Lesson 8: Performance Optimization Techniques

🎧 Lesson Podcast

🎬 Video Overview

Lesson 8: Performance Optimization Techniques

🎯 Core Concept: Your Brain is Your Trading Edge

Peak mental performance is the ultimate competitive advantage in DeFi. While others make decisions in emotional states, you'll learn to enter flow states for optimal research, analysis, and execution. This lesson teaches the neuroscience of elite performance applied to DeFi trading.

📚 The Neuroscience of Trading Performance

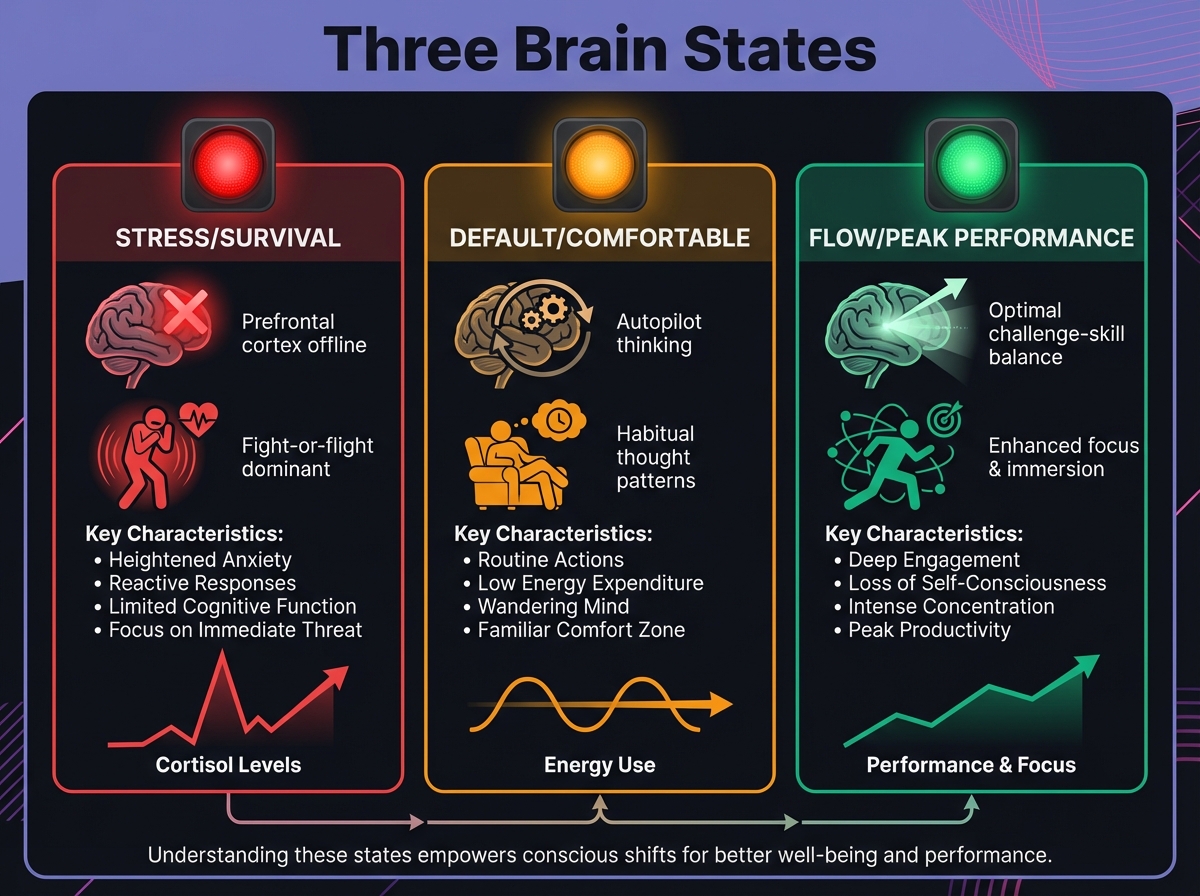

Three Brain States for Trading

State 1: Stress/Survival Mode 🔴

Your prefrontal cortex goes offline, eliminating rational thinking. Fight-or-flight hormones dominate every decision. This state is perfect for running from predators but terrible for trading. The result? Panic buying and selling, emotional decisions that destroy capital.

