Lesson 7: Developing Probability-Based Thinking

🎧 Lesson Podcast

🎬 Video Overview

Lesson 7: Developing Probability-Based Thinking

🎯 Core Concept: Think Like a Casino, Not a Gambler

Successful DeFi traders don't predict the future — they make bets with positive expected value and let probability work in their favor over time. The shift from "certainty seeking" to "probability thinking" separates professionals from perpetual losers.

📚 The Illusion of Control in DeFi Markets

Your brain craves certainty and control, but DeFi markets are inherently uncertain and chaotic. This mismatch creates three dangerous psychological traps that destroy accounts.

Prediction Addiction makes you believe you can accurately forecast prices, turning trading into fortune-telling. Outcome Fixation causes you to judge decisions by results instead of process — a winning trade from bad analysis reinforces destructive habits. Certainty Seeking leads to only making trades you're "sure" about, paralyzing you while opportunities pass by.

The truth: There is no certainty in markets, only probabilities. Embrace this or be destroyed by it.

📚 Base Rate Neglect: The DeFi Edition

Base rates represent the historical frequency of events in similar circumstances — your reality check against hopium.

Consider these sobering DeFi base rates: Only 5-10% of new token launches succeed long-term. Merely 20-30% of DeFi protocols survive beyond 2 years. Less than 1% of "guaranteed 100x" claims actually materialize.

The Trap: You ignore these base rates because "this one is different" or "I have special information." Your brain wants to believe you've found the exception.

The Fix: Always start with base rates as your anchor, then adjust for specific circumstances. If you think a new protocol has a 90% chance of success when the base rate is 10%, you're probably deluding yourself.

💭 From Gambling to Calculated Speculation

The Gambling Mindset Says: "I know this token will moon" — confusing hope with analysis. "I never lose money on DeFi" — denying reality to protect ego. "Technical analysis predicts the future" — seeing patterns in randomness. "This APY is sustainable forever" — ignoring economic fundamentals.

The Probability Mindset Says: "This token has a 60% chance of 2x in 6 months" — acknowledging uncertainty. "I win 55% of my trades with 2:1 average reward:risk" — focusing on edge over time. "Charts show probability ranges, not certainties" — using tools appropriately. "This APY reflects current risk-adjusted demand" — understanding market dynamics.

The difference isn't intelligence — it's intellectual honesty about uncertainty.

