Lesson 12: Building Your Professional LP System

🎧 Lesson Podcast

🎬 Video Overview

Lesson 12: Building Your Professional LP System

🎯 Core Concept: Integration and Automation

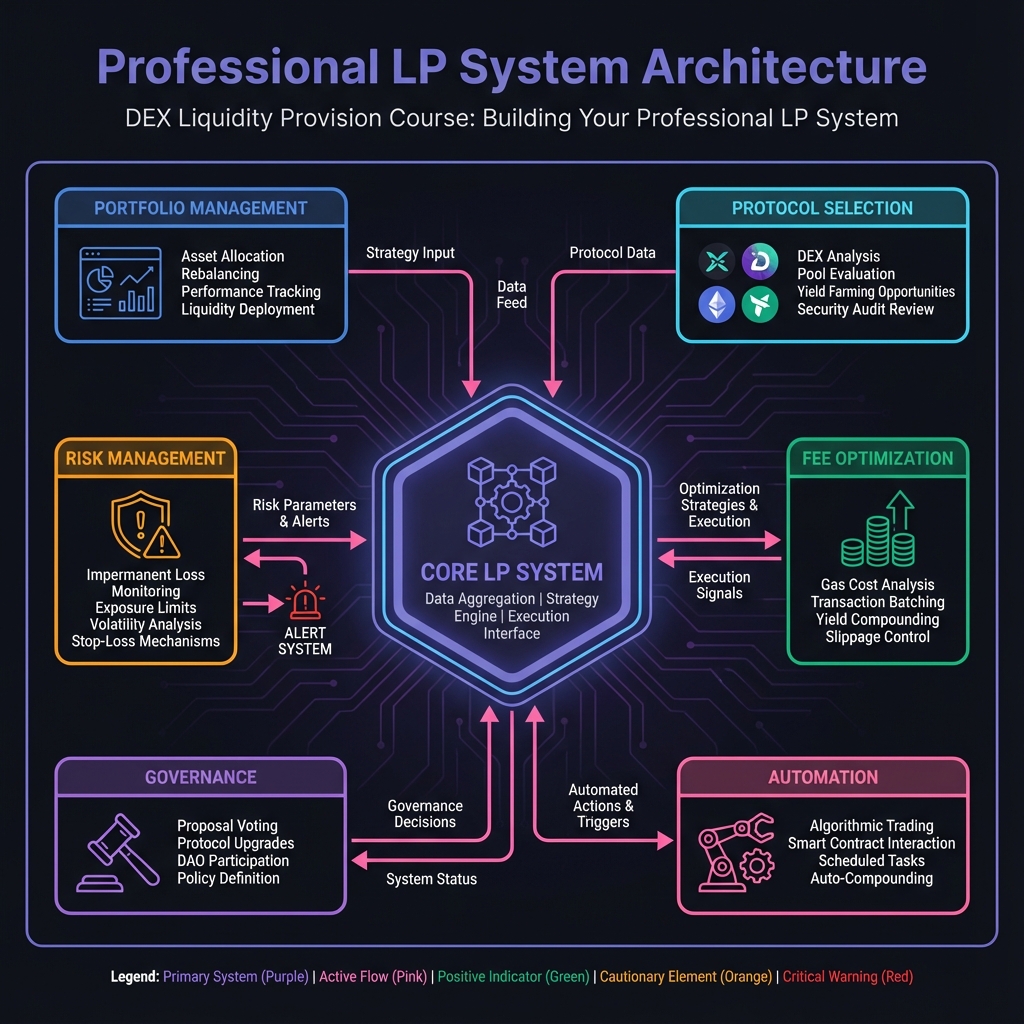

🏗️ System Architecture

Core Components

📊 The Professional LP Dashboard

Essential Metrics

Dashboard Tools

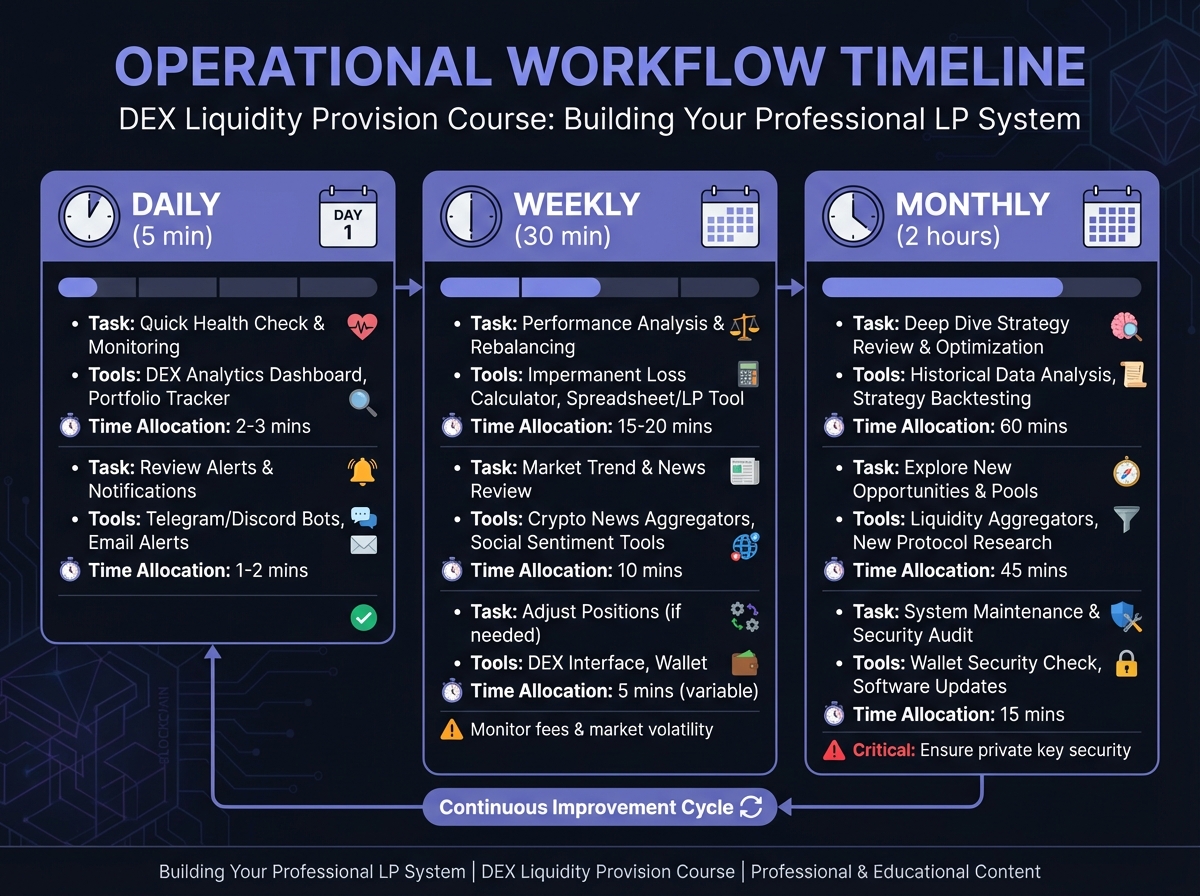

🔄 Operational Workflows

Daily Workflow (5 minutes)

Weekly Workflow (30 minutes)

Monthly Workflow (2 hours)