State 2: Default/Comfortable Mode 🟡

Autopilot thinking and pattern recognition take over. This works for routine tasks but produces mediocre analysis. You're prone to biases and mental shortcuts. The result? Average performance with predictable mistakes that slowly erode your edge.

State 3: Flow/Peak Performance Mode 🟢

You achieve optimal balance between challenge and skill. Enhanced focus, pattern recognition, and creativity emerge. Time distorts as effortless concentration takes hold. The result? Your best research, analysis, and decision-making that creates consistent profits.

Your Goal: Maximize time in State 3, minimize time in State 1, use State 2 only for routine tasks.

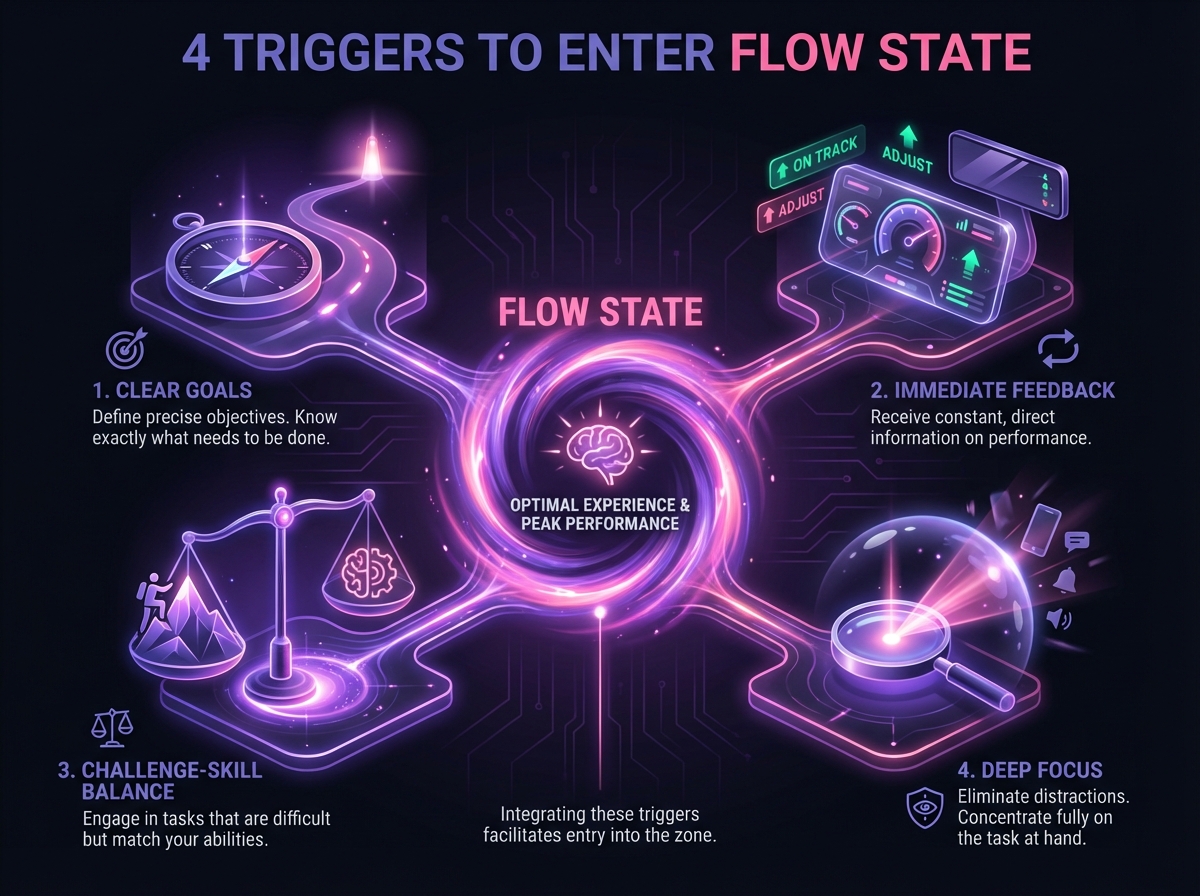

🌊 Creating Flow States for DeFi Research The Four Flow Triggers for Trading Trigger 1: Clear Goals

Vague intentions like "research some DeFi protocols" keep you in mediocrity. Flow requires precision: "Evaluate 3 lending protocols using my 10-point scorecard to find the best risk-adjusted yield opportunity." Specificity creates focus, focus creates flow.

