Exercise 6: Risk Psychology Mastery Protocol

⏰ Time Investment: 45-60 minutes initial setup + 5 minutes daily monitoring 🎯 Goal: Master position sizing psychology to protect capital and maximize sustainable growth

📚 Required Reading Integration 📖 Primary: "The Psychology of Trading" by Brett Steenbarger - Chapters 5-7 📖 Primary: "Trading in the Zone" by Mark Douglas - Chapters 8-9 📖 Supporting: "Thinking, Fast and Slow" by Kahneman - Chapters 25-28 (Prospect Theory) 📖 Livermore Focus: "Reminiscences" - Chapters 20-22 (position sizing mastery)

🔍 Phase 1: Personal Risk Psychology Assessment (15 minutes) Your True Risk Tolerance Discovery

Before you can manage risk properly, you must know your actual risk tolerance — not what you think it is, but what it really is under stress.

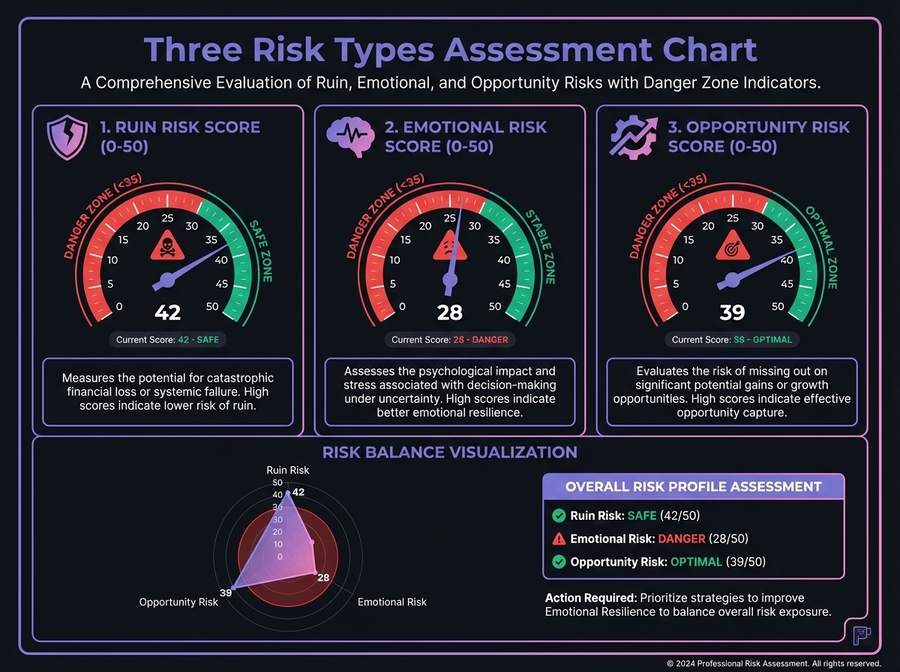

💀 The Three Risk Types Assessment

Ruin Risk Evaluation Rate your current situation 1-10 (1=extremely risky, 10=very safe):

□ My largest single position is ____% of my portfolio ___/10 (10=<2%, 7=2-5%, 5=5-10%, 3=10-20%, 1=>20%)

□ I could lose my largest position completely and continue trading ___/10

□ I never use leverage on volatile DeFi assets ___/10

□ I only invest capital I can afford to lose 100% ___/10

□ My portfolio drawdown tolerance is ____% before I quit ___/10

📊 Ruin Risk Score: ___/50 (Below 35 = DANGER ZONE)

Most dangerous position right now:

Protocol: _________________________________________

Position size: ____% of portfolio

If this went to zero tomorrow: □ I'd be fine and continue □ I'd be stressed but survive □ I'd be financially/psychologically devastated

Emotional Risk Evaluation Rate yourself 1-10 (1=completely emotional, 10=completely calm):

□ I check my portfolio ____ times per day ___/10 (10=1-2x, 7=3-4x, 5=5-8x, 3=9-15x, 1=>15x)

□ I can sleep peacefully regardless of market volatility ___/10

□ I never make impulsive decisions during big swings ___/10

□ My position sizes don't cause me constant anxiety ___/10

□ I can watch a position drop 30% without panic ___/10

📊 Emotional Risk Score: ___/50 (Below 35 = Positions too large)

Position causing most emotional distress:

Protocol: _________________________________________

Anxiety level (1-10): ___/10

Times checked today: _____

Sleep quality impact (1-10): ___/10

Opportunity Risk Evaluation Rate yourself 1-10:

□ My positions are large enough to create meaningful wealth ___/10

□ I'm not over-trading due to position sizes being too small ___/10

□ My risk capital is appropriately allocated (not too conservative) ___/10

□ I can participate in quality opportunities when they arise ___/10

□ My fees-to-gains ratio is favorable (low trading frequency) ___/10

📊 Opportunity Risk Score: ___/50 (Below 35 = Too conservative)

🎯 Your Primary Risk Issue Highest vulnerability: _______________________________

Action required: __________________________________

💸 Current Portfolio Risk Analysis

Total Portfolio Value: $__________

Largest Position: __________ ($______ / ____%)

Top 3 Positions Total: ______%

Single Sector Concentration (largest): ______%

Acceptable Loss per Position: $______ (2% max)

Current Actual Loss Tolerance: $______

Gap (if any): $______ (This is your overexposure)

🧠

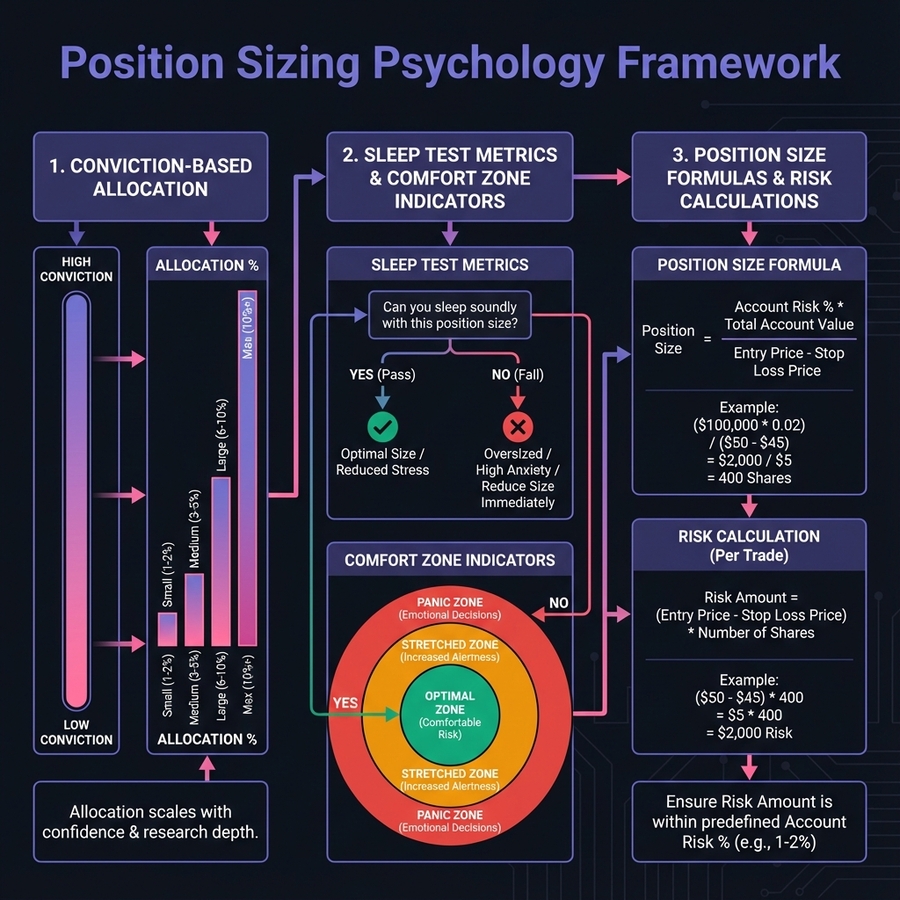

Phase 2: Position Sizing Psychology Framework (20 minutes)

📏 The Conviction-Based Position Sizing System

For each position, rate your conviction level and assign appropriate size:

Current Position #1: ______________________________

Conviction Level (1-10): ___/10

Appropriate Max Size: • 9-10/10 conviction = 5% max • 7-8/10 conviction = 3% max • 5-6/10 conviction = 1% max • Below 5/10 = NO POSITION

Current Size: ____% Target Size: ____% Action: _______

Reason for conviction level:

What would lower conviction: _________________________

What would raise conviction: _________________________

Current Position #2: ______________________________

Conviction Level (1-10): ___/10

Current Size: ____% Target Size: ____% Action: _______

Reason for conviction level:

What would lower conviction: _________________________

What would raise conviction: _________________________

Current Position #3: ______________________________

Conviction Level (1-10): ___/10

Current Size: ____% Target Size: ____% Action: _______

Reason for conviction level:

