Lesson 3: Managing Fear and Greed

🎧 Lesson Podcast

🎬 Video Overview

Lesson 3: Managing Fear and Greed

🎯 Core Concept: Master Your Emotions or They'll Master You

Fear and greed are the two forces that separate money from DeFi traders faster than any exploit or rug pull. They make you sell bottoms and buy tops with mathematical precision. Learning to recognize and neutralize these emotions is the difference between trading and gambling.

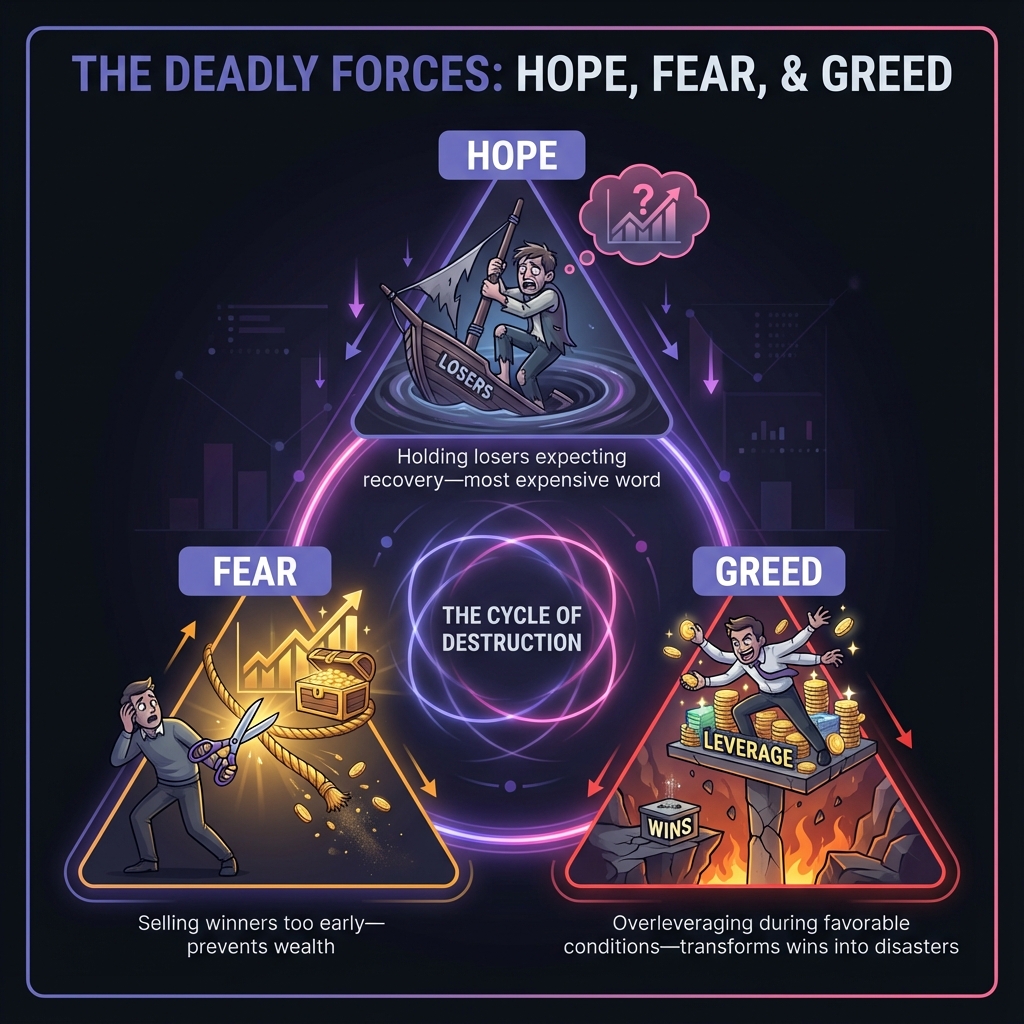

📚 Livermore's Deadly Trinity: Hope, Fear, and Greed

Jesse Livermore identified three emotions that destroy traders:

• Hope: Holding losing positions expecting miraculous recovery • Fear: Selling winning positions too early afraid of giving back gains • Greed: Overleveraging and overtrading during favorable conditions

The cruel irony: Hope makes you hold when you should sell, fear makes you sell when you should hold, and greed makes you buy when you should wait.

