Lesson 12: Layer 2s and the Future of DeFi

Lesson 12: Layer 2s and the Future of DeFi

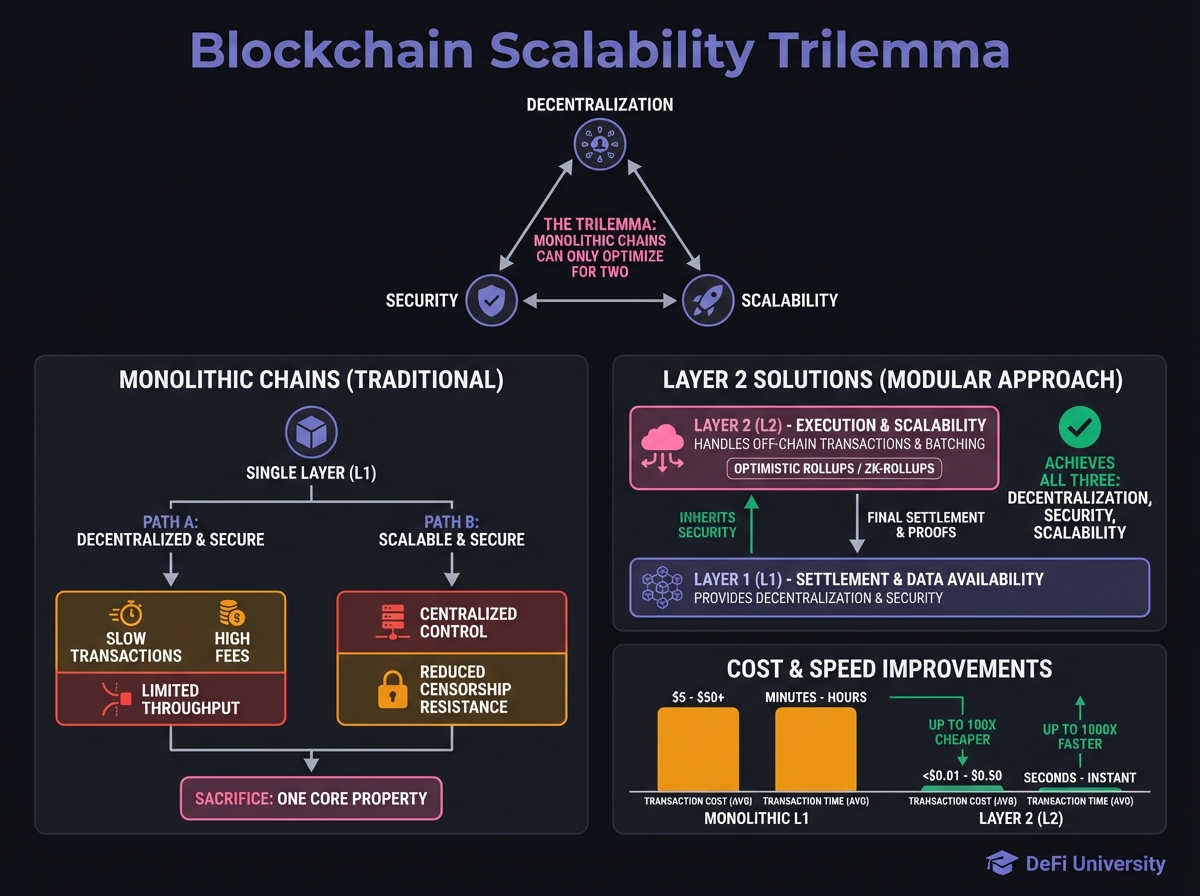

🎯 Core Concept: Scaling Solutions

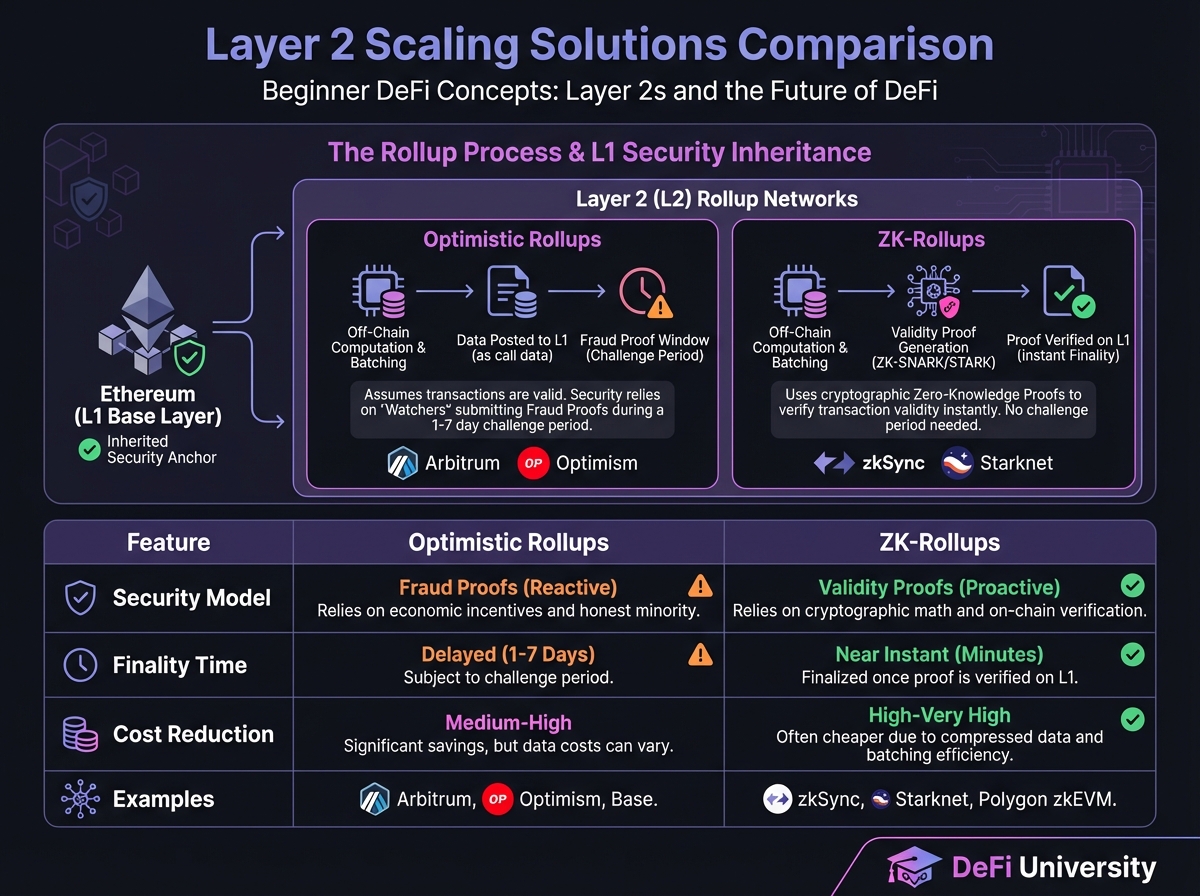

