and knowledge requirements for continued growth. Plan learning objectives and skill development priorities strategically. Set challenges that stretch current capabilities appropriately without overwhelming.

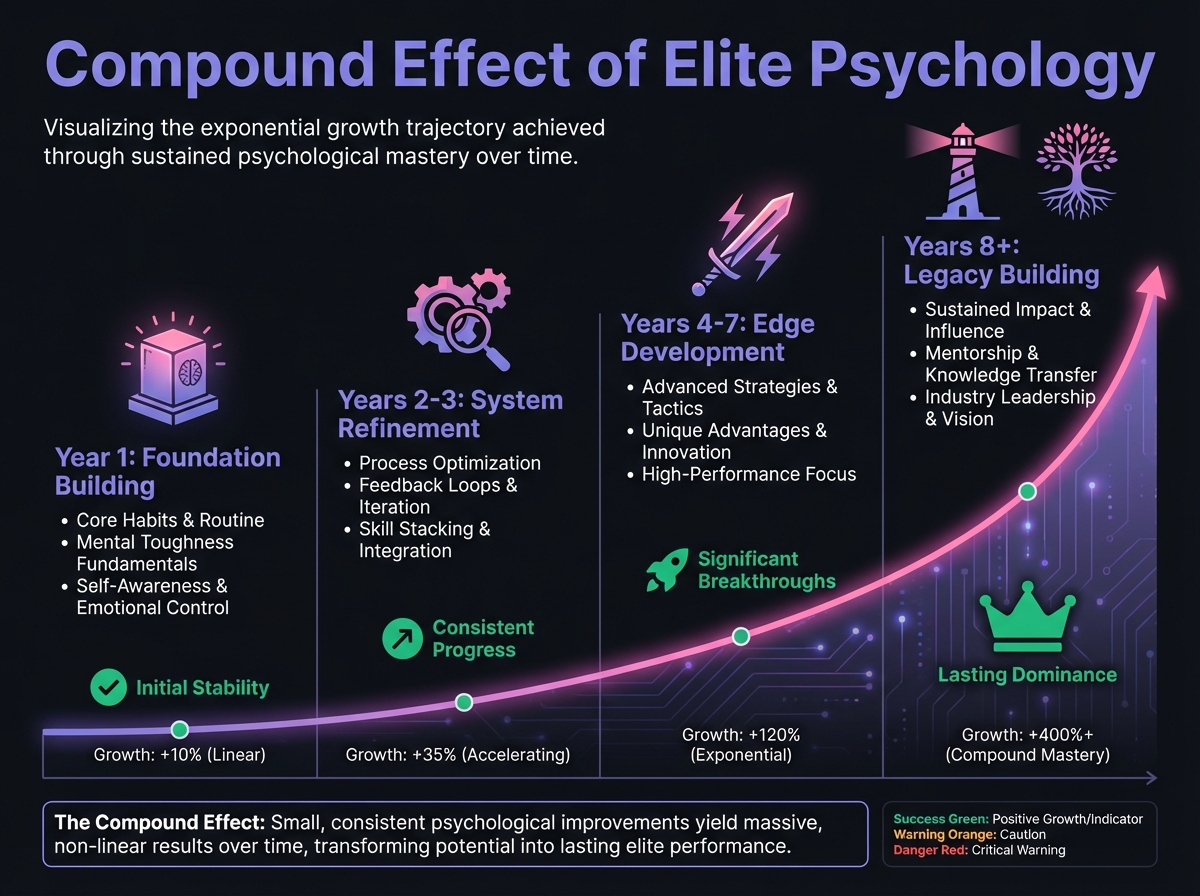

📊 The Compound Effect of Elite Psychology

Year 1: Foundation Building Establish consistent daily and weekly routines that become automatic. Develop basic emotional regulation and discipline that prevents disasters. Build systematic approach to research and decision-making for consistency. Create accountability systems and measurement frameworks for progress tracking. Expected Outcomes: Reduced psychological errors and improved consistency.

Years 2-3: System Refinement Optimize personal trading methodology based on accumulated experience. Develop specialized expertise in chosen DeFi focus areas for competitive advantage. Build network of elite peers and mentors for continuous learning acceleration. Start teaching and helping others to deepen your own understanding. Expected Outcomes: Consistent profitability and recognized expertise.

Years 4-7: Edge Development Create unique insights and approaches that others cannot easily copy. Develop intuitive market sense through accumulated experience and pattern recognition. Build systems that work independently of constant attention for true wealth. Focus on scaling impact beyond personal portfolio performance. Expected Outcomes: Industry recognition and significant wealth creation.

