Lesson 2: TradFi, CeFi, and DeFi

Lesson 2: TradFi, CeFi, and DeFi

🎯 Core Concept: The Three Financial Architectures

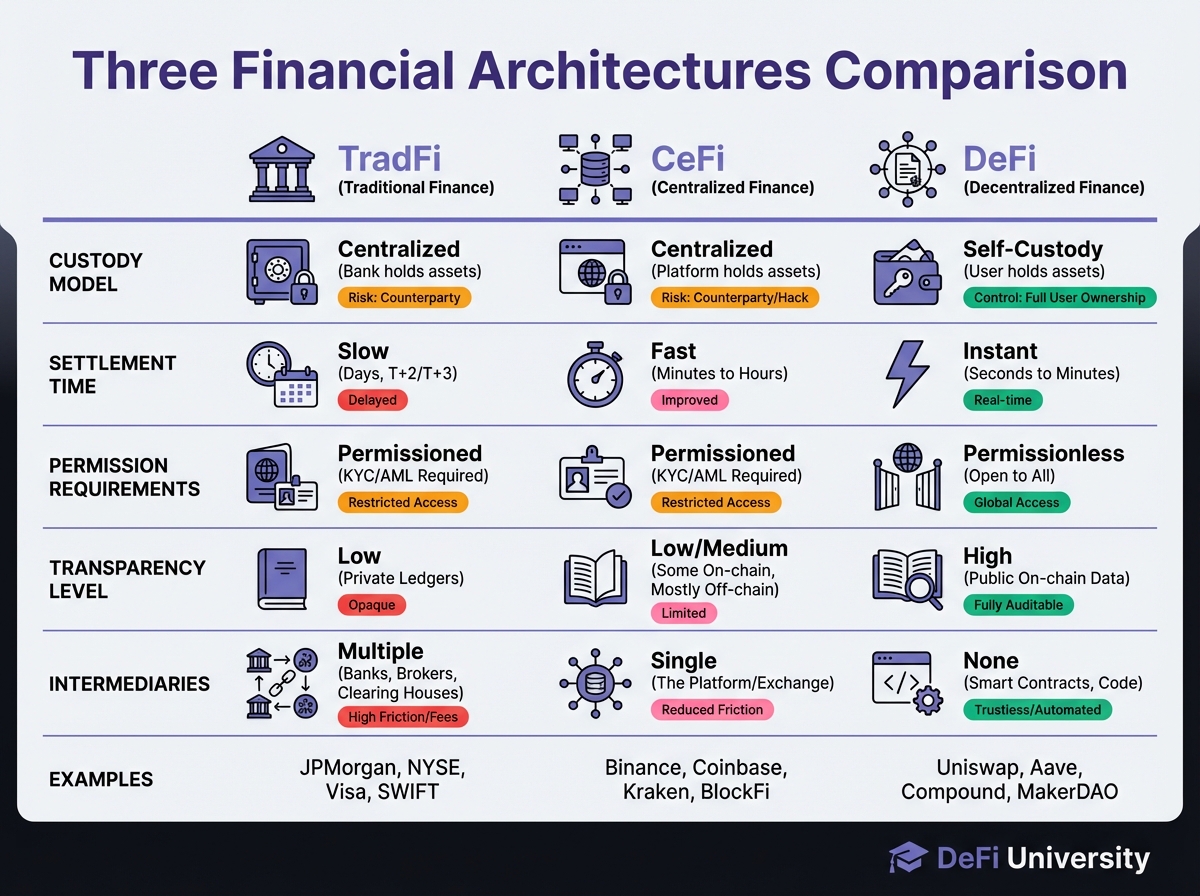

The contemporary financial landscape is not a monolith but a spectrum. We currently exist in a transitional era where legacy systems coexist with emerging protocols. To navigate this landscape, you must distinguish between Traditional Finance (TradFi), Centralized Finance (CeFi), and Decentralized Finance (DeFi), understanding their structural and philosophical divergences.

