Exercise 7: Probability Thinking Development System

⏰ Time Investment: 45-60 minutes initial setup + 5-10 minutes per decision 🎯 Goal: Transform from certainty-seeking gambler to probability-thinking trader

📚 Required Reading Integration 📖 Primary: "Thinking, Fast and Slow" by Daniel Kahneman - Chapters 14-18 📖 Primary: "Predictably Irrational" by Dan Ariely - Chapters 4-8 📖 Supporting: "The Art of Thinking Clearly" by Rolf Dobelli - Chapters 21-40 📖 Livermore Focus: "Reminiscences" - Chapters 23-24 (market timing as probability)

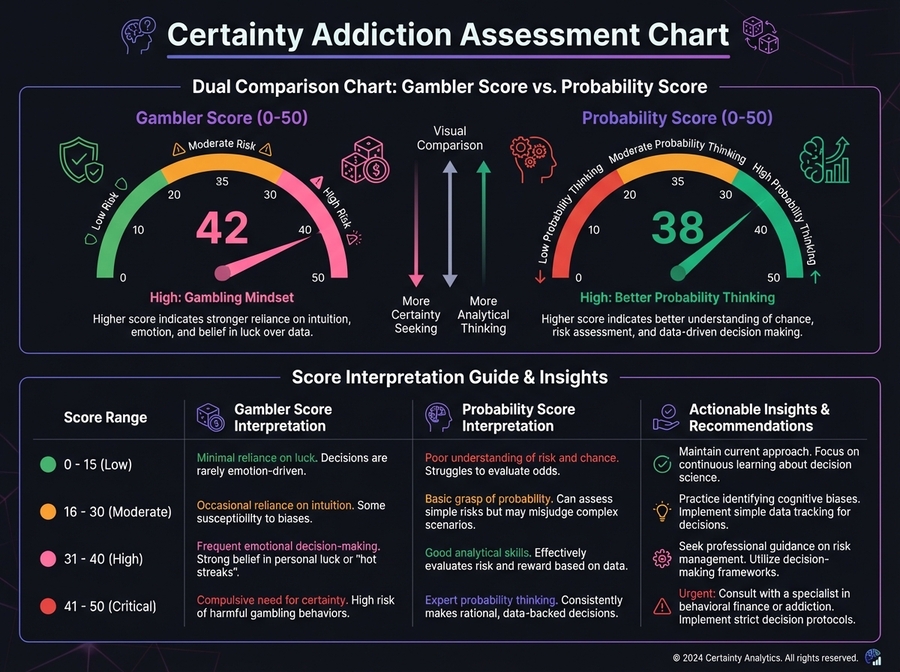

🔍 Phase 1: Certainty Addiction Assessment (10 minutes) Your Prediction Mindset Diagnosis

Before you can think probabilistically, you must identify how certainty-seeking sabotages your trading.

🎰 The Gambler vs Probability Thinker Test

Rate how often you think these thoughts (1=never, 10=constantly):

Gambler Mindset Patterns:

□ "I KNOW this token will moon" ___/10 □ "I never lose money on DeFi" (denial) ___/10 □ "This chart pattern predicts the future with certainty" ___/10 □ "This APY is sustainable forever" ___/10 □ "I'm sure this protocol will succeed" ___/10

📊 Gambler Score: ___/50 (Higher = More gambling mindset)

Probability Mindset Patterns:

□ I think in terms of probabilities (60%, 40%, etc.) ___/10 □ I acknowledge uncertainty in every decision ___/10 □ I focus on expected value over single outcomes ___/10 □ I track my prediction accuracy systematically ___/10 □ I'm comfortable making bets without certainty ___/10

📊 Probability Score: ___/50 (Higher = Better probability thinking)

🎯 Your Mindset Gap: _____ points (Probability - Gambler scores)

Ideal: +30 or higher (Strong probability mindset) Good: +15 to +29 (Developing probability thinking) Concerning: 0 to +14 (Still seeking certainty) Danger: Negative (Gambling mindset dominant)

💀 Your Most Expensive Certainty-Seeking Mistakes

Mistake #1:

What you were "certain" about: ___________________

Actual outcome: _________________________________

Cost: $__________

Lesson: "I should have assigned ____% probability instead of assuming certainty"

Mistake #2:

What you were "certain" about: ___________________

Actual outcome: _________________________________

Cost: $__________

Lesson: __________________________________________

Mistake #3:

What you were "certain" about: ___________________

Actual outcome: _________________________________

Cost: $__________

Lesson: __________________________________________

💸 Total Cost of Certainty-Seeking: $__________

This is what false confidence costs you.

