Lesson 10: Flash Loans and Advanced Primitives

Lesson 10: Flash Loans and Advanced Primitives

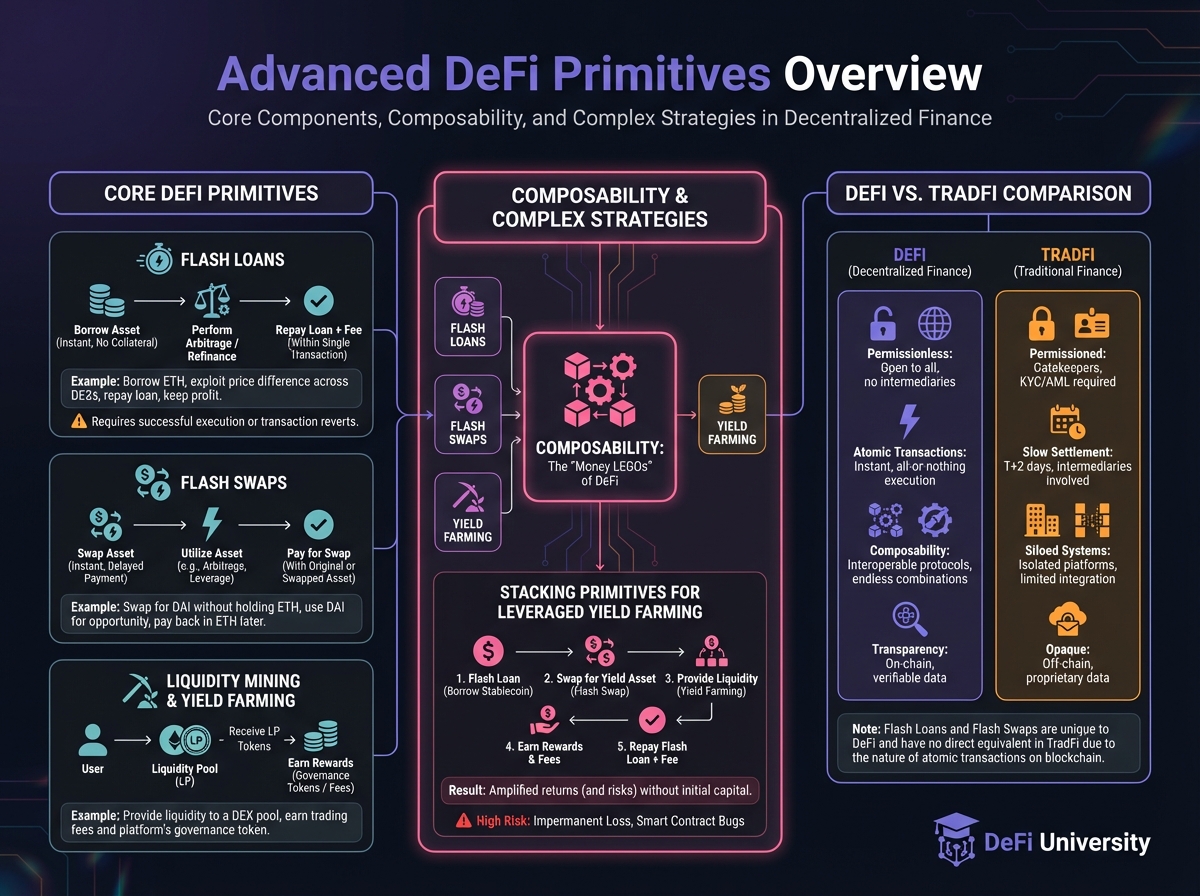

🎯 Core Concept: Flash Loans

