Exercise 11: Market Psychology Mastery System

⏰ Time Investment: 45-60 minutes initial setup + 5 minutes daily tracking 🎯 Goal: Master crowd psychology to position contrarian and profit from predictable human behavior

📚 Required Reading Integration 📖 Primary: "Predictably Irrational" by Dan Ariely - Chapters 9-15 📖 Primary: "The Art of Thinking Clearly" by Rolf Dobelli - Chapters 41-80 📖 Supporting: "Market Wizards" by Jack Schwager - Market psychology insights 📖 Livermore Focus: Crowd behavior and contrarian positioning

🔍 Phase 1: Current Market Cycle Assessment (15 minutes) Where Are We Now?

Before mastering market psychology, you must identify the current cycle phase.

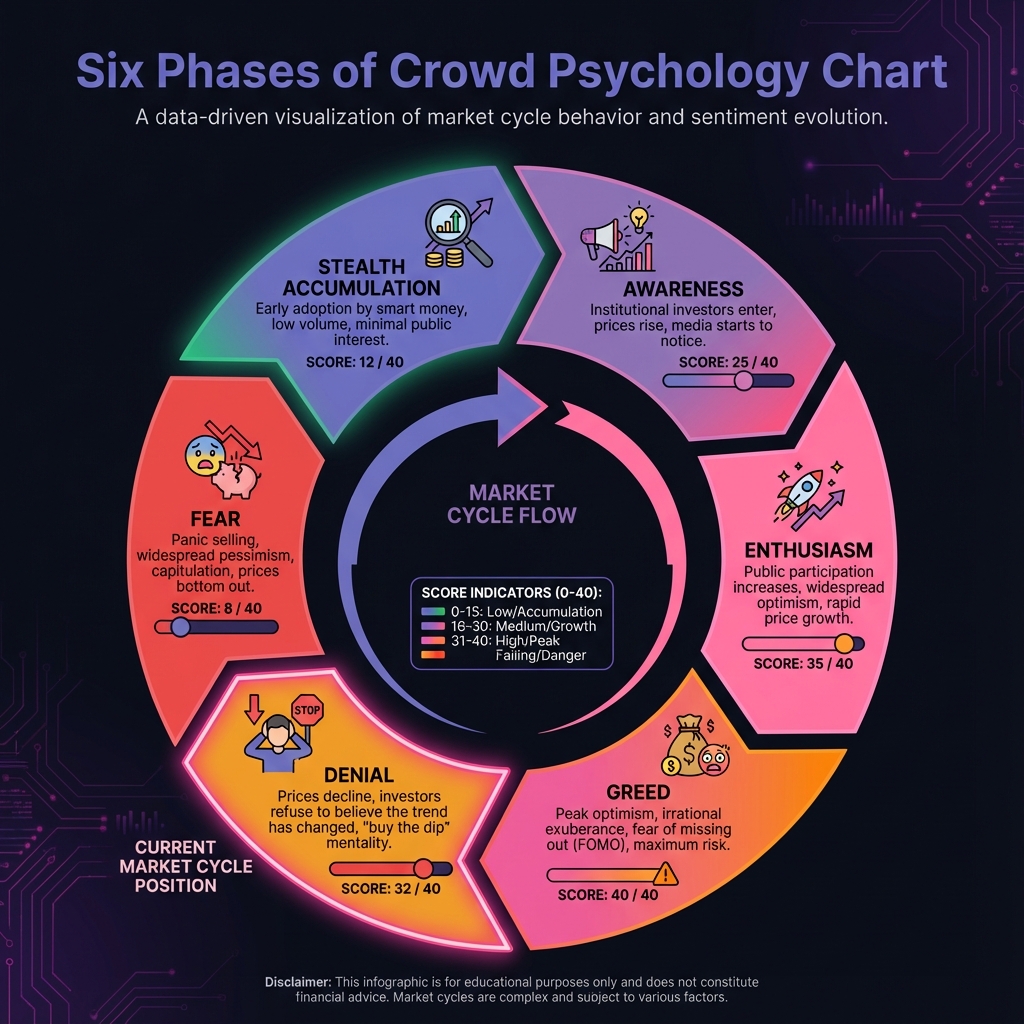

🔄 The Six Phases of Crowd Psychology

Read each phase and rate how well it describes current DeFi markets (1-10):

