Lesson 5: Wallets and Self-Custody

Lesson 5: Wallets and Self-Custody

🎯 Core Concept: Self-Custody and Private Keys

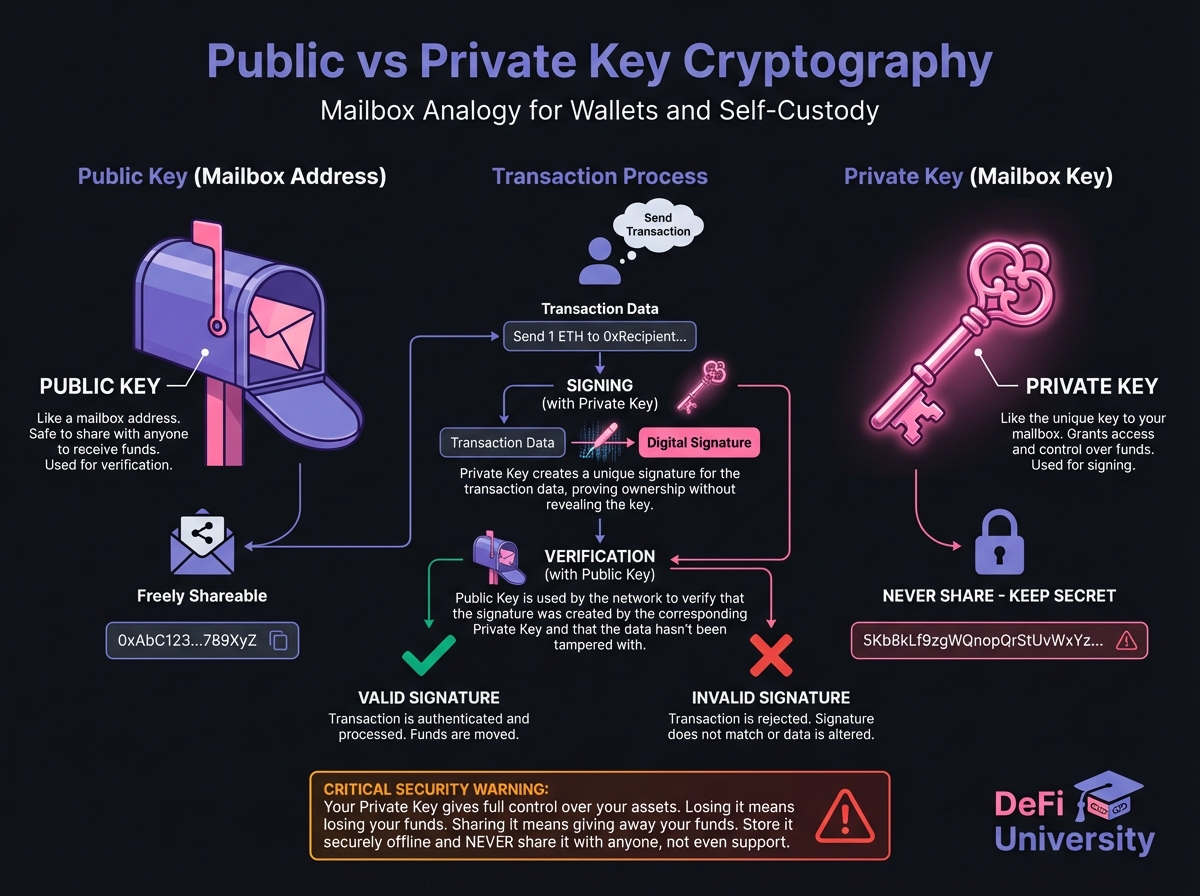

📚 Public vs. Private Key Cryptography

Public Key: Your "Mailbox" Address

Private Key: Your "Key" to the Mailbox

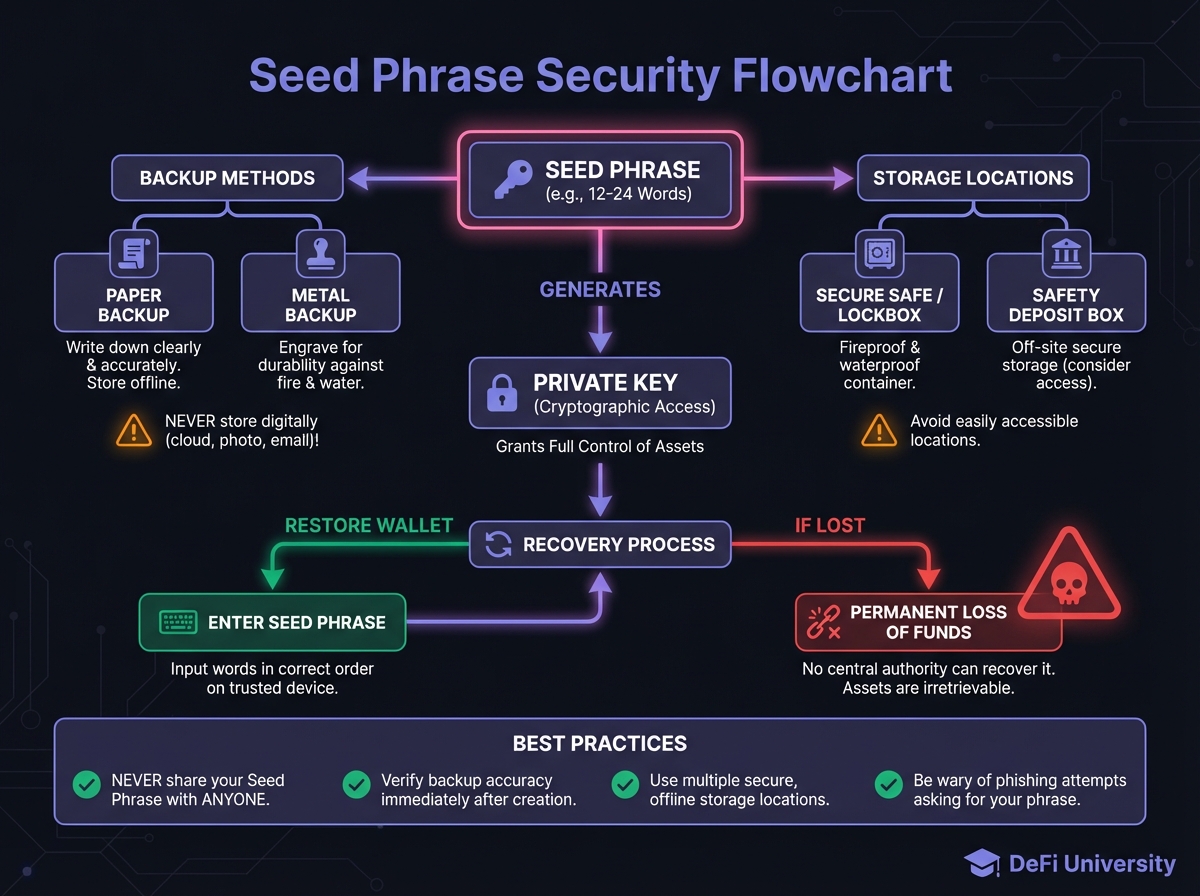

Seed Phrases: The Human-Readable Backup

