Lesson 10: Systems Thinking for Consistency

🎧 Lesson Podcast

🎬 Video Overview

Lesson 10: Systems Thinking for Consistency

🎯 Core Concept: Systems Beat Goals, Process Beats Outcomes

Elite DeFi traders don't rely on willpower, motivation, or lucky picks. They build systematic approaches that produce consistent results regardless of market conditions or emotional states. This lesson teaches you to create your personal DeFi trading methodology.

📚 Livermore's Line of Least Resistance

"I made my success by following the line of least resistance. In other words, I just watched the stock market tell me its story through the tape."

Modern Translation: Build systems that work WITH market forces rather than against them. Your methodology should align with DeFi market realities, not fight them.

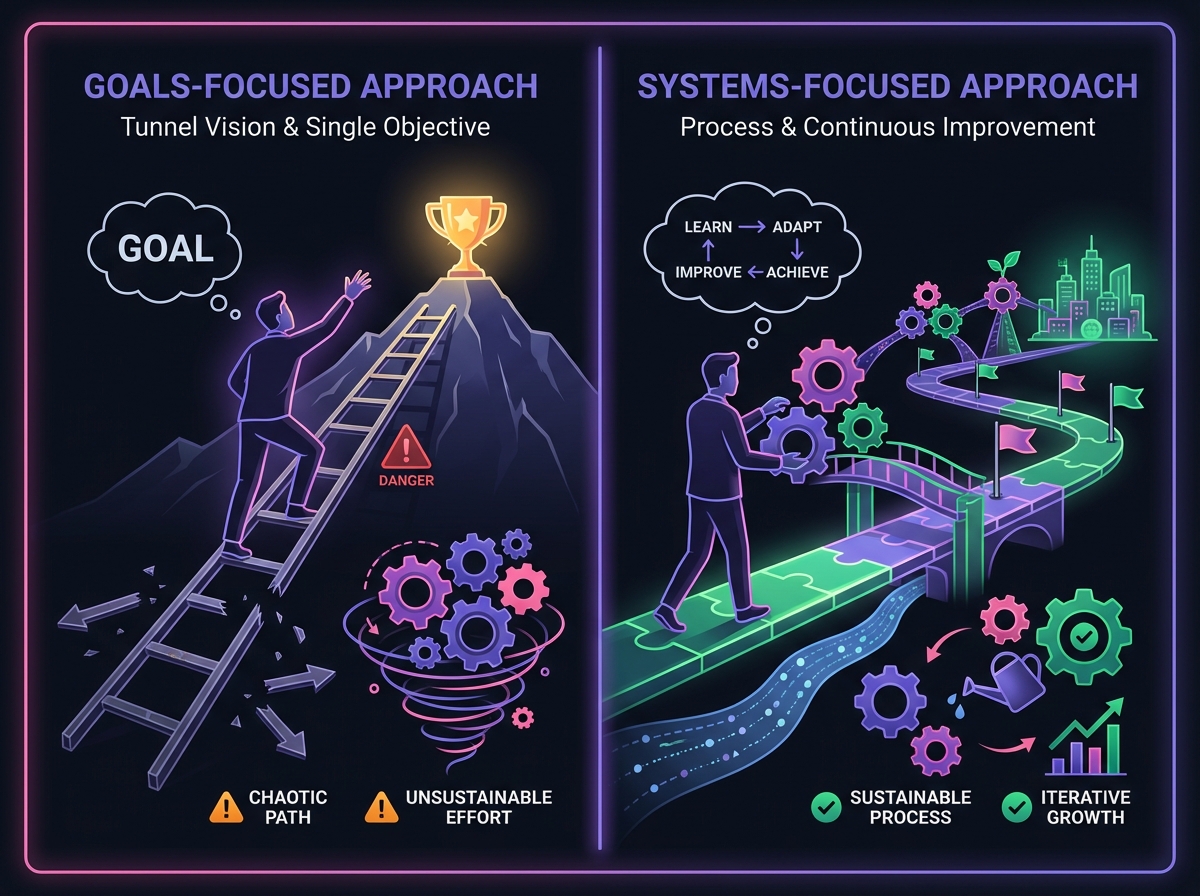

📚 The Difference Between Goals and Systems

Goal-Focused Thinking (Leads to Inconsistency) "I want to make $100k in DeFi this year" creates pressure without process. "I need to find the next 100x token" encourages gambling over investing. "I must time the market perfectly" sets impossible standards that guarantee failure.

