Lesson 7: Decentralized Exchanges

Lesson 7: Decentralized Exchanges

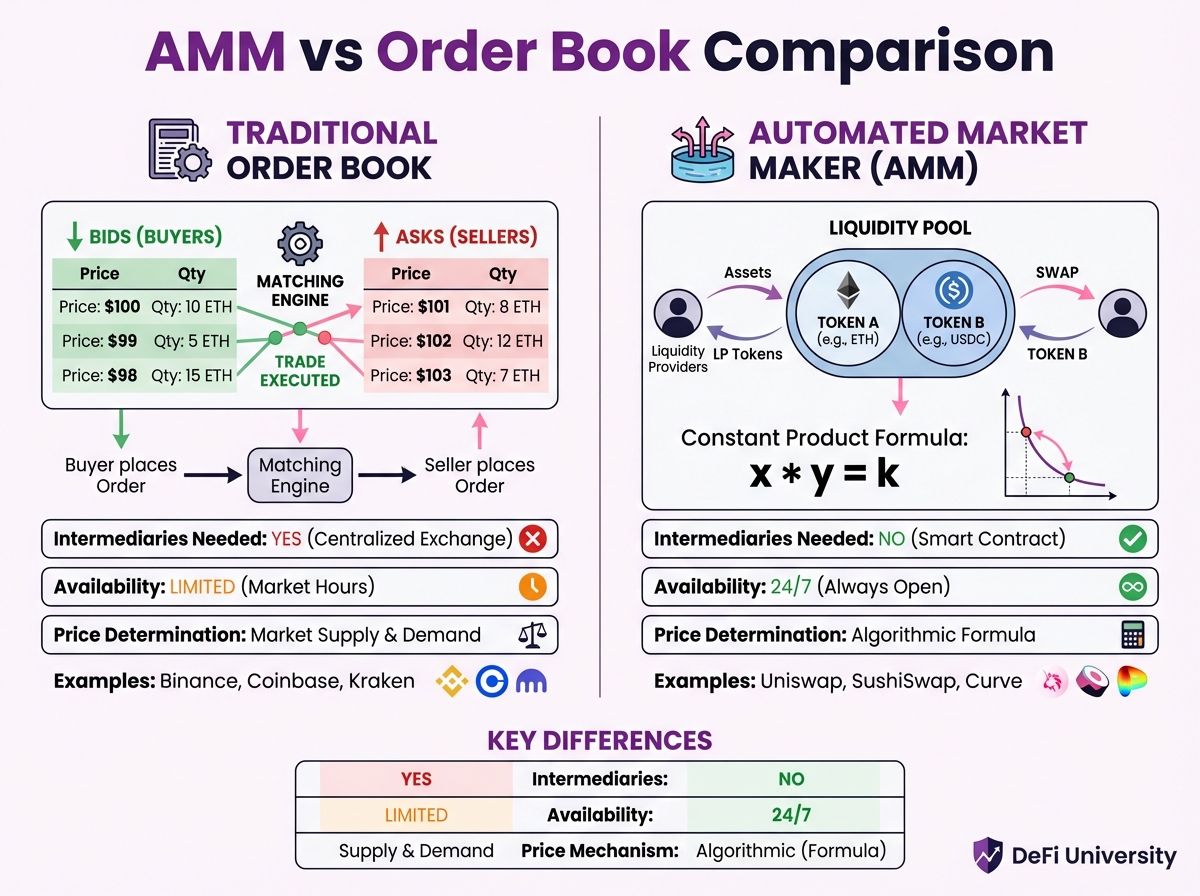

🎯 Core Concept: Automated Market Makers (AMMs)

