Exercise 2: Complete Trading Discipline Protocol

⏰ Time Investment: 45-60 minutes initial setup + daily implementation 🎯 Goal: Build unbreakable trading discipline that becomes automatic

📚 Required Reading Integration 📖 Primary: "Trading in the Zone" by Mark Douglas - Chapters 3-4, 7 📖 Supporting: "The Disciplined Trader" by Mark Douglas - Chapter 2 📖 Livermore Focus: "Reminiscences" - Chapters 2-4 (bucket shop lessons)

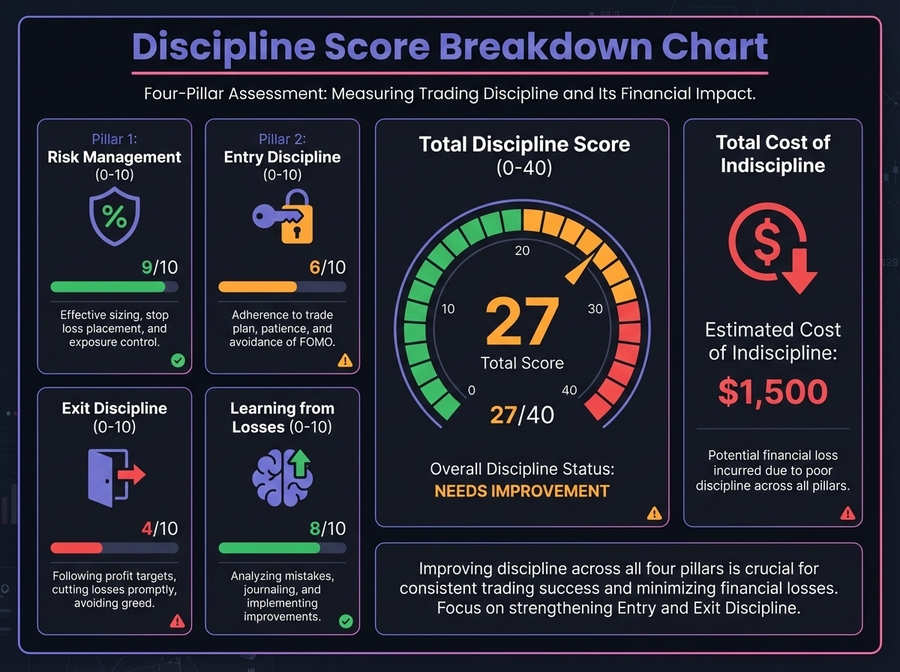

🔍 Phase 1: Discipline Baseline Assessment (10 minutes) Your Current Discipline Audit Rate your discipline level (1-10) across four critical areas:

🛡️ Risk Management

Current Score: ___/10

Evidence of Weakness: ____________________________________

Cost This Month: $________

🎯 Entry Discipline

Current Score: ___/10

Evidence of Weakness: ____________________________________

Cost This Month: $________

🚪 Exit Discipline

Current Score: ___/10

Evidence of Weakness: ____________________________________

Cost This Month: $________

📚 Learning from Losses

Current Score: ___/10

Evidence of Weakness: ____________________________________

Cost This Month: $________

📊 Total Discipline Score: /40 💸 Total Cost of Indiscipline: $_____

🏪 The Bucket Shop Question "In Livermore's bucket shops, discipline violations meant instant losses. What's your modern equivalent?"