Years 8+: Legacy Building Share knowledge and insights to elevate entire DeFi ecosystem. Mentor next generation of elite DeFi investors and builders. Focus on sustainable long-term impact over short-term gains. Integrate trading success with broader life purpose and meaning. Expected Outcomes: Lasting impact and fulfillment beyond financial success.

💡 Advanced Elite Performance Concepts The Paradox of Control Elite Understanding: The more you try to control market outcomes, the less control you actually have. Markets humble those who demand certainty.

Application: Focus intensely on your process, preparation, and decision-making while remaining completely detached from specific outcomes. Control what you can, accept what you can't.

The Leverage of Psychology Elite Understanding: 1% improvement in psychology creates 10% improvement in results through compound effects across all decisions.

Application: Invest disproportionate time and energy in psychological development relative to technical or fundamental analysis. Your mind is your ultimate trading tool.

The Antifragility Principle Elite Understanding: Build systems that get stronger from volatility and stress rather than being damaged by them.

Application: Design your psychology and systems to benefit from market chaos, uncertainty, and extreme conditions. What breaks others makes you stronger.

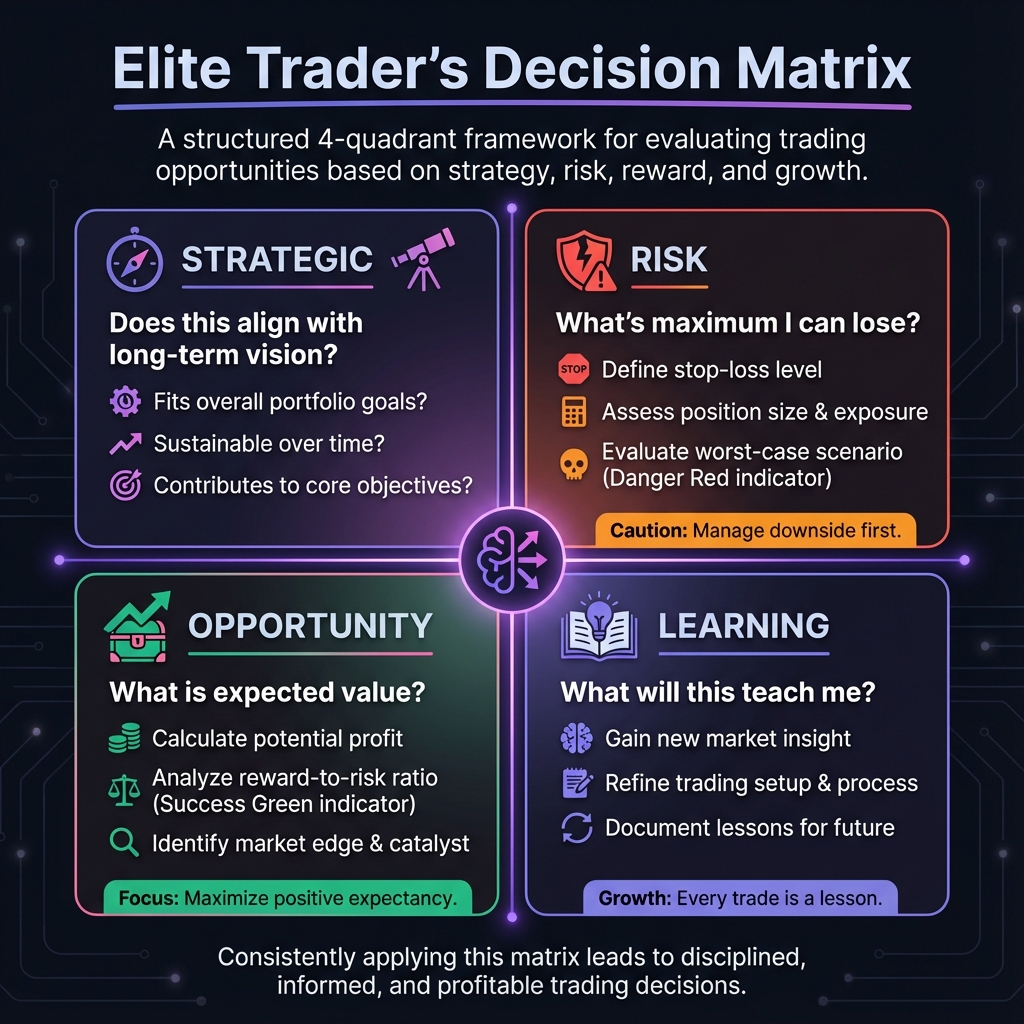

📚 The Elite Trader's Decision Matrix

For Every Major Decision, Ask: Strategic Questions: Does this align with my long-term vision and objectives? What would the most successful trader I know do in this situation? Am I making this decision from fear, greed, or logic?