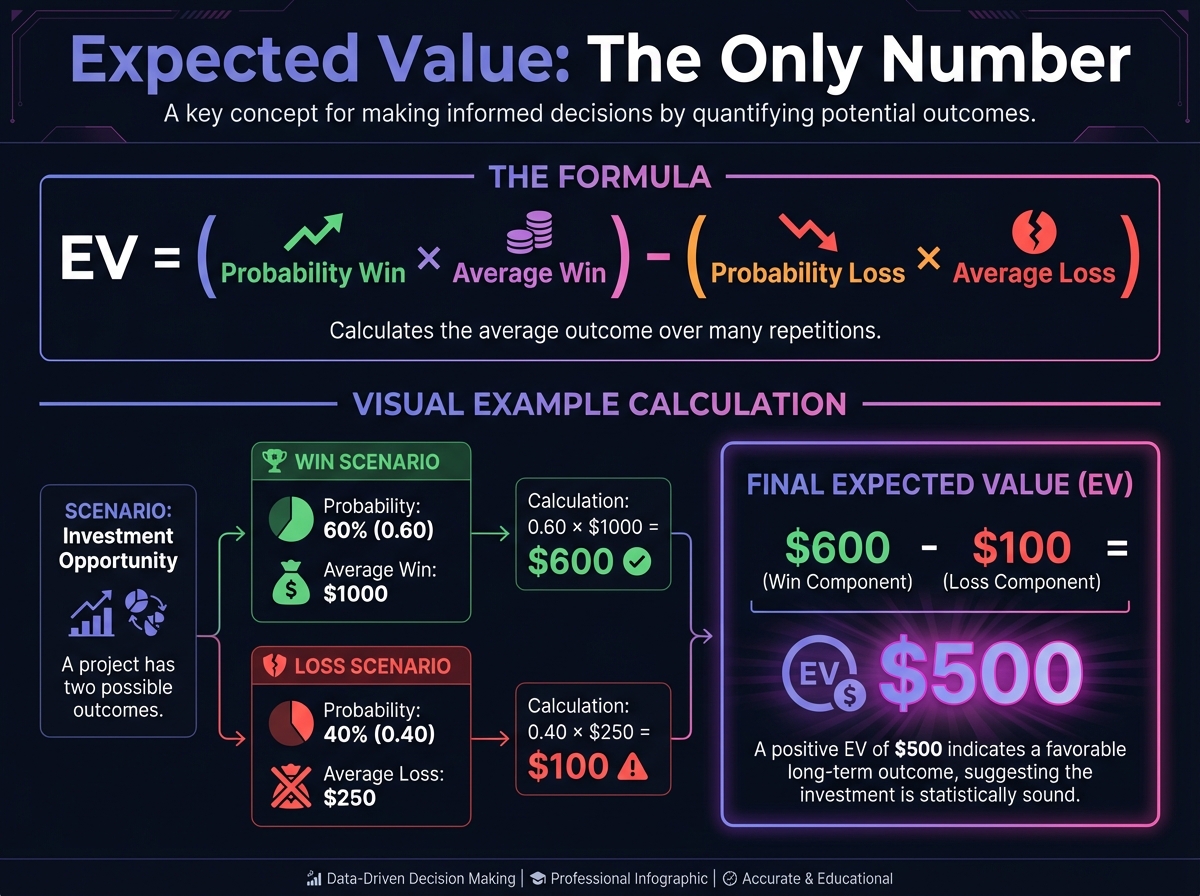

💰 Expected Value: The Only Number That Matters Expected Value (EV) determines whether a bet is worth taking, regardless of individual outcomes.

Formula: (Probability of Win × Average Win) - (Probability of Loss × Average Loss)

DeFi Example 1: New Protocol Launch Consider a $500 investment with a 30% chance of 5x return ($2,500) and 70% chance of 50% loss ($250).

Expected Value = (0.3 × $2,000 profit) - (0.7 × $250 loss) = $600 - $175 = +$425

This positive expected value makes it a good bet — if you can repeat similar bets many times. One instance isn't enough for probability to work.

DeFi Example 2: High-APY Farming An 80% chance of earning 100% APY for 6 months versus 20% chance of total loss through protocol exploit.

Expected Value = (0.8 × 50% gain) - (0.2 × 100% loss) = 40% - 20% = +20%

Positive expected value, but only if your position size accounts for the 20% ruin risk. EV without proper sizing is meaningless.

