Lesson 3: Blockchain Infrastructure

Lesson 3: Blockchain Infrastructure

🎯 Core Concept: The Blockchain Trilemma

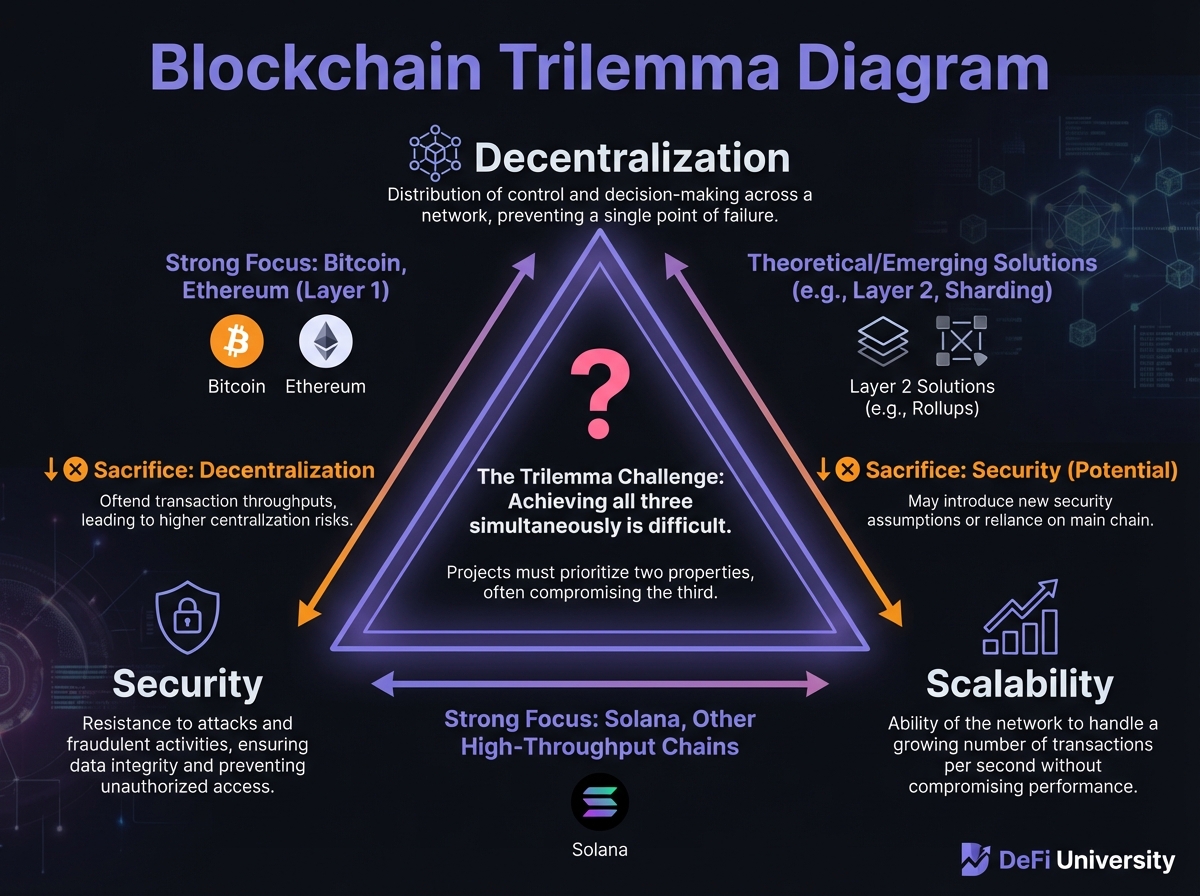

As we transition from historical theory to engineering practice, we encounter the fundamental constraint of blockchain design: the Blockchain Trilemma. Coined by Ethereum co-founder Vitalik Buterin, this concept posits that a decentralized network can only optimize for two of three properties simultaneously: Decentralization, Security, and Scalability.

Understanding this trilemma is essential because it explains why different blockchains make different trade-offs and why Layer 2 solutions exist.