Why This Matters: Confusion often arises between CeFi (Centralized Crypto Finance, like Coinbase or Binance) and true DeFi (like Uniswap or Aave). Understanding the differences is critical for making informed decisions about where to store assets, how to trade, and what risks you're accepting.

📚 Traditional Finance (TradFi): The Legacy Architecture

TradFi represents the established banking, investment, and insurance infrastructure that has evolved from the Medici model. It is characterized by a hierarchical Hub-and-Spoke topology where centralized institutions act as the gatekeepers of value.

Key Characteristics

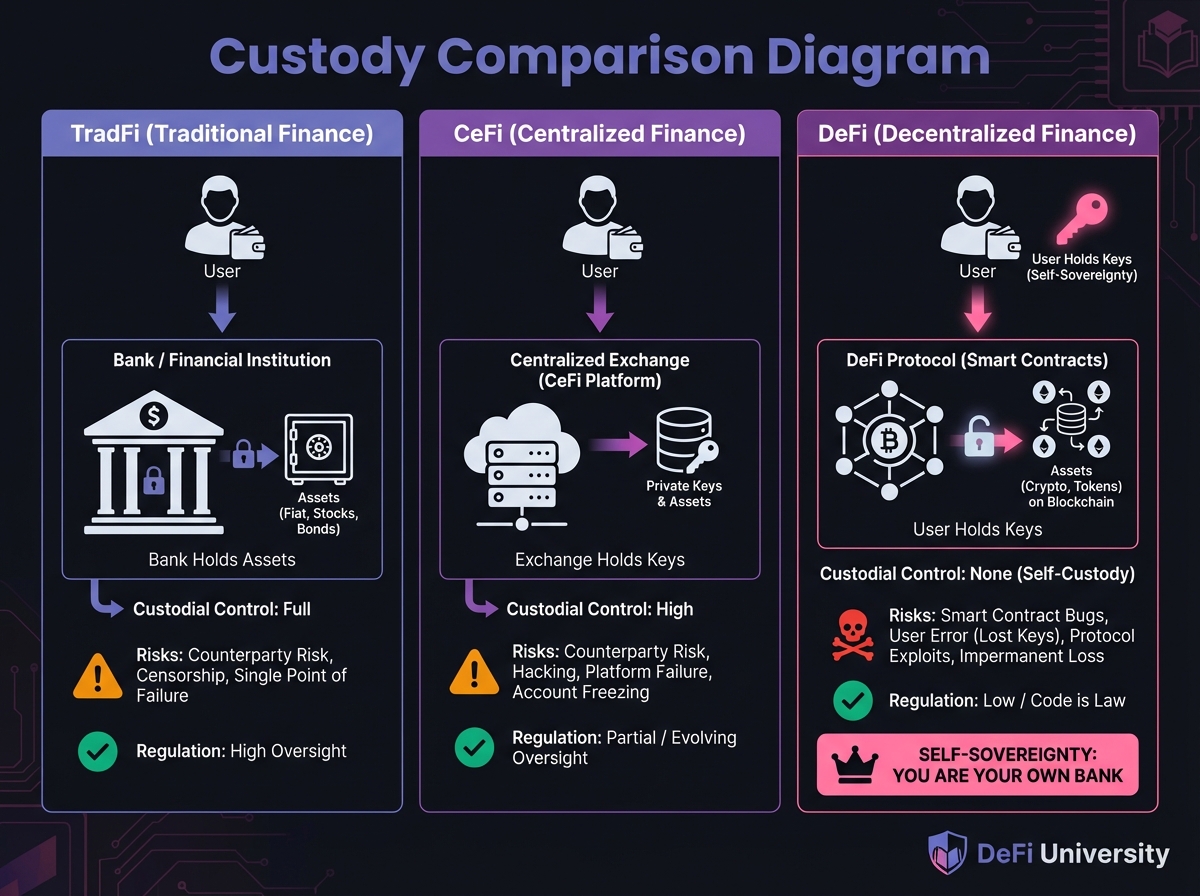

Custody: In TradFi, users do not truly own their money; they are creditors to the bank. The bank acts as the custodian, holding the assets on its balance sheet. If the bank fails, the user is an unsecured creditor, reliant on government insurance (like the FDIC) for restitution.

