Lesson 11: Market Psychology and Crowd Behavior

🎧 Lesson Podcast

🎬 Video Overview

Lesson 11: Market Psychology and Crowd Behavior

🎯 Core Concept: Be Greedy When Others Are Fearful, Fearful When Others Are Greedy

The greatest DeFi fortunes are built by understanding crowd psychology and positioning contrarian to the masses. This lesson teaches you to read market sentiment as precisely as fundamental analysis and profit from predictable human behavior patterns.

📚 Livermore's Crowd Psychology Insight

"The public is always wrong at the turning points."

Jesse Livermore understood that the crowd's emotions create the very opportunities that patient contrarians exploit. In DeFi, this principle applies with mathematical precision due to 24/7 emotional decision-making, social media amplification of sentiment, and retail-heavy participation prone to herd behavior.

The opportunity: While the crowd chases yesterday's narrative, you position for tomorrow's reality.

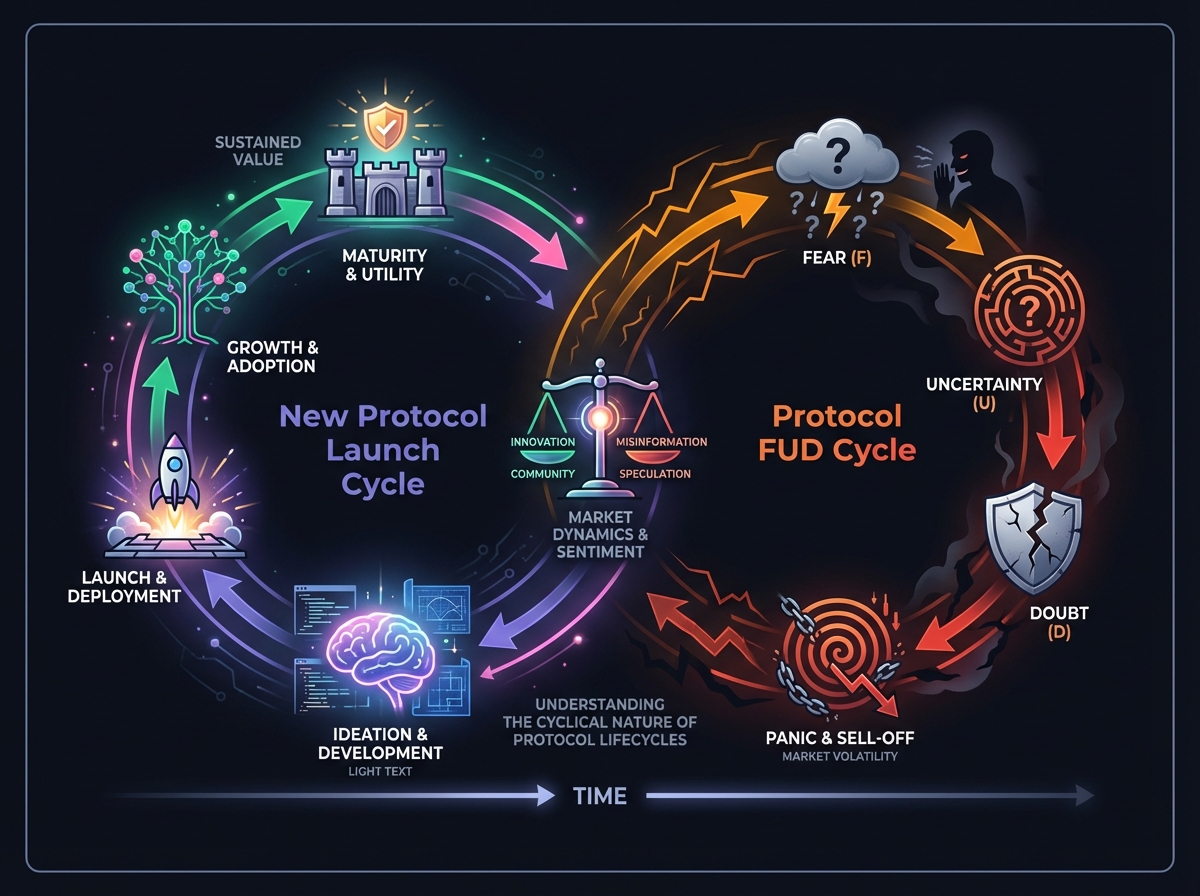

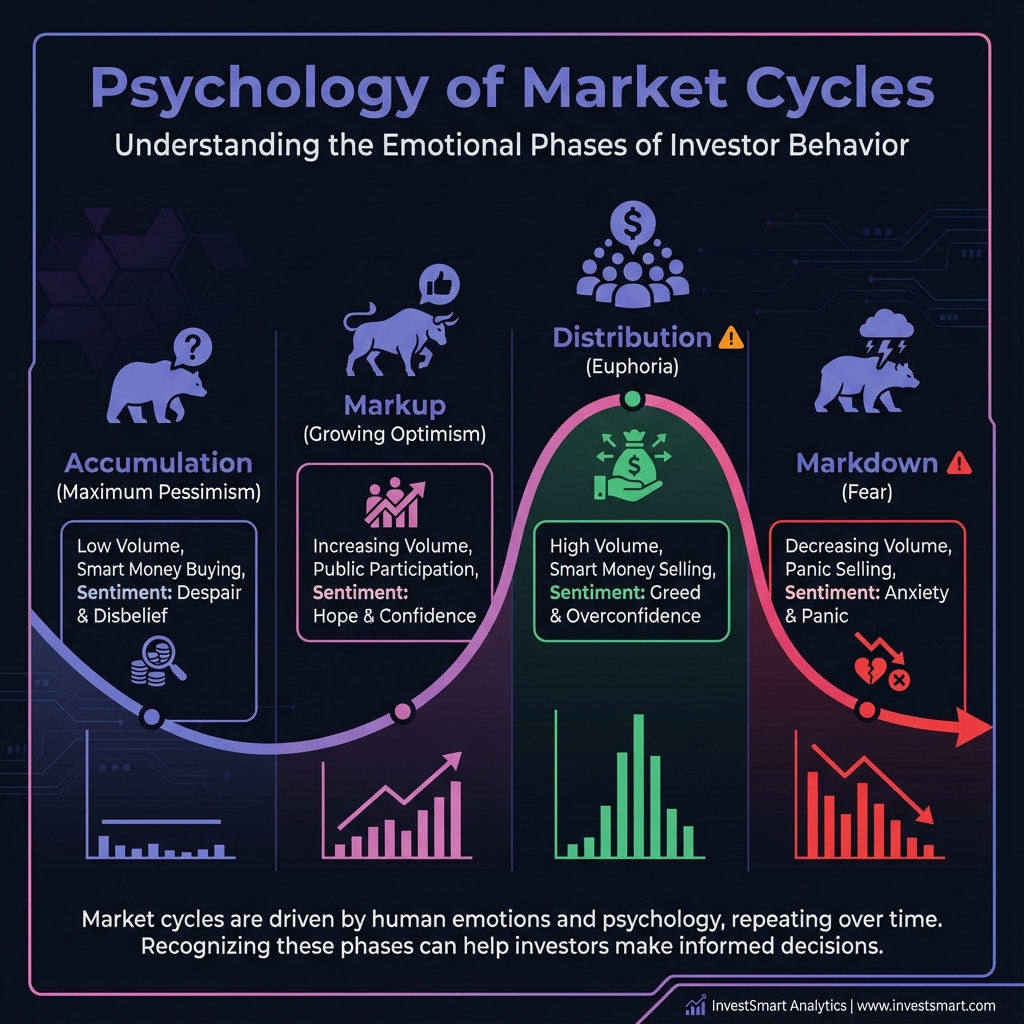

🔄 The Anatomy of Crowd Psychology Cycles Phase 1: Stealth Accumulation (Contrarian Opportunity) 🌱 The crowd feels apathy and disinterest — "DeFi is dead" becomes the consensus. Media coverage is minimal, focused on problems and risks. Price action shows bottoming with low volatility that bores speculators away. Meanwhile, smart money quietly accumulates quality protocols at massive discounts. Your action: Build positions in highest conviction plays while others sleep.

DeFi Examples: Summer 2022 saw DeFi protocols trading at 90% discounts from highs. The 2018-2019 "crypto winter" created generational buying opportunities. Post-Luna/FTX collapses left quality protocols at deep value prices for those with courage.

Phase 2: Awareness (Early Trend) 📈 Cautious optimism emerges — "maybe it's not dead" replaces despair. Media coverage becomes balanced, noting improvements and adoption. Price action shows steady uptrend with increasing volume confirming interest. Smart money continues accumulation as early institutional interest appears. Your action: Add to positions while maintaining discipline.

Phase 3: Enthusiasm (Momentum Phase) 🚀 Growing excitement builds as FOMO creeps into conversations. Media coverage turns increasingly positive with success stories dominating. Price action accelerates with resistance levels breaking dramatically. Smart money holds positions while preparing exit strategies. Your action: Hold positions but resist the temptation to overweight.