Your answer: _________________________________________________________

🏛️

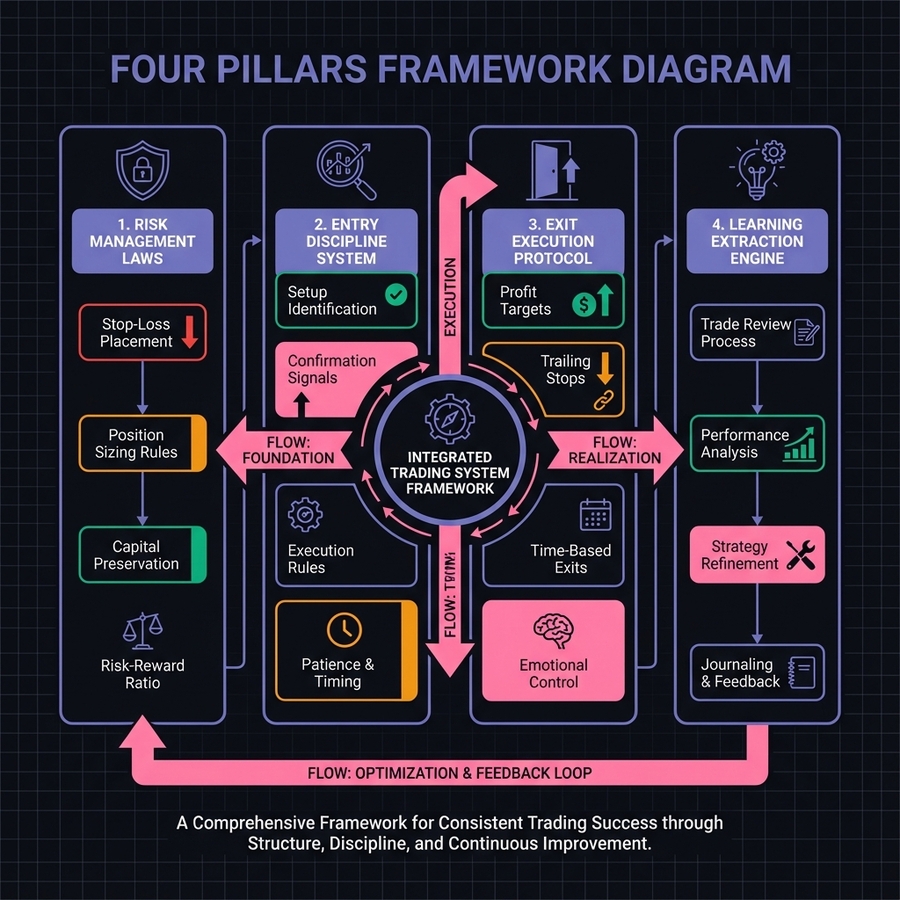

Phase 2: The Four Pillars Construction (20 minutes) 🛡️ Pillar 1: Risk Management Laws Douglas Principle: "Define your risk before entering a trade"

Your Non-Negotiable Risk Laws: □ Maximum Single Trade Risk: % (never exceed 2%) □ Maximum Daily Loss: $ or ____% □ Maximum Correlated Risk: ____% in similar protocols □ Mandatory Stop Loss: Always ____% from entry □ Position Size Formula: Account Risk ÷ (Entry - Stop) = Size

Livermore's "Wrong Thing Prevention": "I did precisely the wrong thing. The cotton showed me a loss and I kept it."

Your Wrong Thing Triggers:

Down ___% = Mandatory exit

Down ___% in 24hr = Trading freeze for ___ days

Hoping for recovery = Immediate market sell

Averaging down urge = _________________________

🎯 Pillar 2: Entry Discipline System Pre-Entry Checklist (ALL must be checked): □ Research completed (minimum ___ hours) □ Risk/Reward ratio > ___:1 □ Position size calculated and documented □ Exit plan written (specific prices/conditions) □ Emotional state verified (score < ___) □ No correlation conflicts □ Thesis clearly defined in one sentence

Entry Prohibition Conditions: Within ___ hours of major loss

When feeling: _______________________

If thinking: _______________________

During: ____________________________

🚪 Pillar 3: Exit Execution Protocol Three Sacred Exit Triggers:

💰 1. Profit Management Level 1: +___% = Sell ___% of position

Level 2: +___% = Sell ___% of position

Level 3: Let ___% run with trailing stop at ___%

🛑 2. Loss Management Stop Loss: -___% = Exit 100% immediately

No exceptions for: news, hope, averaging down

Execution: Market order, no negotiation

⏰ 3. Time/Thesis Management No movement in ___ days = Exit 50%

Thesis change = Exit 100%

Better opportunity = Exit worst performer

📚 Pillar 4: Learning Extraction Engine Daily Discipline Log Format: Date: ________ Trades Taken: ___ Discipline Score: ___/10

Rules Followed: □ Risk limits maintained □ Entry checklist completed □ Exits executed as planned □ Emotions managed

Violations:

Rule: _____________ Cost: $_____

Why: _____________

Prevention: _______

Key Lesson: _______________ Tomorrow's Focus: _________

📜

Phase 3: Personal Trading Constitution (15 minutes) Your Trading Constitution 🏛️ PREAMBLE "I, ____________, acknowledge that the market owes me nothing. My edge comes not from predicting the market, but from disciplined execution of my system. I commit to these principles without exception..."