Trigger 2: Immediate Feedback

Set up systems that provide real-time feedback on research quality. Use checklists that confirm completion of critical steps. Track prediction accuracy to create immediate learning loops. Your brain needs to know it's winning or losing to stay engaged.

Trigger 3: Challenge-Skill Balance

Too easy means researching protocols you already understand completely — your brain disengages. Too hard means analyzing complex derivatives without foundational knowledge — frustration destroys flow. The sweet spot? Stretching your current knowledge by 10-15%, where growth lives.

Trigger 4: Deep Concentration

Eliminate all distractions — phone, social media, price alerts become flow killers. Time-box research sessions to 90-120 minutes maximum before cognitive fatigue sets in. Single-task focus on one protocol, one analysis at a time. Multitasking is the enemy of excellence.

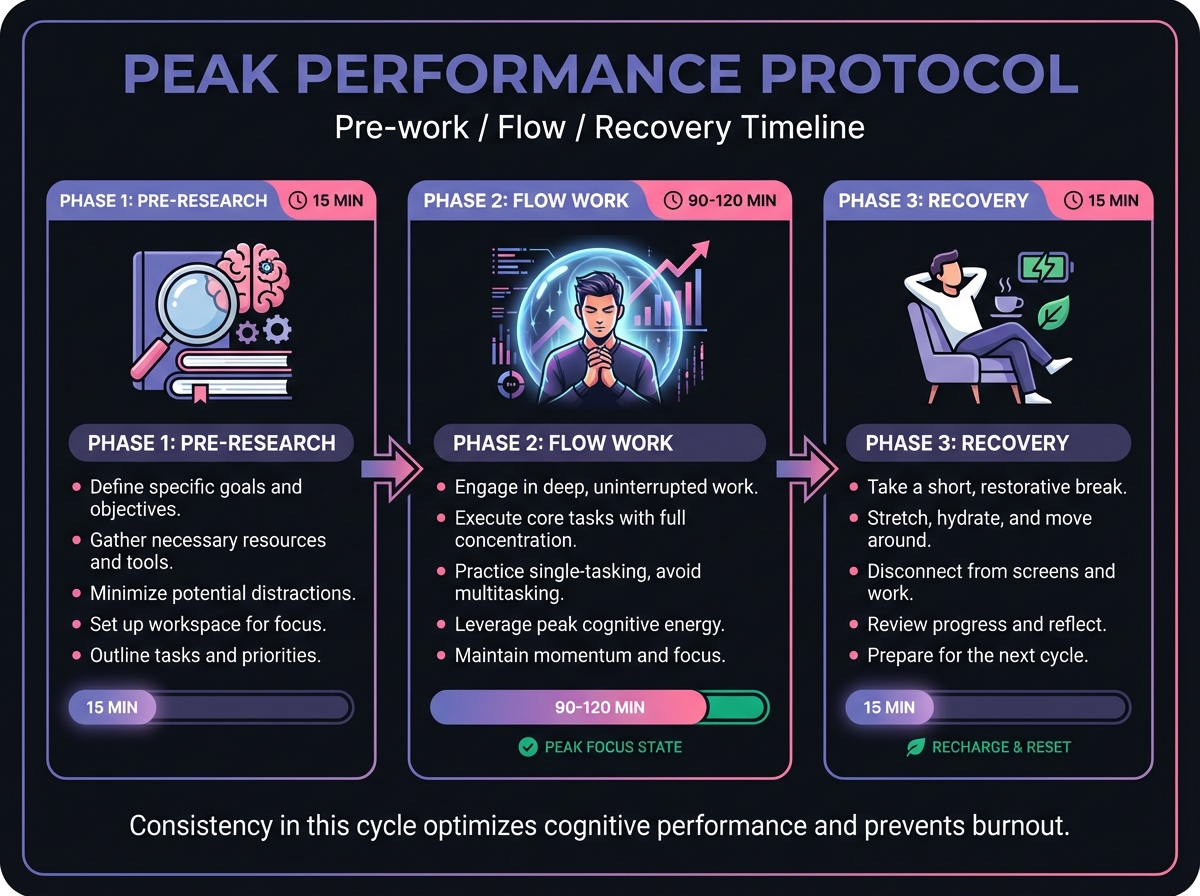

📚 The DeFi Trader's Peak Performance Protocol

Pre-Research Preparation (10 minutes) Physical Optimization begins with hydration — dehydration reduces cognitive performance by 20%. Set room temperature between 68-72°F for peak mental performance. Ensure good lighting with natural light preferred over harsh screens. Maintain comfortable but alert posture to sustain focus.

Mental Preparation starts with a 5-minute meditation or breathing exercise to clear mental clutter. Set clear intentions: "What exactly will I accomplish in this session?" Remove all potential distractions before they tempt you. Set a timer for your focus session to create urgency and boundaries.

Cognitive Priming activates relevant knowledge. Review your research framework and checklist. Spend 5 minutes on protocol overview to activate neural networks. Set specific success metrics for the session to measure achievement.

The Flow Research Session (90-120 minutes) Phase 1: Information Gathering (30-40 minutes)

Read protocol documentation systematically without jumping around. Gather quantitative data including TVL, volume, and tokenomics. Note questions and knowledge gaps for later investigation. Resist evaluation — just collect information with an open mind.

Phase 2: Analysis and Synthesis (40-60 minutes)

Apply your evaluation framework systematically to avoid missing critical elements. Compare with similar protocols and competitors for context. Identify key risks and opportunities that others might miss. Build your investment thesis with specific confidence levels.

Phase 3: Decision and Documentation (20 minutes)

Make your go/no-go decision with precise position sizing. Document reasoning for future reference and learning. Set up monitoring and review triggers to track thesis accuracy. Plan next steps if further research is warranted.

Post-Research Recovery (15 minutes) Step away from screens completely — your brain needs visual rest. Engage in physical movement through walking or stretching. Reflect on session quality and key learnings. Plan your next research session while insights are fresh.