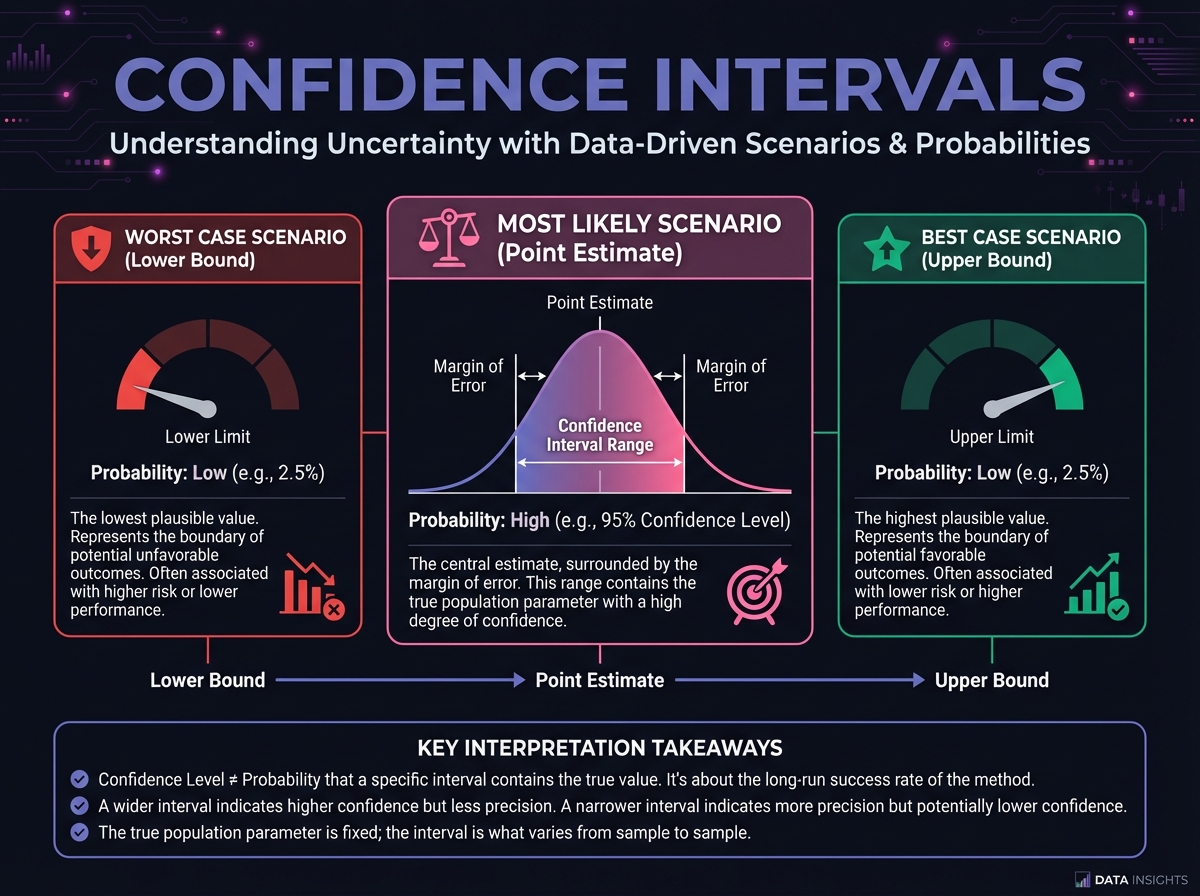

📈 Confidence Intervals vs Point Predictions

Wrong Approach: "ETH will hit $5,000 by end of year" — false precision that breeds overconfidence.

Right Approach: "I'm 70% confident ETH will be between $2,000-$6,000 by year-end" — acknowledging uncertainty while maintaining analytical rigor.

Confidence intervals force you to acknowledge uncertainty, help with position sizing (wider intervals demand smaller positions), and prevent the overconfidence that destroys accounts. Your brain wants certainty; markets demand humility.

🕐 The Planning Fallacy in DeFi We systematically underestimate completion times and overestimate success probabilities — a cognitive bias that costs fortunes in DeFi.

DeFi Manifestations: You believe protocol roadmaps will be completed on schedule despite consistent delays across the industry. You expect bear markets to end sooner than the 2-3 year historical average. You underestimate the decades required for mainstream DeFi adoption, thinking months will suffice.

🔍 The Fix: Reference Class Forecasting

Ask yourself: How long did similar protocols take to reach comparable milestones? What's the historical duration of crypto bear markets? What's the typical timeline for financial innovation adoption? Let history guide expectations, not hope.