📊 ARTICLE I - POSITION SIZING

Never risk more than ___% per trade

High conviction (8-10/10): Max ___% of capital

Medium conviction (6-7/10): Max ___% of capital

Low conviction/experimental: Max ___% of capital

Total correlated exposure: Max ___% of capital

🔍 ARTICLE II - RESEARCH REQUIREMENTS

Minimum ___ hours before any position

Must document: ________________________

Must verify through: ___________________

Red flags that disqualify: _____________

🧠 ARTICLE III - EMOTIONAL DISCIPLINE

No trading when emotional score > ___

Mandatory cooling periods:

After ___% loss: Wait ___ hours

After ___% gain: Wait ___ hours

After drawdown > ___%: Wait ___ days

🚪 ARTICLE IV - SACRED EXITS

Stop losses are contracts with myself

Profit targets execute automatically

Time stops prevent capital decay

Thesis changes trigger immediate exit

🤝 ARTICLE V - ACCOUNTABILITY

Daily discipline review: ___PM

Weekly constitution audit: ________

Monthly performance review with: ___

Violations confessed to: __________

✍️ SIGNATURES Trader: _________________ Date: _______ Witness: ________________ Date: _______

🏪 Phase 4: The Modern Bucket Shop Challenge (10 minutes) ⚡ Quick Discipline Test Setup: $1,000 paper account, Goal: Reach $1,200 with perfect discipline

Rules:

Max risk 2% per trade ($20)

Must complete entry checklist

Must honor predetermined exits

Violation = Reduce account to $500

10-Trade Sprint: Trade 1:

Entry Check: □ Complete

Exit Honor: □ Complete

Risk OK: □ Under 2%

P/L: $____

Balance: $____

Discipline: Pass/Fail

Trade 2:

Entry Check: □ Complete

Exit Honor: □ Complete

Risk OK: □ Under 2%

P/L: $____

Balance: $____

Discipline: Pass/Fail

Trade 3:

Entry Check: □ Complete

Exit Honor: □ Complete

Risk OK: □ Under 2%

P/L: $____

Balance: $____

Discipline: Pass/Fail

Trade 4:

Entry Check: □ Complete

Exit Honor: □ Complete

Risk OK: □ Under 2%

P/L: $____

Balance: $____

Discipline: Pass/Fail

Trade 5:

Entry Check: □ Complete

Exit Honor: □ Complete

Risk OK: □ Under 2%

P/L: $____

Balance: $____

Discipline: Pass/Fail

🏆 Discipline Score: ___/5 trades perfect

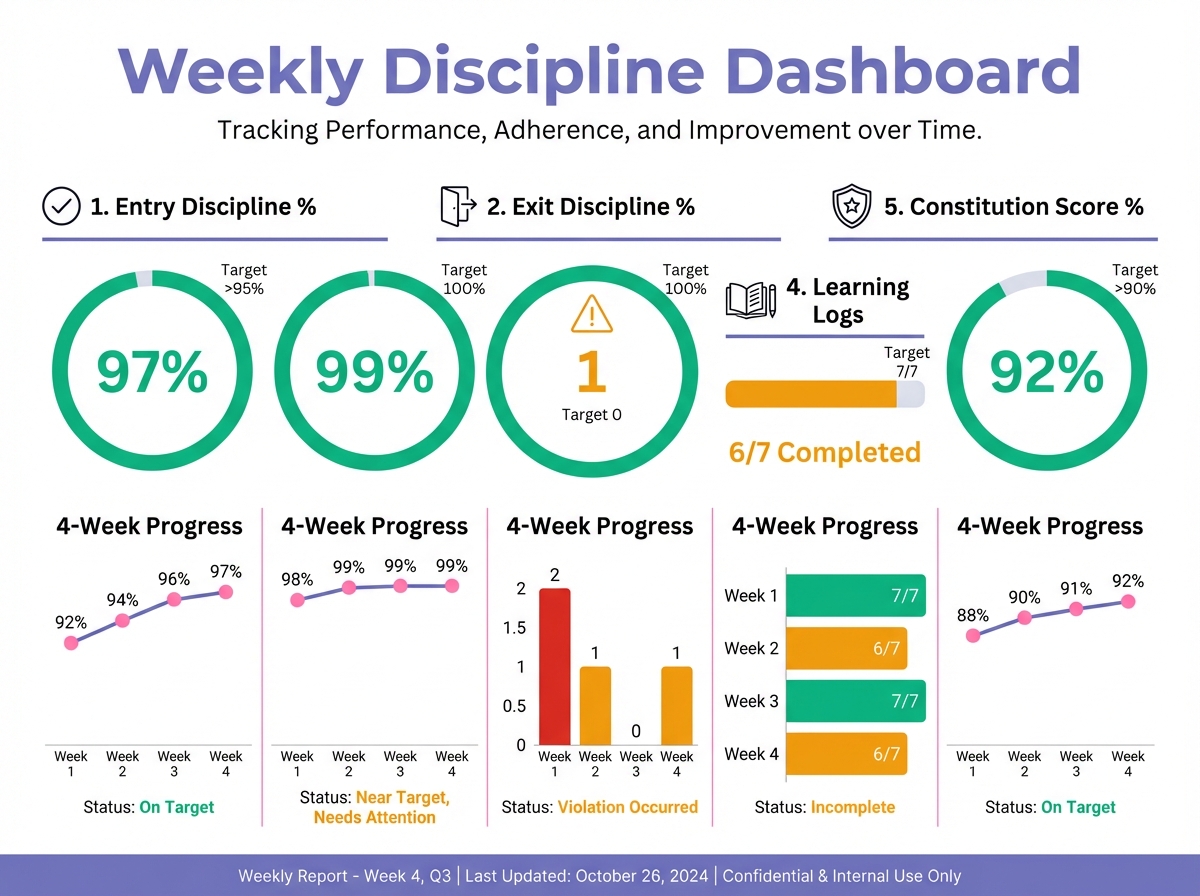

📊 Phase 5: Implementation & Tracking System (5 minutes) Weekly Discipline Dashboard Week 1:

Entry Discipline: __% (Target: >95%)

Exit Discipline: __% (Target: 100%)

Risk Violations: __ (Target: 0)

Learning Logs: __/7 (Target: 7/7)

Constitution Score: __% (Target: >90%)

Week 2:

Entry Discipline: __% (Target: >95%)

Exit Discipline: __% (Target: 100%)

Risk Violations: __ (Target: 0)

Learning Logs: __/7 (Target: 7/7)

Constitution Score: __% (Target: >90%)

Week 3:

Entry Discipline: __% (Target: >95%)

Exit Discipline: __% (Target: 100%)

Risk Violations: __ (Target: 0)

Learning Logs: __/7 (Target: 7/7)

Constitution Score: __% (Target: >90%)

Week 4:

Entry Discipline: __% (Target: >95%)

Exit Discipline: __% (Target: 100%)

Risk Violations: __ (Target: 0)

Learning Logs: __/7 (Target: 7/7)

Constitution Score: __% (Target: >90%)

🔄 The 21-Day Discipline Installation 📅 Days 1-7: Foundation

Perfect entry checklist usage

Document every trade

No exceptions period

📅 Days 8-14: Refinement

Identify weakness patterns

Strengthen weakest pillar

Share with accountability partner

📅 Days 15-21: Integration

Discipline becomes automatic

Violations feel physically wrong

System runs unconsciously

📖 Book Integration Exercises 🧠 From Trading in the Zone The Five Fundamental Truths:

Anything can happen

You don't need to know what happens next to make money

There is a random distribution of wins and losses

An edge is nothing more than a higher probability

Every moment in the market is unique

Your Application: How does discipline support these truths?

🏪 From Reminiscences Bucket Shop Wisdom: "It was the same with all. They would not take a small loss at first but had held on, in the hope of a recovery that would 'let them out even.'"

Your Prevention System: ___________________________________

📅 Daily Practice Protocol (5 minutes) 🌅 Morning (2 min) Review constitution

Set discipline intention

Check emotional state

📈 Trading Hours (ongoing) Use entry checklist

Honor all exits

Log violations immediately

🌙 Evening (3 min) Complete discipline log

Calculate daily score

Extract one lesson

🎯 Success Metrics 📅 30-Day Targets □ Discipline score improvement: >50% □ Cost of violations: Decreased 75% □ Perfect discipline days: >20 □ Constitution adherence: >90% □ Learning logs completed: 30/30

🎓 Graduation Criteria □ 7 consecutive days of perfect discipline □ Zero emotional trades in final week □ All four pillars scoring 8+/10 □ Accountability partner verification □ Ready for advanced strategies

🚀 Quick Reference Card 🏛️ The Four Pillars 🛡️ Risk: Never exceed position limits

🎯 Entry: Complete checklist always

🚪 Exit: Honor all triggers immediately

📚 Learn: Extract lesson from every trade

✅ Daily Minimums □ Review constitution (30 seconds) □ Use entry checklist (2 minutes) □ Complete discipline log (3 minutes)

🚨 Emergency Protocol When discipline wavers:

Stop all trading

Review constitution

Call accountability partner

Return only when centered

💎 Key Takeaway "Discipline is not a restriction of freedom; it is the pathway to it. In trading, as Livermore learned in the bucket shops, immediate discipline creates lasting success."

👇 Comment below with your current discipline score and which pillar needs the most work!

Last updated