Lesson 6: The Psychology of Risk Management

🎧 Lesson Podcast

🎬 Video Overview

Lesson 6: The Psychology of Risk Management

🎯 Core Concept: Position Sizing is 80% Psychology, 20% Math

Most DeFi traders focus on finding the right protocols to buy. Elite traders focus on buying the right amount. Position sizing determines whether you survive long enough to compound gains or blow up chasing quick returns.

📚 The Neuropsychology of Risk Perception

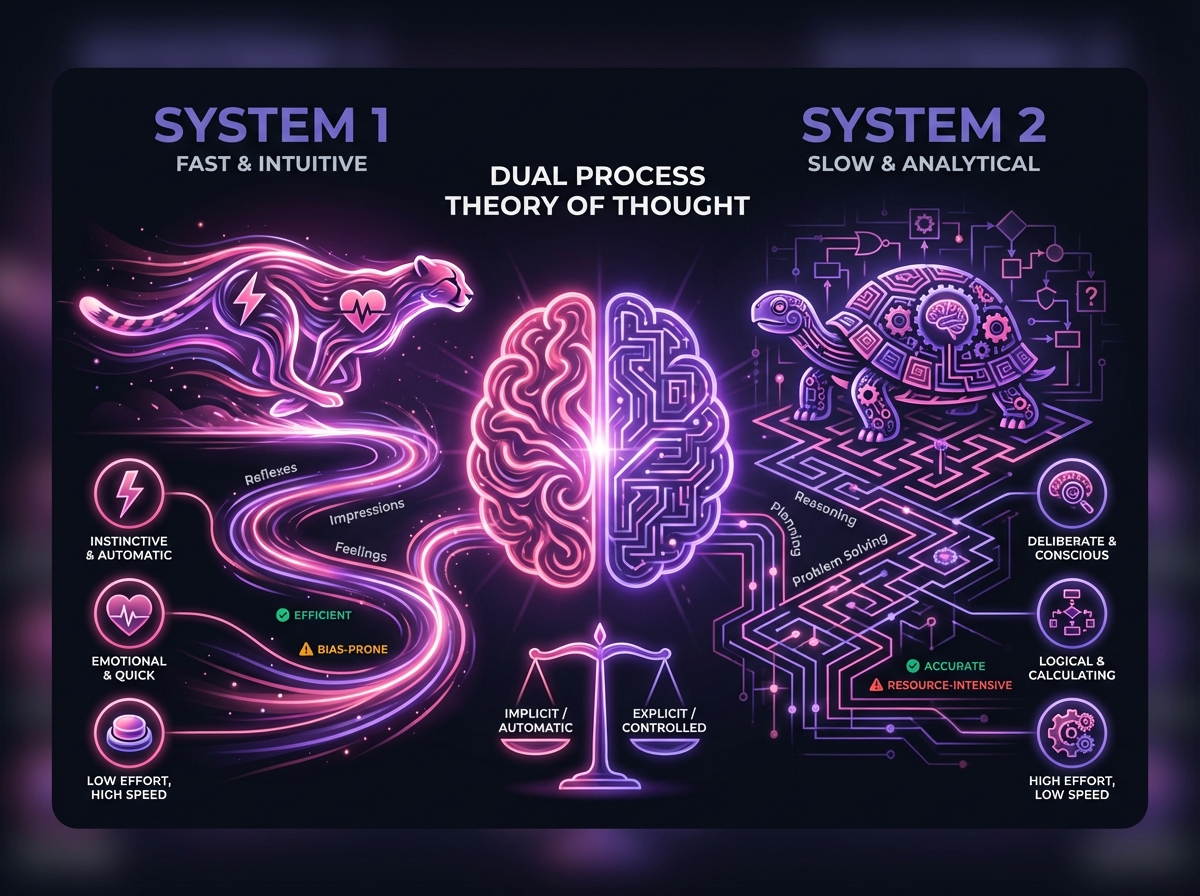

Your brain processes risk through two distinct systems that constantly battle for control.