What would lower conviction: _________________________

What would raise conviction: _________________________

Current Position #4: ______________________________

Conviction Level (1-10): ___/10

Current Size: ____% Target Size: ____% Action: _______

Reason for conviction level:

What would lower conviction: _________________________

What would raise conviction: _________________________

Current Position #5: ______________________________

Conviction Level (1-10): ___/10

Current Size: ____% Target Size: ____% Action: _______

Reason for conviction level:

What would lower conviction: _________________________

What would raise conviction: _________________________

Total Adjustments Needed: $________ (rebalancing required)

😴 The Emotional Sizing Tests

The Sleep Test Review each position and rate sleep quality impact:

Position: ____________ Sleep Impact (1-10): ___ If 8-10 (ruins sleep) = Position too large, reduce by 50%

Position: ____________ Sleep Impact (1-10): ___ Position: ____________ Sleep Impact (1-10): ___ Position: ____________ Sleep Impact (1-10): ___ Position: ____________ Sleep Impact (1-10): ___

Positions requiring reduction: _______________________

The Comfort Zone Test Rate emotional state for each position (1-10): • 1-3 = Too small to care • 4-7 = Optimal psychological size • 8-10 = Overleveraged emotionally

Position: ____________ Emotional State: ___/10 Action: ______ Position: ____________ Emotional State: ___/10 Action: ______ Position: ____________ Emotional State: ___/10 Action: ______ Position: ____________ Emotional State: ___/10 Action: ______ Position: ____________ Emotional State: ___/10 Action: ______

The "Zero Tomorrow" Test For each position, complete: "If this went to zero tomorrow, I would feel..."

Position 1: ___________________________________________ Feeling: □ Fine (good size) □ Stressed (too large) □ Devastated (way too large)

Position 2: ___________________________________________ Feeling: □ Fine (good size) □ Stressed (too large) □ Devastated (way too large)

Position 3: ___________________________________________ Feeling: □ Fine (good size) □ Stressed (too large) □ Devastated (way too large)

Position 4: ___________________________________________ Feeling: □ Fine (good size) □ Stressed (too large) □ Devastated (way too large)

Position 5: ___________________________________________ Feeling: □ Fine (good size) □ Stressed (too large) □ Devastated (way too large)

Any position marked "Devastated" = Reduce immediately to 50% or less Any position marked "Stressed" = Reduce to achieve "Fine" status

📊 Livermore's Pyramiding Protocol

"I never buy a stock at the top or sell at the bottom. I wait for the market to prove my case."

Your Pyramiding Plan (building positions gradually):

Target Protocol: ______________________________________

Total Target Position: ____% (of portfolio)

Pyramiding Structure:

Initial Test Position: % (25% of total target) Entry price: $__ Conditions to add: _________________________________

Second Tier: _% (25% of total target) Only add if: Price up % AND ___________________ Target entry: $

Third Tier: _% (25% of total target) Only add if: Price up % AND ___________________ Target entry: $

Final Tier: _% (25% of total target) Only add if: Price up % AND ___________________ Target entry: $

Never Average Down Rule: "I will NEVER add to a losing position. Only the market confirming my thesis justifies additional capital allocation."

Signed: _________________ Date: _______

📅

Phase 3: Pre-Commitment Risk Protection System (10 minutes)

The Pre-Trade Risk Contract Before entering ANY new position, complete this contract:

New Position: _________________________________________

Position Size Decision:

Portfolio value: $__________ Maximum risk per position: $______ (2% recommended) Position size: $______ Percentage of portfolio: ____%

Conviction level: ___/10 Appropriate for conviction: Yes/No

Pre-Commitment Stop Loss:

Entry price: $______ Stop loss price: $______ (Never change this) Maximum loss: $______ (Must be ≤ 2% of portfolio)

"I commit to exiting at $______ without hesitation, regardless of hope, conviction, or belief in recovery. I understand the market doesn't care about my entry price."

Signed: _________________ Date: _______

Emotional Sizing Check:

□ I can sleep peacefully with this position size □ I won't need to check this position constantly □ I can lose the maximum loss amount without panic □ This size aligns with my conviction level □ I have capital reserved for other opportunities

If ANY box is unchecked, reduce position size by 50% and re-evaluate.