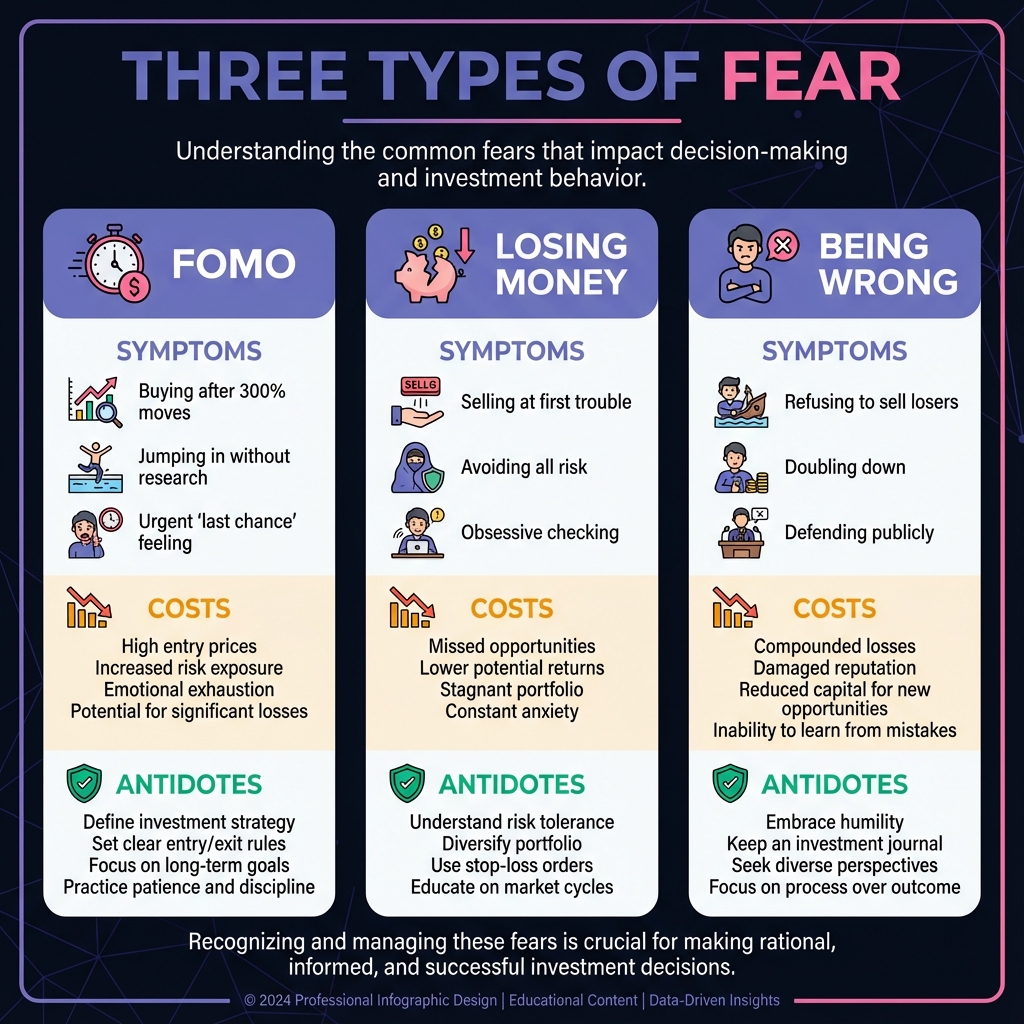

📚 The Anatomy of Fear in DeFi

Fear Type 1: Fear of Missing Out (FOMO) 🚀 The Symptoms: You find yourself buying tokens after 300% pumps, jumping into protocols without research, feeling physical anxiety when others are making money without you.

DeFi Triggers: New protocol launches ignite your urgency. Influencer shilling creates artificial scarcity. Viral Twitter threads make you feel left behind. The fear whispers: "This is your last chance."

The Real Cost: Buying tops consistently, getting rugged repeatedly, concentrating your portfolio dangerously, destroying your risk management discipline.

💊 The FOMO Antidote:

Stop. Take three deep breaths before any decision

Question: "What would I think of this opportunity in 48 hours?"

Apply your standard research checklist regardless of urgency

Respect your predetermined position size limits

Remember: There's always another opportunity tomorrow

Fear Type 2: Fear of Losing Money 💸 The Symptoms: Selling positions at the first sign of trouble, avoiding all risk even reasonable ones, checking prices obsessively, losing sleep over paper losses.

DeFi Triggers: Protocol exploits shake your confidence. Market crashes trigger panic. FUD campaigns override logic. Every red candle feels like a personal attack.

The Real Cost: Selling bottoms with surgical precision, missing recovery rallies completely, holding only "safe" cash while inflation erodes value, paralysis by analysis.