Phase 4: Greed (Danger Zone) 🔥 Euphoria dominates — "this time is different" becomes the rallying cry. Media coverage reaches mainstream with bubble warnings ignored. Price action turns parabolic with extreme volatility becoming normal. Smart money systematically takes profits and reduces exposure. Your action: Systematic profit-taking and position reduction despite peer pressure.

Phase 5: Denial (Distribution) 😰 "Just a correction" and "buying the dip" dominate discourse. Media coverage shows mixed signals with widespread rationalization. Price action reveals choppy decline with dead cat bounces fooling hopeful holders. Smart money completes distribution to eager buyers. Your action: Continue reducing exposure despite false recoveries.

Phase 6: Fear (Capitulation Opportunity) 💀 Panic sets in — "sell everything" becomes the new consensus. Media coverage turns to doom and gloom with obituaries for DeFi. Price action shows sharp decline with high volume selling climaxes. Smart money prepares for next accumulation cycle. Your action: Start building shopping lists of quality protocols.

📊 DeFi-Specific Sentiment Indicators

On-Chain Sentiment Signals Bullish Extremes (Time to Reduce Risk) occur when DeFi TVL hits all-time highs with unsustainable growth rates. New protocol launches emerge daily with million-dollar treasuries from nowhere. Gas fees exceed $100 as retail rushes to participate in everything. Yield farming APYs become unsustainably high across all protocols, signaling the end approaches.

Bearish Extremes (Time to Accumulate) manifest when DeFi TVL declines for 6+ months despite protocol improvements. Quality protocols trade below book value or treasury holdings. Development activity remains high but market cap stays low. Long-term builders continue shipping during downturns while speculators flee.