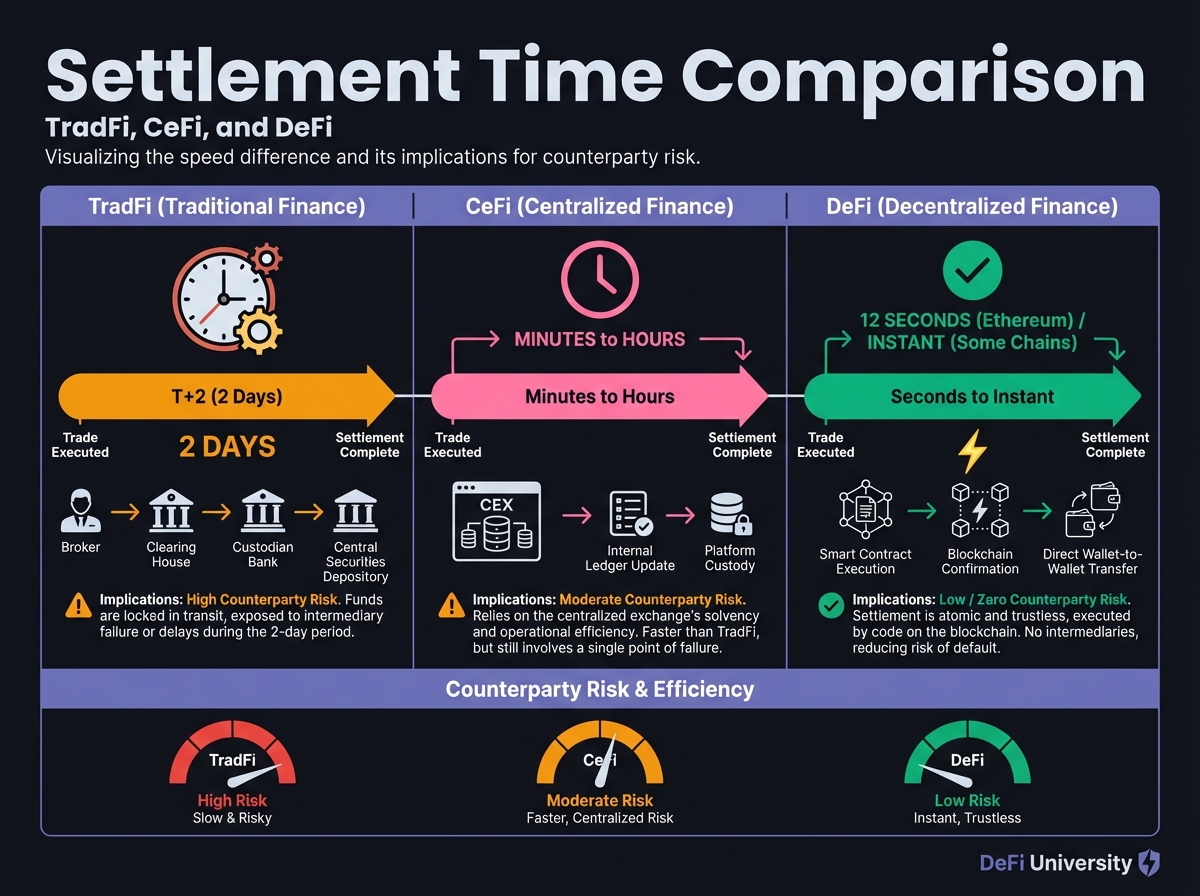

Settlement Latency (T+2): Transactions in TradFi are slow. While a credit card swipe feels instant, the actual settlement of funds often takes days. Stock trades typically settle on a T+2 (Trade Date + 2 Days) or recently T+1 cycle. This delay exists because the disparate internal ledgers of buyers, sellers, brokers, and clearinghouses must be reconciled through batch processing. This latency creates counterparty risk—the risk that one party defaults before the trade settles.