Phase 1: Stealth Accumulation 🌱 □ "DeFi is dead" is the consensus ___/10 □ Media coverage minimal, focused on problems ___/10 □ Price action bottoming with low volatility ___/10 □ Smart money quietly accumulating ___/10

Score: ___/40

Phase 2: Awareness 📈 □ Cautious optimism emerging ___/10 □ Media coverage becoming balanced ___/10 □ Steady uptrend with increasing volume ___/10 □ Early institutional interest appearing ___/10

Score: ___/40

Phase 3: Enthusiasm 🚀 □ Growing excitement, FOMO creeping in ___/10 □ Media coverage increasingly positive ___/10 □ Price action accelerating upward ___/10 □ Resistance levels breaking ___/10

Score: ___/40

Phase 4: Greed 🔥 □ Euphoria dominant, "this time is different" ___/10 □ Mainstream media coverage, bubble warnings ignored ___/10 □ Parabolic price action, extreme volatility ___/10 □ Everyone talking about easy money ___/10

Score: ___/40

Phase 5: Denial 😰 □ "Just a correction," "buy the dip" common ___/10 □ Mixed media signals, rationalizations ___/10 □ Choppy decline with dead cat bounces ___/10 □ Still holding hoping for recovery ___/10

Score: ___/40

Phase 6: Fear 💀 □ Panic, "sell everything" consensus ___/10 □ Doom and gloom media coverage ___/10 □ Sharp decline with high volume selling ___/10 □ Capitulation and widespread despair ___/10

Score: ___/40

Highest Scoring Phase: _________________ (___/40)

This is likely where we are in the cycle.

🎯 Your Current Positioning vs Cycle Phase

Current Phase: _________________

Appropriate positioning for this phase:

Stealth/Fear (Buy Time): Target: 60-80% deployed in quality protocols Your current: ___% deployed Action needed: _______________________________

Awareness/Spring (Add Time): Target: 70-90% deployed, adding to positions Your current: ___% deployed Action needed: _______________________________

Enthusiasm/Summer (Hold Time): Target: 70-90% deployed, resist overallocation Your current: ___% deployed Action needed: _______________________________

Greed (Reduce Time): Target: 40-60% deployed, systematic profit-taking Your current: ___% deployed Action needed: _______________________________

Denial/Autumn (Exit Time): Target: 30-50% deployed, continuing reduction Your current: ___% deployed Action needed: _______________________________

Positioning Gap: ___% (Target minus current)

💸 Cost of Being Wrong on Cycle Phase

If I'm wrong and we're actually in: _____________ phase instead of _____________ phase

Then I should be ___% deployed, not ___% deployed

Risk of current positioning: +/- $______

This is what cycle blindness costs.

📊 Phase 2: Sentiment Tracking System (20 minutes)

Daily Sentiment Dashboard (5 minutes daily)

Date: __________

Social Media Sentiment (1-10 scale): 1 = Extreme fear/despair 5-6 = Neutral/balanced 10 = Extreme greed/euphoria

Crypto Twitter mood: ___/10 Discord/Telegram activity level: ___/10 YouTube content themes: ___/10 (1 = doom, 5 = balanced, 10 = moon/lambo)

Average Social Sentiment: ___/10

On-Chain Sentiment Indicators:

DeFi TVL trend: Declining / Stable / Growing Gas fees: Low (<$5) / Medium ($5-20) / High (>$20) New protocol launches: Few / Moderate / Many Yield farming APYs: Low (<20%) / Medium (20-50%) / Unsustainable (>50%)