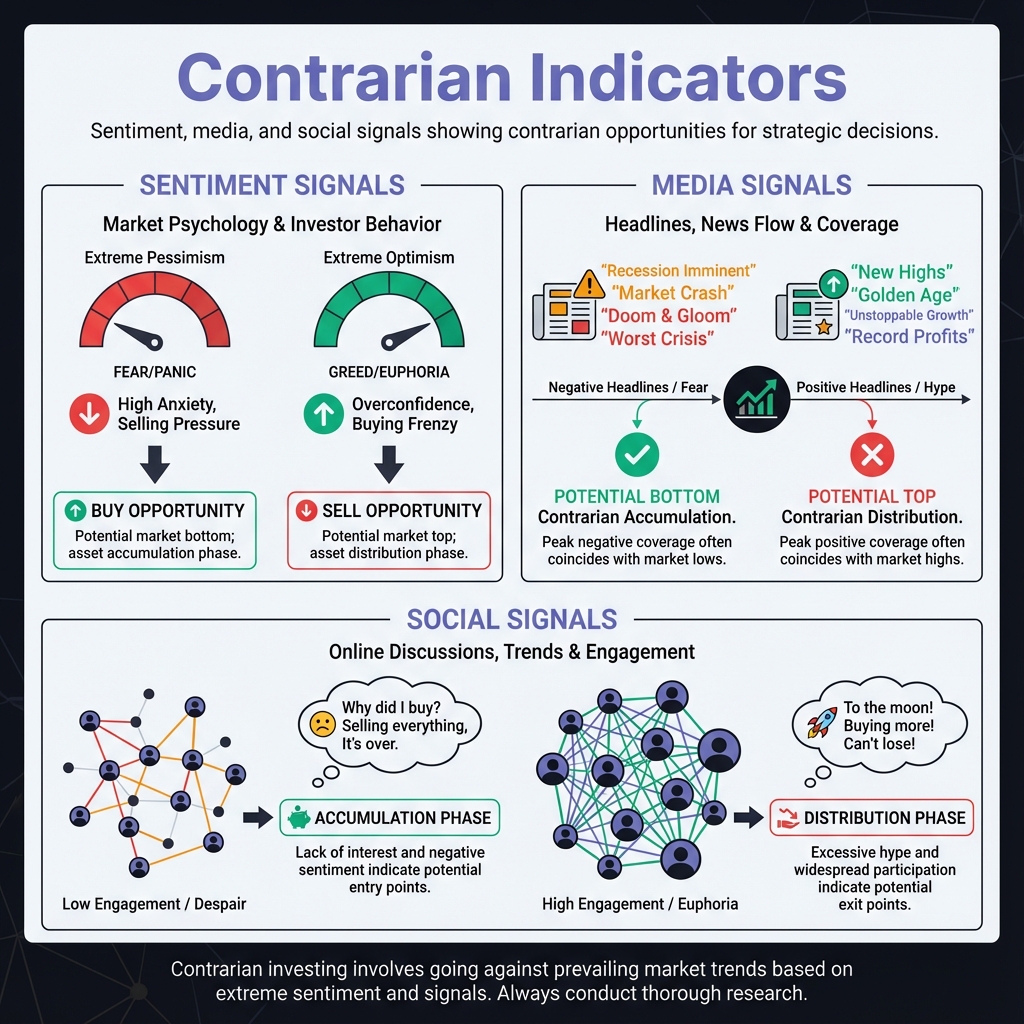

Social Sentiment Indicators Euphoria Signals (Sell Indicators) appear when Crypto Twitter fills with Lambo and moon memes. Mainstream media covers DeFi as "easy money" for everyone. Your barista asks about yield farming strategies. "Diamond hands" and "HODL" trend universally as mantras.

Despair Signals (Buy Indicators) emerge when "DeFi is dead" articles dominate major publications. Core developers become the only ones discussing protocols. Social media engagement hits multi-year lows. Quality projects struggle to raise capital at any valuation.

📚 The Contrarian Psychology Playbook

Rule 1: Fade the Consensus at Extremes When 90%+ are bullish, take profits systematically regardless of momentum. Reduce position sizes even in winning investments that feel unstoppable. Build cash reserves for future opportunities that will emerge. Ignore FOMO and social pressure to stay fully invested.

Rule 1: Fade the Consensus at Extremes When 90%+ are bullish, take profits systematically regardless of momentum. Reduce position sizes even in winning investments that feel unstoppable. Build cash reserves for future opportunities that will emerge. Ignore FOMO and social pressure to stay fully invested.

When 90%+ are bearish, build positions in quality protocols at historic discounts. Increase research and due diligence activity while others give up. Deploy cash reserves methodically into fear. Ignore negativity and predictions of permanent decline.

Rule 2: Follow the Smart Money, Not the Loud Money Smart Money Indicators include venture capital investing in protocols during downturns when valuations make sense. Core developer activity and improvement proposals continue regardless of price. Institutional treasuries diversify into DeFi for long-term value. Long-term protocol governance participation increases during bear markets.

Loud Money Indicators to ignore include social media hype and influencer promotions with hidden agendas. Get-rich-quick YouTube videos and expensive courses proliferate. Telegram pump groups and Discord "alpha" calls multiply. Celebrity endorsements and meme coin promotions dominate headlines.

Rule 3: Position Size Inversely to Comfort When investments feel scary during bear markets with bad news and pessimism, this often signals the best time to buy quality assets. Increase position sizes within risk management limits. Focus on long-term value creation over short-term pain.

When investments feel easy during bull markets with good news and optimism, this often warns of the worst time to increase exposure. Reduce position sizes and take profits into strength. Focus on capital preservation over chasing gains.

🌍 Reading DeFi Market Cycles

The Four Seasons of DeFi DeFi Winter (Bear Market) typically lasts 12-24 months with 80-90% declines, protocol failures, and widespread despair. The opportunity lies in accumulating quality protocols at deep discounts. Psychology requires enormous patience and conviction when everything seems broken.

DeFi Spring (Early Bull) spans 6-12 months with steady recovery, improving metrics, and cautious optimism returning. The opportunity involves adding to positions while maintaining discipline. Psychology makes it easy to doubt sustainability after recent trauma.

DeFi Summer (Bull Market) runs 6-18 months with rapid growth, new highs, and infectious enthusiasm. The opportunity requires holding positions while resisting overallocation temptation. Psychology creates the illusion it will never end.

DeFi Autumn (Late Bull/Early Bear) lasts 3-9 months with increasing volatility, distribution, and widespread denial. The opportunity demands systematic profit-taking despite peer pressure. Psychology makes it hard to believe the party is ending.

🔍 Advanced Crowd Psychology Techniques Sentiment Divergence Analysis Price vs Sentiment Divergence reveals hidden opportunities. Prices declining but sentiment still optimistic suggests more downside likely. Prices rising but sentiment still pessimistic indicates more upside likely. Prices and sentiment aligned typically means trend continuation.

Fundamental vs Sentiment Divergence creates alpha. Fundamentals improving but sentiment poor presents buying opportunities. Fundamentals deteriorating but sentiment positive warns of selling opportunities. Fundamentals and sentiment aligned suggests fair value pricing.