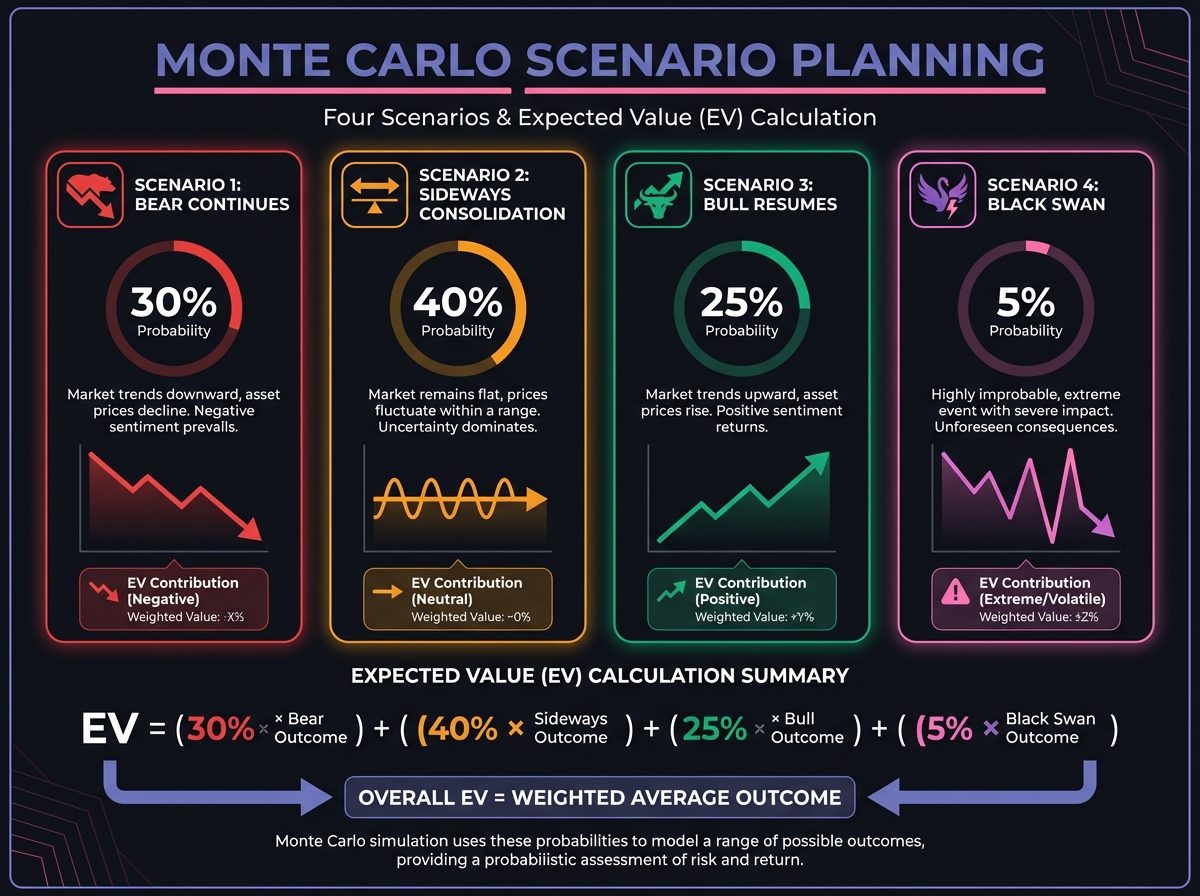

🎲 Monte Carlo Thinking for DeFi Portfolios

Instead of single predictions, consider multiple scenarios with assigned probabilities.

Scenario Planning Example: Bull Market (25% probability): Portfolio returns +300% driven by institutional adoption

Moderate Bull (40% probability): Portfolio returns +50% from steady ecosystem growth

Sideways Market (20% probability): Portfolio returns -10% to +10% amid regulatory uncertainty

Bear Market (15% probability): Portfolio returns -60% in crypto winter conditions

Expected Portfolio Return: (0.25×300%) + (0.4×50%) + (0.2×0%) + (0.15×-60%) = +86%

This framework beats single-point predictions by acknowledging multiple futures exist simultaneously.

📚 Calibrating Your Prediction Accuracy

Most people are terribly overconfident in their predictions. Here's how to fix that.

The Confidence Calibration Exercise: For your next 20 DeFi predictions, assign confidence levels (50%, 60%, 70%, 80%, 90%) and track actual outcomes. Well-calibrated traders see 60% confidence predictions succeed ~60% of the time and 80% confidence predictions succeed ~80% of the time.

