Lesson 5: Cognitive Biases in DeFi Markets

🎧 Lesson Podcast

🎬 Video Overview

Lesson 5: Cognitive Biases in DeFi Markets

🎯 Core Concept: Your Brain is Not Wired for Trading Success

Your brain evolved to keep you alive on ancient savannas, not to make optimal decisions in volatile financial markets. Understanding and neutralizing cognitive biases is the difference between systematic success and expensive psychological mistakes.

📚 Livermore's Insight: "The Market Does Not Beat Them — They Beat Themselves"

Jesse Livermore observed that most traders destroy their own accounts through predictable psychological errors. In DeFi, these mental mistakes happen faster and more expensively due to 24/7 markets, extreme volatility, and social media amplification.

The brutal truth: Your brain's default wiring will cost you money. The question is whether you'll recognize and override it.

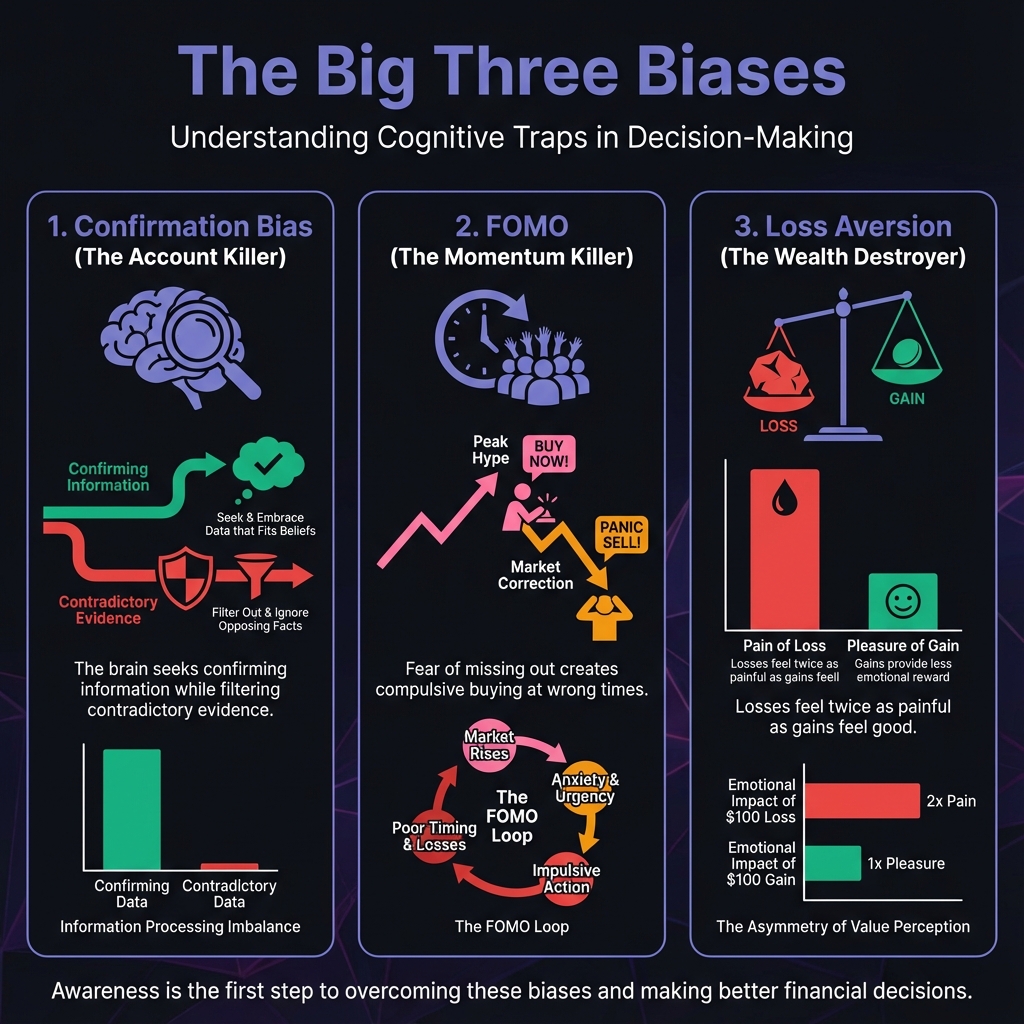

📚 The Big Three: Most Expensive DeFi Biases

Bias #1: Confirmation Bias — The Account Killer 🔍 What It Is: Your brain seeks information confirming your beliefs while actively filtering out contradictory evidence. It's intellectual comfort food that destroys portfolios.