The Commitment Test High Commitment Indicators suggest stronger trends through large institutional investments with long lock-up periods, protocol founders and teams holding significant positions, users paying high fees to participate despite costs, and long-term stakers and governance participants increasing.

Low Commitment Indicators warn of weaker trends through day trading and short-term speculation dominance, yield chasers rotating between protocols weekly, heavy leverage and margin trading activity, and focus on price rather than utility or fundamentals.

🧬 Behavioral Finance in DeFi Context Herding Behavior Patterns Information cascades create bubbles independent of fundamentals. First person buys protocol after thorough research. Second person buys because first person bought, ignoring own research. Third person buys because both others bought, assuming they know something. The cascade continues until reality intervenes.

DeFi Herding Examples include everyone moving to the "flavor of the month" Layer 2 solution, mass migration to highest APY farms regardless of sustainability, and copying whale wallet movements without understanding context or timeframe.

Social Proof in DeFi Positive social proof fuels bull markets through "everyone is making money in DeFi" narratives, success stories dominating social media, and peer pressure to participate or miss out.

Negative social proof accelerates bear markets through "everyone is losing money in DeFi" stories, horror stories dominating headlines, and social pressure to exit before further losses.

Contrarian Use: When positive social proof peaks, reduce exposure. When negative social proof peaks, increase exposure.

📈 Practical Sentiment Analysis Framework Daily Sentiment Tracking (5 minutes) Monitor the social media pulse by rating Crypto Twitter mood on a fear/greed scale from 1-10. Check Discord and Telegram activity levels for engagement changes. Note YouTube content themes shifting between educational and hype.

Observe market behavior asking: Are people buying quality or garbage? Are discussions long-term or short-term focused? Is educational or get-rich-quick content gaining popularity?

Weekly Sentiment Analysis (30 minutes) Track institutional behavior through VC investment announcements and themes, corporate treasury allocation trends, and regulatory sentiment and responses.

Monitor developer activity via GitHub commits and protocol improvements, conference quality and attendance levels, and quality of new protocol launches versus cash grabs.

Monthly Contrarian Positioning Review Evaluate your portfolio allocation versus sentiment. Are you overweight in popular sectors everyone loves? Do you have exposure to unloved but quality protocols? Is your positioning contrarian enough for the current cycle phase?

📚 The Anti-Fragile Contrarian Strategy

When Everyone Is Greedy (Bull Markets) Systematically take profits at predetermined levels regardless of momentum. Reduce position sizes even in winning investments that feel unstoppable. Build cash reserves for future opportunities that always emerge. Focus on capital preservation over growth when risk is highest.

When Everyone Is Fearful (Bear Markets) Deploy cash reserves into quality protocols at historic discounts. Increase research and analysis activity when competition is lowest. Build positions methodically despite negative sentiment everywhere. Focus on long-term value creation when prices are most attractive.

When Everyone Is Confused (Transition Periods) Maintain balanced positioning without making dramatic moves. Continue systematic approach regardless of conflicting signals. Focus on fundamental analysis over sentiment noise. Prepare for next clear directional move with patience.

🔑 Key Takeaways

Be greedy when others are fearful, fearful when others are greedy - The greatest DeFi fortunes are built by understanding crowd psychology

Livermore's insight - "The public is always wrong at the turning points"

The Contrarian Psychology Playbook - Read market sentiment as precisely as fundamental analysis

The Six Phases of Market Psychology - Disbelief, Hope, Optimism, Euphoria, Anxiety, and Capitulation

The Anti-Fragile Contrarian Strategy - Position differently based on whether everyone is greedy, fearful, or confused

✅ Success Metrics Your market psychology mastery this week:

• Created systematic sentiment tracking process across social and on-chain indicators

• Identified current market cycle phase and positioned accordingly

• Built contrarian positioning framework with specific buy/sell triggers

• Established crowd psychology analysis routine for major investment decisions

• Implemented anti-fragile strategy that benefits from volatility and sentiment extremes

• Started tracking correlation between sentiment indicators and subsequent price movements

🔮 Looking Ahead Next week, we'll integrate all concepts into the complete elite trader's mental framework for sustained high performance.

💎 Remember: The crowd is right during trends but wrong at turning points. Your edge comes from knowing the difference.

📌 Assignment: This week, rate market sentiment daily on a 1-10 scale. Compare your ratings to price action one month later. You'll be amazed how sentiment extremes predict reversals.

Exercise

Complete the Exercise 11

Last updated