Risk Questions: What's the maximum I can lose if everything goes wrong? How will this decision affect my overall portfolio risk profile? Can I sleep well at night with this position size and risk level?

Opportunity Questions: What is the expected value of this decision over multiple iterations? What opportunities might I miss by taking this position? Does this fit my current market cycle positioning strategy?

Learning Questions: What will this decision teach me regardless of outcome? How can I structure this to maximize learning value? What feedback loops will help me improve future similar decisions?

🏛️ Building Your Elite Trader Legacy The Four Pillars of Trading Legacy Pillar 1: Consistent Excellence means maintaining a track record of superior risk-adjusted returns across multiple market cycles. Disciplined adherence to principles during both easy and difficult periods defines character. Continuous improvement and adaptation without abandoning core methodology shows wisdom.

Pillar 2: Knowledge Contribution involves sharing insights and methods that help others achieve success. Teaching and mentoring elevates the overall quality of DeFi participation. Publishing or speaking about principles and approaches that work creates lasting impact.

Pillar 3: Ecosystem Building requires supporting projects and people that advance the DeFi ecosystem. Using wealth and influence to promote positive developments multiplies impact. Building connections and networks benefits the broader community exponentially.

Pillar 4: Personal Integration aligns trading success with broader life values and purpose. Maintaining relationships and health while pursuing financial excellence creates sustainability. Using wealth as a tool for impact rather than just accumulation brings fulfillment.

📋 Your Personal Elite Development Plan 90-Day Mastery Sprint Days 1-30: Foundation Solidification Implement all daily and weekly routines consistently without exception. Complete psychological assessment and identify top 3 development areas for focus. Build accountability systems and measurement frameworks for tracking. Execute system with small position sizes to build confidence gradually.

Days 31-60: System Optimization Analyze first month's performance and refine approach based on data. Increase position sizes gradually as confidence and competence grow together. Develop specialized expertise focus area and structured learning plan. Begin teaching or sharing knowledge to test and deepen understanding.

Days 61-90: Elite Integration Operate system with full position sizes and complete confidence. Start developing unique insights and approaches based on experience. Build network connections with other serious DeFi investors. Plan next phase of development and skill building for continuous growth.

Annual Elite Review Questions Performance: How did my actual results compare to my system's expected performance?

Psychology: What emotional patterns helped versus hurt my performance this year?

Learning: What new knowledge or skills significantly improved my results?

Systems: How did my methodology evolve and what improvements are needed?

Contribution: How did I help others and contribute to the DeFi ecosystem?

Integration: How well did trading success integrate with my broader life goals?

🚀 The Never-Ending Journey Elite performance is not a destination but a continuous journey of growth, learning, and contribution. The principles in this course provide the foundation, but your unique path to mastery will be shaped by your individual psychological makeup and natural strengths, the specific market conditions and opportunities you encounter, the relationships and mentors who guide your development, and the unique insights and innovations you discover through experience.

🔑 Key Takeaways

Mastery is a journey, not a destination - You now possess the complete psychological toolkit for DeFi success

The Hierarchy of Trading Mastery - Five levels from Survival to Mastery, each with specific development focus

The Elite Trader's Decision Matrix - Integrates all course concepts into a systematic decision-making framework

Continuous improvement - Mastery requires ongoing learning and adaptation without ego

Integration and contribution - Teaching and mentoring others accelerates your own mastery development

✅ Final Success Metrics Your elite psychology mastery achievements:

• Created comprehensive elite psychology operating system with daily, weekly, and monthly practices

• Established long-term mastery development plan with specific milestones and objectives

• Built decision-making framework that integrates all course concepts systematically

• Committed to continuous learning and improvement mindset for ongoing development

• Started contributing to others' success through teaching, mentoring, or knowledge sharing

• Integrated trading psychology mastery with broader life vision and purpose

💎 Your DeFi Psychology Mastery Journey Begins Now You have the tools. You have the knowledge. You have the framework.

The only question remaining is: Will you commit to the daily practice and continuous improvement required to join the elite 5% of consistently profitable DeFi traders?

The choice — and the results — are entirely yours.

📌 Final Assignment: Write a letter to yourself one year from now. Describe the trader you will become, the disciplines you will maintain, and the success you will achieve. Seal it. Open it in 365 days. You'll be amazed at your transformation.

Exercise

Complete the Exercise 12

Last updated