📚 The Trilemma Trade-offs

1. Decentralization

The number of nodes participating in the network. More nodes equal higher resistance to censorship, collusion, and state attacks. If a network has only 10 nodes, it is easy to shut down; if it has 100,000, it is nearly impossible.

Why It Matters: Decentralization ensures that no single entity can control or censor the network. It's what makes blockchain "trustless."

2. Security

The cost or difficulty of attacking the network (e.g., a 51% attack). High security requires expensive consensus mechanisms (like Proof of Work or significant Proof of Stake capital) to make attacking the chain economically irrational.

Why It Matters: Security ensures that the network can't be easily manipulated or attacked. It protects user funds and data integrity.

3. Scalability

The throughput of the network (Transactions Per Second - TPS) and latency (time to finality). A scalable chain can handle Visa-levels of traffic (thousands of TPS).

Why It Matters: Scalability determines how many users can use the network simultaneously and how cheap transactions are.

The Trade-off Reality

You cannot optimize for all three simultaneously. Every blockchain must choose which two to prioritize:

Bitcoin/Ethereum: Prioritize Decentralization + Security → Sacrifice Scalability

Solana: Prioritize Scalability + Security → Sacrifice some Decentralization

Some Alt-chains: Prioritize Scalability + Decentralization → Sacrifice Security

📚 Case Studies: Different Approaches

Bitcoin and Ethereum: The Security/Decentralization Maxis

Bitcoin and Ethereum (Layer 1) prioritize Decentralization and Security. Their architecture requires every node in the network to process and verify every single transaction to ensure the ledger is pristine.

Consequence: They are slow. Bitcoin handles ~7 TPS; Ethereum ~15-30 TPS. This is the necessary cost of ensuring that a student in a dorm room can run a node on a laptop and verify the integrity of the global financial system without trusting a third party. They sacrifice Scalability to maintain the "Trustless" property.

The Philosophy: It's better to be slow and trustless than fast and centralized.

Solana: The Scalability Maxi

Solana takes a fundamentally different architectural approach. It prioritizes Scalability and Security, aiming for 65,000+ TPS.

Mechanism: Solana uses a novel consensus mechanism called Proof of History (PoH). PoH creates a cryptographic timestamp (a "clock" for the blockchain) that allows nodes to process transactions in parallel rather than sequentially. This is combined with "Sealevel," a parallel execution engine.

The Trade-off: To process 65,000 TPS, a validator node effectively needs to be a supercomputer. The hardware requirements (massive RAM, high-end CPUs, gigabit upload speeds) are exorbitant. This high barrier to entry reduces the number of people who can run a validator, leading to a more centralized network topology compared to Ethereum. Solana accepts a degree of centralization risk (fewer, more powerful nodes) to achieve the speed necessary for high-frequency trading and consumer applications.