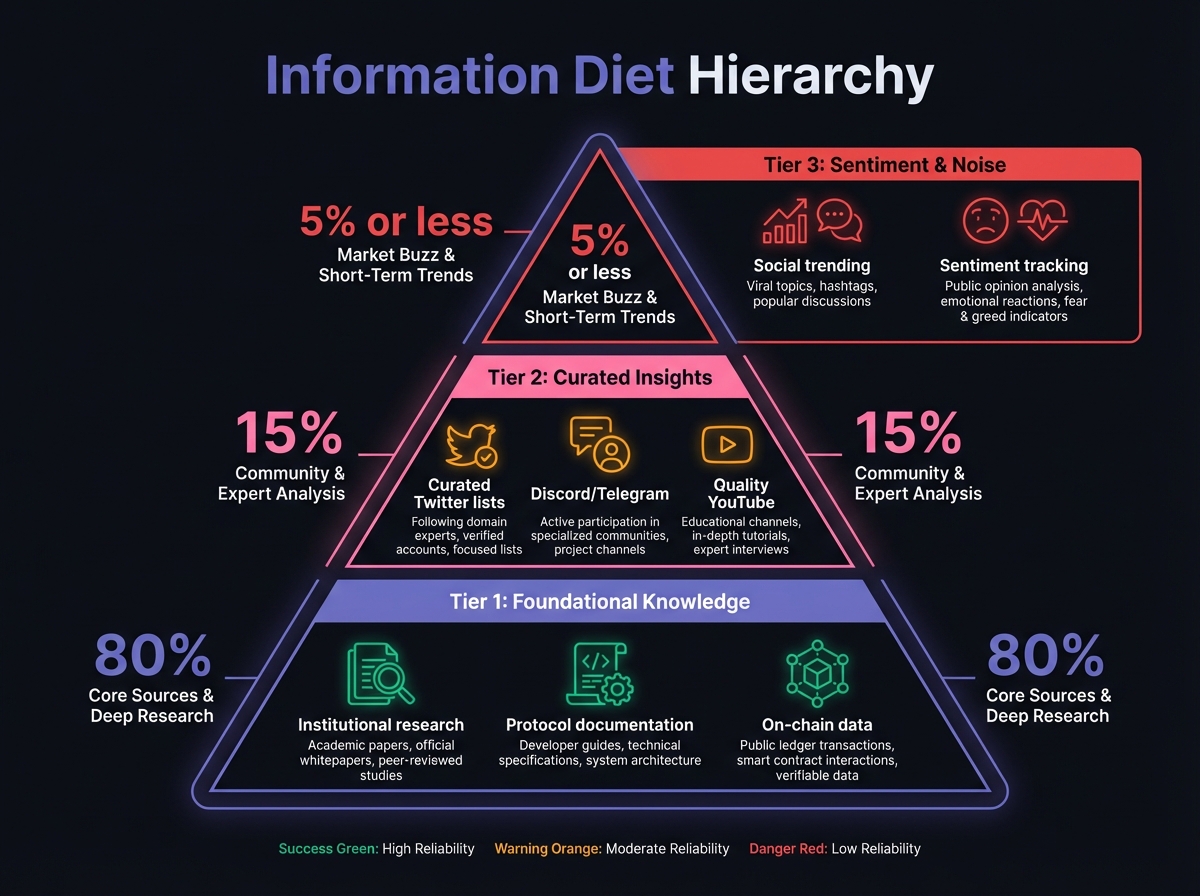

📊 Attention Management in Information Overload DeFi moves fast with constant information streams. Elite traders filter signal from noise with ruthless precision.

The Information Diet Hierarchy

Tier 1: Essential (Daily) includes portfolio performance and major protocol updates that affect your positions. Monitor market structure changes like regulation and major adoptions. Focus on high-signal sources like quality research reports from Messari or Delphi.

Tier 2: Important (2-3x Weekly) covers industry trends and ecosystem developments that shape the future. Quality DeFi podcasts and long-form content provide depth. Peer discussions and community insights offer different perspectives.

Tier 3: Optional (Weekly or Less) encompasses social media and community forums for sentiment checks. Price predictions and short-term market noise can be entertaining but rarely actionable. Entertainment and low-signal content should be consumed sparingly.

Tier 4: Never includes gambling-focused content and get-rich-quick schemes that rot your brain. Emotional manipulation and fear-mongering destroy objectivity. Low-quality influencer content wastes precious cognitive resources.

💪 The Stress + Rest = Growth Formula Peak performance requires balancing stress and recovery, not just adding more stress until you break.

Productive Stress for Trading Challenging research projects that expand your knowledge create growth. Position sizing that creates appropriate nervousness sharpens focus. Learning new DeFi concepts and protocols builds capability. Healthy competition with other traders provides motivation and benchmark.

