Lesson 8: DeFi Lending and Borrowing

Lesson 8: DeFi Lending and Borrowing

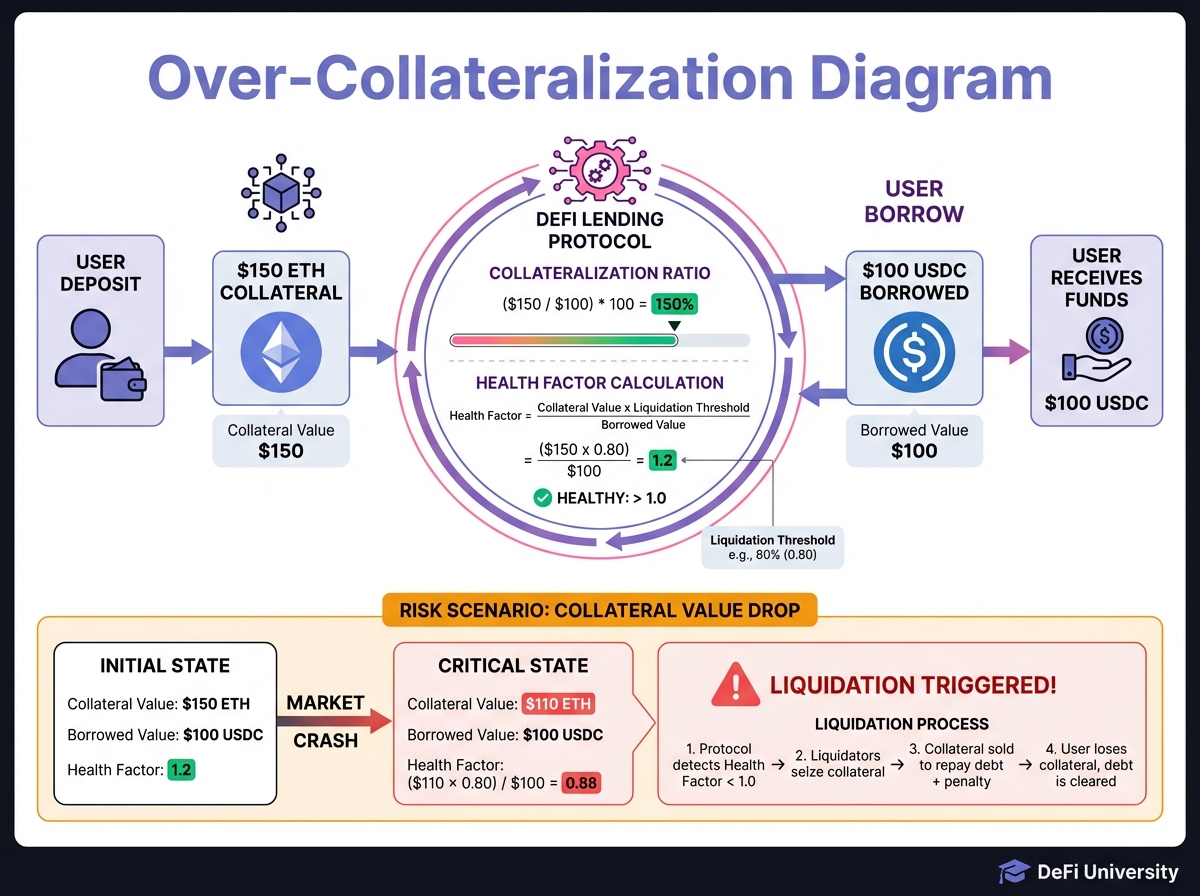

🎯 Core Concept: Over-Collateralized Lending

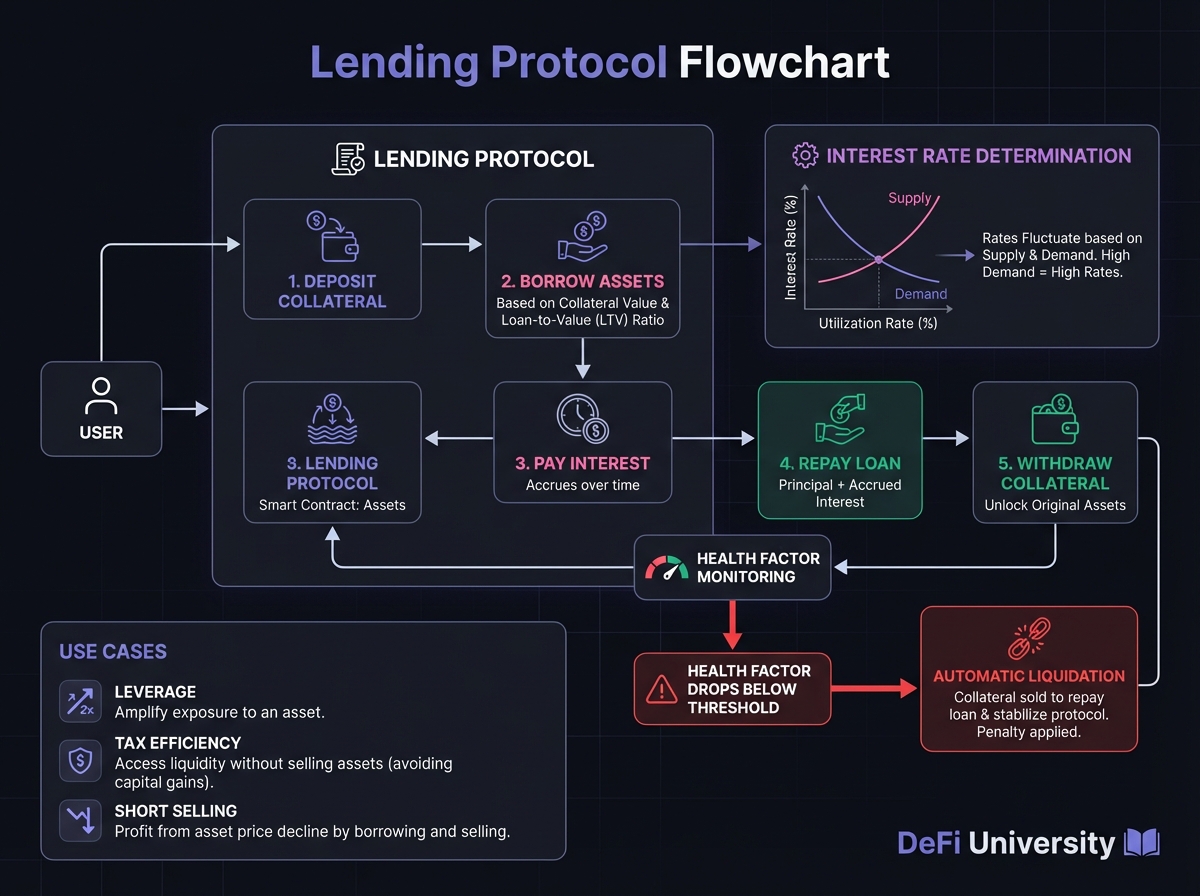