How It Destroys DeFi Wealth:

You follow only bulls during crypto winter, missing critical bear market signals that could save your capital. You research only positive news about your protocol holdings, creating an echo chamber of false confidence. You dismiss smart contract audit concerns as "FUD" because acknowledging risks threatens your narrative.

The Terra/LUNA Tragedy: In early 2022, LUNA holders focused obsessively on Do Kwon's optimistic tweets while ignoring economists' warnings about algorithmic stablecoin risks. They sought confirmation, not truth — and paid dearly for it.

🛡️ The Bias-Breaker Protocol:

The Three-Step Protocol:

Red Team Your Thesis — for every bull case you write, create an equally detailed bear case. This isn't pessimism; it's balance.

Apply the Devil's Advocate Rule — before any major investment, find three credible sources arguing against it.

Conduct the Failure Audit — ask: "What would have to be true for this to go to zero?" This question alone saves fortunes.

Bias #2: FOMO — The Momentum Killer 🚀 What It Is: Fear of missing out creates compulsive buying at exactly the wrong times. Your brain treats missed gains as actual losses, driving irrational urgency.

How It Destroys DeFi Wealth:

You buy tokens after 1000% pumps because "this time is different" — spoiler: it never is. You jump into new protocols without research because others are getting rich, forgetting that by the time you hear about gains, it's usually too late. You abandon carefully crafted long-term strategies for whatever's pumping today.

The Dogecoin Delusion: Seeing Dogecoin pump 10,000%, thousands bought at peak prices because Twitter was full of gain screenshots. They didn't understand memecoin tokenomics or sustainability — they only understood regret at "missing out."

🚫 The FOMO Firewall:

The Three-Step Firewall:

Implement the 48-Hour Rule — never invest in anything trending for less than 48 hours. This simple delay filters out 90% of bad decisions.

Ask the Opportunity Cost Question — "What am I NOT buying because I'm chasing this?"

Apply the Regret Test — "How will I feel if this goes to zero tomorrow?" If the answer makes you uncomfortable, you have your answer.

Bias #3: Loss Aversion — The Wealth Destroyer 📉 What It Is: Losses feel twice as painful as equivalent gains feel good, leading to holding losers far too long and selling winners far too early.

How It Destroys DeFi Wealth:

You hold failing protocols hoping for miraculous recovery, watching them slowly bleed to zero. You sell profitable positions too early to "lock in gains," missing the moves that create real wealth. You refuse to take necessary stops because it makes losses "real," as if the market cares about your accounting.

The ETH Holder's Dilemma: Buying ETH at $4,000, watching it drop to $1,000, refusing to sell because "I can't take that loss." Meanwhile, you miss opportunities to buy quality protocols at discount prices because your capital is trapped in yesterday's mistake.

💊 The Loss Aversion Antidote:

Set pre-commitment stops before entering positions, not during the pain of losses. Adopt the portfolio perspective — focus on total performance, not individual position outcomes. Most importantly, reframe losses as tuition: "I paid $500 to learn this protocol has poor tokenomics" transforms failure into education.