System 1 operates fast, emotional, and survival-focused — it's the part that makes you panic-sell during crashes and FOMO-buy during pumps. System 2 works slowly, analytically, calculating expected values and probabilities like a computer. The problem? System 1 dominates during volatility, making you sell bottoms and buy tops with surgical precision.

The Solution: Pre-commit to position sizes when System 2 is in control, before emotions hijack your decisions.

📈 Livermore's Pyramiding Psychology Jesse Livermore built positions with the patience of a master craftsman:

He started with small "test" positions to gauge market response. He added only when positions moved in his favor — the market confirming his thesis. He never averaged down into losers, knowing hope isn't a strategy. His position size reflected both conviction and market feedback, not ego or desperation.

Modern DeFi Translation:

Position Sizing Guidelines:

Begin with 1% positions in unproven protocols — enough to matter, not enough to hurt

Scale to 2-3% in promising protocols showing good metrics and adoption

Reserve 5% maximum for your highest conviction plays with proven track records

Never exceed 25% in any single sector (L1s, DEXs, lending) — concentration creates fragility

☠️ The Three Types of Risk That Destroy DeFi Accounts

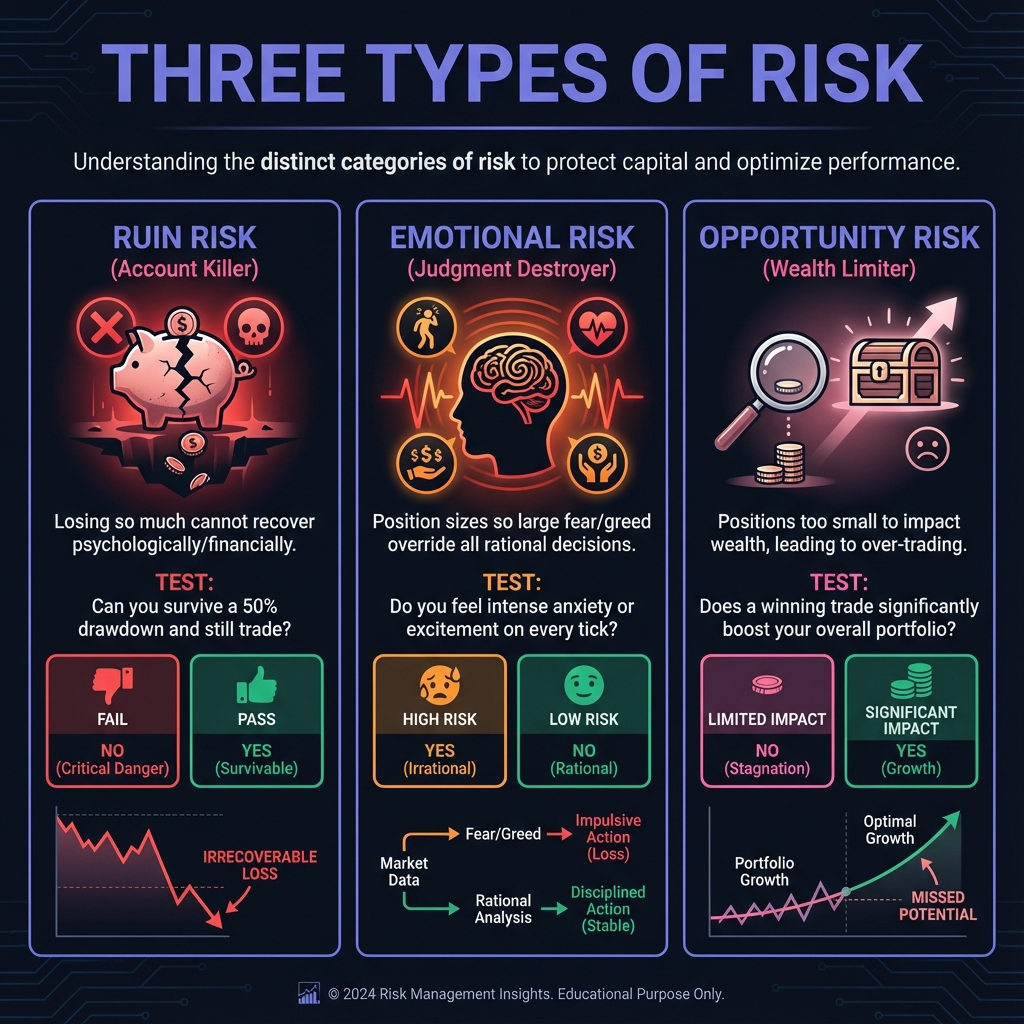

Type 1: Ruin Risk — The Account Killer 💀 What It Is: The risk of losing so much capital that you cannot recover psychologically or financially. This isn't just about money — it's about maintaining the mental capacity to continue.

DeFi Reality Check:

Putting 50% of net worth in a single protocol isn't investing — it's gambling with your future. Using leverage on volatile DeFi tokens multiplies not just gains but the speed of destruction. Yield farming with funds needed for living expenses turns market volatility into life volatility.