🛡️ The Loss Management Framework:

Pre-determine acceptable loss levels before entering any position — this removes in-the-moment panic. Use position sizing to make losses manageable psychologically, not just financially. View losses as "market tuition" rather than failures. Remember that quality protocols often recover — no loss if you don't sell.

Fear Type 3: Fear of Being Wrong 🎯 The Symptoms: Refusing to sell losing positions to avoid admitting mistakes, doubling down on failures to prove you're right, defending bad investments publicly.

DeFi Triggers: Public predictions on social media create ego investment. Protocol tribalism makes objectivity impossible. Your identity becomes tied to your positions.

The Real Cost: Riding tokens to zero out of pride, refusing to adapt to new information, becoming the bagholder others learn from.

🧠 The Ego Bypass System:

• Separate your identity from your trading positions completely • Practice saying "I was wrong" out loud daily until it loses its sting • Celebrate quick loss-cutting as much as big wins • Keep positions small enough that being wrong doesn't matter

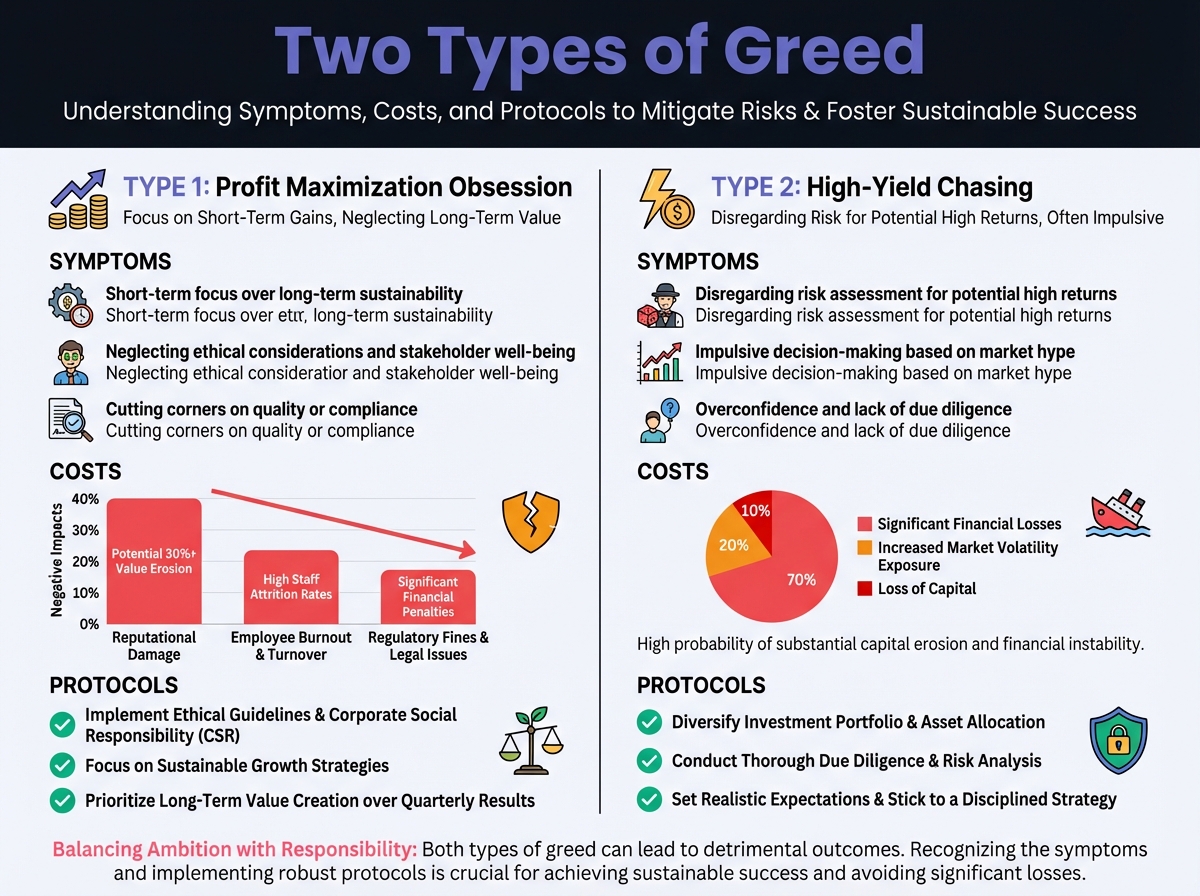

📚 The Anatomy of Greed in DeFi

Greed Type 1: Profit Maximization Obsession 📈 The Symptoms: Never taking profits because "it could go higher," watching massive gains evaporate, screenshot profits you never realized, the eternal "just a little more."