📚 The Layered Architecture: A Modular Solution

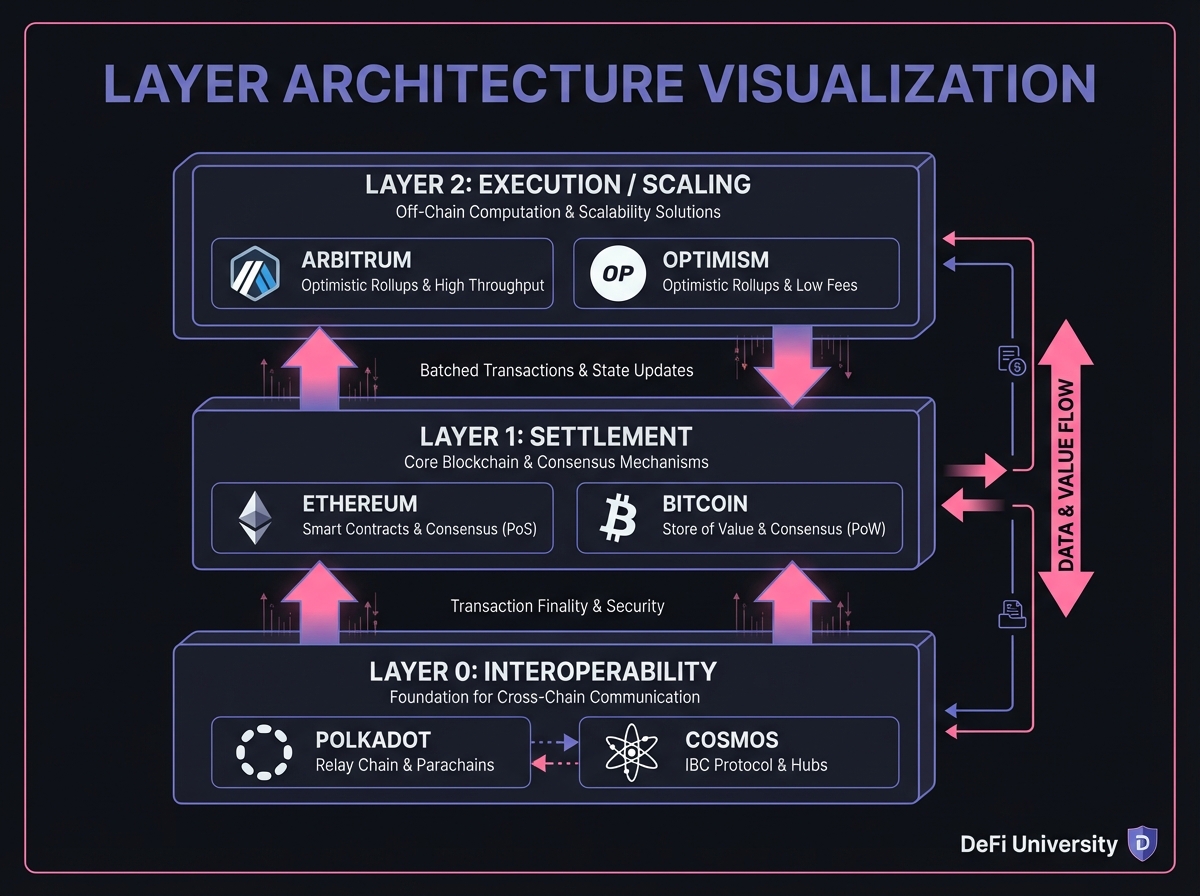

To solve the Trilemma without sacrificing the core value of decentralization, the industry has moved towards a Modular Architecture. Instead of one blockchain trying to do everything (Monolithic), the stack is unbundled into specialized "Layers."

Layer 0: The Infrastructure and Interoperability Layer

Layer 0 is the foundational substrate that allows different blockchains to communicate—the "Internet of Blockchains."

Analogy: If blockchains (Bitcoin, Ethereum) are independent cities with their own laws and currencies, Layer 0 is the highway system and diplomatic corps connecting them. Without Layer 0, these cities are isolated islands.

Examples:

Polkadot: Uses a central "Relay Chain" (Layer 0) to provide shared security and consensus to connected "Parachains" (specialized Layer 1s). This allows a gaming chain to talk to a DeFi chain seamlessly.

Cosmos: Uses the Inter-Blockchain Communication (IBC) protocol to allow independent "Zones" to swap assets and data. It functions like the TCP/IP of blockchains.

Layer 1: The Settlement Layer (The Supreme Court)

