Lesson 11: Governance and Incentive Optimization

🎧 Lesson Podcast

🎬 Video Overview

Lesson 11: Governance and Incentive Optimization

🎯 Core Concept: Liquidity as a Political Asset

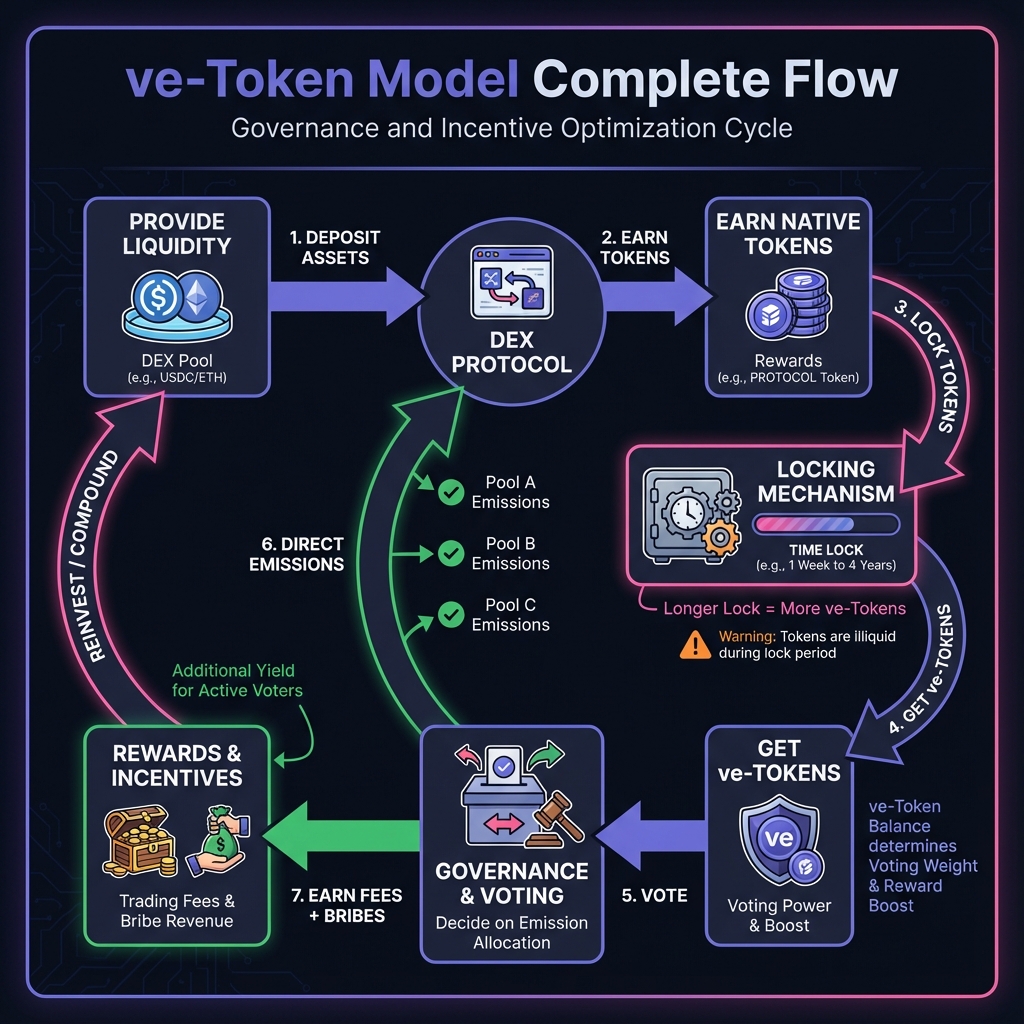

🗳️ Understanding ve-Token Models

The ve(3,3) Architecture

How It Works

💰 The Bribe Market

What Are Bribes?