🛡️ The Ruin Risk Formula:

Never risk more than 2% of total capital on any single position. Even if you're wrong 10 times in a row, you still have 80% of your capital left. This isn't conservative — it's sustainable.

Ask yourself: "If this position goes to zero tomorrow, will I still be able to sleep and continue trading?" If the answer is no, the position is too large.

Type 2: Emotional Risk — The Judgment Destroyer 😰 What It Is: Position sizes so large that fear and greed override all rational decision-making. Your portfolio becomes your emotional prison.

DeFi Symptoms:

You check your portfolio every 10 minutes when positions are large, each check eroding your objectivity. You can't cut losses because "I have too much in this" — the sunk cost fallacy in action. You make impulsive decisions during 20% daily swings, each one compounding previous errors.

The Emotional Risk Test: If you check a position more than 3 times daily, it's too big for your psychological comfort zone.

Psychological Fix: Size positions so you can "sleep well at night" regardless of short-term volatility. Peace of mind is worth more than potential gains.

Type 3: Opportunity Risk — The Wealth Limiter 📉 What It Is: Position sizes too small to meaningfully impact wealth, leading to over-trading and desperation plays.

DeFi Trap:

Those $100 positions can't change your life even if they 10x — the math doesn't work. Trading fees eat into small position gains, turning winners into break-evens. You take excessive risks because "normal" investments feel pointless, creating a dangerous psychology.

The Balance: Large enough to matter if you're right, small enough to survive if you're wrong.

Interactive Risk Psychology Calculator

Use this interactive tool to calculate your risk across all three categories:

Launch Risk Psychology Calculator →

📚 The Psychology of Drawdowns

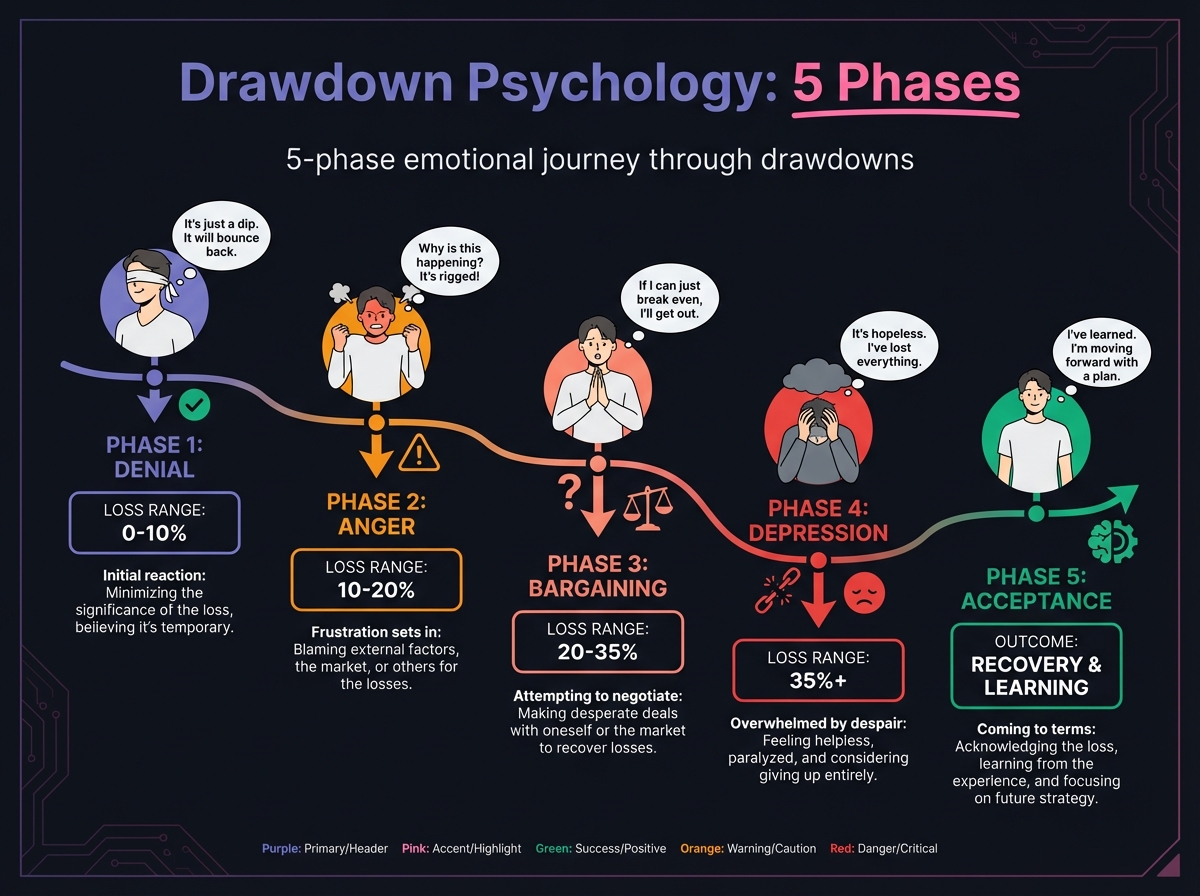

The Five Stages:

Phase 1: Denial (0-10% portfolio loss) - "This is just a correction, it will bounce back." You refuse to adjust strategy or risk levels, believing the market will validate your decisions. Fix: Pre-commit to portfolio review triggers at 5% and 10% losses.

Phase 2: Anger (10-20% portfolio loss) - "The market is rigged and manipulated." Revenge trading begins, doubling down on failing positions to "show the market." Fix: Take a mandatory 48-hour break from all trading decisions.

Phase 3: Bargaining (20-35% portfolio loss) - "If I just make one big trade to get back to even." All-or-nothing bets emerge from desperation, leading to complete ruin. Fix: Accept the losses and focus on capital preservation, not recovery.

Phase 4: Depression (35%+ portfolio loss) - "I'm terrible at this, I should quit." The urge to sell everything at the bottom becomes overwhelming. Fix: Remember this is part of the learning process — reduce position sizes and continue.

Phase 5: Acceptance - "Losses are tuition for market education." This is when real learning and improvement begins. You've paid for wisdom — now use it.

📚 DeFi-Specific Risk Management Psychology

The Impermanent Loss Mental Model Psychological Trap: Viewing impermanent loss as "not real" because you still hold tokens creates false comfort.

Reality Check: Opportunity cost is real cost — you could have held assets separately for better returns.

Fix: Calculate impermanent loss as part of total return, not separate from it. The market doesn't care about your accounting methods.

The High-APY Delusion Psychological Trap: Assuming high yields are "safe" because they're not leveraged ignores fundamental risk-reward relationships.