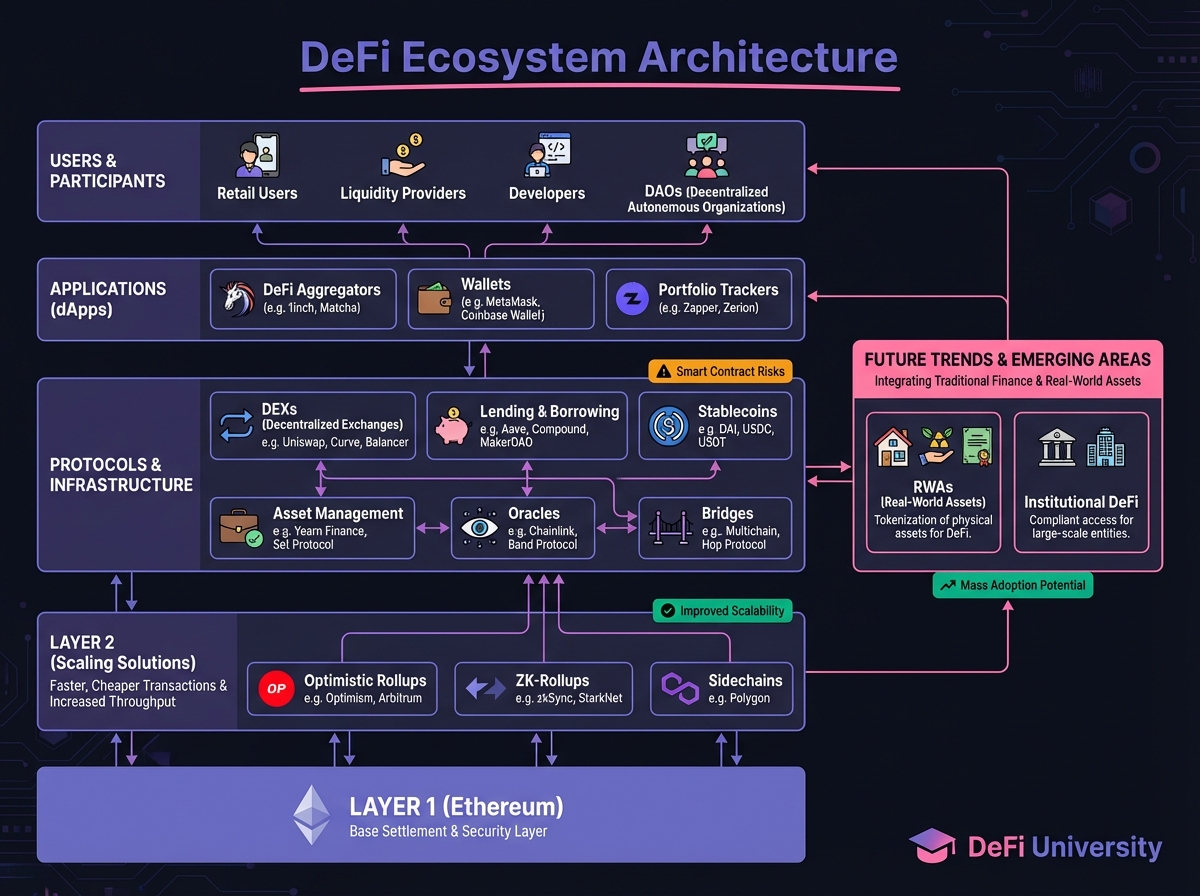

📚 Types of Layer 2s

Optimistic Rollups

ZK-Rollups

📚 The Future: Real World Assets (RWAs)

📚 Institutional DeFi

🔑 Key Takeaways

Interactive DeFi Risk Assessment

📖 Course Conclusion

Last updated