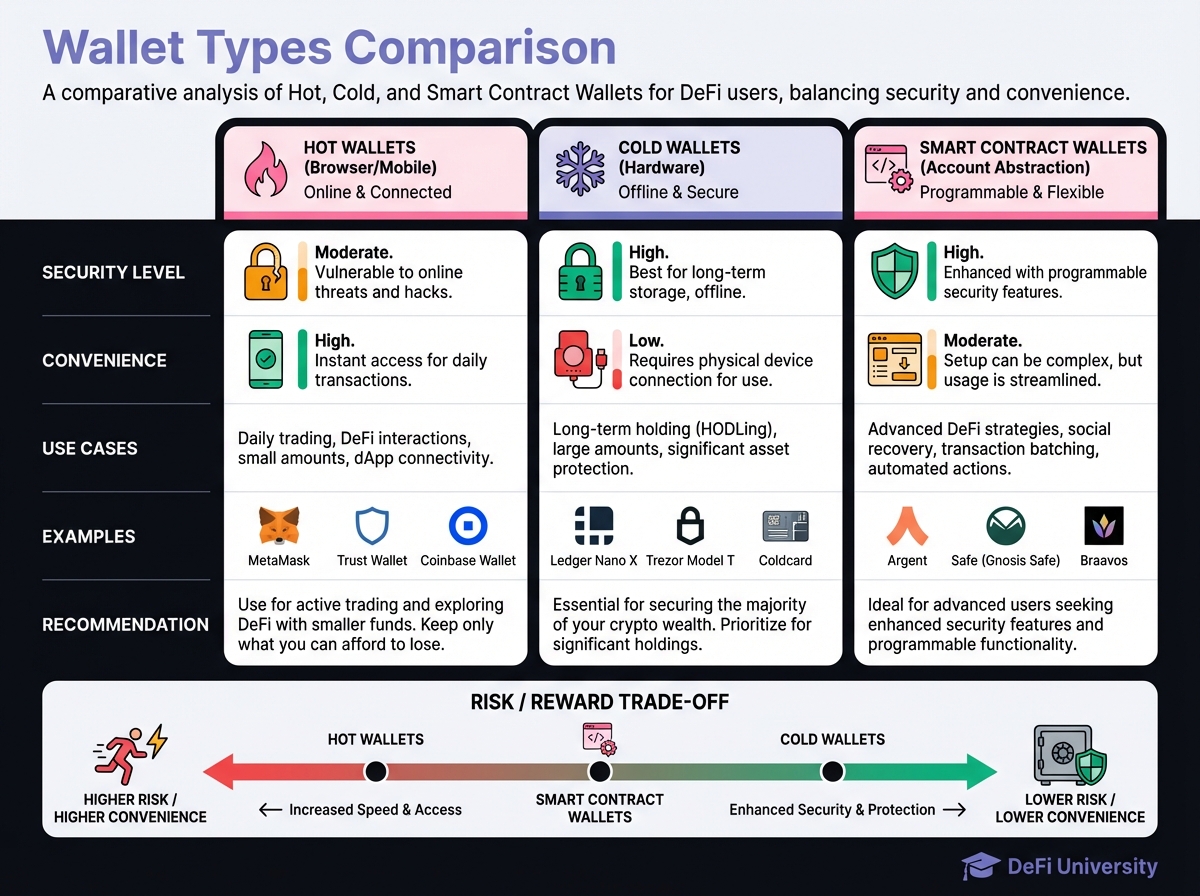

📚 Wallet Typology and Risk Hierarchies

Hot Wallets (Browser Extensions/Mobile Apps)

Cold Wallets (Hardware Wallets)

Smart Contract Wallets (Account Abstraction)

🎮 Interactive: Wallet Type Selector

🔑 Key Takeaways

📖 Beginner's Corner

Interactive Wallet Security Checklist

⚠️ Important Warnings

Last updated