Reality Check: High yields mean high risks — protocol failure, token collapse, regulatory shutdown all lurk beneath attractive numbers.

Fix: Risk-adjust yields by probability of protocol survival. A 1000% APY means nothing if the protocol dies in a month.

The Smart Contract Comfort Zone Psychological Trap: Believing audited contracts are "safe" creates dangerous complacency.

Reality Check: Audits reduce but don't eliminate risks — exploits regularly happen to audited protocols.

Fix: Diversify across multiple protocols and never risk more than you can afford to lose completely.

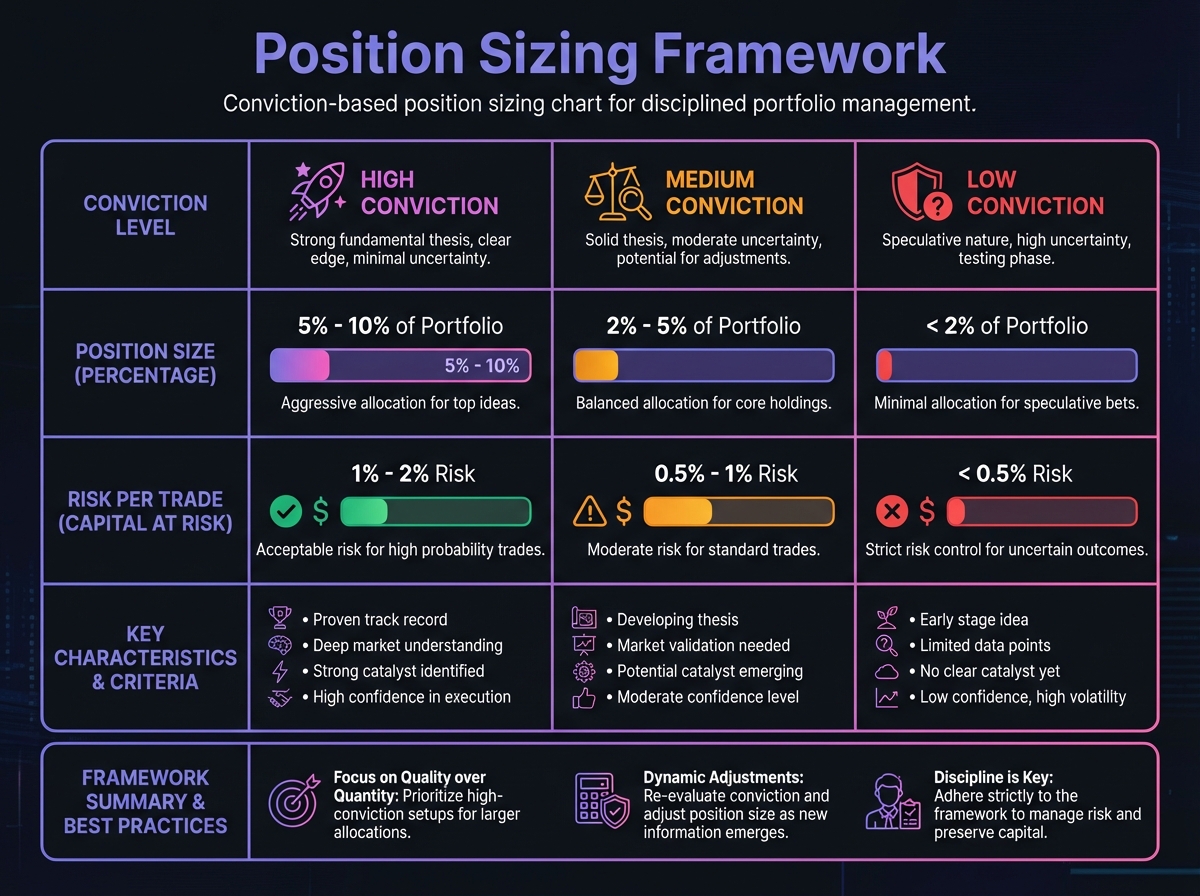

🎰 Position Sizing Psychology Framework The Conviction-Based System 10/10 Conviction (5% max position): Bitcoin and Ethereum have proven track records with massive adoption. In DeFi, think Aave or Uniswap — battle-tested protocols with clear utility and sustainable economics.