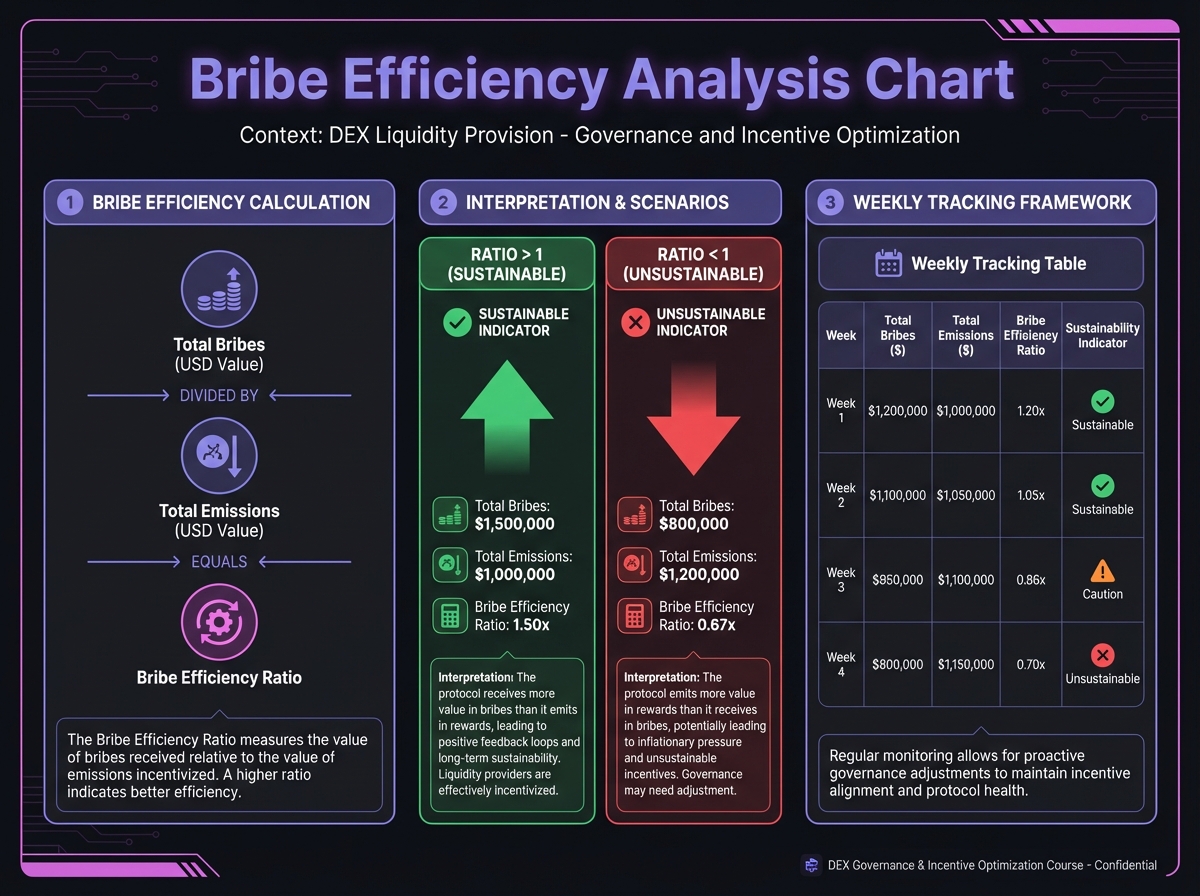

Bribe Efficiency

Real-World Bribe Example

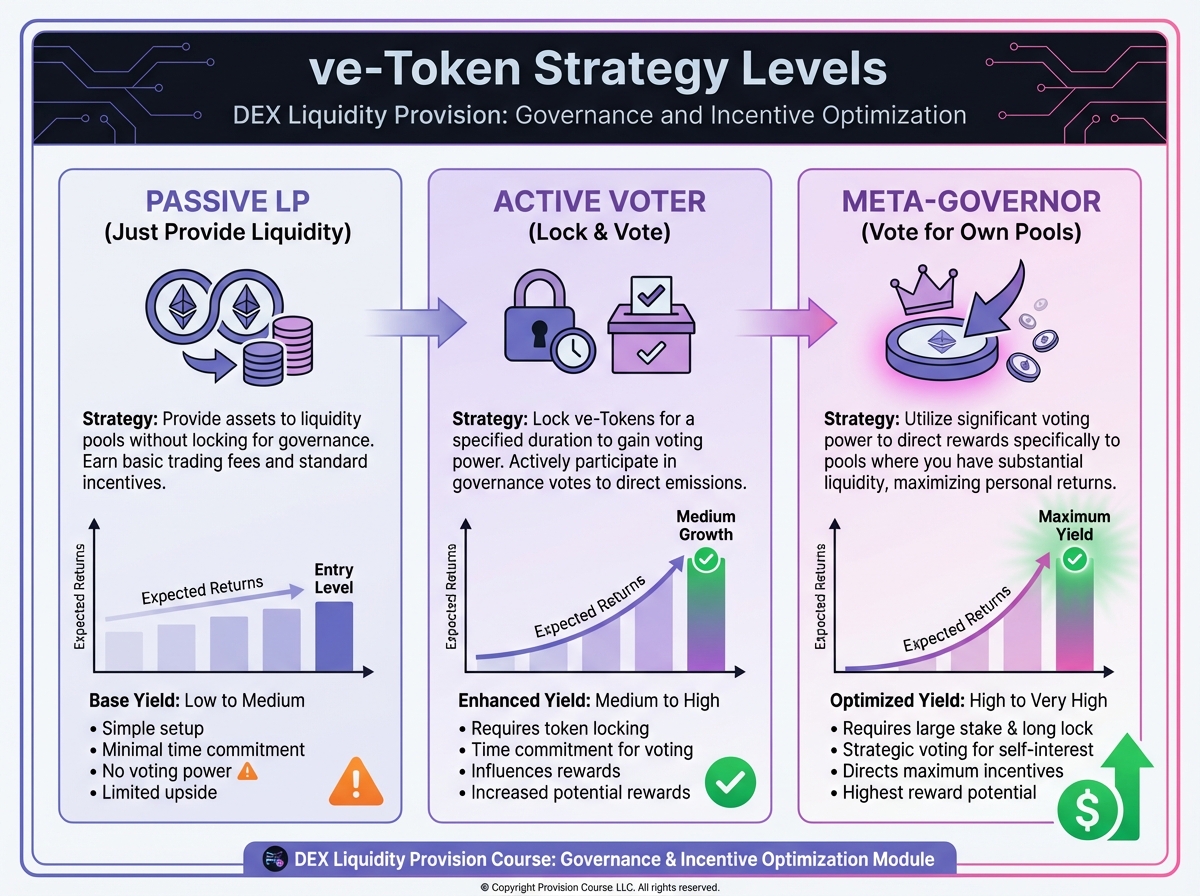

🎯 ve-Token Strategy Framework

Strategy 1: Passive LP

Strategy 2: Active Voter

Strategy 3: Meta-Governor

📊 Emission Optimization

Identifying High-Emission Pools

Emission Sustainability

🔄 Cross-Protocol Incentives

Multi-Protocol Strategy

Incentive Arbitrage

🔬 Advanced Deep-Dive: ve-Token Math

Voting Power Calculation

Emission Distribution

Bribe ROI

🎓 Beginner's Corner: Governance Basics

📈 Real-World ve-Token Example

🔑 Key Takeaways

🚀 Next Steps

PreviousExercise 10: MEV Analysis and Protection StrategiesNextExercise 11: Governance Participation and Yield Maximization

Last updated