Exercise 10: Systems Thinking Framework Builder

⏰ Time Investment: 90-120 minutes initial creation + ongoing refinement 🎯 Goal: Build a complete, systematic DeFi trading methodology that produces consistent results

📚 Required Reading Integration 📖 Primary: "The Disciplined Trader" by Mark Douglas - Chapters 1-3, 8-12 📖 Primary: "Market Wizards" by Jack Schwager - Introduction + 5 key trader interviews 📖 Supporting: "Peak Performance" by Stulberg & Magness - Chapters 9-10 📖 Livermore Focus: Systematic approach and discipline

🔍 Phase 1: Current System Audit (20 minutes) Understanding Your Current Approach

Before building a system, you must audit what you're already doing (or not doing).

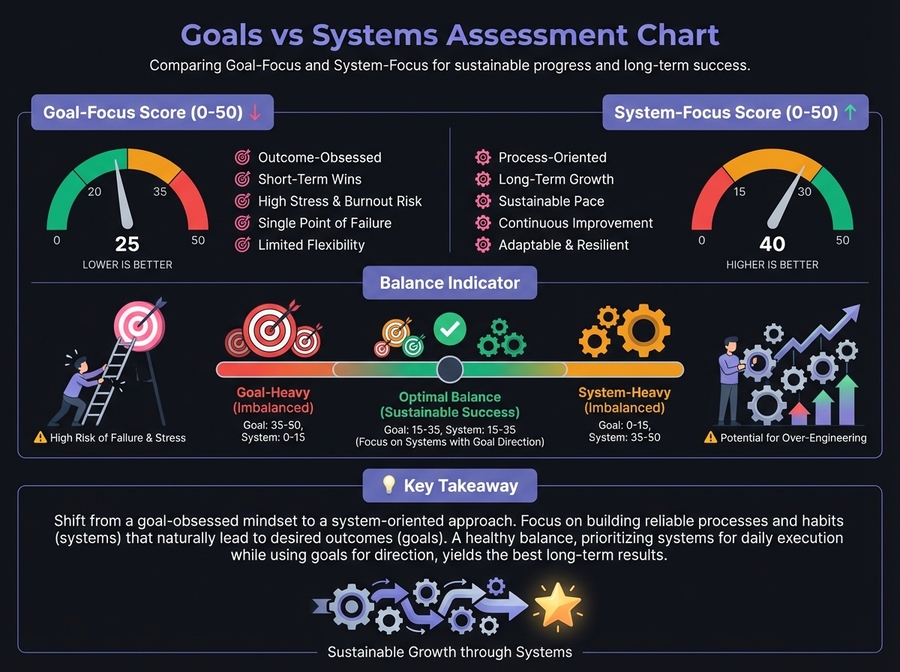

🎯 Goals vs Systems Assessment

Rate each statement (1=never, 10=always):

Goal-Focused Behavior: □ I focus on dollar targets without process ___/10 □ I look for "the next big trade" vs systematic selection ___/10 □ I make decisions based on how I feel that day ___/10 □ I rely on willpower and motivation ___/10 □ I judge success by outcomes, not process ___/10

📊 Goal-Focus Score: ___/50 (Lower is better)

System-Focused Behavior: □ I follow repeatable research processes ___/10 □ I use predetermined position sizing rules ___/10 □ I make decisions independent of emotions ___/10 □ I have systematic entry/exit criteria ___/10 □ I judge success by process adherence ___/10

📊 System-Focus Score: ___/50 (Higher is better)

Gap: _____ points (System score minus Goal score)

Target: +30 or higher (strong systematic approach)

🔄 System Component Assessment

Do you have clearly defined:

□ Opportunity identification process (how you find investments) Current state: None / Informal / Documented

□ Position sizing rules (how much you invest) Current state: None / Informal / Documented

□ Entry criteria (when you buy) Current state: None / Informal / Documented

□ Exit criteria (when you sell) Current state: None / Informal / Documented

□ Portfolio allocation framework (balance across types) Current state: None / Informal / Documented

□ Rebalancing rules (when/how you adjust) Current state: None / Informal / Documented

□ Performance review process (how you improve) Current state: None / Informal / Documented

Components documented: ___/7

0-2: No system (gambling) 3-4: Partial system (inconsistent) 5-7: Complete system (professional)

💸 Cost of No System

Estimate money lost in past 3 months due to:

Emotional decisions vs systematic ones: $______ No position sizing rules: $______ No clear exit strategy: $______ Chasing opportunities vs systematic selection: $______ No portfolio management: $______

Total Cost of No System: $________

This is what ad-hoc trading costs you.