8/10 Conviction (3% max position): Promising protocols with strong teams but shorter track records deserve meaningful but controlled exposure. New Layer 2 solutions with good metrics but limited history fit here.

6/10 Conviction (1% max position): Speculative plays with potential but high uncertainty get lottery ticket sizing. New protocol launches and experimental tokenomics belong in this category.

Below 6/10 Conviction: No position. Wait for better opportunities. Not every protocol deserves your capital.

The Kelly Criterion for DeFi (Advanced) The formula: Position Size = (Win Probability × Average Win - Loss Probability × Average Loss) ÷ Average Loss

Example calculation: With a 60% chance of 50% gain and 40% chance of 25% loss, Kelly suggests an 80% position. This is mathematically optimal but psychologically impossible for most traders.

Reality Check: Use 25% of Kelly's suggestion for psychological sustainability. Math doesn't account for sleepless nights.

😴 Emotional Position Sizing Rules The Comfort Zone Test After entering a position, rate your emotional state from 1-10. If you're at 1-3, the position is too small to matter — consider increasing. At 4-7, you've found optimal psychological sizing. At 8-10, you're overleveraged emotionally — reduce immediately.

The Sleep Test If a position keeps you awake worrying, it's too large regardless of mathematical calculations. No gains are worth chronic stress.

The Opportunity Cost Rule Before increasing any position size, ask: "What other opportunities am I missing by concentrating capital here?" Concentration is the enemy of opportunity.