Market Behavior Observations:

Quality focus (1) vs Garbage buying (10): ___/10 Long-term discussions (1) vs Short-term hype (10): ___/10 Educational content (1) vs Get-rich-quick (10): ___/10

Combined Sentiment Score: ___/10

0-2: Extreme Fear (Max buying opportunity) 3-4: Fear (Good buying opportunity) 5-6: Neutral (Normal market) 7-8: Greed (Start taking profits) 9-10: Extreme Greed (Max selling opportunity)

Today's Sentiment: ___/10 Classification: _______________________

Contrarian Action Indicated:

Weekly Sentiment Analysis (30 minutes)

Week ending: __________

Institutional Behavior: □ VC investment announcements: Active / Quiet □ Corporate treasury allocations: Increasing / Stable / Decreasing □ Regulatory sentiment: Positive / Neutral / Negative

Developer Activity: □ GitHub commits: High / Medium / Low □ Protocol improvements shipping: Many / Some / Few □ Conference quality: Strong / Moderate / Weak

New Protocol Quality: □ Innovation level: High / Medium / Low □ Team quality: Strong / Medium / Weak □ Obvious cash grabs: Few / Some / Many

Smart Money vs Loud Money:

Smart Money Indicators (count present): □ VCs investing in down markets □ Developer activity high despite low prices □ Institutional treasury diversification □ Long-term governance participation increasing

Total: ___/4

Loud Money Indicators (count present): □ Social media hype and influencer pumps □ Get-rich-quick course proliferation □ Telegram pump groups multiplying □ Celebrity meme coin endorsements

Total: ___/4

Smart/Loud Ratio: :

Ideal for accumulation: 4:0 (Smart money only) Ideal for distribution: 0:4 (Loud money only)

Weekly Sentiment Summary: Current cycle phase: _______________________ Overall sentiment (1-10): ___/10 Recommended positioning: ___% deployed Current positioning: ___% deployed Adjustment needed: _______________________________

Monthly Contrarian Positioning Review

Month: __________

Portfolio Allocation Analysis:

Overweight Popular Sectors: Sector: ______________ Your allocation: ___% (Everyone loves this) Sector: ______________ Your allocation: ___% (Crowded trade)

Action: Consider reducing popular sector exposure by ____%

Exposure to Unloved Quality: Protocol: _____________ Your allocation: ___% (Ignored but quality) Protocol: _____________ Your allocation: ___% (Hated but improving)

Action: Consider increasing contrarian exposure by ____%

Contrarian Score:

Rate your positioning (1-10): 1 = Following the herd completely 5 = Balanced/neutral positioning 10 = Maximum contrarian positioning

Your score: ___/10

Phase 1-2 (Accumulation): Target 8-10/10 contrarian Phase 3-4 (Bull market): Target 4-6/10 contrarian Phase 5-6 (Distribution): Target 7-9/10 contrarian