🧠

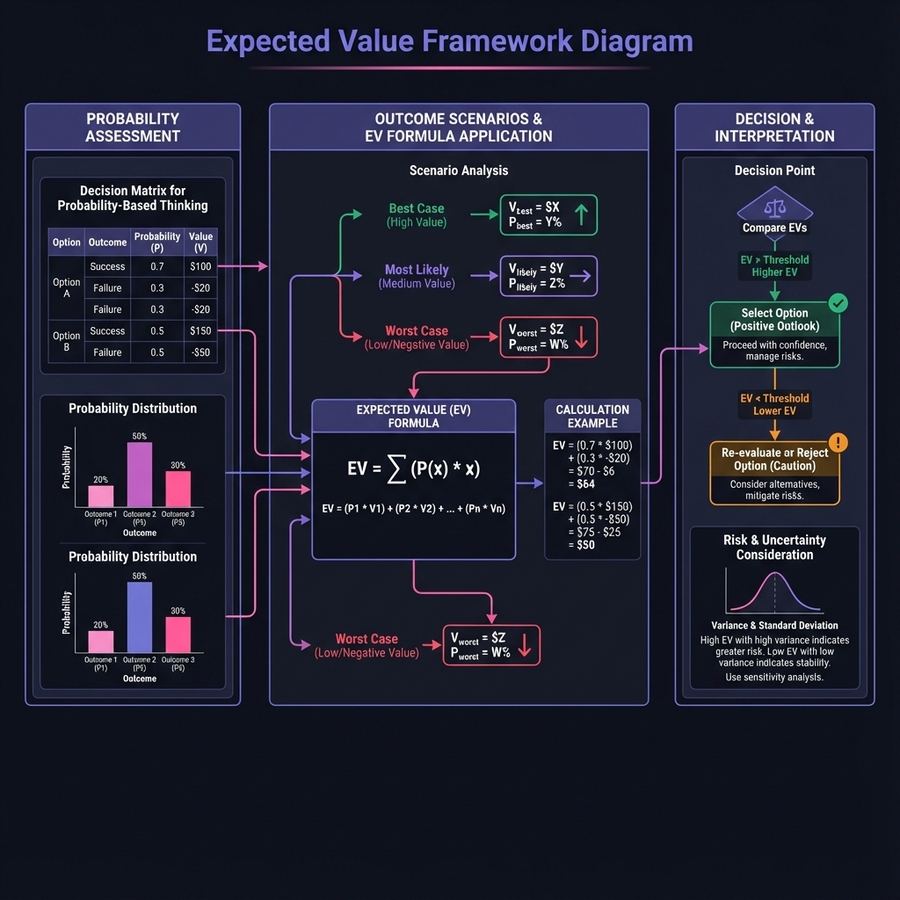

Phase 2: Expected Value Framework (20 minutes)

💰 The Expected Value Calculator

Expected Value (EV) = (Win Probability × Average Win) - (Loss Probability × Average Loss)

Positive EV = Good bet (make it repeatedly) Negative EV = Bad bet (avoid completely) Zero EV = Coin flip (not worth your time)

DeFi Opportunity #1: ______________________________

Investment Amount: $__________

Scenario 1 - Bull Case: Probability: % Return if this happens: +% Dollar gain: $__________

Scenario 2 - Base Case: Probability: % Return if this happens: +/- % Dollar gain/loss: $__

Scenario 3 - Bear Case: Probability: % Return if this happens: -% Dollar loss: $__________

(Probabilities must sum to 100%)

Expected Value Calculation: (% × $) + (% × $) + (% × $__) = $____

Expected Value %: ____%

Decision: □ Positive EV - Take the bet with appropriate position size □ Negative EV - Pass completely □ EV unclear - Research more before deciding

Position Size Based on EV:

+30% EV: Up to 5% of portfolio +15% to +30% EV: Up to 3% of portfolio +5% to +15% EV: Up to 1% of portfolio <+5% EV: Pass or minimal allocation

Appropriate Position: ____% of portfolio ($________)

DeFi Opportunity #2: ______________________________

Investment Amount: $__________

Bull Case: % probability × +% return = $______ Base Case: % probability × +/-% return = $______ Bear Case: % probability × -% return = $______

Expected Value: $______ (___%)

Position Size: ____% of portfolio

DeFi Opportunity #3: ______________________________

Investment Amount: $__________

Bull Case: % probability × +% return = $______ Base Case: % probability × +/-% return = $______ Bear Case: % probability × -% return = $______

Expected Value: $______ (___%)

Position Size: ____% of portfolio

📊 The Base Rate Reality Check

Always start with base rates before adjusting for specifics:

Base Rate Reference Table: New DeFi protocol success (2+ years): 20-30% Token launch 100x claim success: <1% High-APY farm sustainability (6+ months): 30-40% Smart contract exploit despite audit: 5-10% Bear market duration: 1-3 years (historical) Bull market duration: 6-18 months (historical)

For Your Next Investment:

Protocol/Token: ___________________________________

Relevant base rate: ____% (start here, not your gut feeling)

Positive factors adjusting probability UP:

_________________________ +____%

_________________________ +____%

_________________________ +____%

Negative factors adjusting probability DOWN:

_________________________ -____%

_________________________ -____%

_________________________ -____%

Final probability estimate: ____%

If your final number is >2x the base rate, you're probably overconfident. Question your assumptions aggressively.

🎯

Phase 3: Prediction Calibration System (15 minutes)

The 20-Prediction Tracking System Track your actual prediction accuracy to eliminate overconfidence:

Prediction #1:

Statement: "I believe [protocol/outcome] will [specific result] by [date]"

Confidence level: ___% (How certain are you?)

Actual outcome: □ Correct □ Incorrect □ Pending

Prediction #2:

Statement: ________________________________________

Confidence level: ___%

Actual outcome: □ Correct □ Incorrect □ Pending

Prediction #3:

Statement: ________________________________________

Confidence level: ___%

Actual outcome: □ Correct □ Incorrect □ Pending

Prediction #4:

Statement: ________________________________________

Confidence level: ___%

Actual outcome: □ Correct □ Incorrect □ Pending

Prediction #5:

Statement: ________________________________________

Confidence level: ___%

Actual outcome: □ Correct □ Incorrect □ Pending

Prediction #6:

Statement: ________________________________________

Confidence level: ___%

Actual outcome: □ Correct □ Incorrect □ Pending

Prediction #7:

Statement: ________________________________________

Confidence level: ___%

Actual outcome: □ Correct □ Incorrect □ Pending

Prediction #8:

Statement: ________________________________________

Confidence level: ___%

Actual outcome: □ Correct □ Incorrect □ Pending

Prediction #9:

Statement: ________________________________________

Confidence level: ___%

Actual outcome: □ Correct □ Incorrect □ Pending

Prediction #10:

Statement: ________________________________________

Confidence level: ___%

Actual outcome: □ Correct □ Incorrect □ Pending

(Continue through Prediction #20 using same format)

📊 Calibration Analysis (Complete after 20 predictions)

Your 50-60% confidence predictions: ___% actual accuracy Your 60-70% confidence predictions: ___% actual accuracy Your 70-80% confidence predictions: ___% actual accuracy Your 80-90% confidence predictions: ___% actual accuracy Your 90%+ confidence predictions: ___% actual accuracy

Well-calibrated trader: Confidence matches actual accuracy Overconfident trader: Actual accuracy significantly lower than stated confidence

Your calibration gap: _____ percentage points

If gap >15 percentage points: You're severely overconfident Reduce position sizes by 50% until calibration improves.

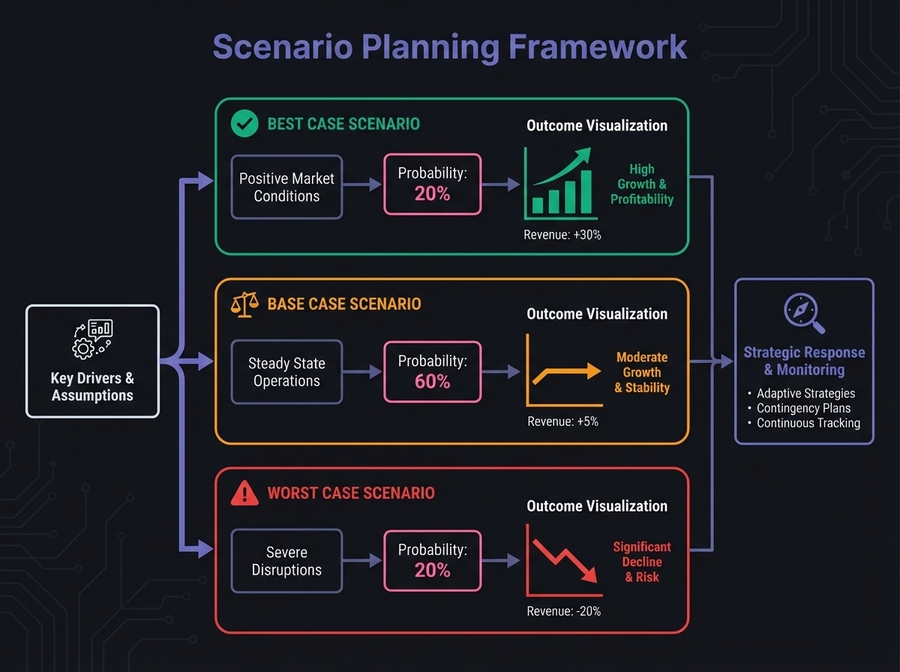

🌐 Phase 4: Scenario Planning Framework (20 minutes)