📋

Phase 2: Building Your DeFi Trading System (40 minutes)

Component 1: System Identity and Philosophy (10 minutes)

Your System Name: ____________________________________ (Example: "DeFi Value Accumulator" or "Protocol Growth Investor")

Core Philosophy (One sentence):

What makes your approach unique:

Your DeFi Universe: Protocol minimum TVL: $________ Protocol minimum age: _____ months Categories you focus on: □ Layer 1s □ Layer 2s □ DEXs □ Lending □ Derivatives □ Others: _________________________

Your typical holding period: _____ months to _____ years

Risk tolerance: Conservative / Moderate / Aggressive

Component 2: Opportunity Identification System (15 minutes)

The DeFi Opportunity Funnel

Stage 1: Universe Screening

Starting universe: All DeFi protocols (~5,000+)

Your screening filters: □ Minimum TVL: $________ □ Minimum age: _____ months □ Minimum volume: $________ □ Audit required: Yes/No □ Other criteria: ________________________________

Protocols passing Stage 1: ~_____ (estimate)

Stage 2: Category Analysis

Categories to focus on:

______________ (Why: _______________________)

______________ (Why: _______________________)

______________ (Why: _______________________)

Categories to avoid:

______________ (Why: _______________________)

______________ (Why: _______________________)

Protocols passing Stage 2: ~_____ (estimate)

Stage 3: Fundamental Screening

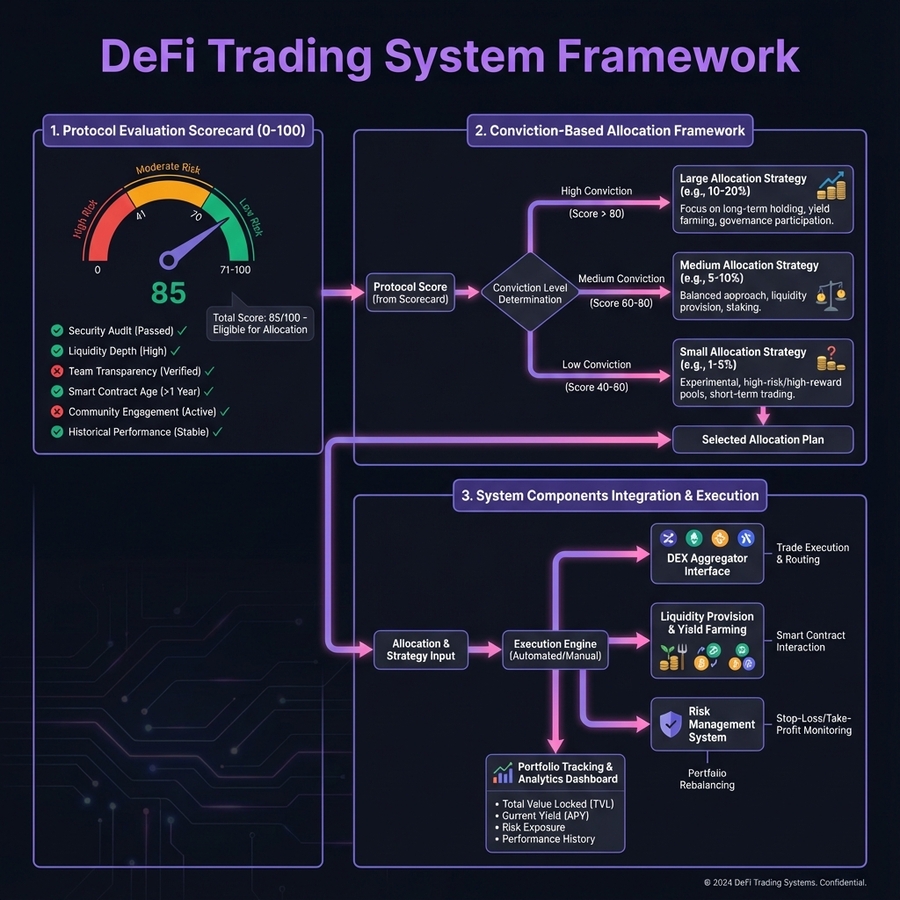

Your Protocol Evaluation Scorecard (Rate 1-10 each):