Current optimal: ___/10 Your actual: ___/10 Gap: ___ points

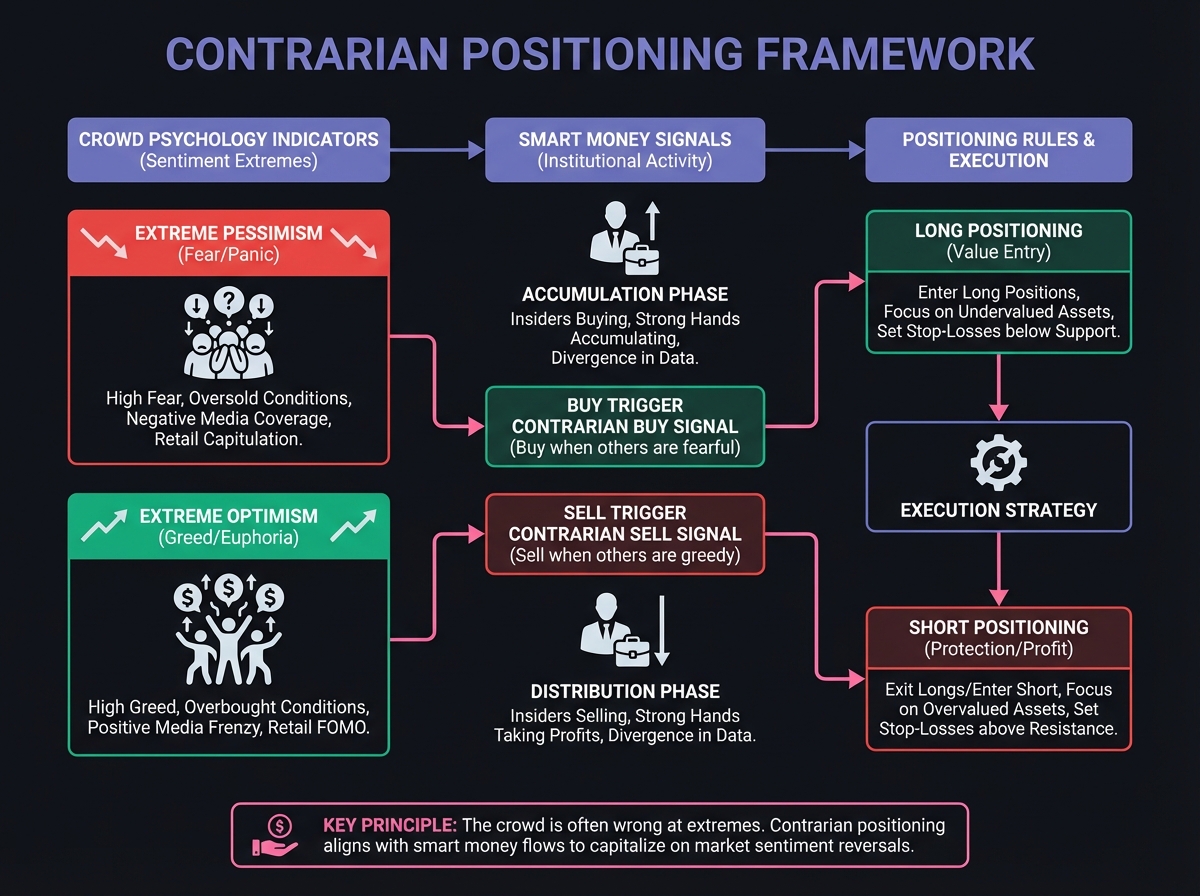

🎯 Phase 3: The Contrarian Playbook (15 minutes)

Rule 1: Fade the Consensus at Extremes

The 90% Rule: When 90%+ are bullish (Sentiment >8/10):

My automatic actions: □ Take profits at ___% levels on all positions □ Reduce position sizes by ___% across the board □ Build cash reserves to ___% of portfolio □ Ignore FOMO and social pressure completely

"When everyone is greedy, I will be fearful and take profits."

When 90%+ are bearish (Sentiment <3/10):

My automatic actions: □ Deploy ___% of cash reserves into quality protocols □ Increase research time to _____ hours per week □ Build positions in top _____ conviction plays □ Ignore negativity and permanent decline narratives

"When everyone is fearful, I will be greedy and accumulate."

Current sentiment: ___/10 Action triggered: None / Profit-taking / Accumulating

Rule 2: Follow Smart Money, Not Loud Money

Smart Money Tracking List:

VC firms I monitor:

______________ (Recent activity: _______________)

______________ (Recent activity: _______________)

______________ (Recent activity: _______________)

Protocol teams I follow:

______________ (Development activity: __________)

______________ (Development activity: __________)

______________ (Development activity: __________)

On-chain analytics I check:

______________ (What it shows: _______________)

______________ (What it shows: _______________)

Loud Money to Ignore:

Influencers I've unfollowed: _____ Pump groups I've left: _____ Hype content I no longer consume: _______________

"I will make investment decisions based on smart money actions, not loud money noise."

