Lesson 4: Smart Contracts and Token Standards

Lesson 4: Smart Contracts and Token Standards

🎯 Core Concept: Smart Contracts as Automated Trust

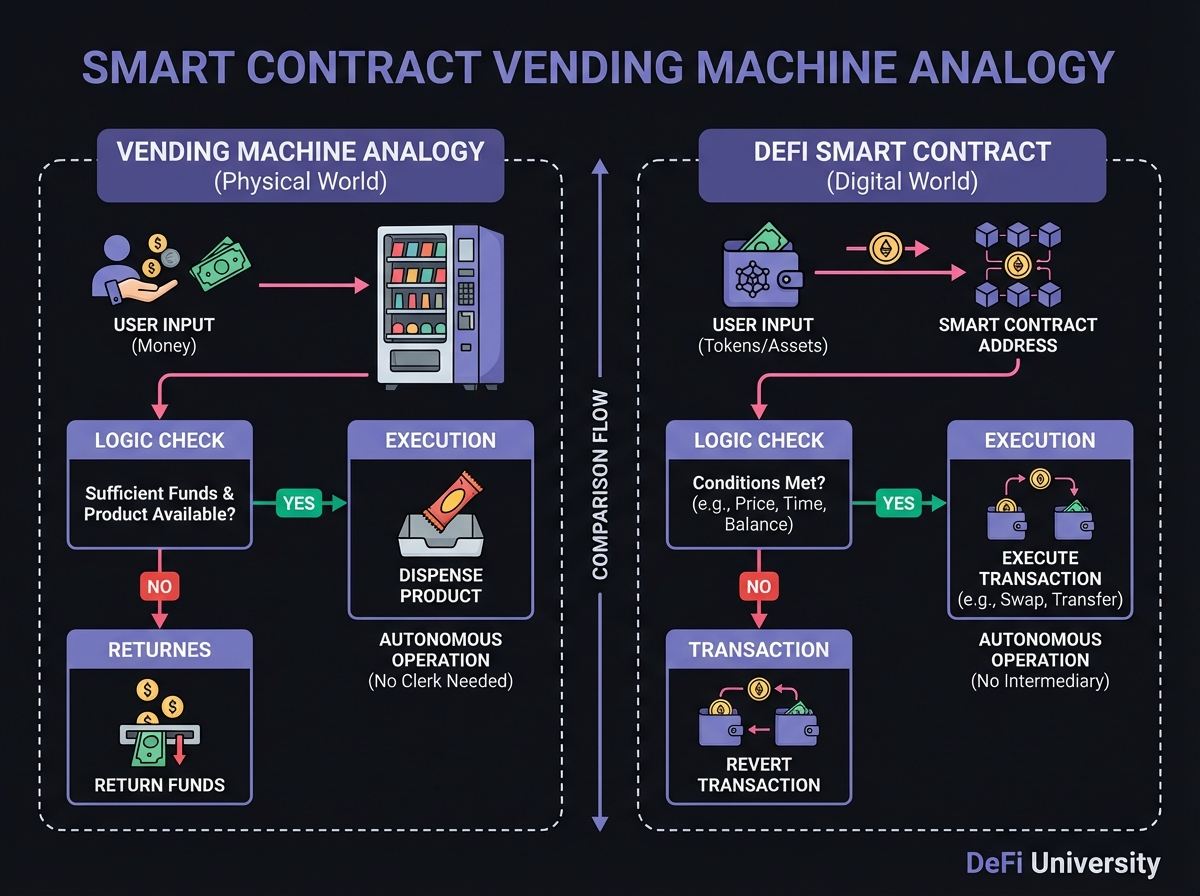

📚 The Vending Machine Model

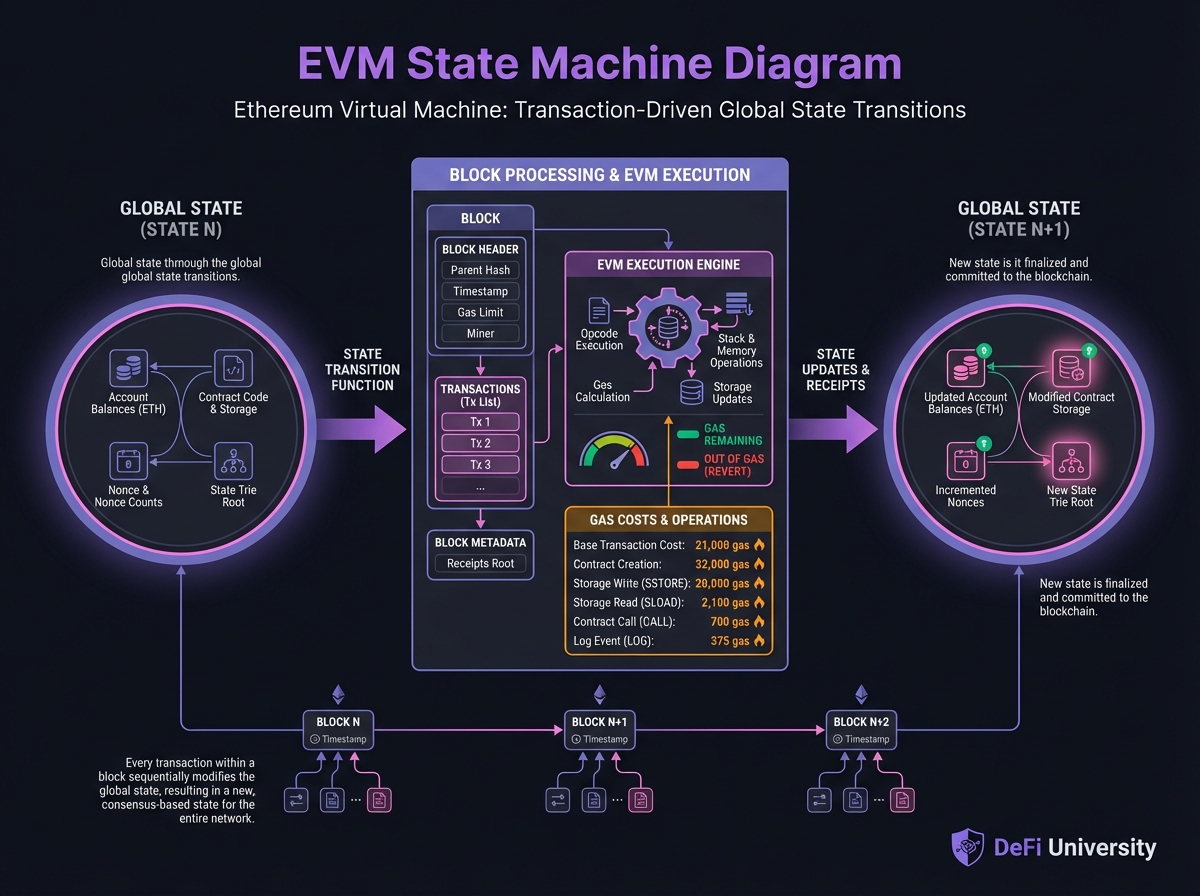

📚 Ethereum and the EVM Paradigm

The EVM as a State Machine

Gas and Economic Incentives

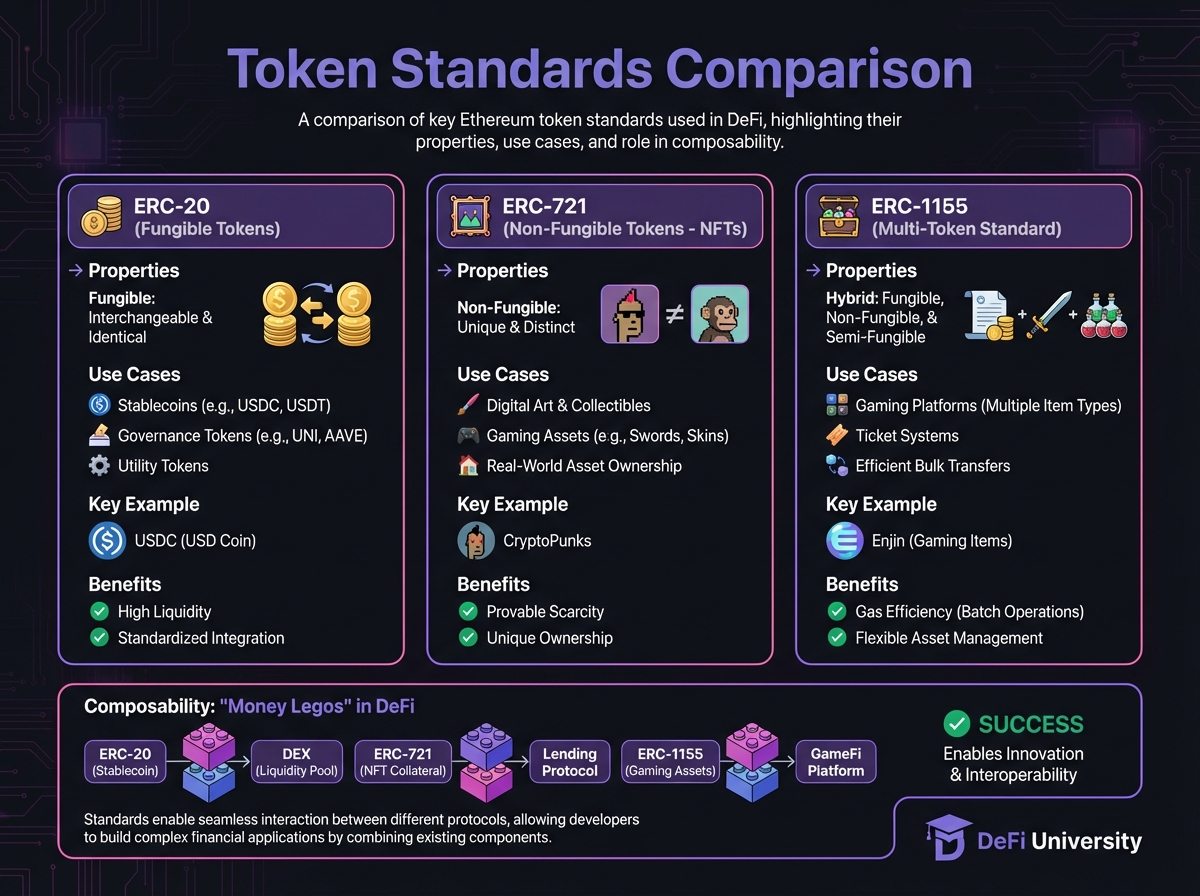

📚 Token Standards as Building Blocks

ERC-20: Fungible Tokens

ERC-721: Non-Fungible Tokens (NFTs)

Composability: The "Money Legos" Concept

🔑 Key Takeaways

📖 Beginner's Corner

Interactive Token Economics Calculator

⚠️ Important Warnings

PreviousExercise 3: Infrastructure and Architecture AnalysisNextExercise 4: Smart Contracts and Standards Assessment

Last updated