🛡️ Building Anti-Fragile Risk Management

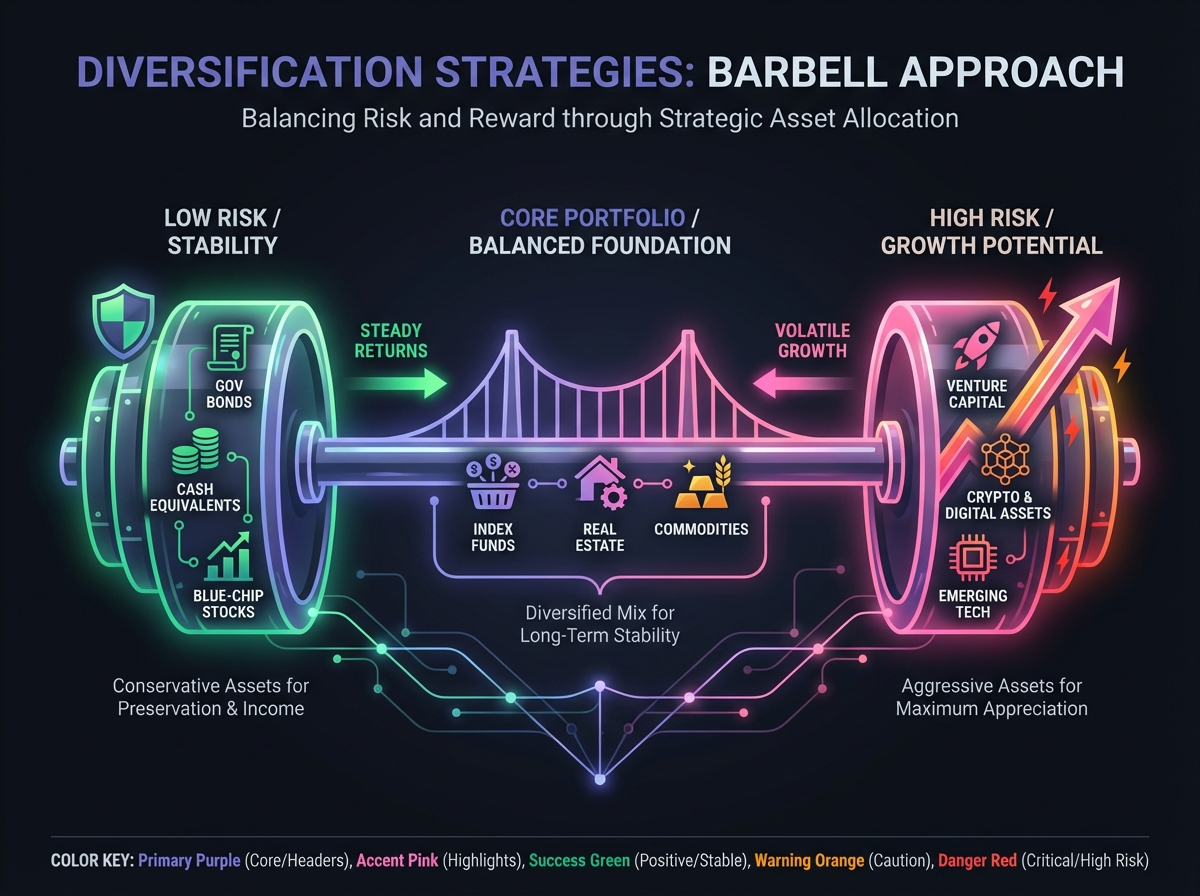

Diversification Psychology True diversification spans multiple dimensions. Spread across protocols — don't bet everything on lending or DEXs. Diversify across chains like Ethereum, Polygon, and Arbitrum. Mix risk levels with both blue chips and speculative plays. Vary time horizons with some short-term trades and multi-year holds.

The Barbell Strategy for DeFi Put 80% in extremely safe assets — BTC, ETH, and stablecoins form your foundation. Allocate 20% to extremely high-upside, high-risk protocols for asymmetric returns. Avoid the "mediocre middle" where risk-reward is unfavorable.

🚨 Risk Management Emergency Protocols When Portfolio Falls 10%: Pause all new investments for 48 hours to prevent emotional decisions. Review position sizes and risk allocation with fresh eyes. Consider taking profits on remaining winners to rebalance.

When Portfolio Falls 20%: Reduce all position sizes by 50% immediately. Focus only on highest conviction plays with best risk-reward. Stop all speculative trading until equilibrium returns.

When Portfolio Falls 35%: Preserve remaining capital at all costs — survival trumps recovery. Consider moving to majority stablecoin position for mental reset. Take extended break to reassess strategy without pressure.

🔑 Key Takeaways

Position sizing is 80% psychology, 20% math - Most traders focus on finding the right protocols, but elite traders focus on buying the right amount

Two systems of risk perception - System 1 (emotional, fast) and System 2 (analytical, slow) constantly battle for control

The Comfort Zone Test - If a position size keeps you awake at night, it's too large regardless of the math

Drawdown psychology - Your brain processes losses 2.5x more intensely than equivalent gains

DeFi-specific risk factors - Smart contract risk, protocol risk, and regulatory risk require different position sizing approaches

✅ Success Metrics Your risk management mastery this week:

• Calculated maximum position sizes for different conviction levels

• Created portfolio allocation limits across DeFi sectors

• Established drawdown response protocols with specific triggers

• Tested position sizing with "sleep test" and "comfort zone" metrics

• Implemented diversification across protocols, chains, and risk levels

🔮 Looking Ahead Next week, we'll master probability-based thinking to move from gambling to calculated speculation. You'll learn to think in distributions, not certainties.

💎 Remember: Position sizing is the difference between professional trading and expensive gambling. Master it, or the market will master you.

📌 Assignment: This week, review every position in your portfolio. Rate each on the comfort zone scale. Adjust any position scoring above 7 until you can sleep peacefully.

Exercise

Complete the Exercise 6

Last updated