Essential Recovery Practices Complete disconnection from markets during evenings and weekends restores perspective. Physical exercise enhances neuroplasticity and stress recovery. Quality sleep consolidates memory and regulates emotions. Non-trading hobbies and social connections prevent identity fusion with trading.

🔋 Cognitive Load Management Your brain has limited processing capacity. Elite traders optimize cognitive allocation like venture capitalists optimize capital allocation.

High Cognitive Load Activities (Reserve for Peak Hours) New protocol research and analysis demands your best mental energy. Complex DeFi strategy development requires clear thinking. Major portfolio decisions and rebalancing need full cognitive resources. Learning new concepts and skills creates lasting value when done right.

Low Cognitive Load Activities (Perfect for Off-Peak) Routine portfolio monitoring can be done with partial attention. Reading familiar content and news updates requires less mental effort. Administrative tasks like tax records and organization fit here. Social media and community engagement work when energy is low.

The Energy Management Calendar Schedule high-energy hours for deep research and major decisions. Use medium-energy hours for analysis and planning. Reserve low-energy hours for monitoring and administrative tasks. Protect recovery periods with complete disconnection from markets.

🛡️ Decision Fatigue Prevention Every decision depletes mental energy. Successful traders automate routine decisions to preserve cognitive resources for what matters.

Decisions to Automate Create a daily routine with same times for market checks and research. Use position sizing formulas that remove in-the-moment decisions. Pre-commit profit-taking and stop-loss levels through rules. Schedule information consumption at specific times only.