Systems-Focused Thinking (Leads to Consistency) "I will research 2 new protocols weekly using my evaluation framework" creates sustainable progress. "I will allocate capital using predetermined position sizing rules" removes emotional decisions. "I will rebalance monthly regardless of market conditions" ensures discipline over time.

The Magic: Systems compound over time and work regardless of motivation levels. Goals expire; systems endure.

🏆 The Market Wizards' Common Traits Applied to DeFi Jack Schwager identified patterns among consistently profitable traders. Here's how they translate to DeFi success.

Trait 1: They All Have Trading Systems Real systems aren't gut feelings, social media tips, or emotional impulses. They're repeatable processes with specific entry and exit criteria that work regardless of how you feel on any given day.

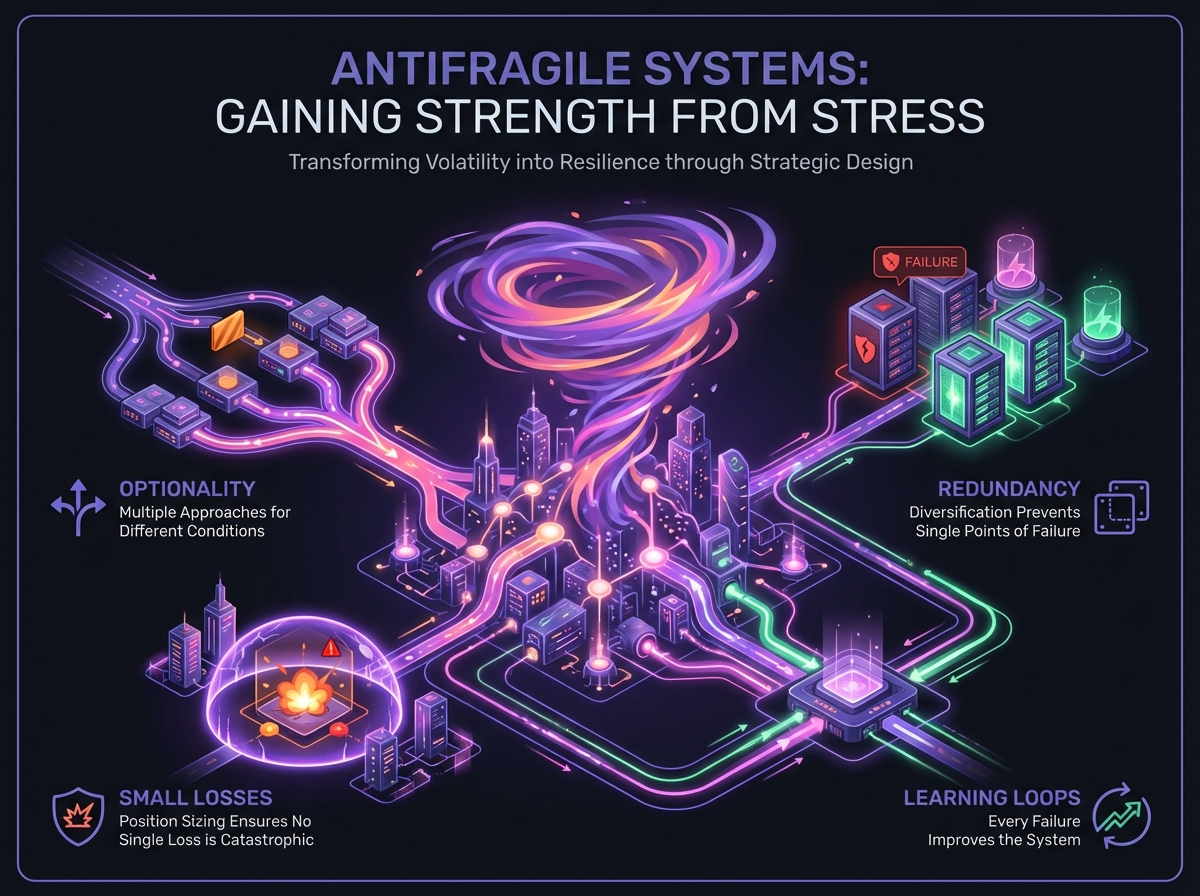

Trait 2: They Cut Losses Short and Let Winners Run In DeFi, this means stop losses at -20% for speculative protocols before hope becomes expensive. Take 25% profits at 2x to pay yourself, then let the remainder run with house money. Never average down on losing positions — the market is telling you something.

Trait 3: They Control Risk Through Position Sizing Maximum 5% in any single protocol prevents catastrophic losses. Maximum 25% in any category (lending, DEXs, etc.) ensures diversification. Scale position sizes based on conviction levels, not excitement levels.

Trait 4: They Have Realistic Expectations DeFi reality check: 20-30% annual returns are excellent long-term performance, not disappointing. 50%+ drawdowns are normal and expected, not signs of failure. Most protocols will underperform; winners must be sized appropriately to compensate.