Exit Conditions (Non-Emotional):

I will exit this position if:

I will take profits if:

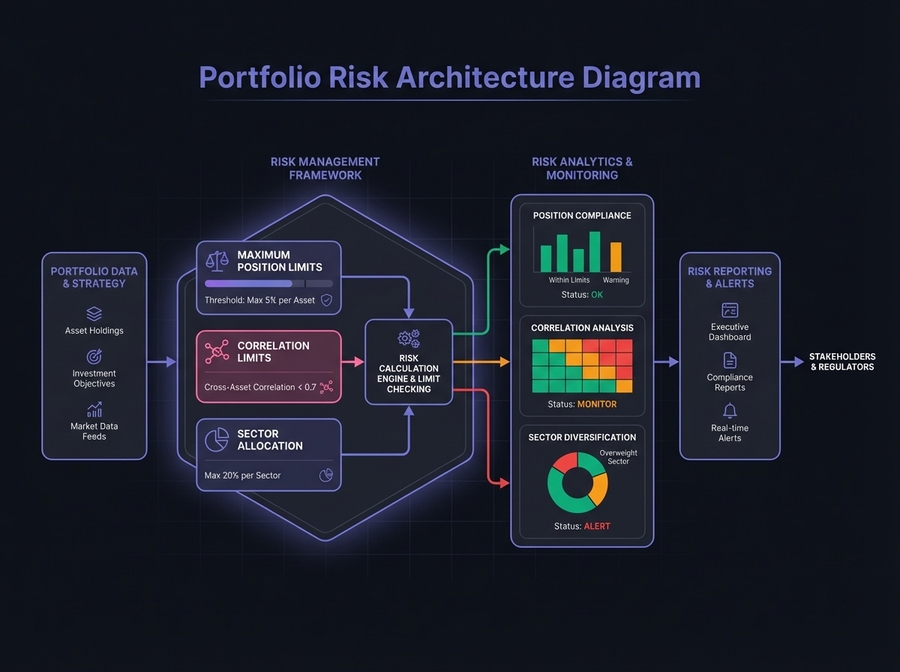

🎯 Phase 4: Portfolio Risk Architecture (15 minutes)

DeFi Sector Allocation Limits Prevent concentration risk across sectors:

Layer 1 Blockchains: ____% (Max 25%) Current: ____% - Action: _____________

Layer 2 Solutions: ____% (Max 20%) Current: ____% - Action: _____________

DEXs & AMMs: ____% (Max 15%) Current: ____% - Action: _____________

Lending Protocols: ____% (Max 15%) Current: ____% - Action: _____________

Derivatives: ____% (Max 10%) Current: ____% - Action: _____________

Stablecoins: ____% (Min 15%, Max 40%) Current: ____% - Action: _____________

Other/Speculative: ____% (Max 15%) Current: ____% - Action: _____________

Total: 100%

The Barbell Risk Strategy Combine extreme safety with extreme upside:

80% Foundation (Safe Assets): • BTC: ____% • ETH: ____% • Stablecoins: ____% • Blue Chip DeFi (Aave, Uni, etc.): ____%

Total Foundation: ____% (Target: 75-85%)

20% Asymmetric Bets (High Risk/Reward): • New protocols: ____% • Small caps: ____% • Experimental: ____%

Total Asymmetric: ____% (Target: 15-25%)

Avoid Mediocre Middle: ____% (Medium risk, medium reward - worst risk/reward profile) Target: <10%

Chain Diversification Don't put all capital on one chain:

Ethereum: ____% Polygon: ____% Arbitrum/Optimism: ____% Other L2s: ____% Alt L1s (Solana, etc.): ____% Multi-chain: ____%

Largest chain exposure: ____% (Maximum 50% recommended)

🚨

Phase 5: Drawdown Response Protocols (10 minutes)

Pre-Program Your Responses Set these triggers NOW before emotions take over:

10% Portfolio Drawdown Trigger Current portfolio value: $__________ 10% trigger point: $__________ (90% of current)

Automatic Actions: □ Pause all new investments for 48 hours □ Review and rate conviction on all positions □ Consider taking profits on remaining winners □ Reduce position sizes on speculative plays by 50% □ Review risk management rules for violations

"At $_________, I will execute the 10% protocol without debate."

20% Portfolio Drawdown Trigger 20% trigger point: $__________ (80% of starting value)

Automatic Actions: □ Reduce ALL positions by 50% immediately □ Move to 50% stablecoins minimum □ Keep only highest conviction positions (9-10/10) □ Stop ALL speculative trading □ Review strategy for fundamental flaws

"At $_________, I will execute the 20% protocol without hesitation."

35% Portfolio Drawdown Trigger 35% trigger point: $__________ (65% of starting value)

Automatic Actions: □ Move to 75% stablecoins immediately □ Preserve remaining capital at all costs □ Take 1-4 week complete break from markets □ Seek mentor/accountability partner guidance □ Start over with 1% position sizes

"At $_________, I will execute the 35% protocol. Survival > Recovery."