Monte Carlo Thinking for Portfolio Decisions

Instead of predicting one future, consider multiple scenarios with probabilities:

12-Month DeFi Market Scenarios:

Scenario 1: Bull Market 🚀 Probability: % Portfolio return in this scenario: +% Key drivers: ___________________________________

Scenario 2: Moderate Bull 📈 Probability: % Portfolio return in this scenario: +% Key drivers: ___________________________________

Scenario 3: Sideways Market 📊 Probability: % Portfolio return in this scenario: +/-% Key drivers: ___________________________________

Scenario 4: Bear Market 🐻 Probability: % Portfolio return in this scenario: -% Key drivers: ___________________________________

(Probabilities must sum to 100%)

Expected Portfolio Return: (% × +%) + (% × +%) + (% × +/-%) + (% × -%) = +/- ____%

Position Sizing Based on Scenarios:

If bear market probability >30%: Increase stablecoin allocation to 30%+ If bull market probability >40%: Increase beta exposure to high-growth protocols If sideways probability >35%: Focus on yield-generating strategies

Current allocation adjustment needed: ________________

Specific Protocol Scenario Analysis:

Protocol: _________________________________________

Scenario 1: Protocol Success (Mass adoption) Probability: % Return: +% Timeline: _____ months

Scenario 2: Moderate Growth Probability: % Return: +% Timeline: _____ months

Scenario 3: Struggles (Low adoption) Probability: % Return: -% Timeline: _____ months

Scenario 4: Failure (Exploit/abandonment) Probability: % Return: -% Timeline: _____ months

Expected Value: ____% Appropriate position size: ____% of portfolio

📅

Phase 5: Daily Probability Practice (5-10 minutes)

The Pre-Decision Probability Checklist

Before ANY DeFi investment decision, complete this:

□ I have calculated expected value for this opportunity

EV: +/- ____%

□ I have considered base rates for this type of investment

Base rate: ____% My adjusted estimate: ____% Justification for difference: ____________________

□ I have created multiple scenarios with probabilities

Bull: ___% probability Base: ___% probability Bear: ___% probability

□ I am expressing confidence as a range, not a point prediction

"I'm ___% confident this will return between ___% and ___% over ___ months"

NOT: "This will definitely return ____%"

□ My position size reflects probability, not certainty

Position size: ____% Matches EV and uncertainty level: Yes/No

□ I have identified what could prove me wrong

Three things that would invalidate this thesis:

If ANY checkbox remains unchecked, you're not ready to invest.

Weekly Probability Journal:

Monday Decision:

Opportunity: ______________________________________

Expected Value: +___% (calculation: ______________)

Confidence level: ____%

Position size: ____%

Base rate used: ____%

Tuesday Decision:

Opportunity: ______________________________________

Expected Value: +___% (calculation: ______________)

Confidence level: ____%

Position size: ____%

Base rate used: ____%

Wednesday Decision:

Opportunity: ______________________________________

Expected Value: +___% (calculation: ______________)

Confidence level: ____%

Position size: ____%

Base rate used: ____%

Thursday Decision:

Opportunity: ______________________________________

Expected Value: +___% (calculation: ______________)

Confidence level: ____%

Position size: ____%

Base rate used: ____%

Friday Decision:

Opportunity: ______________________________________

Expected Value: +___% (calculation: ______________)

Confidence level: ____%

Position size: ____%

Base rate used: ____%

📊 Weekly Probability Review

Completed every Sunday:

Decisions made this week: _____

Decisions with positive EV: _____

Decisions with calculated probabilities: _____

Average confidence level: ____%

Predictions that resolved this week: _____

Accuracy rate: ____%

Calibration gap: +/- _____ percentage points

Adjustment needed: _______________________________

🎲 Livermore's Probability Wisdom Integration

"I never argue with the tape. Getting sore at the market doesn't get you anywhere."

Livermore's Probability Principles

Principle 1: The Market Doesn't Care About Your Opinion Your conviction level doesn't change probabilities — only analysis does.

Your Application: "When I feel certain about a trade, I will calculate actual probabilities before sizing. My feelings ≠ facts."