Reality for Most Traders: Their 80% confidence predictions only succeed 65% of the time. Their 90% confidence predictions merely hit 75% accuracy. This overconfidence gap destroys capital through oversized positions.

Track your calibration religiously — self-awareness beats market knowledge.

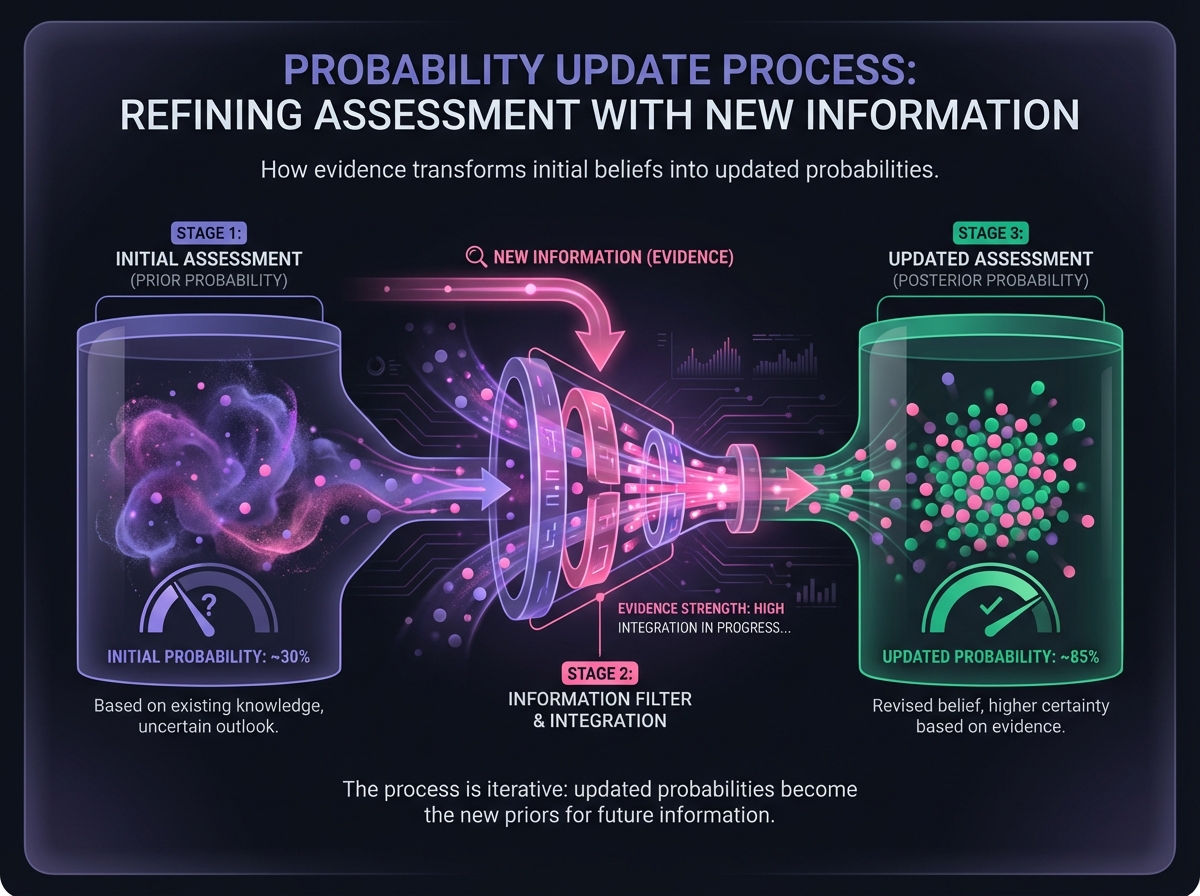

🔄 Bayesian Updates in DeFi

Start with base rates, then systematically update based on new information.