Monthly Risk Review Checklist

Completed on: ________ (First of each month)

□ Current portfolio drawdown: ____% □ Largest position size: ____% (Max 5%) □ Top 3 positions combined: ____% (Max 15%) □ Largest sector concentration: ____% (Max 25%) □ Number of positions causing sleep issues: _____ (Target: 0) □ Risk per position average: ____% (Target: 1-2%) □ Times I violated position sizing rules: _____ (Target: 0) □ Times I violated stop losses: _____ (Target: 0) □ Emotional risk score (1-10): _____ (Target: 7+) □ Risk management grade: A B C D F

Actions required this month: _________________________

🎯 Implementation Action Plan

⚡ Immediate Actions (Today) □ Complete personal risk psychology assessment □ Calculate appropriate position sizes for all holdings □ Identify and reduce any oversized positions □ Set pre-commitment stops for all positions □ Create drawdown trigger alerts

📅 30-Day Risk Mastery Goals □ Rebalance portfolio to appropriate position sizes □ Implement conviction-based sizing for all positions □ Use pre-trade risk contract for 100% of new positions □ Pass sleep test on all positions (0 sleepless nights) □ Maintain risk per position below 2% □ Document and follow drawdown protocols if triggered

🏆 Success Metrics

Primary: Zero positions causing sleep issues or anxiety

Secondary: All positions sized appropriately for conviction level

Behavioral: Pre-trade risk contract used 100% of time

Financial: Maximum drawdown <15% despite market volatility

Psychological: Emotional risk score improved to 7+/10

📖 Book Integration Exercises

🧠 From Trading in the Zone (Douglas)

Probability Mindset Applied to Position Sizing "Anything can happen. I don't need to know what will happen next to make money."

Complete this reframe: Old mindset: "This WILL go up, so I'll bet big" New mindset: "This MIGHT go up, so I'll bet appropriately"

Your position sizing rules based on probability: High probability (>70%): ___% max position Medium probability (50-70%): ___% max position Low probability (<50%): ___% max position or no position

💡 From The Psychology of Trading (Steenbarger)

The Risk Management Self-Audit Answer honestly:

How often do you violate your position sizing rules? Never / Rarely / Sometimes / Often / Always

What triggers the violations?

What's the cost of these violations this year? $__________

Commitment to change: "Starting today, I will ______________________________"

📚 From Thinking, Fast and Slow (Kahneman)

Prospect Theory and Loss Aversion You feel losses 2x more intensely than equivalent gains.

This means: A $1,000 loss feels like losing $2,000 psychologically.

Your loss aversion impact assessment: How many times have you held losers too long? _____ Average additional loss from holding: $______ Total cost of loss aversion this year: $______

New commitment: "I will honor all pre-commitment stops to prevent loss aversion from controlling my decisions."

Signed: _________________ Date: _______

👥 Community Integration

🎯 Weekly Risk Management Mastermind:

Share your largest position size challenge this week

Discuss drawdown triggers and whether you followed protocols

Celebrate successful position sizing decisions

Hold each other accountable to risk rules

🤝 Accountability Structure:

Risk Management Partner: ___________________________

Weekly Check-in: Every _______ at _______ (day/time)

What we share: • Current largest position size and conviction level • Any violations of position sizing or stop loss rules • Emotional risk score (1-10) • Portfolio drawdown percentage

Support protocol: If partner reports position sizing violation:

Identify the psychological trigger

Discuss appropriate position size

Create commitment to adjust

Follow up in 24 hours

🚀 Quick Reference Card

⚡ Before Every Trade (2 min) Complete pre-trade risk contract

Calculate maximum loss (≤2% portfolio)

Set pre-commitment stop loss

Pass emotional sizing tests

Confirm conviction level matches size

📅 Weekly Risk Review (10 min) Check all position sizes vs conviction levels

Verify no positions causing sleep issues

Confirm sector allocations within limits

Review and log any risk rule violations

Calculate current portfolio drawdown

Monthly Deep Audit (30 min) Complete full risk psychology assessment

Recalibrate position sizes for changed convictions

Update drawdown trigger levels

Review risk management performance

Grade yourself and set improvement goals

💎 Key Takeaway

"Position sizing is 80% psychology, 20% math. Master the psychology, and the math will protect you. Ignore the psychology, and no math will save you."

The most important question in trading isn't "Will this go up?" — it's "How much should I risk to find out?"

👇 Comment below with your largest position size as a % of your portfolio and whether it passes the sleep test!

Last updated