Permissioned Access: Access is gated. Users must undergo strict Know Your Customer (KYC) and Anti-Money Laundering (AML) checks. Billions of unbanked individuals are excluded from this system due to geographic or economic barriers.

Opacity: Institutional health is opaque. Balance sheets are audited quarterly. Between these audits, the institution's solvency is a "black box" to the public, as demonstrated by the sudden collapse of Silicon Valley Bank.

📚 Centralized Finance (CeFi): The Uncanny Valley

CeFi sits in the "uncanny valley" between the old world and the new. It utilizes the assets of the crypto economy (Bitcoin, Ethereum, Stablecoins) but operates using the centralized business logic of TradFi. Entities like Binance, Coinbase, and the defunct FTX are CeFi platforms.

The CeFi Facade

In a CeFi exchange, users deposit cryptocurrencies into a wallet controlled by the exchange. The user surrenders their private keys and thus their cryptographic ownership. Internal trading on the exchange happens "off-chain" on the company's private SQL database, not on the blockchain. This allows for instant, high-frequency trading but reintroduces the Principal-Agent Problem and the opacity of the Medici model.

Case Studies: FTX and Celsius Collapse

The catastrophic failures of FTX and Celsius in 2022 serve as critical case studies in the dangers of CeFi.

FTX (The Fraud of Commingling): Users believed their assets were held in segregated accounts. In reality, FTX had commingled customer funds with its sister hedge fund, Alameda Research. Alameda used these funds to make risky venture bets. Crucially, Alameda used FTX's own token, FTT, as collateral for loans. Because FTT was an illiquid token printed by FTX, its value was artificial. When the market realized this and sold FTT, the collateral value collapsed, revealing a multi-billion dollar hole in the balance sheet. Because the internal ledger was private, this insolvency was hidden until the final moment.

Celsius (The Rehypothecation Trap): Celsius operated as a "shadow bank," offering high yields on crypto deposits. It took user funds and rehypothecated (lent out) them into risky DeFi strategies to generate yield. When the market turned and liquidity dried up, Celsius faced a "duration mismatch"—it owed users liquid funds on demand but had locked those funds into illiquid long-term investments. Since users had surrendered custody, they were powerless to withdraw when Celsius froze accounts.

The Lesson: These were not failures of blockchain technology; they were failures of governance, custody, and transparency. CeFi replicates the structural weaknesses of the Medici model—centralized trust, opaque ledgers, and human fallibility—often without the regulatory guardrails of TradFi.

📚 Decentralized Finance (DeFi): The Architectural Break

DeFi represents a fundamental departure from both TradFi and CeFi. It is a financial system built on public, permissionless blockchains (primarily Ethereum) where financial services are executed by Smart Contracts—autonomous, self-executing code—rather than by centralized intermediaries.

Key Characteristics

Non-Custodial (Self-Sovereignty): Users retain control of their private keys at all times. Funds interact with smart contracts but are never "held" by a corporation. This eliminates the custodial risk that destroyed FTX users.

Radical Transparency: Every transaction, loan, liquidation, and collateral ratio is visible on the public blockchain in real-time. There is no "quarterly audit"; the audit is continuous, algorithmic, and available to anyone with an internet connection.

Permissionless Access: The protocols are open to anyone. A smart contract does not discriminate based on nationality or credit score; it only checks if the transaction meets the mathematical criteria (e.g., is there enough collateral?).

Atomic Settlement: Trades settle within the block time of the network (e.g., ~12 seconds on Ethereum, ~0.4 seconds on Solana). There is no T+2 delay; the trade and the settlement are the same event, eliminating counterparty settlement risk.

The Resilience of DeFi

During the 2022 contagion that toppled FTX, Celsius, and Voyager, DeFi protocols like Aave, Compound, and Uniswap continued to function without interruption.