Rule 3: Position Size Inversely to Comfort

The Discomfort Allocation System:

When investments feel SCARY (bear markets, bad news, pessimism): This is often the BEST time to buy quality.

My scary = buying allocation: If I'm nervous buying: ___% position (within limits) If I'm terrified buying: ___% position (max conviction)

Current scary opportunities:

______________ (Discomfort level: ___/10)

______________ (Discomfort level: ___/10)

When investments feel EASY (bull markets, good news, optimism): This is often the WORST time to increase exposure.

My comfortable = selling allocation: If everyone is excited: Reduce by ___% If I feel like genius: Reduce by ___% more

Current comfortable positions (time to reduce):

______________ (Comfort level: ___/10)

______________ (Comfort level: ___/10)

📅 Phase 4: Seasonal DeFi Strategy (10 minutes)

The Four Seasons of DeFi

Current Season Assessment:

DeFi Winter (Bear Market): □ 12-24 month duration, 80-90% declines □ Protocol failures and widespread despair □ Quality protocols at deep discounts

Are we here? Yes/No If yes, Strategy: _______________________________

DeFi Spring (Early Bull): □ 6-12 month duration, steady recovery □ Improving metrics, cautious optimism □ Adding to positions with discipline

Are we here? Yes/No If yes, Strategy: _______________________________

DeFi Summer (Bull Market): □ 6-18 month duration, rapid growth □ New highs, infectious enthusiasm □ Hold but resist overallocation

Are we here? Yes/No If yes, Strategy: _______________________________

DeFi Autumn (Late Bull/Early Bear): □ 3-9 months duration, increasing volatility □ Distribution happening, widespread denial □ Systematic profit-taking time

Are we here? Yes/No If yes, Strategy: _______________________________

Current Season: _________________

My positioning for this season:

Deployment level: ___% (vs ___% target) Cash reserves: ___% (vs ___% target) Action needed: _________________________________

Seasonal Strategy Rules:

Winter Strategy (Max Opportunity): □ Deploy 60-80% into quality protocols □ Research time maximum □ Build conviction in 5-10 year winners □ Ignore short-term pain

Spring Strategy (Add Selectively): □ Deploy 70-90% total □ Add to existing winners □ Start new positions carefully □ Maintain discipline

Summer Strategy (Hold and Trim): □ Stay 70-90% deployed □ Take profits at 2x and 5x targets □ Resist adding to positions □ Build cash reserves

Autumn Strategy (Systematic Exit): □ Reduce to 30-50% deployed □ Take profits aggressively □ Ignore "it's just a dip" narratives □ Prepare for Winter

🧠 Phase 5: Advanced Contrarian Techniques (10 minutes)

Sentiment Divergence Analysis

Track these divergences for alpha:

Price vs Sentiment Divergence:

Situation 1: Price declining but sentiment still optimistic Interpretation: More downside likely Action: Avoid or reduce position

Current examples: Protocol: _____________ Price: Down Sentiment: High Action: _______________________________

Situation 2: Price rising but sentiment still pessimistic Interpretation: More upside likely Action: Accumulate or hold

Current examples: Protocol: _____________ Price: Up Sentiment: Low Action: _______________________________

Fundamental vs Sentiment Divergence:

Situation 1: Fundamentals improving but sentiment poor Interpretation: Buying opportunity Action: Build position

Current examples: Protocol: _____________ Fundamentals: ↑ Sentiment: ↓ Action: _______________________________

Situation 2: Fundamentals deteriorating but sentiment positive Interpretation: Selling opportunity Action: Reduce or exit position