🏗️ Building Your Personal DeFi Trading System

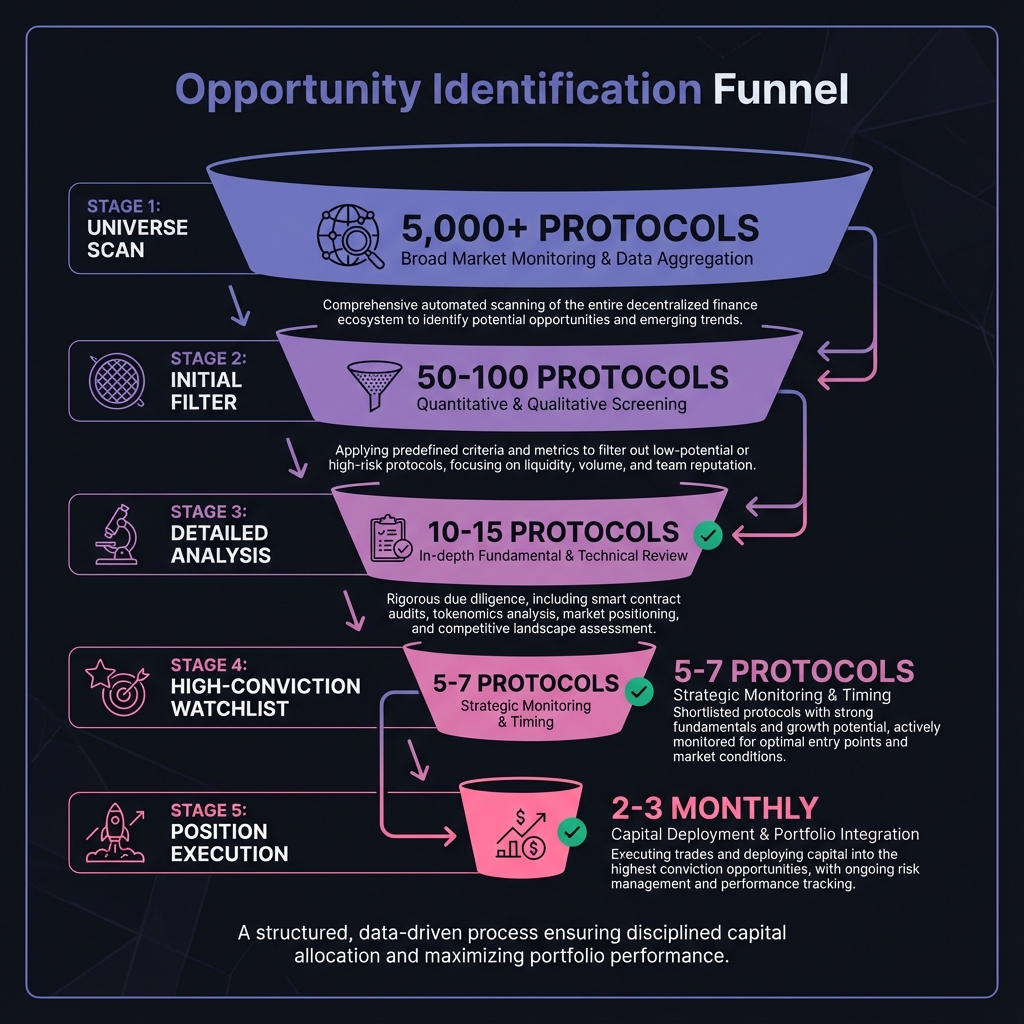

Component 1: Opportunity Identification System

The DeFi Opportunity Funnel systematically narrows thousands of possibilities to handful of high-conviction plays.

Stage 1: Universe Screening starts with all DeFi protocols (5,000+) and filters by minimum TVL ($10M+) and age (6+ months), reducing the field to ~200 protocols worth considering.

Stage 2: Category Analysis groups protocols by type (lending, DEXs, derivatives), identifies growing versus declining categories, and focuses on categories with long-term tailwinds, narrowing to ~50 protocols in attractive categories.

Stage 3: Fundamental Screening applies your protocol evaluation scorecard, ranks by score and conviction level, and focuses research time on the top 20% candidates, resulting in 10-15 protocols for deep analysis.

Stage 4: Deep Due Diligence completes fundamental and technical analysis, assesses competitive positioning and moats, evaluates team, tokenomics, and sustainability, yielding 3-5 high-conviction investment candidates.

Component 2: Position Sizing System The Conviction-Based Allocation Framework removes emotion from position sizing decisions.

10/10 Conviction (5% maximum) reserved for established protocols with proven track records, clear sustainable competitive advantages, and strong teams with successful previous projects — think Aave or Uniswap in their prime.

8/10 Conviction (3% maximum) applies to protocols with strong fundamentals but shorter operating history, good competitive position with manageable risks, and solid teams with less proven track records — emerging Layer 2 DEXs with good metrics fit here.

6/10 Conviction (1% maximum) covers interesting concepts with high execution risk, early-stage protocols with potential, and speculative plays with asymmetric upside — new protocol launches with innovative features.

Below 6/10 Conviction means no position. Wait for better opportunities, keep on watchlist for future evaluation, and focus capital on higher conviction ideas. Not every opportunity deserves your money.