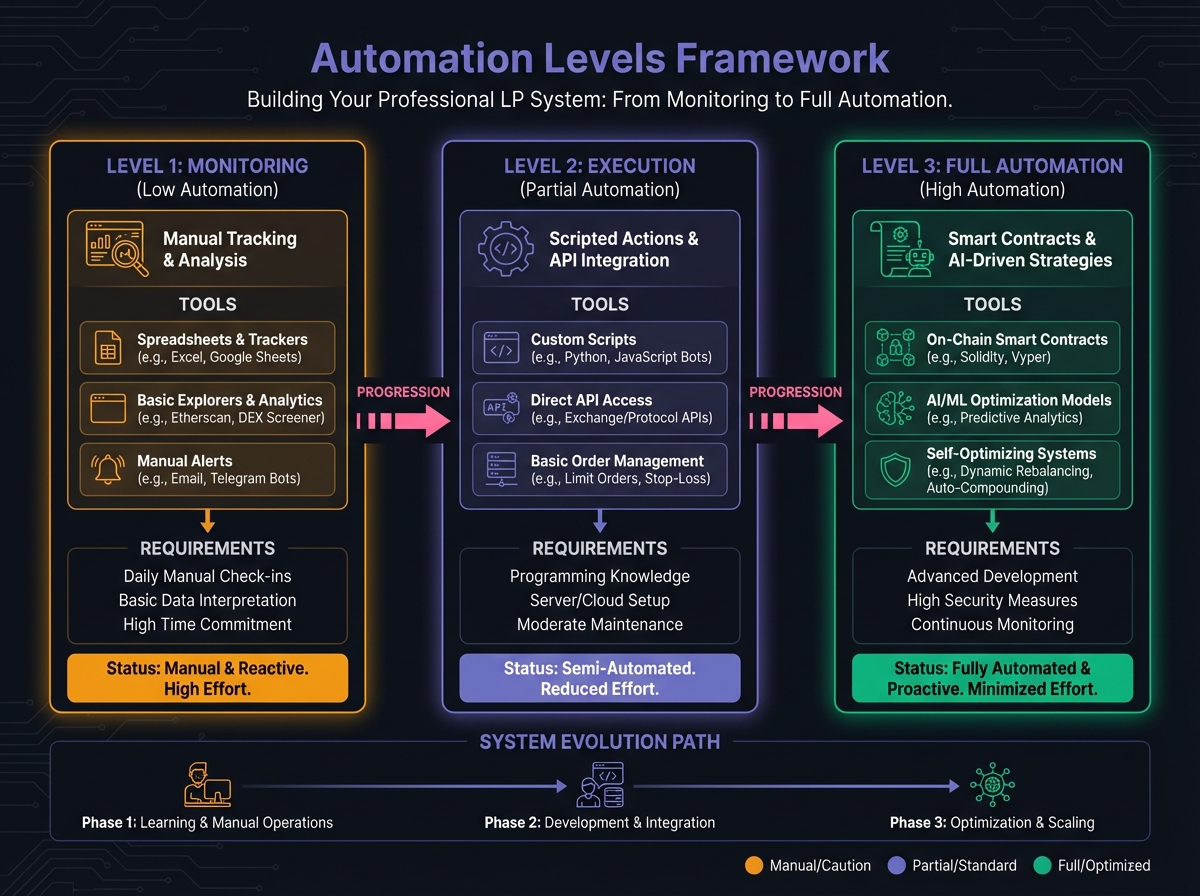

🤖 Automation Strategies

Level 1: Monitoring Automation

Level 2: Execution Automation

Level 3: Full Automation

📋 Complete System Checklist

Setup Phase

Operational Phase

Optimization Phase

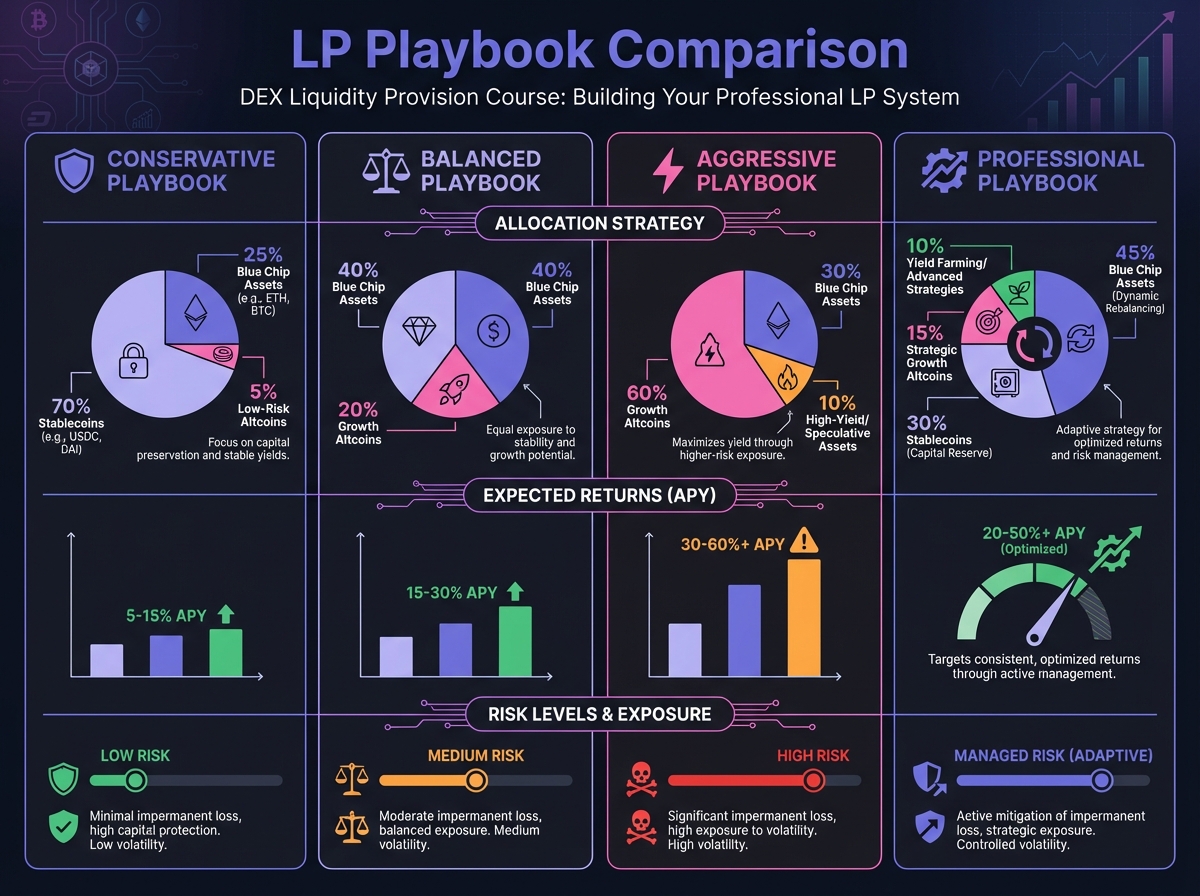

🎯 Professional LP Playbook

Playbook 1: Conservative LP

Playbook 2: Balanced LP

Playbook 3: Aggressive LP

Playbook 4: Professional LP

🔬 Advanced Deep-Dive: System Integration

API Integration

Smart Contract Integration

Data Pipeline

📈 Real-World Professional System

Complete Example

🎓 Beginner's Corner: Building Your System

🔑 Key Takeaways

🚀 Course Completion

PreviousExercise 11: Governance Participation and Yield MaximizationNextExercise 12: Complete LP System Integration

Last updated