□ Team quality and track record __/10 □ Technology and innovation __/10 □ Tokenomics and sustainability __/10 □ Competitive positioning __/10 □ Growth metrics and traction __/10 □ Revenue model viability __/10 □ Community strength __/10 □ Security and audits __/10 □ Total Addressable Market __/10 □ Execution risk assessment __/10

Total Score: __/100

Minimum score to proceed: ___/100 (Recommended: 70+ for consideration)

Protocols passing Stage 3: ~_____ (estimate)

Stage 4: Deep Due Diligence Checklist

For protocols scoring above threshold, complete:

□ Read whitepaper and documentation thoroughly □ Analyze tokenomics and emissions schedule □ Review smart contract audits □ Research team backgrounds and track records □ Compare to competitors (positioning analysis) □ Check on-chain metrics and growth trends □ Read community sentiment (Discord/Twitter) □ Assess regulatory risk □ Evaluate long-term sustainability □ Stress test thesis against bear case scenarios

Time per protocol deep dive: _____ hours

Final candidates for investment: _____ protocols

Component 3: Position Sizing System (10 minutes)

Conviction-Based Allocation Framework:

10/10 Conviction: Maximum position size: ___% (recommend: 5%) Criteria for 10/10:

Current 10/10 positions: _________________________

8/10 Conviction: Maximum position size: ___% (recommend: 3%) Criteria for 8/10:

Current 8/10 positions: _________________________

6/10 Conviction: Maximum position size: ___% (recommend: 1%) Criteria for 6/10:

Current 6/10 positions: _________________________

Below 6/10 Conviction: Position size: 0% Action: Watchlist for future evaluation

Portfolio Concentration Limits:

Maximum single position: ___% (recommend: 5%) Maximum category concentration: ___% (recommend: 25%) Maximum top 3 positions combined: ___% (recommend: 15%)

Minimum stablecoin reserve: ___% (recommend: 15%)

Component 4: Entry and Exit System (15 minutes)

Entry Rules (All must be satisfied):

Market Conditions: □ Not in extreme euphoria (RSI < _____) □ Not buying all-time highs (unless conviction 10/10) □ Adequate stablecoin reserves available □ Portfolio not overconcentrated in this category

Emotional State: □ Not feeling FOMO or urgency □ Not reacting to social media hype □ Not trying to "make back losses" □ Calm and rational decision state

Position Building: Never buy full position at once. Scale in using: First 33%: Initial decision (test position) Second 33%: If thesis strengthens OR price improves Final 33%: If position shows positive momentum

Entry scaling conditions:

Exit Rules (Systematic, Non-Emotional):

Profit Taking: □ Take 25% profits at 2x (pay yourself) □ Take additional 25% at 5x □ Let remaining 50% run with trailing stop at ____%

Stop Losses: □ Speculative positions (6/10): -20% □ High conviction (8/10): -25% □ Blue chips (10/10): -30%

"I will honor all stops without hesitation or hope."

Signed: _________________ Date: _______

Thesis Break Exits: I will exit immediately if: □ Fundamental thesis invalidated by facts □ Team or protocol behaves unethically □ Smart contract exploit or major hack □ Regulatory action threatens protocol □ Better opportunity requires capital reallocation

Time-Based Exits: □ Re-evaluate all positions older than _____ years □ Reconfirm thesis or exit position

Component 5: Portfolio Management System

Asset Allocation Framework:

Blue Chip DeFi (BTC, ETH, Top 5 protocols): ____% Target: 30-50% Current: ___% Action needed: _______________

High Conviction DeFi (Strong protocols 8-10/10): ____% Target: 30-40% Current: ___% Action needed: _______________

Emerging Opportunities (Newer protocols 6-8/10): ____% Target: 15-25% Current: ___% Action needed: _______________

Speculation/Moonshots (Lottery tickets): ____% Target: 5-10% Current: ___% Action needed: _______________

Stablecoins (Dry powder): ____% Target: 15-25% Current: ___% Action needed: _______________

Total: 100%

Rebalancing Rules:

Monthly Rebalancing: Date: First _________ of each month Review all positions vs target allocations Rebalance if any category >5% off target Document all changes and reasoning

Immediate Rebalancing Triggers: □ Any position exceeds maximum size (%) □ Category exceeds maximum concentration (%) □ Stablecoin reserve falls below minimum (___%) □ Portfolio drawdown exceeds ____%

Bull Market Protocol: □ Take profits systematically at 2x and 5x □ Increase stablecoin reserves to ____% □ Reduce speculative positions to ____%

Bear Market Protocol: □ Accumulate blue chips below target allocations □ Maintain higher stablecoin reserves (___%) □ Focus only on highest conviction opportunities

📊

Phase 3: System Adherence and Tracking (15 minutes)

The System Adherence Scorecard

Track every investment decision:

Decision #1: _______________________________________

□ Followed opportunity identification process: Y/N □ Used position sizing rules: Y/N □ Met entry criteria: Y/N □ Set stop losses per system: Y/N □ Within portfolio allocation limits: Y/N

System Adherence Score: ___/5

If any "No": What was deviation and why?

Cost/benefit of deviation: +/- $______

Decision #2: _______________________________________

System Adherence Score: /5 Deviations: _______________________________________ Cost/benefit: +/- $___

Weekly System Adherence Review:

Week ending: __________

Decisions made: _____ System-following decisions: _____ System-breaking decisions: _____

Adherence rate: ___% (Target: 95%+)

Cost of deviations: $______ Benefit of system-following: $______

Lessons learned: ___________________________________

Monthly System Performance Review:

Month: __________

System-Following Decisions: Number: _____ Average return: +/- ____% Win rate: ____%

Discretionary Decisions (System breaks): Number: _____ Average return: +/- ____% Win rate: ____%

Comparison: System performs _____ (better/worse) than discretionary

This data proves whether your system works.

🧠 Phase 4: System Psychology Management (15 minutes)

The Pre-Commitment Contract

"I, ______________, commit to following my documented trading system for the next 90 days without deviation.

I understand that: • Systems work slowly and steadily, not through gambling excitement • Periods of underperformance are normal and expected • Missing "obvious" opportunities is the cost of consistency • The system created success, not my genius in any single trade

If I deviate from the system, I will:

Document the deviation and reason

Calculate the cost in dollars

Review with accountability partner

Recommit to system for 7 days before next decision

I will review and update my system only on scheduled dates: Monthly review: First ______ of each month Quarterly update: _________, _________, _________, _________ Annual overhaul: _________

No changes outside these scheduled times."

Signed: _________________ Date: _______ Witness: ________________ Date: _______

The System Abandonment Warning Signs

Check if you're experiencing:

□ Bored because system is "too slow" □ Considering changes after 1-2 weeks of use □ Wanting to "just this once" break a rule □ Seeing others' results and doubting your system □ Making exceptions during extreme market conditions □ Overconfident after a few winning trades □ Blaming system for normal variance □ Adding complexity constantly

Checked items: ___ (If >3, you're at risk of abandonment)

The System Adherence Reaffirmation:

When tempted to deviate, ask:

"Is this deviation based on better information or emotion?"

"What would my system say about this situation?"

"How would I feel if this deviation costs me money?"

"Am I changing a losing system or sabotaging a winning one?"

If answers don't clearly support deviation, follow your system.

🔄 Phase 5: Continuous Improvement Protocol (20 minutes)

Monthly System Review Checklist

Completed on: ________ (First of each month)

Performance Assessment: □ Month's return: +/- ____% □ System adherence rate: % □ Number of opportunities evaluated: _____ □ Number of investments made: _____ □ Win rate: % □ Average gain: +% □ Average loss: -%

Component Review: □ Opportunity identification: Working well / Needs adjustment Changes needed: ________________________________

□ Position sizing: Working well / Needs adjustment Changes needed: ________________________________

□ Entry/exit rules: Working well / Needs adjustment Changes needed: ________________________________

□ Portfolio management: Working well / Needs adjustment Changes needed: ________________________________

Lessons Learned: Most valuable insight this month:

Biggest mistake and prevention:

One improvement to test next month:

Quarterly System Update

Completed on: ________ (Every 3 months)

