Lesson 9: Stablecoins and Stability Mechanisms

Lesson 9: Stablecoins and Stability Mechanisms

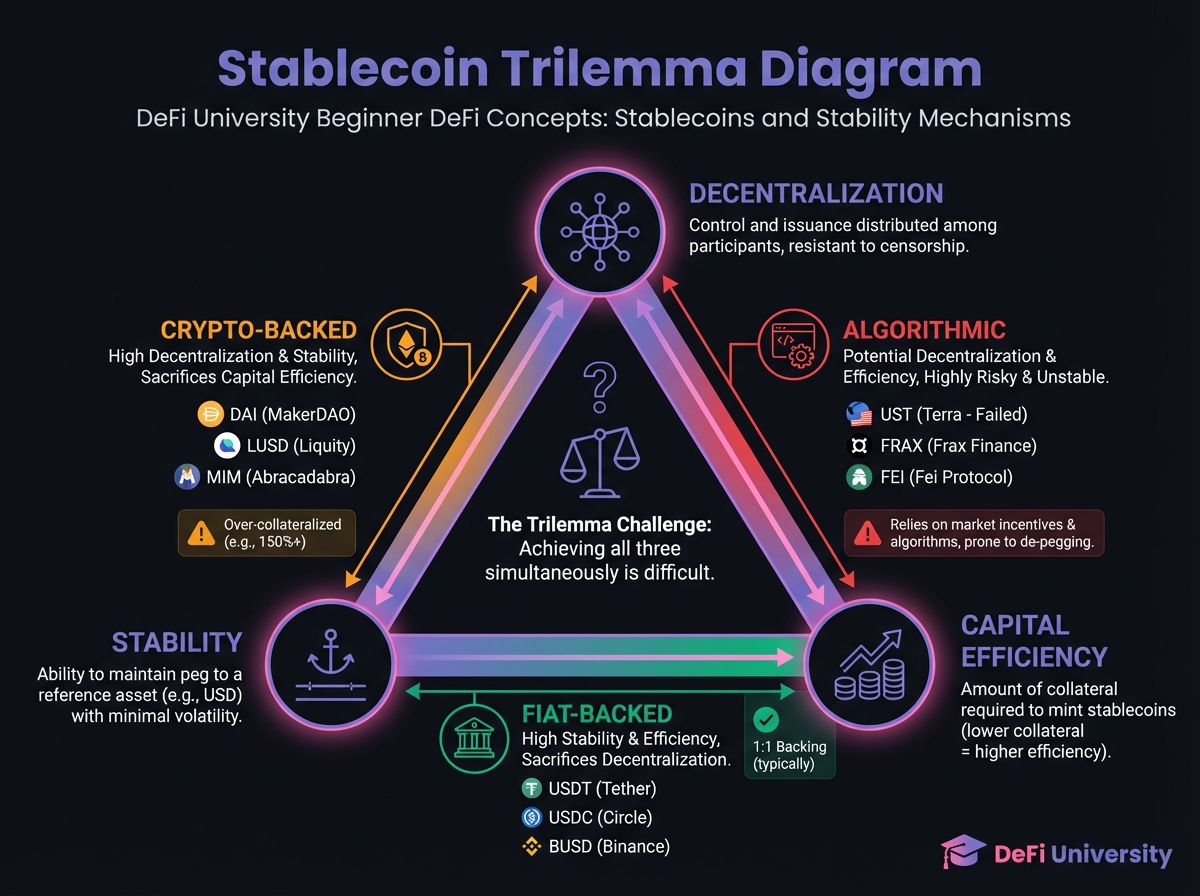

🎯 Core Concept: The Stability Trilemma

📚 Types of Stablecoins

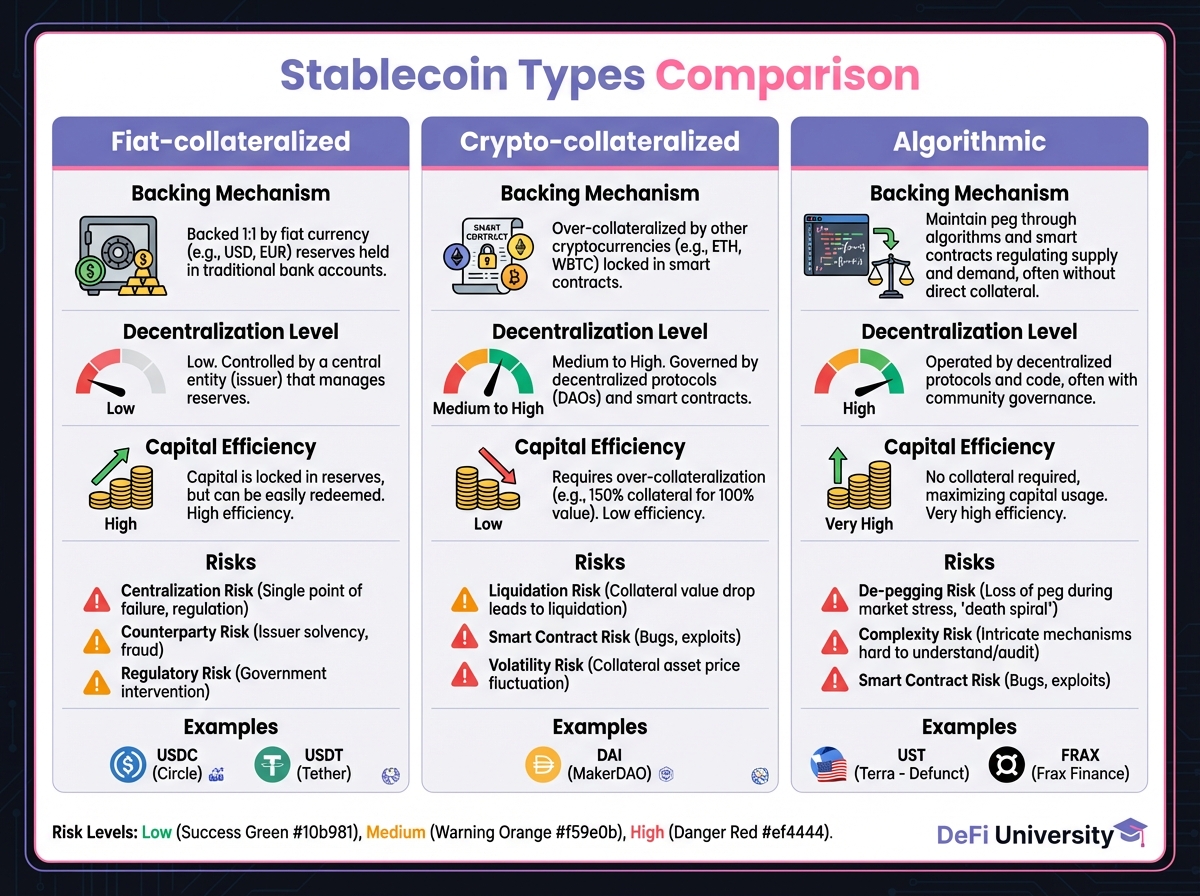