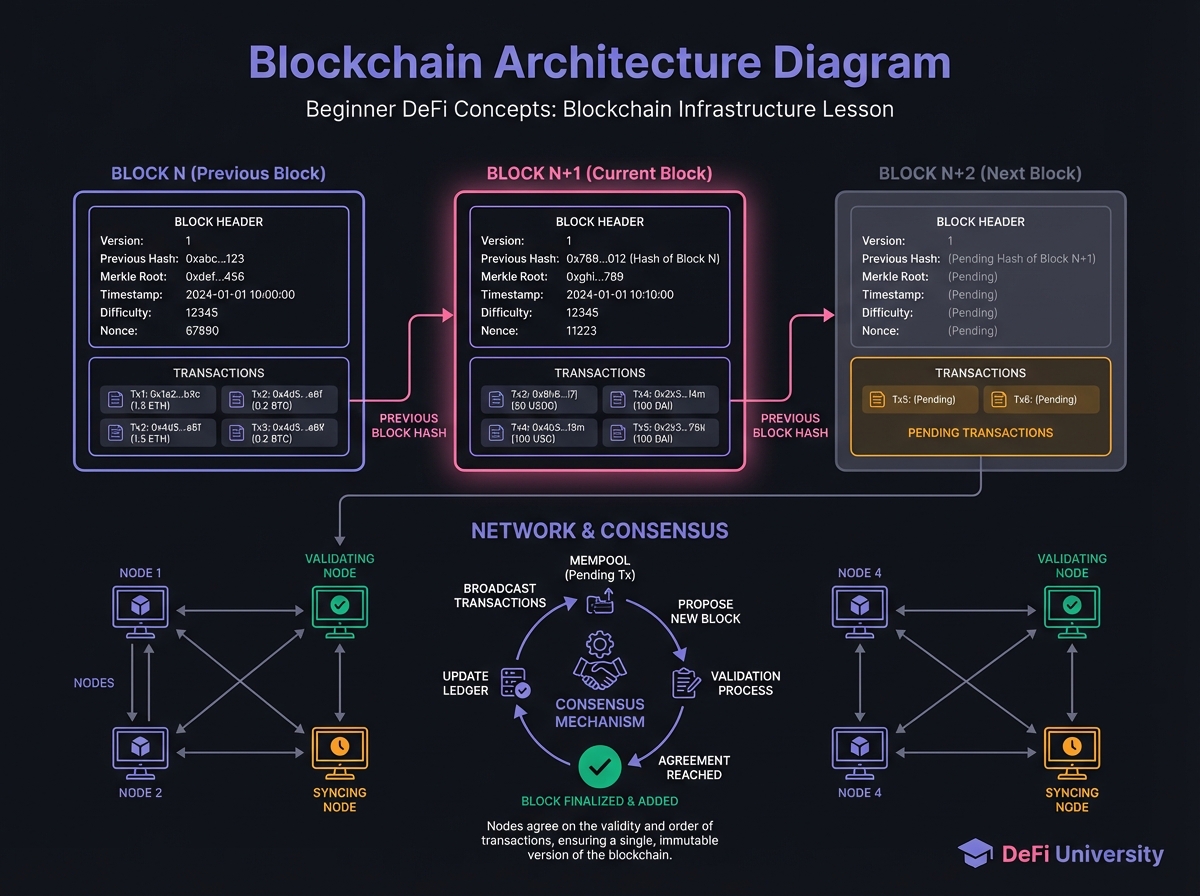

Layer 1 (L1) is the base blockchain (e.g., Ethereum, Bitcoin). In a modular stack, the L1 is not where you buy a coffee; it is where you settle the books at the end of the day.

The Supreme Court Analogy: Think of Ethereum (L1) as the Supreme Court. It is expensive, slow, and authoritative. You do not go to the Supreme Court to contest a speeding ticket (a micro-transaction). You only go there to resolve major disputes or to finalize the "ultimate truth."

Role: The L1 provides Data Availability and Consensus. It ensures that the record is immutable and secure. It is the anchor of trust. Other layers build on top of this rock-solid foundation.

Layer 2: The Execution/Scaling Layer (The Express Highway)

Layer 2 (L2) solutions sit on top of L1. They handle the heavy lifting of processing transactions (Execution) and only report the final results to L1 for settlement.

The Highway Analogy: If L1 is a congested, single-lane road through a city center, L2 is an elevated Express Highway built above it. Cars (transactions) zip along the express highway at high speed. Periodically, the express highway bundles all the traffic data and sends a single "bus" (batch) down to the main road to register the movement.

Mechanism - Rollups: The dominant L2 technology is the "Rollup." It bundles (rolls up) hundreds or thousands of transactions into a single piece of data and posts it to Ethereum. This compresses the data, splitting the L1 gas fee among thousands of users, reducing costs by 10-100x.