📚 How It Works

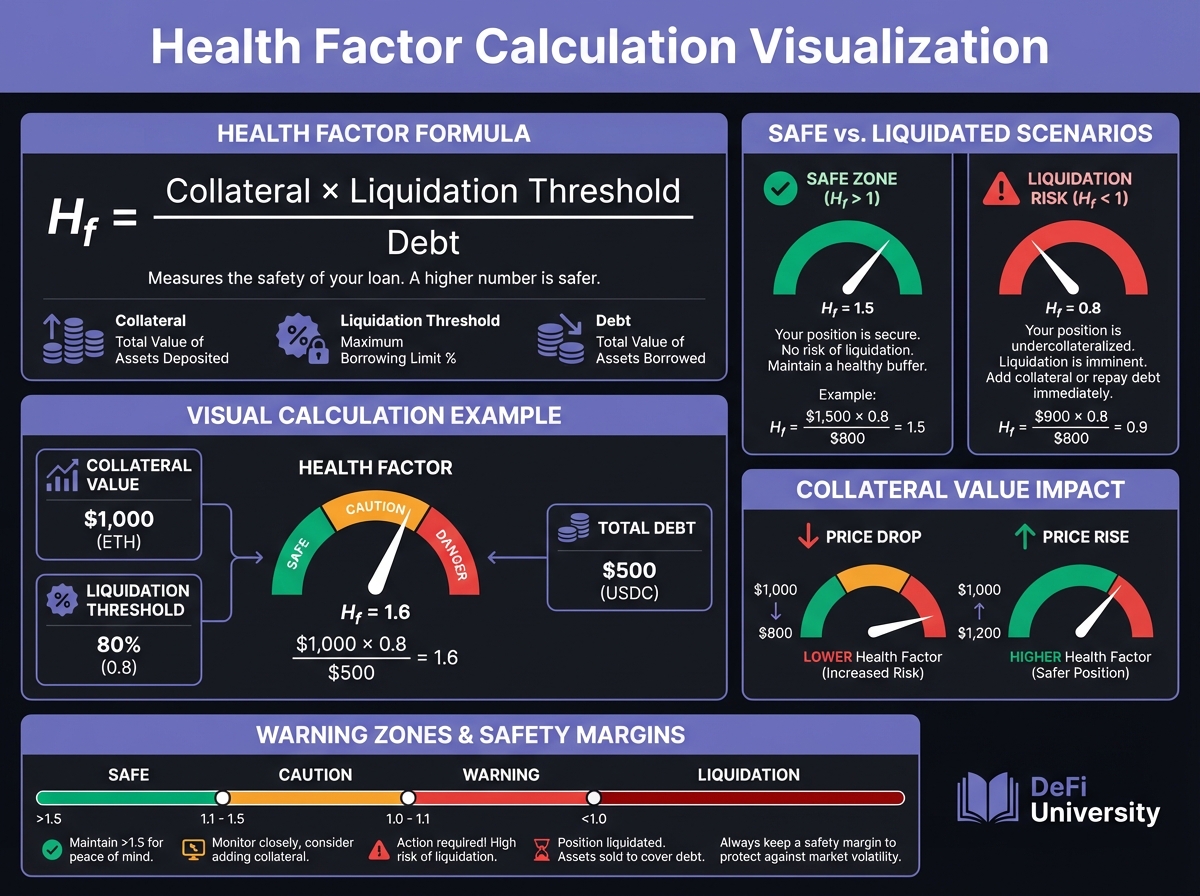

📚 Health Factors

🎮 Interactive: Lending Calculator

Interactive DeFi Protocol Explorer

🔑 Key Takeaways

Last updated