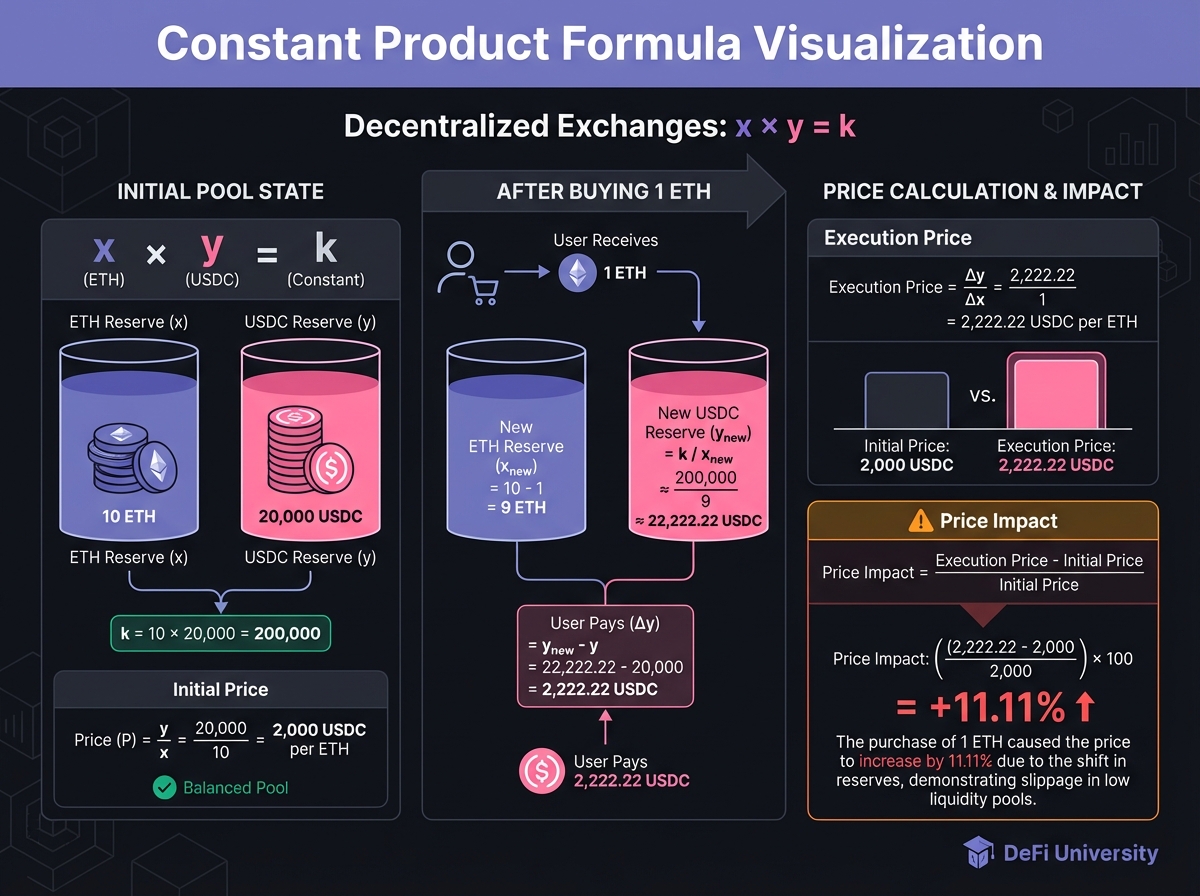

📚 The Constant Product Formula

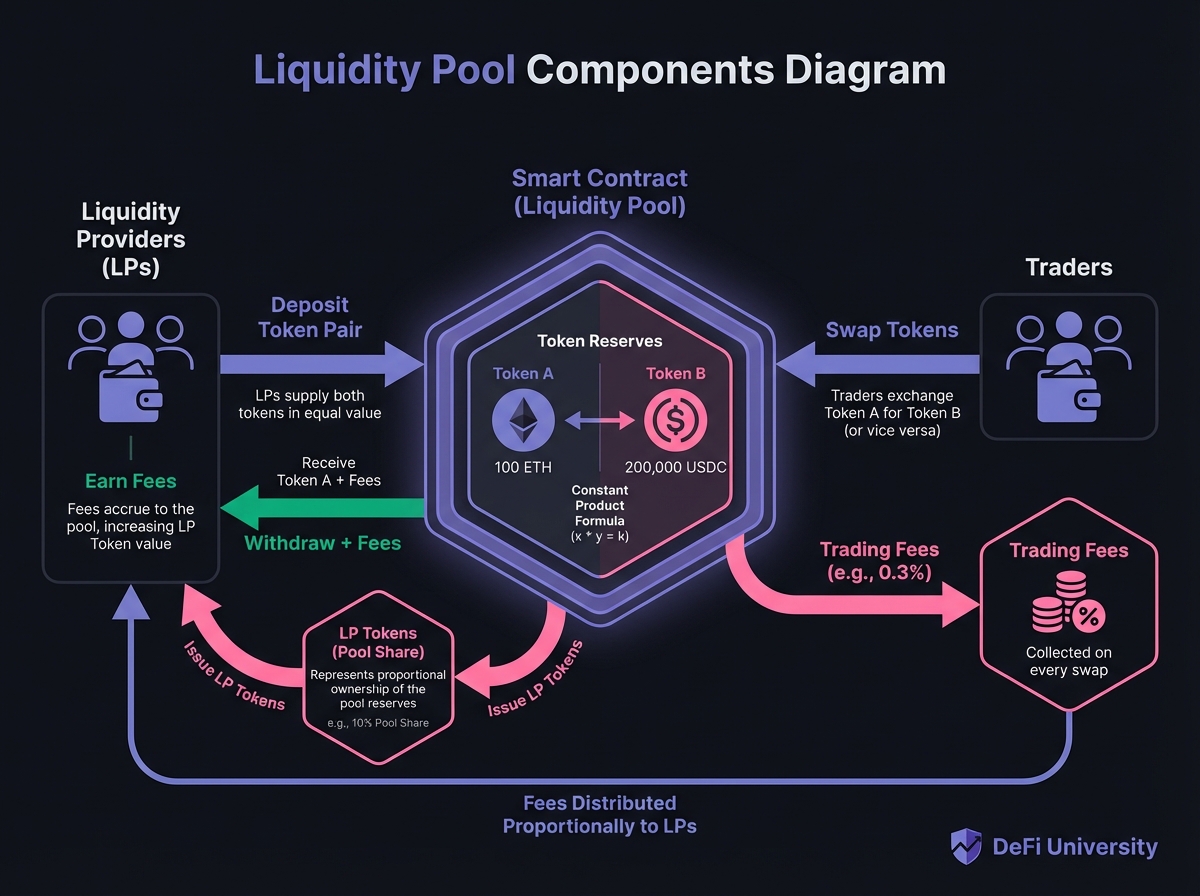

📚 Liquidity Pools

🎮 Interactive: DEX Swap Simulator

Interactive DeFi Protocol Explorer

Interactive Yield Farming Calculator

Interactive Gas Fee Estimator

🔑 Key Takeaways

Last updated