Types of Rollups:

Optimistic Rollups (e.g., Arbitrum, Optimism): These operate on the "Honor System." They assume transactions are valid by default ("Optimistic"). However, they allow for a Challenge Period (typically 7 days) where any "Verifier" can check the math. If fraud is detected (e.g., the Sequencer tried to steal funds), the Verifier submits a Fraud Proof, the transaction is reverted, and the malicious actor is penalized (slashed). This uses game theory to ensure security.

ZK-Rollups (Zero-Knowledge): These use advanced cryptography called Validity Proofs (e.g., zk-SNARKs). The rollup generates a complex mathematical proof that verifies the correctness of the entire batch before it is posted to Ethereum. The L1 contract verifies the proof. If the proof is valid, the transactions are final immediately. Analogy: An impregnable mathematical seal of approval that requires no "challenge period" because the math cannot lie.

Security Inheritance: Crucially, L2s inherit the security of L1. A user on Arbitrum (L2) is ultimately protected by Ethereum's (L1) consensus. Even if the L2 sequencer goes offline or tries to censor transactions, the user can force-exit their funds via the L1 "Supreme Court." This distinguishes L2s from "Sidechains" (like the old Polygon PoS), which have their own validator sets and can fail independently.

📚 Ethereum and the EVM Paradigm

While Bitcoin acts as a decentralized calculator (tracking balances), Ethereum acts as a decentralized computer. The Ethereum Virtual Machine (EVM) is a turing-complete environment that allows developers to upload persistent scripts known as "smart contracts."

The EVM as a State Machine

The EVM is a state machine: a global computer that transitions from one state to the next with every block of transactions. Every transaction changes the global state of Ethereum.

Gas and Economic Incentives

The concept of "gas" is non-negotiable for DeFi literacy. Gas is the fee paid to network validators to execute computational steps. It serves a dual purpose:

Incentivizing Security: Paying validators to secure the network

Preventing Spam: Making infinite loops prohibitively expensive

Key Understanding: Complex DeFi interactions (like entering a liquidity pool) cost more gas than simple transfers because they require more computational work from the EVM. Gas prices fluctuate based on network demand—when the network is congested, gas prices rise.

Gas Units vs. Gas Price:

Gas Units: The computational work required (e.g., a simple transfer = 21,000 gas units)

Gas Price: The price per unit (measured in Gwei, where 1 Gwei = 0.000000001 ETH)

Total Cost: Gas Units × Gas Price = Transaction Fee

🔑 Key Takeaways

The Trilemma is Real: Every blockchain must choose which two properties to optimize. There's no perfect solution.

Layer 2s Solve Scalability: By moving execution off-chain and only settling on L1, Layer 2s allow Ethereum to scale while maintaining security and decentralization.

Security Inheritance: L2s inherit L1 security. This is why they're safer than independent sidechains.

Gas Economics Matter: Understanding gas helps you understand why some transactions are expensive and when to use L2s.

The Future is Modular: The industry is moving toward specialized layers rather than trying to do everything on one chain.

📖 Beginner's Corner

Why is Ethereum Slow?: Because it prioritizes decentralization and security. Every node must verify every transaction. This is a feature, not a bug—it ensures trustlessness.

What's the Difference Between L1 and L2?:

L1: The base blockchain (Ethereum mainnet). Slow, expensive, but ultra-secure.

L2: Built on top of L1. Fast, cheap, but inherits L1 security.

When Should I Use L2?: For most DeFi interactions, L2s are better—they're cheaper and faster. Use L1 for high-value transactions or when you need maximum security.

Interactive Gas Fee Estimator

Use this interactive tool to estimate gas fees for different blockchain operations:

⚠️ Important Notes

Not All L2s Are Equal: Different L2s have different security models, decentralization levels, and features.

Bridge Risk: Moving assets between L1 and L2 requires bridges, which can have security risks. Always use official, audited bridges.

Gas Optimization: Learning to optimize gas usage is a valuable skill in DeFi. Sometimes waiting for lower gas prices or using L2s can save significant money.

Next Lesson: In Lesson 4, we'll explore smart contracts and token standards—the building blocks that make DeFi applications possible.

Last updated