Lesson 11: Risk Management

Lesson 11: Risk Management

🎯 Core Concept: Understanding DeFi Risks

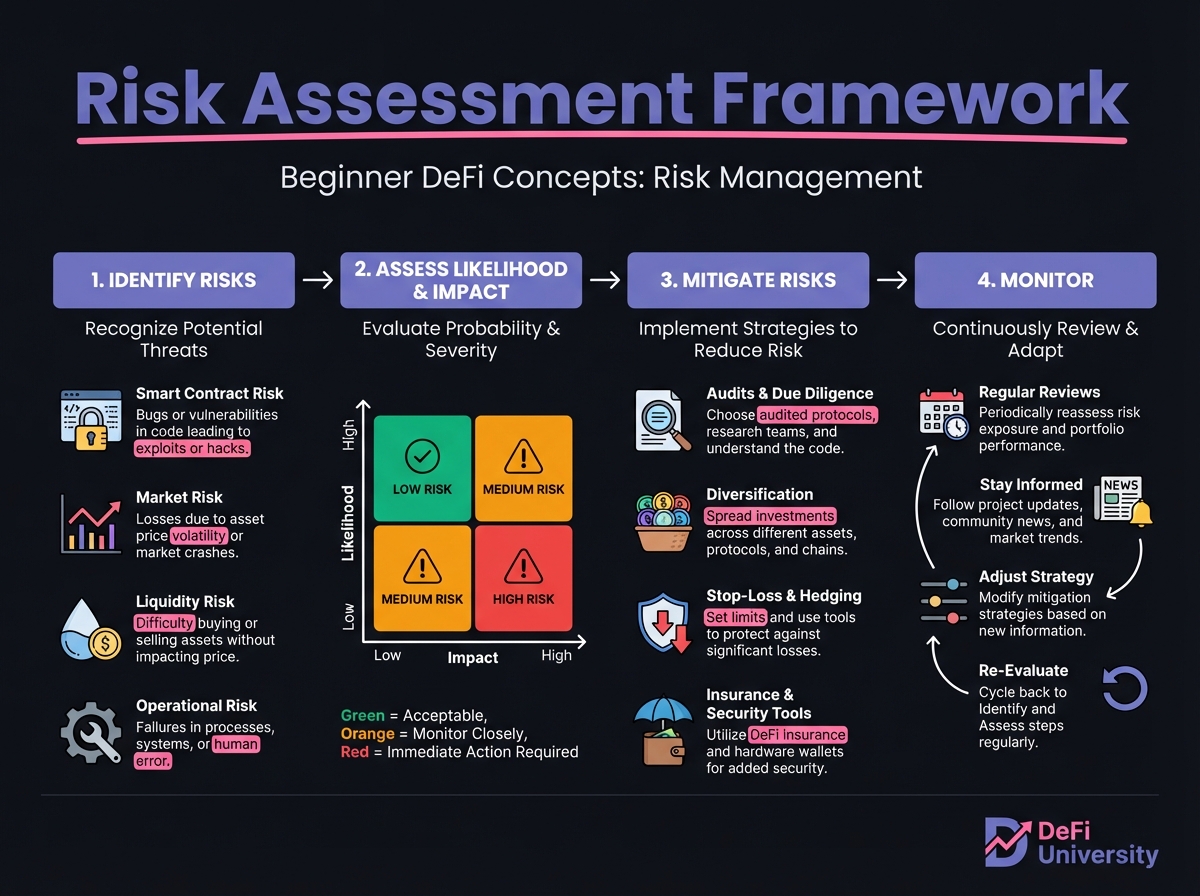

📚 Types of Risks

Smart Contract Risk

Oracle Risk

Governance Risk

Liquidation Risk

Impermanent Loss

Interactive DeFi Risk Assessment

🔑 Key Takeaways

Last updated