Lesson 9: Advanced Protocols and Hooks

🎧 Lesson Podcast

🎬 Video Overview

Lesson 9: Advanced Protocols and Hooks

🎯 Core Concept: The Future of Programmable Liquidity

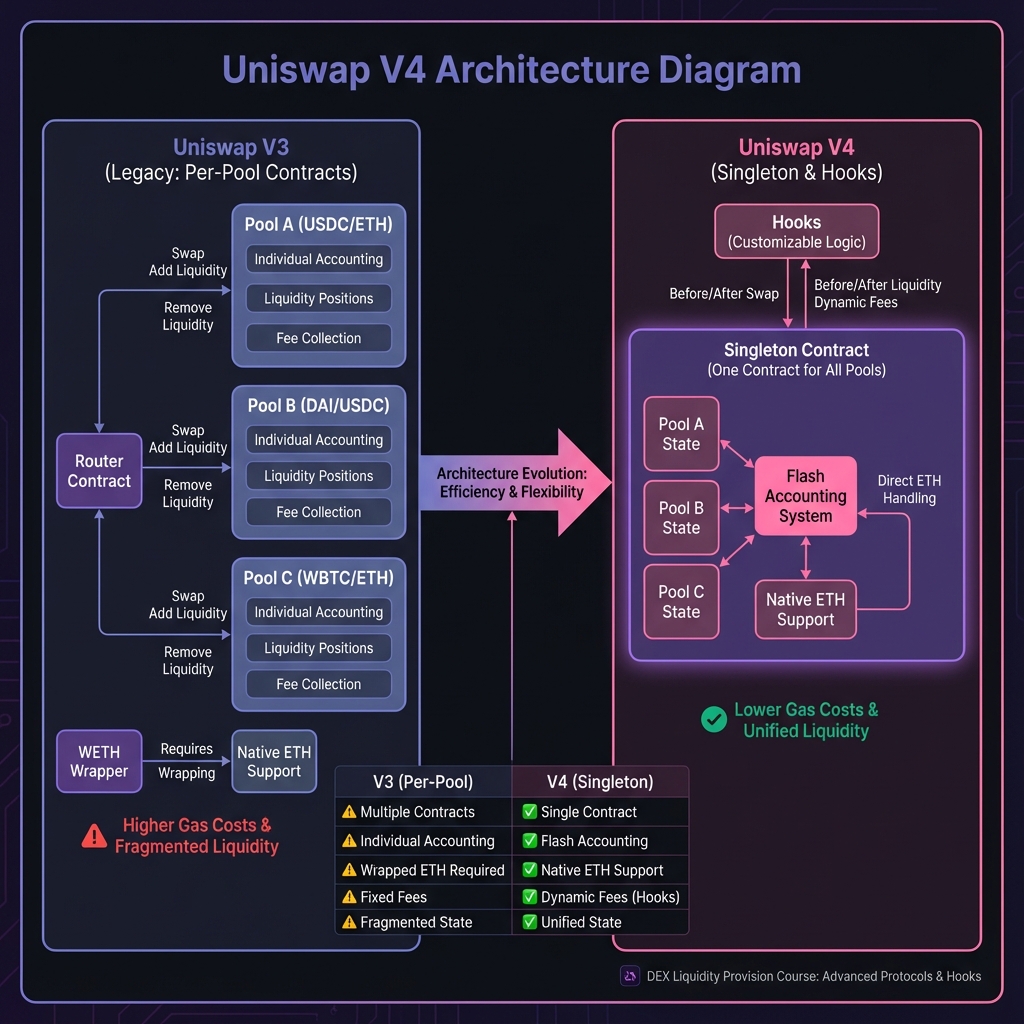

🏗️ Uniswap V4 Architecture

The Singleton Design

Flash Accounting

Native ETH Support

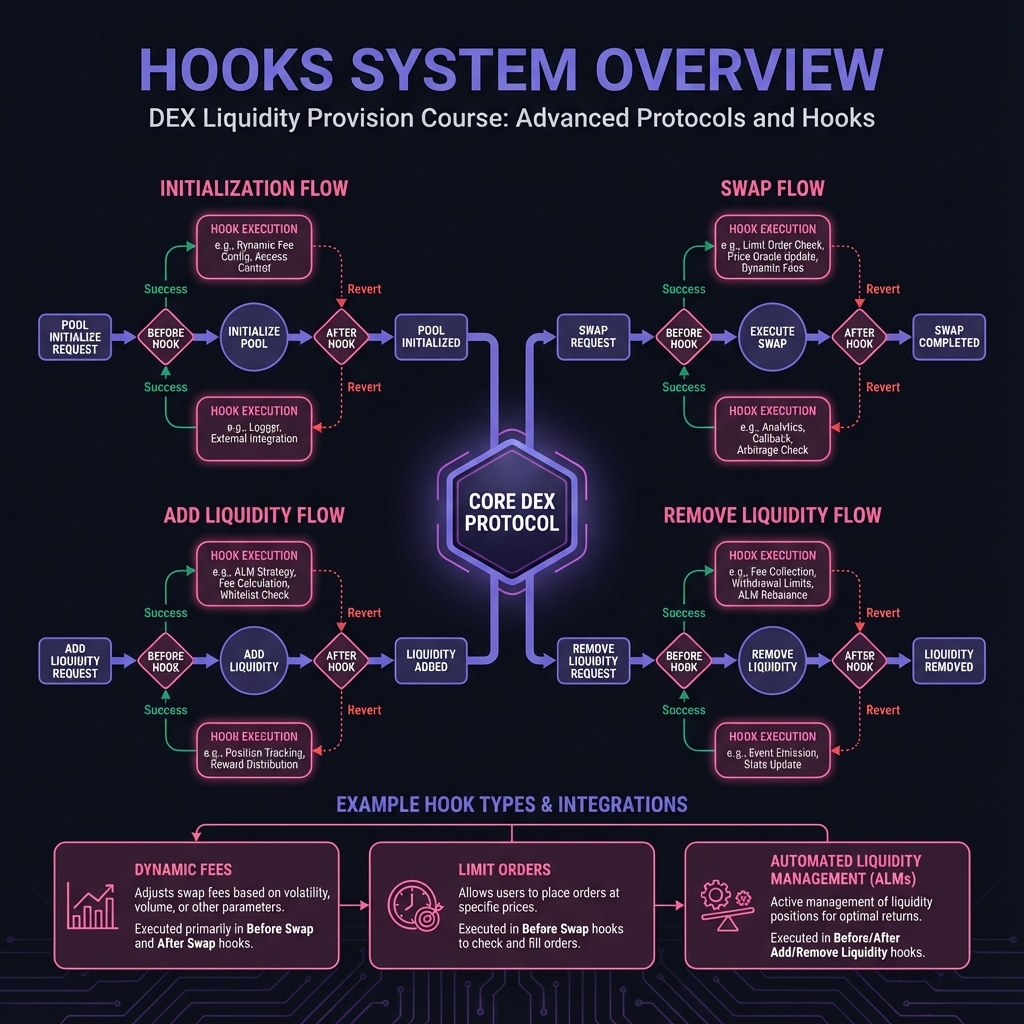

🪝 Understanding Hooks

What Are Hooks?

Hook Use Cases

🔧 Hook Architecture

Hook Interface

Hook Permissions