Current examples: Protocol: _____________ Fundamentals: ↓ Sentiment: ↑ Action: _______________________________

The Commitment Test

High Commitment Indicators (Strong trend): □ Large institutional investments with lock-ups □ Founders/teams holding significant positions □ Users paying high fees despite costs □ Long-term stakers increasing

Count present: ___/4

Low Commitment Indicators (Weak trend): □ Day trading and short-term speculation □ Yield chasers rotating weekly □ Heavy leverage and margin trading □ Focus on price over utility

Count present: ___/4

Commitment Score: :

High commitment (4:0) = Sustainable trend Low commitment (0:4) = Fragile trend likely to reverse

🎯 Implementation Action Plan

⚡ Immediate Actions (This Week) □ Identify current market cycle phase □ Set up daily sentiment tracking system □ Create contrarian positioning framework □ Determine current season (Winter/Spring/Summer/Autumn) □ Adjust positioning based on cycle analysis □ Establish smart money tracking process

📅 30-Day Market Psychology Mastery □ Track daily sentiment and record (1-10 scale) □ Complete weekly institutional/developer analysis □ Execute monthly contrarian positioning review □ Compare sentiment to price action 30 days later □ Build database of sentiment/price correlations □ Refine contrarian triggers based on data

🏆 Success Metrics

Primary: Daily sentiment tracking completion 95%+

Secondary: Positioning aligned with cycle phase

Behavioral: Automatic contrarian action at sentiment extremes

Psychological: Comfort being uncomfortable (buying fear, selling greed)

Financial: Outperformance via cycle-appropriate positioning

📖 Book Integration Exercises

🧠 From Predictably Irrational (Ariely)

Herd Behavior Recognition Identify 3 times you followed the herd:

Investment: ____________ (Everyone was buying) Outcome: _________________________________

Investment: ____________ (Everyone was selling) Outcome: _________________________________

Investment: ____________ (Crowd consensus) Outcome: _________________________________

New commitment: "I will question crowd consensus before every major investment decision."

💡 From The Art of Thinking Clearly (Dobelli)

Social Proof Resistance When everyone says the same thing, I will:

_______________________________________________(Seek contrarian viewpoints)

📚 From Market Wizards (Schwager)

Elite Trader Contrarian Thinking "The public is right during trends but wrong at turning points."

My system for identifying turning points:

Sentiment reaches ___/10 (extreme)

Combined with ____________________________

Triggers contrarian positioning automatically

👥 Community Integration

🎯 Market Psychology Mastermind:

Share daily sentiment ratings and observations

Discuss current cycle phase assessment

Challenge each other's consensus thinking

Celebrate contrarian wins (buying fear, selling greed)

🤝 Accountability Partnership:

Market Psychology Partner: _______________________

Weekly Check-in: Every _______ at _______

What we share: • Daily sentiment average for the week • Current cycle phase assessment • Contrarian actions taken • Herd behavior we avoided

🚀 Quick Reference Card

⚡ Daily Practice (5 min) Rate social sentiment (1-10)

Check on-chain indicators

Observe market behavior

Calculate combined sentiment score

Take contrarian action if needed

📅 Weekly Analysis (30 min) Track institutional behavior

Monitor developer activity

Assess smart vs loud money

Review contrarian positioning

Adjust based on cycle phase

Monthly Deep Review (60 min) Complete contrarian positioning analysis

Review overweight popular sectors

Identify unloved quality opportunities

Compare sentiment to subsequent price action

Refine cycle phase assessment

💎 Key Takeaway

"The crowd is right during trends but wrong at turning points. Your edge comes from knowing the difference. Be greedy when others are fearful, fearful when others are greedy. Position size inversely to comfort. Follow smart money, not loud money."

The greatest fortunes are built by understanding what everyone else is feeling — and doing the opposite at extremes.

👇 Comment below with today's sentiment rating (1-10) and whether you're positioned contrarian or with the crowd!

Last updated