Principle 2: Patience for High-Probability Setups Livermore waited weeks or months for his "certain" opportunities (what we'd call high-probability setups today).

Your High-Probability Criteria: I only make significant bets (>3% position) when:

Otherwise, I wait or make smaller exploratory positions.

Principle 3: Quick Exits When Probability Changes When the market proved him wrong, Livermore exited immediately — the new information changed his probability assessment.

Your Bayesian Update Protocol: "When new information significantly changes my probability estimate, I will adjust position size within 24 hours."

Initial probability: ____% New information: _________________________________ Updated probability: ____% Action: Increase/Decrease/Exit position

🎯 Implementation Action Plan

⚡ Immediate Actions (This Week) □ Complete certainty addiction assessment □ Calculate expected value for current top 3 positions □ Begin 20-prediction tracking system □ Create scenario analysis for portfolio □ Use pre-decision probability checklist for all new trades

📅 30-Day Probability Mastery Goals □ Calculate EV for 100% of investment decisions □ Complete 20-prediction tracking with calibration analysis □ Adjust position sizes based on expected value framework □ Reduce overconfidence gap to <10 percentage points □ Create and update monthly scenario planning model □ Make zero decisions based on "certainty" — only probabilities

🏆 Success Metrics

Primary: 100% of decisions include calculated expected value

Secondary: Prediction accuracy within 10% of stated confidence

Behavioral: Zero trades made without probability assessment

Financial: Portfolio returns match expected value projections

Psychological: Comfortable making bets without certainty

📖 Book Integration Exercises

🧠 From Thinking, Fast and Slow (Kahneman)

Base Rate Neglect Exercise Identify 5 times you ignored base rates in favor of specific stories:

Investment: ____________ Base rate ignored: ___% Outcome: ________

Investment: ____________ Base rate ignored: ___% Outcome: ________

Investment: ____________ Base rate ignored: ___% Outcome: ________

Investment: ____________ Base rate ignored: ___% Outcome: ________

Investment: ____________ Base rate ignored: ___% Outcome: ________

New commitment: "I will always start with base rates before adjusting for specific circumstances."

💡 From Predictably Irrational (Ariely)

The Anchor Effect on Probability Your first estimate anchors all subsequent thinking.

Exercise: For your next 5 investments, estimate probability BEFORE looking at price charts or reading others' opinions.

Your independent estimate: ____% After seeing charts/opinions: ____% Difference: ___% (This is anchoring bias)

Protection: Always form independent probability estimates first.

📚 From The Art of Thinking Clearly (Dobelli)

Confirmation Bias in Probability Assessment You seek information confirming your probability estimates.

Exercise: For each high-conviction investment, find 3 sources arguing for LOWER probability of success.

Investment: ___________________________________________ Your probability: ____% Contrarian source 1 probability: ____% Contrarian source 2 probability: ____% Contrarian source 3 probability: ____%

Revised probability (average): ____%

This exercise forces intellectual honesty.

👥 Community Integration

🎯 Weekly Probability Mastermind:

Share your expected value calculations for recent decisions

Discuss calibration gaps and overconfidence patterns

Challenge each other's probability estimates with data

Celebrate decisions with positive EV (regardless of outcome)

🤝 Accountability Structure:

Probability Thinking Partner: _______________________

Weekly Check-in: Every _______ at _______ (day/time)

What we share: • Expected value calculations for the week • Prediction accuracy and calibration data • Scenarios updated based on new information • Decisions made without probability assessment (goal: 0)

Support protocol: If partner makes decision without EV calculation:

Work through the calculation together retroactively

Identify why probability thinking was skipped

Commit to checklist use for next decision

Follow up before next investment

🚀 Quick Reference Card

⚡ Before Every Investment (5 min) Calculate expected value (probabilities × outcomes)

Check relevant base rates

Create 3+ scenarios with probabilities

Express confidence as range, not point

Size position based on EV and uncertainty

📅 Weekly Probability Review (15 min) Review all decisions for EV calculation

Track prediction accuracy vs confidence levels

Update scenario probabilities based on new info

Identify decisions made without probability thinking

Calculate calibration gap and adjust

Monthly Deep Analysis (30 min) Complete 20-prediction calibration analysis

Update base rate reference table

Rebuild scenario planning for next period

Compare actual returns to expected value projections

Adjust probability thinking system based on results

💎 Key Takeaway

"The market doesn't reward predictions — it rewards positive expected value bets made repeatedly over time. Think like a casino, not a gambler."

The most profitable question in DeFi: "What's the expected value?" The most dangerous delusion: "I'm certain this will happen."

👇 Comment below with one investment where you were "certain" but wrong, and what probability you should have assigned!

Last updated