Gas Optimization

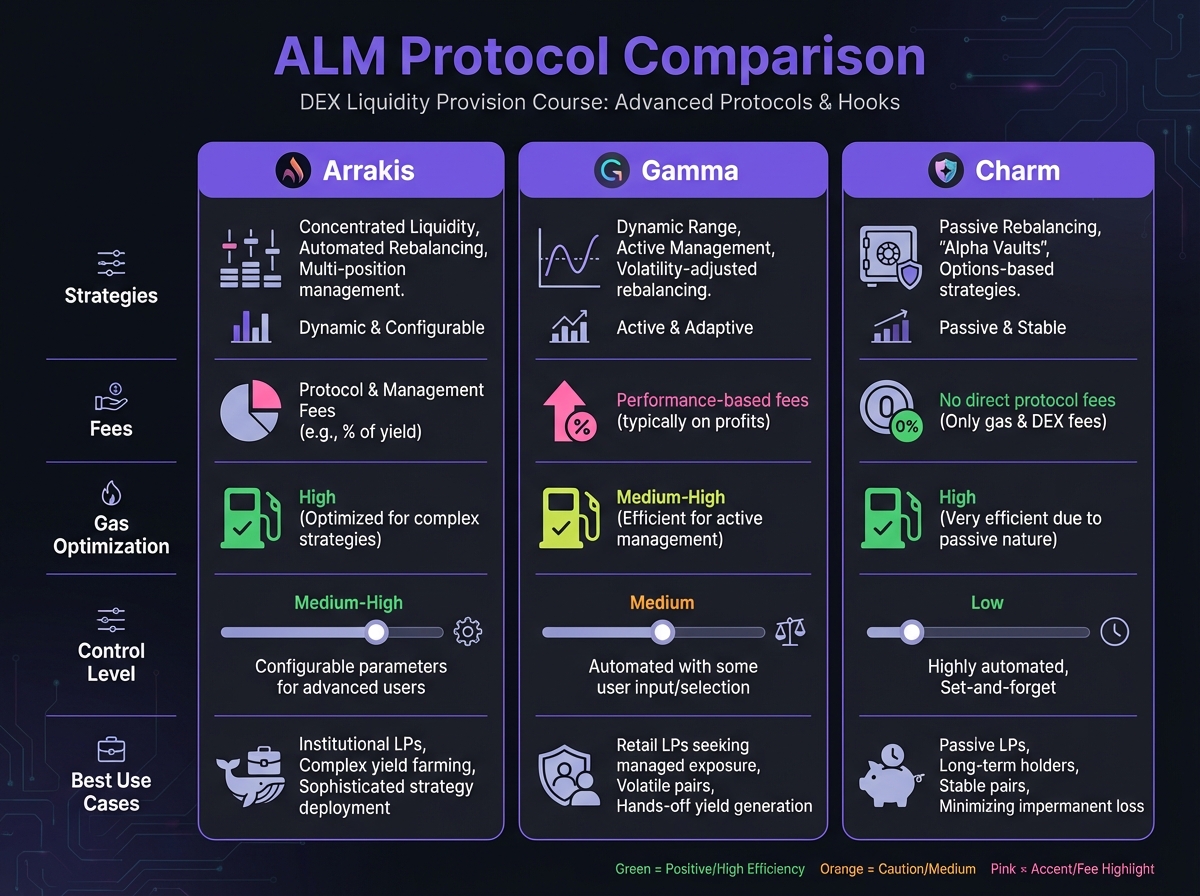

📊 Active Liquidity Managers (ALMs)

What Are ALMs?

Popular ALMs

Using ALMs

🎯 V4 Hook Strategies

Strategy 1: Dynamic Fee Hook

Strategy 2: Limit Order Hook

Strategy 3: Auto-Rebalancing Hook

Strategy 4: TWAP Oracle Hook

🔬 Advanced Deep-Dive: Hook Security

Security Considerations

Hook Best Practices

🎓 Beginner's Corner: V4 and Hooks

📈 Real-World V4 Example

🔑 Key Takeaways

🚀 Next Steps

Last updated