Component 3: Entry and Exit System Entry Rules create discipline in deployment. Only buy during predetermined market conditions, never in emotional states. Never buy all at once — use 3-position scaling with first 33% at initial decision, second 33% if thesis strengthens or price improves, and final 33% if position shows clear momentum.

Exit Rules protect gains and limit losses systematically: • Profit Taking: 25% at 2x, 50% at 5x, let remainder run • Stop Losses: -20% for speculative, -30% for experimental • Thesis Breaks: Exit immediately if fundamental thesis changes • Time Stops: Re-evaluate positions older than 2 years

Component 4: Portfolio Management System Asset Allocation Framework balances risk and opportunity: • 40% Blue Chip DeFi (BTC, ETH, established protocols) • 35% High Conviction DeFi (proven protocols with growth) • 20% Emerging Opportunities (newer protocols with potential) • 5% Speculation/Moonshots (lottery tickets with huge potential)

Rebalancing Rules maintain discipline: Monthly rebalancing regardless of market sentiment. Immediate rebalancing if any position exceeds size limits. Systematic profit-taking during bull markets. Strategic accumulation during bear markets within limits.

🧠 The Psychology of System Adherence Why Traders Abandon Good Systems Boredom strikes because systems work slowly and steadily without gambling excitement. Fix: Track long-term progress and celebrate small wins that compound into wealth.

Recent Poor Performance tests faith when systems don't work during all market conditions. Fix: Backtest through different cycles and expect periods of underperformance as normal.

Missing "Obvious" Opportunities creates FOMO when your system says no but everyone else appears to profit. Fix: Remember that consistent singles beat inconsistent home runs over time.

Overconfidence After Success tempts you to abandon the system that created success. Fix: Remember the system created the success, not your genius.

System Adherence Techniques Pre-Commitment involves writing down system rules when markets are calm, signing and dating your trading constitution, and reviewing rules before every major decision.