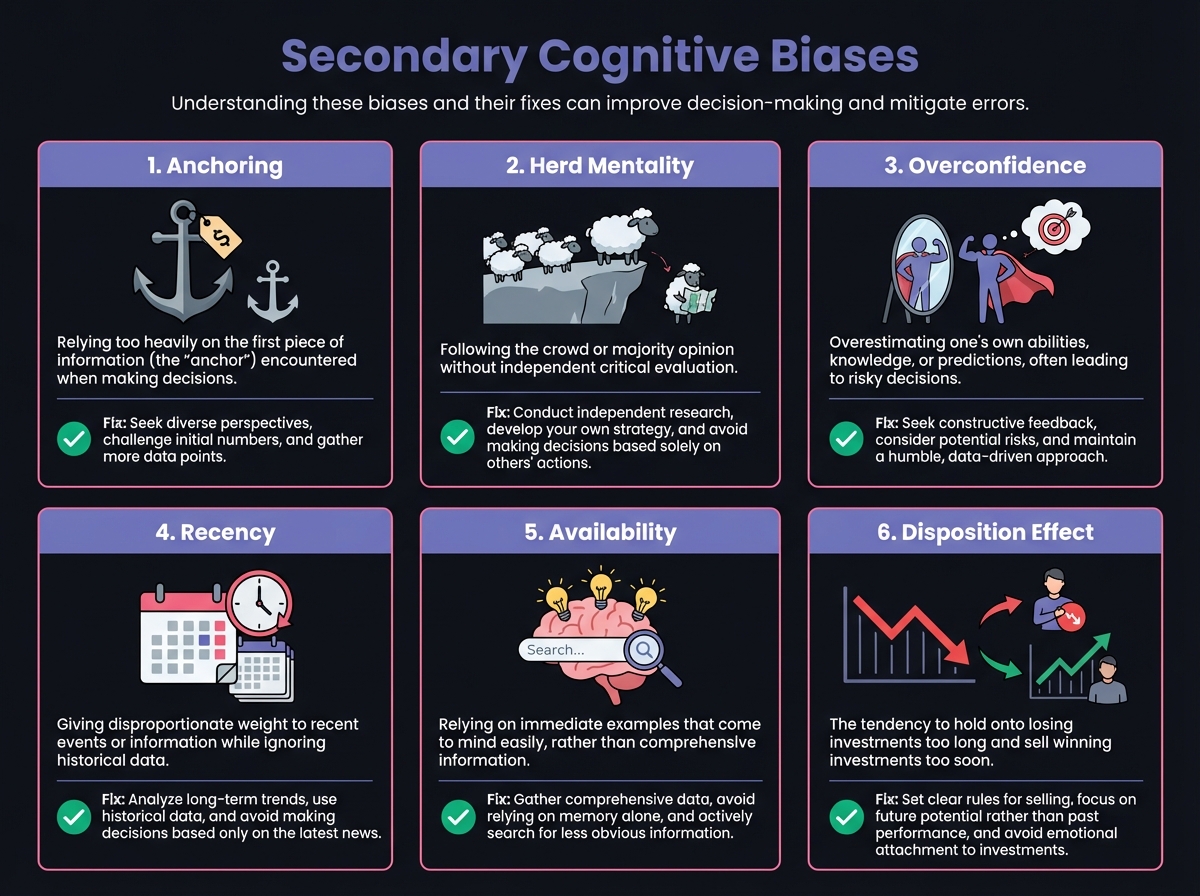

📚 The Secondary Six: Common DeFi Bias Traps

Anchoring Bias: The Price Prison ⚓ You fixate on all-time highs or purchase prices instead of current market reality. That token isn't "cheap" because it's down 90% — it might be properly valued. The Fix: Use multiple valuation metrics beyond price — TVL growth, user adoption, revenue generation.

Herd Mentality: The Echo Chamber Effect 🐑 Following crypto Twitter consensus without independent analysis leads to buying tops and selling bottoms with the crowd. The Fix: Actively seek contrarian viewpoints. If everyone agrees, everyone is probably wrong.

Overconfidence: The Leverage Trap 💪 Early DeFi success creates dangerous confidence, leading to excessive risk-taking and position sizing that eventually destroys accounts. The Fix: Keep detailed performance records tracking actual versus perceived skill. Reality is sobering.

Recency Bias: The Trend Trap 📊 Believing current market conditions will continue indefinitely causes you to buy aggressively in bulls and sell desperately in bears. The Fix: Study full crypto cycles (2017, 2018, 2020, 2022) for perspective on how quickly narratives change.

Availability Heuristic: Headline Trading 📰 Making decisions based on memorable recent events rather than comprehensive analysis leads to reactive rather than strategic positioning. The Fix: Create systematic research checklists that don't depend on news cycles.