Decisions Worth Your Best Mental Energy Protocol selection and investment thesis development create or destroy wealth. Position sizing for new opportunities determines risk and reward. Portfolio allocation and rebalancing shape long-term returns. Strategy pivots based on market changes require full cognitive engagement.

🔄 The DeFi Trader's Recovery Toolkit Micro-Recovery (2-5 minutes between tasks) Deep breathing exercises reset your nervous system. Brief meditation or mindfulness clears mental residue. Physical movement and stretching restore circulation. Hydration and nutrition fuel cognitive performance.

Daily Recovery (30-60 minutes) Physical exercise or movement processes stress hormones. Non-screen activities like reading or nature restore attention. Social connection unrelated to trading maintains perspective. Hobbies or creative activities engage different brain networks.

Weekly Recovery (Half or Full Day) Complete market disconnection prevents burnout. Outdoor activities and nature exposure reduce cortisol. Quality time with family and friends maintains relationships. Reflection and planning sessions integrate learnings.

🏠 Environmental Design for Peak Performance Physical Environment A dedicated workspace free from distractions signals your brain it's time to focus. Multiple monitors enable efficient information processing without constant switching. Comfortable chair and good ergonomics prevent physical distraction. Natural light and plants provide proven cognitive benefits.

Digital Environment Organized bookmarks and information systems reduce cognitive load. Distraction-blocking software protects focus sessions from temptation. Automated alerts only for high-priority events prevent constant checking. Clean, organized file systems speed research and reduce frustration.

Social Environment Surround yourself with serious, improving traders who elevate your game. Limit exposure to emotional or gambling-focused communities that normalize destructive behavior. Find accountability partners for goals and habits. Engage with educational and growth-oriented content that compounds knowledge.

📈 Performance Tracking and Optimization Daily Performance Metrics Rate your cognitive clarity on a 1-10 scale each day. Assess decision quality honestly without ego protection. Track energy levels throughout the day to find patterns. Monitor stress and recovery balance to prevent burnout.

Weekly Performance Review Questions Which conditions led to your best research and decisions? What time of day proves optimal for different types of work? How did physical and mental state affect performance? What environmental changes could improve next week?

⚠️ Common Performance Killers in DeFi The Always-On Trap Checking portfolios and charts constantly fragments attention and increases anxiety. Never disconnecting from market information prevents recovery and perspective. Fix: Set specific times for market engagement and protect off-hours religiously.

The Information Overload Trap Trying to follow every DeFi development and opportunity ensures you master none. FOMO-driven information consumption reduces quality thinking. Fix: Curate high-quality sources ruthlessly and ignore noise.

The Perfectionism Trap Requiring perfect information before making decisions guarantees missed opportunities. Analysis paralysis on good opportunities lets others capture value. Fix: Set decision deadlines and accept uncertainty as the price of profit.

🔑 Key Takeaways

Your brain is your trading edge - Peak mental performance is the ultimate competitive advantage in DeFi

Three brain states - Stress/Survival Mode, Normal Operating Mode, and Flow State each require different approaches

The Peak Performance Protocol - Physical preparation, mental preparation, and environmental optimization

Information diet hierarchy - Curate high-signal sources and ignore noise to maintain cognitive clarity

Stress + Recovery balance - Schedule disconnection periods to prevent burnout and maintain peak performance

✅ Success Metrics Your performance optimization progress this week:

• Established daily peak performance routine with physical and mental preparation

• Identified optimal times and conditions for different types of DeFi work

• Created information diet hierarchy and curated high-signal sources

• Implemented stress + recovery balance with scheduled disconnection periods

• Built environmental optimizations for sustained peak performance

• Started tracking performance metrics to identify personal optimization opportunities

🔮 Looking Ahead Next week, we'll integrate all previous concepts into an unshakeable winning mindset framework that sustains you through any market condition.

💎 Remember: Your brain is your most valuable trading tool. Optimize it like you would optimize a million-dollar algorithm.

📌 Assignment: This week, track your energy levels and cognitive clarity every 2 hours. Identify your peak performance windows and schedule your most important DeFi work accordingly.

Exercise

Complete the Exercise 8

Last updated