Backtesting: □ System tested against last quarter's opportunities □ Performance compared to buy-and-hold BTC/ETH □ Risk-adjusted returns calculated (Sharpe ratio)

Results: System is outperforming / underperforming / matching benchmark

Market Evolution Assessment: □ New DeFi categories emerged worth considering □ Categories declining that should be avoided □ Regulatory changes affecting approach □ Technological shifts impacting evaluation

Major Updates to Implement:

Annual System Overhaul

Completed on: ________ (Once per year)

Complete Component Review: □ System philosophy still aligned with goals: Y/N □ Opportunity identification process still effective: Y/N □ Position sizing producing optimal results: Y/N □ Entry/exit rules performing as expected: Y/N □ Portfolio allocation appropriate for goals: Y/N

Year's Performance: Total return: +/- ____% System adherence rate: ____% Versus benchmark (BTC/ETH): +/- ____% Number of investments: _____ Win rate: ____%

Major Changes for Next Year:

🎯 Implementation Action Plan

⚡ Immediate Actions (This Week) □ Complete system audit (current state assessment) □ Document all system components □ Create opportunity identification funnel □ Define position sizing rules □ Establish entry/exit criteria □ Set portfolio allocation targets □ Sign pre-commitment contract

📅 90-Day System Implementation Days 1-30: Testing Phase □ Paper trade system without real money □ Track all decisions and hypothetical results □ Refine components based on learning □ Build confidence in system approach

Days 31-60: Small Position Phase □ Implement system with 25% normal position sizes □ Track adherence and results meticulously □ Make first monthly review and adjustments □ Build trust through real-world testing

Days 61-90: Full Implementation Phase □ Increase to full position sizes □ System should feel natural and automatic □ Complete first quarterly review □ Commit to long-term adherence

🏆 Success Metrics

Primary: 95%+ system adherence rate over 90 days

Secondary: System-following decisions outperform discretionary

Behavioral: Zero emotional overrides of systematic rules

Psychological: Confidence in system during drawdowns

Financial: Consistent returns independent of market conditions

📖 Book Integration Exercises

🧠 From The Disciplined Trader (Douglas)

System as Mental Framework "The goal is not to have a 100% winning system, but to trade a system with which you are comfortable, both psychologically and financially."

Your comfort assessment: □ I can follow this system during 30% drawdowns: Y/N □ I can ignore "better" opportunities outside system: Y/N □ I can execute system during extreme volatility: Y/N

If any "No," adjust system for psychological sustainability.

💡 From Market Wizards (Schwager)

Common Elite Trader Traits All consistently profitable traders share:

They have documented trading systems

They cut losses and let winners run

They control risk through position sizing

They have realistic expectations

Your system includes all four: Y/N

📚 From Peak Performance

Systems for Sustainable Excellence "The best performers build systems that allow consistency even when motivation wanes."

Your system works even when you're: □ Not feeling motivated □ Experiencing drawdowns □ Bored with markets □ Distracted by life

System resilience score: ___/4

👥 Community Integration

🎯 System Mastermind Group:

Share documented systems

Test each other's systems for holes

Compare system vs discretionary results

Hold accountable to adherence commitments

🤝 Accountability Partnership:

System Accountability Partner: _______________________

Weekly Check-in: Every _______ at _______

What we share: • System adherence rate for the week • Any deviations and their outcomes • Temptations to break system • Lessons learned from system application

🚀 Quick Reference Card

⚡ Before Every Investment Does this opportunity pass my funnel? Y/N

What's my conviction level? ___/10

What's appropriate position size? ___%

Do I meet ALL entry criteria? Y/N

Are stops set per system? Y/N

If any "No," don't invest.

📅 System Maintenance Schedule Monthly: First ______ - Performance review

Quarterly: _________ - Major updates

Annually: _________ - Complete overhaul

Outside these times: No changes allowed

When Tempted to Deviate Ask: "Is this emotion or better information?"

Review: My pre-commitment contract

Remember: The system created my success

Decision: Follow system or document deviation

💎 Key Takeaway

"Amateurs focus on being right. Professionals focus on having a system that works over time. Your consistency comes not from perfect predictions but from perfect execution of imperfect systems."

The elite trader's advantage: A documented, tested, followed system.

👇 Comment below with your system name and core philosophy statement - public commitment increases adherence!

Last updated