Example: Protocol Investment Decision Starting Point (Base Rate): 20% of new DeFi protocols succeed long-term

New Information Updates:

Strong team with previous exits: +15%

Multiple security audits passed: +10%

Major VC backing: +10%

Clear revenue model: +5%

Updated Probability: 20% + 40% = 60% chance of success

This 60% probability justifies a larger position than the base 20%, but still respects uncertainty. Bayesian thinking prevents both excessive pessimism and dangerous optimism.

🤔 Managing Uncertainty vs Risk Risk involves situations where probabilities can be calculated — coin flips, dice rolls, historical lending rates on established protocols.

Uncertainty involves situations where probabilities are unknown — regulatory responses to DeFi, technological paradigm shifts, black swan events.

Strategy for Uncertainty: Use smaller position sizes when probabilities can't be calculated. Diversify more widely to avoid concentrated uncertainty. Demand higher potential returns to compensate for unknowable risks. Reassess positions more frequently as information emerges.

DeFi lives at the intersection of risk and uncertainty — respect both.

📝 Practical Probability Exercises Exercise 1: DeFi Opportunity Assessment For each potential investment, systematically estimate probability of 2x return, probability of breaking even, probability of 50%+ loss, expected time horizon, then calculate expected value and confidence intervals. This framework replaces gut feelings with analysis.

Exercise 2: Prediction Tracking Make 10 specific DeFi predictions with assigned confidence levels. Track outcomes over 3 months. Analyze your calibration accuracy and identify overconfidence patterns. This exercise reveals your true prediction ability versus perceived ability.

Exercise 3: Scenario Planning Create 4 scenarios for DeFi markets over the next 12 months. Assign probabilities to each scenario. Calculate portfolio expected returns across all scenarios. Adjust position sizes based on composite expected value. This prevents betting everything on one future.

⚠️ Common Probability Thinking Errors The Conjunction Fallacy Thinking "ETH hits $10k AND Bitcoin hits $200k" is more likely than just "crypto bull market" — specificity feels more real but is mathematically less probable.

The Gambler's Fallacy Believing "I've lost 5 trades in a row, so the next must win" — past independent events don't affect future probabilities.

Hot-Hand Fallacy Assuming winning streaks will continue indefinitely — regression to the mean is inevitable, usually when you've sized up.

📚 Building Probabilistic Decision Systems

The Expected Value Spreadsheet Track all DeFi opportunities with estimated probabilities for different outcomes, position sizes based on expected value, and actual outcomes for learning and calibration. This systematic approach beats intuition over time.

The Scenario Dashboard Conduct monthly reviews of different market scenarios. Update probabilities based on new information. Rebalance portfolio based on changed expectations. This keeps you ahead of shifting probabilities.

🔑 Key Takeaways

Think like a casino, not a gambler - Make bets with positive expected value and let probability work in your favor over time

The Illusion of Control - Prediction Addiction, Outcome Fixation, and Certainty Seeking destroy accounts

Base Rate Neglect - Always start with historical base rates as your anchor, then adjust for specific circumstances

Calibrate your predictions - Track your prediction accuracy to improve your probability estimates

Expected Value Framework - Calculate EV before every trade; if EV is negative or unclear, don't trade

✅ Success Metrics Your probability mastery this week:

• Created expected value framework for all DeFi investment decisions

• Completed prediction tracking exercise with confidence calibration

• Built scenario planning model for portfolio allocation

• Identified personal probability thinking errors and correction systems

• Started making position sizing decisions based on EV rather than feelings

🔮 Looking Ahead Next week, we'll optimize your cognitive performance and create flow states for better DeFi research and decision-making. You'll learn to think clearly when it matters most.

💎 Remember: The market doesn't care about your predictions. It only cares about probabilities. Trade accordingly.

📌 Assignment: This week, calculate the expected value of every trade before entering. If EV is negative or unclear, don't trade. Let math, not emotion, guide your decisions.

Exercise

Complete the Exercise 7

Last updated