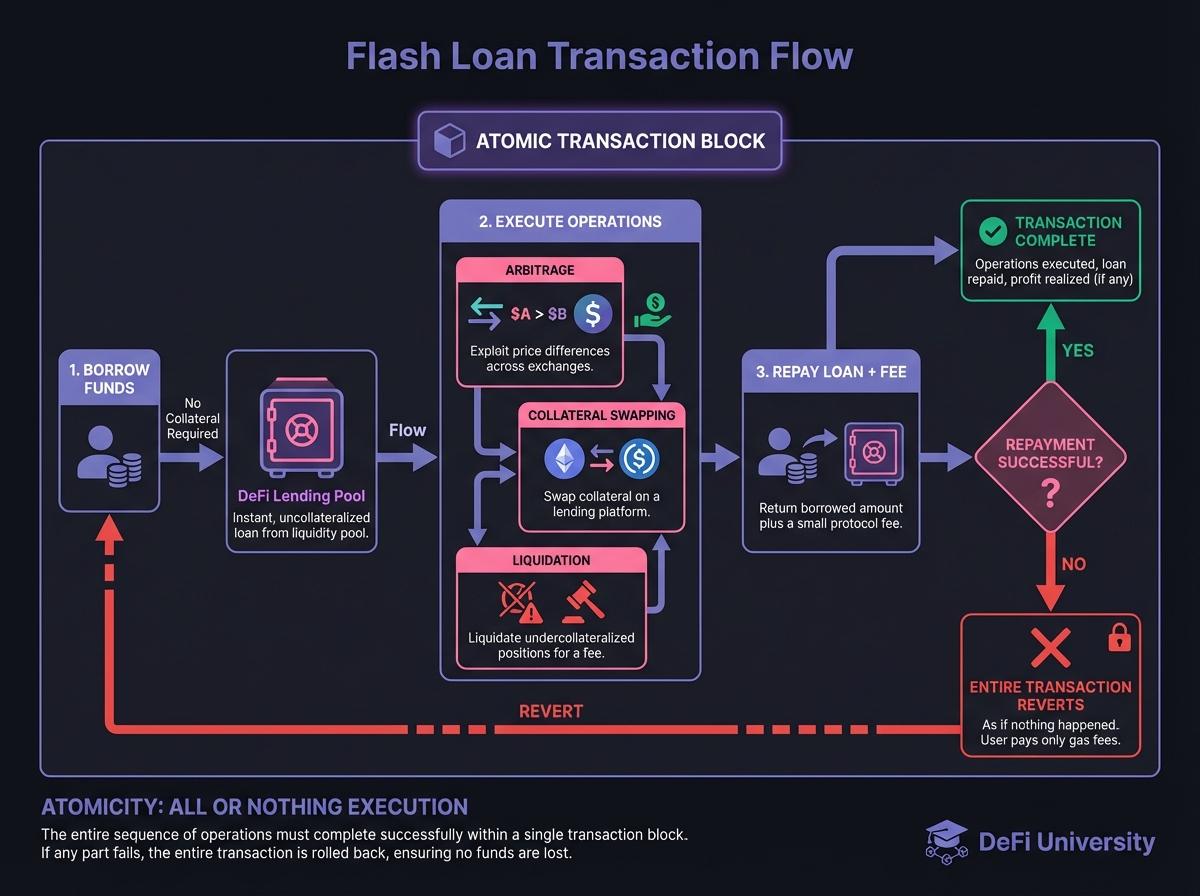

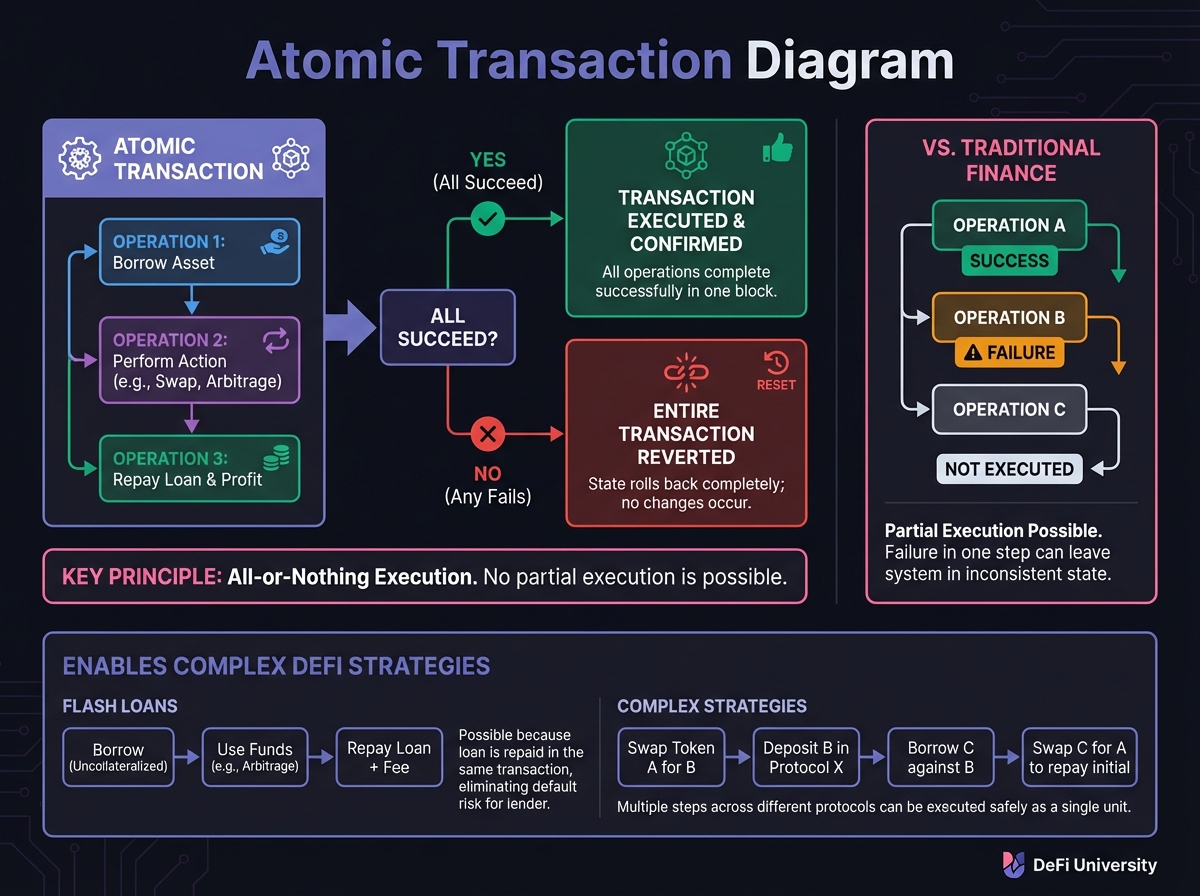

📚 How Flash Loans Work

📚 Use Cases

Interactive Yield Farming Calculator

🔑 Key Takeaways

Last updated