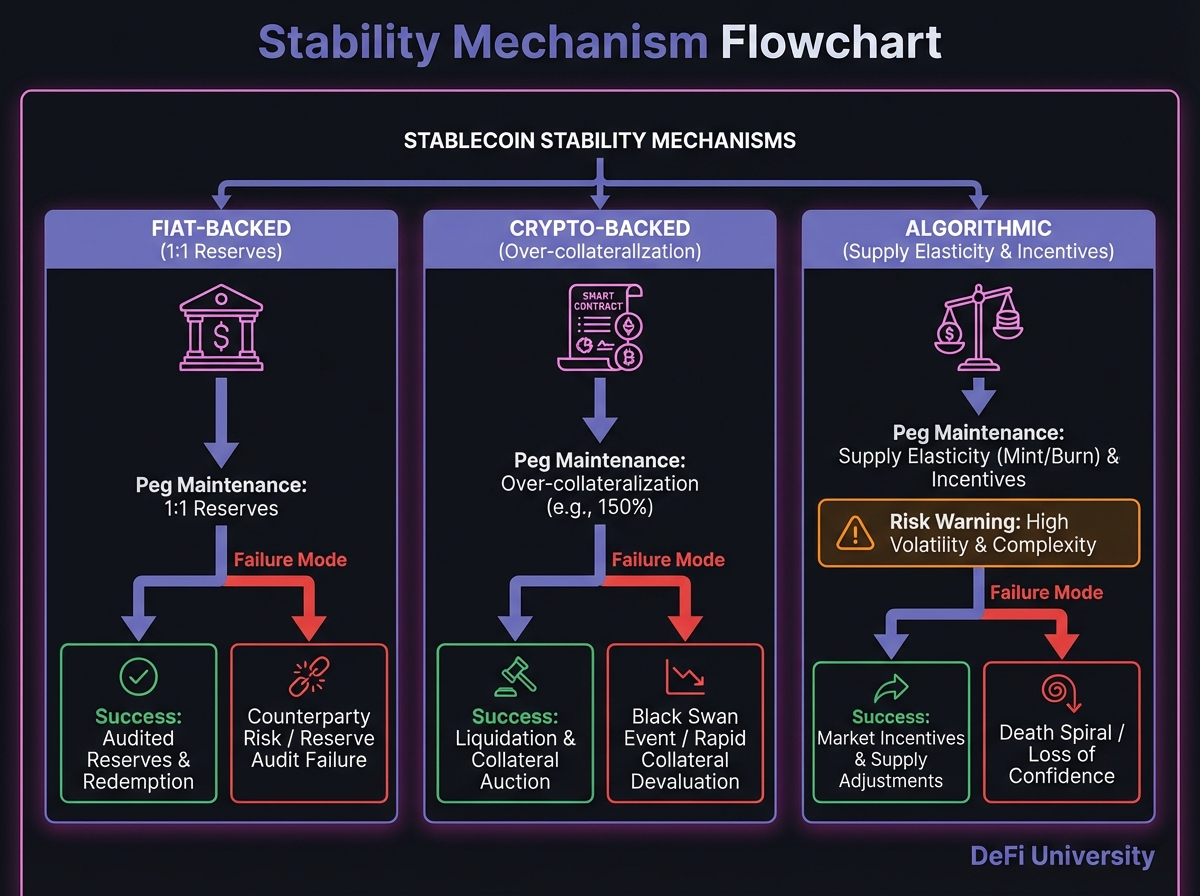

Fiat-Collateralized (e.g., USDC, USDT)

Crypto-Collateralized (e.g., DAI)

Algorithmic

🎮 Interactive: Stablecoin Comparison Tool

Interactive DeFi Protocol Explorer

Interactive Token Economics Calculator

🔑 Key Takeaways

Last updated