Disposition Effect: The Winner-Loser Reversal 🔄 Selling winners too early while holding losers too long systematically reduces returns over time. The Fix: Use systematic rebalancing rules based on conviction changes, not comfort levels.

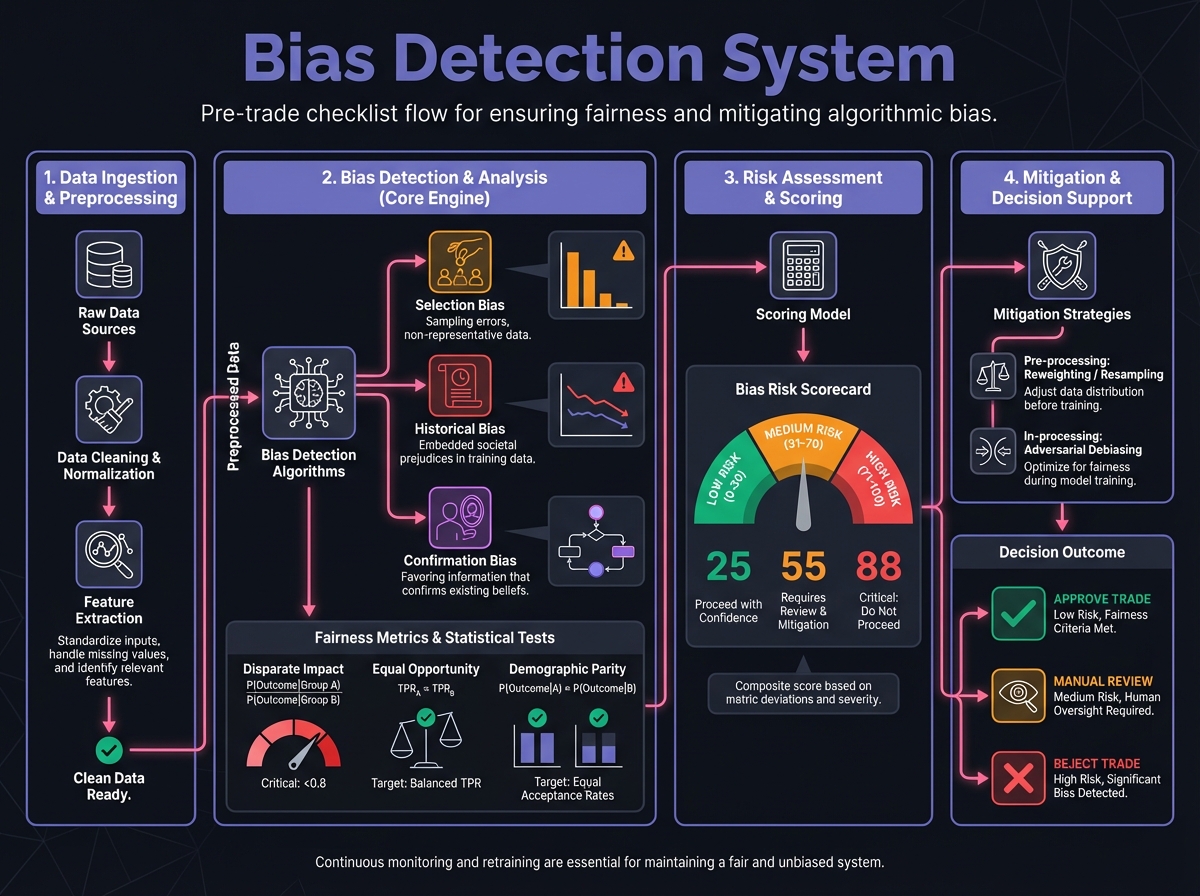

🔍 The Bias Detection System

Pre-Trade Bias Checklist (2 minutes) Before any DeFi decision, run through these questions:

[ ] Am I seeking information that confirms what I want to believe?

[ ] Is this decision driven by recent price movements or social media?

[ ] Am I risking more than my predetermined position size limits?