Why DeFi Survived: When Celsius faced insolvency, it famously paid back its DeFi loans first—hundreds of millions of dollars—before freezing customer withdrawals. Why? Because the DeFi protocol (Aave) is governed by code, not human negotiation. If Celsius's collateralization ratio dropped below the threshold, the smart contract would automatically liquidate their position. There was no CEO to call to ask for a delay. This demonstrates the concept that "Code is Law"—DeFi eliminates the human discretion that allows for "sweetheart deals" and corruption in CeFi/TradFi.

📊 Comparative Analysis

Intermediary

Banks, Brokers, Clearinghouses

Crypto Exchanges (Binance, FTX)

Smart Contracts / Code

Trust Model

Institutional Trust (Legal/Regulated)

Corporate Trust (Reputation)

Code Trust (Cryptographic Verification)

Custody

Custodial (Bank holds assets)

Custodial (Exchange holds keys)

Non-Custodial (User holds keys)

Settlement

T+1 or T+2 Days (Batch processing)

Instant (Internal DB) / Slow (Withdrawal)

Block Time (Seconds/Minutes)

Transparency

Low (Private Ledgers, Quarterly Reports)

Low (Private Ledgers, "Trust Me")

High (Real-time On-Chain Data)

Access

Permissioned (KYC/AML)

Permissioned (KYC/AML)

Permissionless (Open Access)

Failure Mode

Counterparty / Solvency / Regulatory

Fraud / Hack / Mismanagement

Smart Contract Bug / User Error

🔑 Permissioned vs. Permissionless Systems

A critical distinction within the blockchain space is the concept of permission.

Permissionless Systems (e.g., Bitcoin, Ethereum): These are open networks where anyone can participate as a user or a validator (miner/staker). They prioritize Censorship Resistance. Because there is no central server or CEO, no government can force the network to block a specific transaction (as seen in the Tornado Cash sanctions, where the protocol continued to run despite legal bans, although interface access was restricted).

Permissioned Systems (e.g., Hyperledger, JP Morgan's Onyx): These are "corporate blockchains" or consortiums where validators are vetted entities (e.g., banks). They offer high speed and privacy but sacrifice the core value proposition of decentralization. They are effectively shared, cryptographically secured databases. While useful for enterprise efficiency, they do not solve the "Trust Paradox" as they rely on a closed group of trusted authorities.

🔑 Key Takeaways

TradFi = Legacy Infrastructure: Slow, opaque, permissioned, custodial. Relies on institutional trust.

CeFi = Crypto Assets, TradFi Logic: Uses crypto but retains centralized custody and opacity. Often lacks regulatory protections.

DeFi = Architectural Break: Non-custodial, transparent, permissionless, atomic settlement. Relies on code and consensus.

The Continuum: These aren't mutually exclusive—many users interact with all three. Understanding the differences helps you make informed choices.

Risk Profiles Differ: Each has different failure modes. TradFi has regulatory risk, CeFi has custodial risk, DeFi has smart contract risk.

📖 Beginner's Corner

Common Confusion: Many people think "crypto" means DeFi, but most crypto trading happens on CeFi exchanges (Binance, Coinbase). True DeFi means interacting directly with smart contracts.

When to Use Each:

TradFi: For traditional banking, fiat currency, regulated investments

CeFi: For easy crypto trading, fiat on/off ramps, convenience

DeFi: For true self-custody, permissionless access, composability

The Key Question: Who controls your private keys? If it's you, it's DeFi. If it's an exchange, it's CeFi.

⚠️ Important Warnings

CeFi Risk: Just because it uses crypto doesn't mean it's decentralized. CeFi has the same custodial risks as TradFi.

Not All "DeFi" is True DeFi: Some protocols claim to be DeFi but have centralized components. Always verify.

Regulatory Uncertainty: DeFi operates in a regulatory gray area. This creates both opportunity and risk.

Next Lesson: In Lesson 3, we'll explore the blockchain infrastructure that makes DeFi possible, including the trilemma, Layer 0/1/2 architecture, and how Ethereum works as the "world computer."

Last updated