DeFi Triggers: Tokens pumping past your targets create new dreams. Unlimited upside potential narratives override logic. Success stories of others who held longer haunt you.

The Real Cost: Giving back life-changing gains, holding through complete market cycles, turning winners into losers, destroying confidence in your system.

💰 The Profit Discipline Protocol:

Set profit targets before entering positions — make them sacred. Take profits at predetermined levels regardless of momentum or FOMO. Follow the "champagne rule": If gains make you want to celebrate, take some off the table. Remember you can always buy back after taking profits — many never do, and that's okay.

Greed Type 2: High-Yield Chasing 🎰 The Symptoms: Moving money to whatever offers highest APY, ignoring risk for reward, believing unsustainable yields will last forever, yield farming addiction.

DeFi Triggers: 1000%+ APY farming opportunities activate primal greed. New protocol launches with unsustainable rewards. Yield aggregators promising impossible returns.

The Real Cost: Getting rugged repeatedly, suffering massive impermanent loss, losing principal chasing yields, protocol exploitation victims.

🔍 The Yield Reality Check:

• If APY seems too good to be true, it definitely is • Calculate maximum sustainable yields based on protocol economics • Only allocate "gambling money" to extreme yield opportunities • Remember: High returns always mean high risks, no exceptions

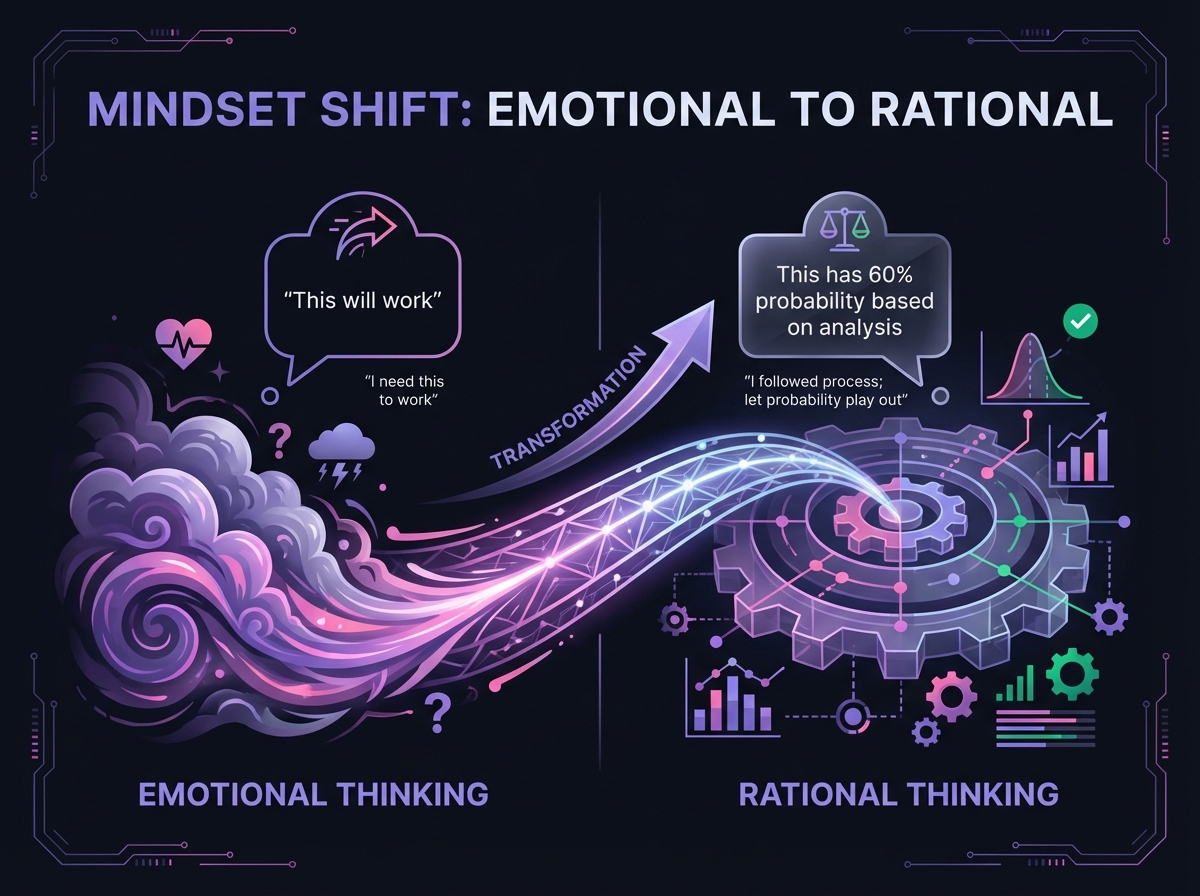

📚 Trading in the Zone: Emotional Regulation Techniques

Technique 1: The Probability Mindset 🎲 Instead of: "This trade will definitely work" Think: "This trade has a 60% probability of success based on my analysis"

This shift removes the emotional weight of needing to be right and allows you to accept losses as statistical inevitabilities rather than personal failures.