[ ] Have I considered equally credible opposing viewpoints?

[ ] Is my timeline for this investment realistic given market cycles?

Daily Bias Audit (5 minutes) Each evening, reflect on four critical questions: What biases influenced my decisions today? Which information sources did I seek versus avoid? How did emotions affect my analysis? What would an objective observer say about my choices?

Interactive Cognitive Bias Detector

Use this interactive tool to identify which cognitive biases may be affecting your trading decisions:

🔥 DeFi-Specific Bias Amplifiers 24/7 Markets = 24/7 Bias Opportunities Unlike traditional markets, crypto never sleeps — and neither do your biases. Solution: Set specific times for portfolio checks (maximum 3x daily). Your brain needs rest from constant decision-making.

Social Media Echo Chambers Crypto Twitter and Discord create information bubbles that reinforce existing beliefs. Solution: Follow equal numbers of bulls and bears. Rotate information sources monthly to prevent mental calcification.

Complex Technology = Simplified Decision-Making When protocols are too complex to understand, your brain defaults to simple heuristics like "number go up." Solution: If you can't explain the protocol simply, don't invest significantly.

Tribal Loyalty Bitcoin Maxis, ETH believers, Solana supporters — tribalism replaces analysis. Solution: Regularly evaluate competing ecosystems objectively. Your portfolio doesn't care about your loyalty.

🚨 The Cognitive Bias Emergency Kit When You Feel FOMO: 🏃 Close all charts and social media immediately — remove the stimulus. Set a timer for 24 hours with no decisions allowed until it expires. Ask yourself: "What am I afraid of missing that won't still be there tomorrow?" The answer is almost always "nothing."

When You're Avoiding Losses: 🩹 Calculate the opportunity cost of holding versus selling — what could this capital earn elsewhere? Ask: "If I had this cash amount today, would I buy this asset?" If no, sell immediately. Remember: The market doesn't know or care what you paid.

When You're Overconfident: 🎯 Review your last 10 trades and calculate actual success rate — numbers don't lie. Ask: "What role did luck play in my recent successes?" Honesty here saves fortunes. Reduce position sizes until confidence recalibrates to reality.

🏗️ Building Bias-Resistant Systems Information Diet Rules Read both bull and bear cases before any major investment — truth lives between extremes. Set Google alerts for negative news about your holdings to counter confirmation bias. Follow traders who disagree with your positions to maintain perspective.

Decision-Making Rules Never invest based on social media posts alone — tweets aren't research. Use position sizing formulas that remove emotional decisions from the equation. Create mandatory cooling-off periods for all major trades.

Review and Learning Rules Conduct a monthly bias audit asking which biases cost you money. Perform success attribution analysis determining how much was skill versus luck. Document near-misses — what almost went wrong and why — to catch patterns before they become problems.

🔑 Key Takeaways

Your brain is not wired for trading success - It evolved for survival, not optimal financial decisions

The Big Three Biases - Confirmation Bias, Anchoring Bias, and Loss Aversion cost traders the most money

The Secondary Six - Recency Bias, Hindsight Bias, Overconfidence, Availability Heuristic, Sunk Cost Fallacy, and Herding Behavior

Bias Detection Systems - Create checklists and routines to catch biases before they cost you money

Monthly bias audit - Review which biases cost you money and adjust your systems accordingly

✅ Success Metrics Your bias mastery progress this week:

• Completed bias identification audit of your last 10 DeFi decisions

• Created personal bias detection checklist for future trades

• Identified top 3 biases that most affect your DeFi decisions

• Implemented daily bias audit routine (5 minutes each evening)

• Set up information sources that challenge your existing beliefs

🔮 Looking Ahead Next week, we'll explore the psychology of risk management and why most traders get position sizing completely wrong. You'll learn how your brain sabotages mathematical risk rules and how to override it.

💎 Remember: The most expensive words in DeFi are "This time is different." Your biases are costing you money every day. The question is whether you'll do something about it.

📌 Assignment: This week, document every trade decision and identify which bias influenced it most. No judgment, just observation. Awareness is the first step to wealth.

Exercise

Complete the Exercise 5

Last updated