Accountability requires sharing your system with a mastermind group or mentor, regular check-ins on system adherence, and tracking deviations from the system.

Systematic Tracking documents every decision as either following the system or deviating, compares results of systematic versus discretionary decisions, and quantifies the cost of system deviations in real money.

📈 Continuous Improvement and System Evolution Monthly System Review Ask yourself: Which components worked well this month? What signals did you miss or misinterpret? How could the system be improved without overfitting to recent events? What new information changes your fundamental assumptions?

Quarterly System Updates Backtest system performance across different periods to ensure robustness. Update screening criteria based on market evolution. Refine position sizing rules based on actual results. Adjust for changes in DeFi landscape and regulations.

Annual System Overhaul Conduct complete review of all system components. Make major updates based on year's learning and results. Integrate new DeFi developments and opportunities. Benchmark against other successful approaches for continuous improvement.

⚠️ Common System Building Mistakes

Mistake 1: Over-Optimization Building systems that work perfectly on past data creates fragility. Too many rules and conditions ensure future failure. Fix: Keep systems simple and robust enough to handle uncertainty.

Mistake 2: Under-Testing Not backtesting across different market conditions guarantees surprises. Insufficient paper trading before real money creates expensive lessons. Fix: Test extensively before implementing with serious capital.

Mistake 3: Perfectionism Paralysis Waiting for the "perfect" system before starting means never starting. Constantly tweaking instead of executing prevents learning. Fix: Start with good enough and improve through experience.

Mistake 4: Emotional Overrides Making exceptions during extreme market conditions destroys consistency. Abandoning system during drawdowns ensures buying high and selling low. Fix: Build emotional circuit breakers into the system itself.

📋 Your Personal DeFi Methodology Template Create your system using this framework:

System Name: [Your Trading Style + DeFi Focus]

Core Philosophy: One sentence describing your approach

Universe: Which DeFi protocols you focus on

Timeframe: Your typical holding periods

Risk Management: Position sizing and loss limits

Entry Criteria: Specific conditions for buying

Exit Criteria: Specific conditions for selling

Portfolio Rules: Allocation and diversification limits

Review Schedule: When and how you evaluate performance

💼 Example: The "DeFi Value Accumulator" System Philosophy: Build wealth through systematic accumulation of undervalued, cash-flowing DeFi protocols

Universe: Established DeFi protocols with >$100M TVL and 12+ month track records

Timeframe: 6 months to 3 years average holding periods

Risk Management: Max 5% per position, 25% per category, -25% stops

Entry Criteria: Protocol score >75/100, trading below fundamental value, positive trend in key metrics

Exit Criteria: 2x profit target (take 50%), fundamental deterioration, better opportunity identified

Portfolio Rules: 40% blue chips, 35% value plays, 20% growth, 5% speculation

Review Schedule: Weekly screening, monthly portfolio review, quarterly system updates

🔑 Key Takeaways

Systems beat goals, process beats outcomes - Elite traders build systematic approaches that produce consistent results

Livermore's Line of Least Resistance - Build systems that work WITH market forces rather than against them

Goals vs Systems - Goals are destinations; systems are the vehicle that gets you there

The Complete Trading System - Opportunity identification, evaluation, position sizing, risk management, portfolio allocation, and review schedule

Continuous improvement - Track system performance and update based on results, not emotions

✅ Success Metrics Your systems mastery this week:

• Created complete personal DeFi trading system with all components defined

• Backtested system approach using historical protocol data

• Established systematic opportunity identification and evaluation process

• Built position sizing and risk management rules based on conviction levels

• Created portfolio allocation framework with rebalancing triggers

• Implemented system tracking and continuous improvement processes

• Started live testing of system with small position sizes

🔮 Looking Ahead Next week, we'll master the art of reading crowd psychology and positioning contrarian to the masses for maximum opportunity capture.

💎 Remember: Amateurs focus on being right. Professionals focus on having a system that works over time. Which will you choose?

📌 Assignment: This week, document your complete trading system. Test it on paper for 7 days before risking real capital. Track every deviation and its cost. Systems only work if you work them.

Exercise

Complete the Exercise 10

Last updated