Technique 2: The Process Focus 🎯 Instead of: "I need this trade to work to pay my bills" Think: "I followed my process correctly, now let probability play out"

Focusing on process rather than outcomes removes desperation from your decision-making and allows clear thinking even under pressure.

Technique 3: The Acceptance Approach ☯️ Accept these truths before every trade: • Every trade can lose money, even the "sure things" • You cannot control market outcomes, only your decisions • You can only control your risk management • Losses are business expenses, not personal failures

📚 DeFi-Specific Emotional Management

Managing Protocol Exploit Fear 🔐 Only invest amounts you can afford to lose completely — this is DeFi's first rule. Diversify across multiple protocols and chains to reduce single points of failure. Research smart contract audit history and team reputation obsessively. Have a predetermined response plan for exploit scenarios before they happen.

Managing Bull Market Greed 🐂 Set portfolio allocation limits and stick to them when euphoria hits. Take profits systematically regardless of market sentiment or peer pressure. Remember that bull markets end suddenly and without warning — always. Keep cash reserves for bear market opportunities that will inevitably come.

Managing Bear Market Despair 🐻 Focus on building positions in quality protocols during downturns when others panic. Use dollar-cost averaging to remove timing pressure and emotional weight. Study successful investors who bought during previous bear markets for inspiration. Remember that bear markets create generational wealth — but only for those who act.

📚 Practical Exercise: The Emotional State Journal

Daily Tracking Protocol (2 minutes): Before any DeFi decision, rate your emotional state:

• Fear Level (1-10) • Greed Level (1-10) • Confidence Level (1-10) • Stress Level (1-10)

🚦 Trading Rule: No decisions when Fear + Greed + Stress > 15

This simple metric prevents your worst decisions before they happen.

Interactive Emotional State Tracker

Use this interactive tool to track your emotional state before making trading decisions:

Launch Emotional State Tracker →

📚 Emergency Emotional Regulation Toolkit

When Fear Spikes: 😰 Breathe: Box breathing — 4 counts in, 4 hold, 4 out, 4 hold

When Fear Spikes: 😰 Breathe: Box breathing — 4 counts in, 4 hold, 4 out, 4 hold

Perspective: "What would I advise a friend in this situation?"

Review: Has anything fundamentally changed in your thesis?

Pause: Take a mandatory 24-hour cooling period

When Greed Spikes: 🤑 Calculate: What you could lose if position goes to zero

Project: "How will I feel if I don't take profits and it dumps?"

Execute: Follow predetermined profit rules regardless of momentum

Remember: Past times greed cost you money — learn from them

🔑 Key Takeaways

Fear and greed are the two forces that separate money from DeFi traders faster than any exploit

Livermore's Deadly Trinity - Hope, Fear, and Greed destroy traders

Three types of fear - FOMO, Fear of Losing Money, and Fear of Being Wrong each have specific antidotes

Three types of greed - Profit Maximization Obsession, High-Yield Chasing, and Overleveraging

Emotional regulation techniques - Probability Mindset, Process Focus, and Acceptance Approach neutralize emotions

The Emotional State Journal - Track your emotional state before decisions; no decisions when Fear + Greed + Stress > 15

✅ Success Metrics Your emotional mastery progress this week:

• Completed daily emotional state tracking for 7 consecutive days

• Identified your personal fear and greed triggers in DeFi scenarios

• Created emergency regulation protocols for high-emotion situations

• Practiced saying "I was wrong" and cut at least one small losing position

🔮 Looking Ahead Next week, we'll build daily habits that make emotional regulation automatic and effortless. You'll learn how small, consistent actions compound into unshakeable trading discipline.

💎 Remember: The market is a wealth transfer mechanism from the emotional to the disciplined. Choose your side.

📌 Assignment: This week, before every trade, write down your emotional state and your reason for trading. Compare your most profitable decisions with your emotional scores. The pattern will surprise you.

Exercise

Complete the Exercise 3

Last updated