Lesson 3: Impermanent Loss and Risk Fundamentals

🎧 Lesson Podcast

🎬 Video Overview

Lesson 3: Impermanent Loss and Risk Fundamentals

🎯 Core Concept: The Hidden Cost of Liquidity Provision

The Brutal Truth

💸 What is Impermanent Loss?

Simple Definition

Why It Happens

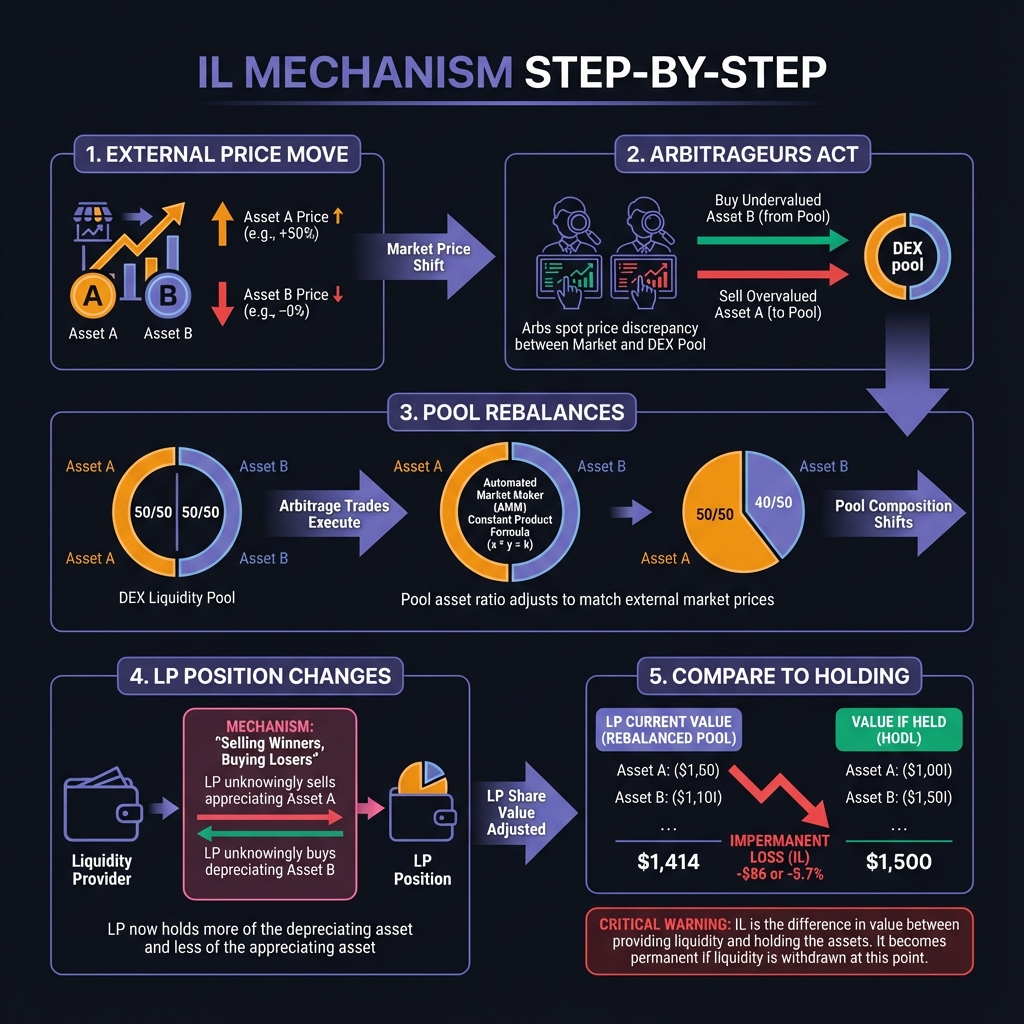

📊 Impermanent Loss: Step-by-Step Example

Scenario Setup

What Happens When ETH Rises to $2,500

What Happens When ETH Drops to $1,500

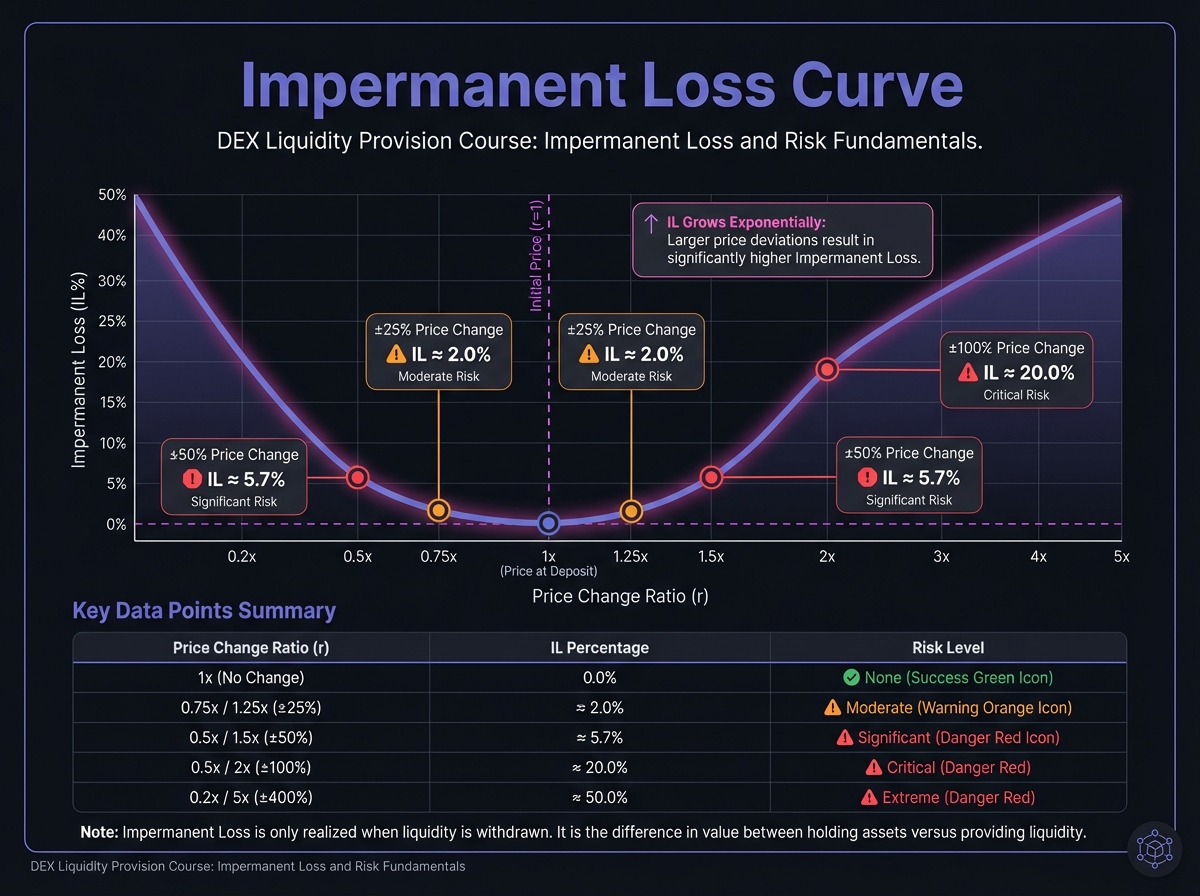

📈 The Impermanent Loss Formula

Mathematical Formula

IL Table: Price Changes vs. Loss

Price Change

Impermanent Loss

Visual Representation

⚠️ When IL Becomes Permanent

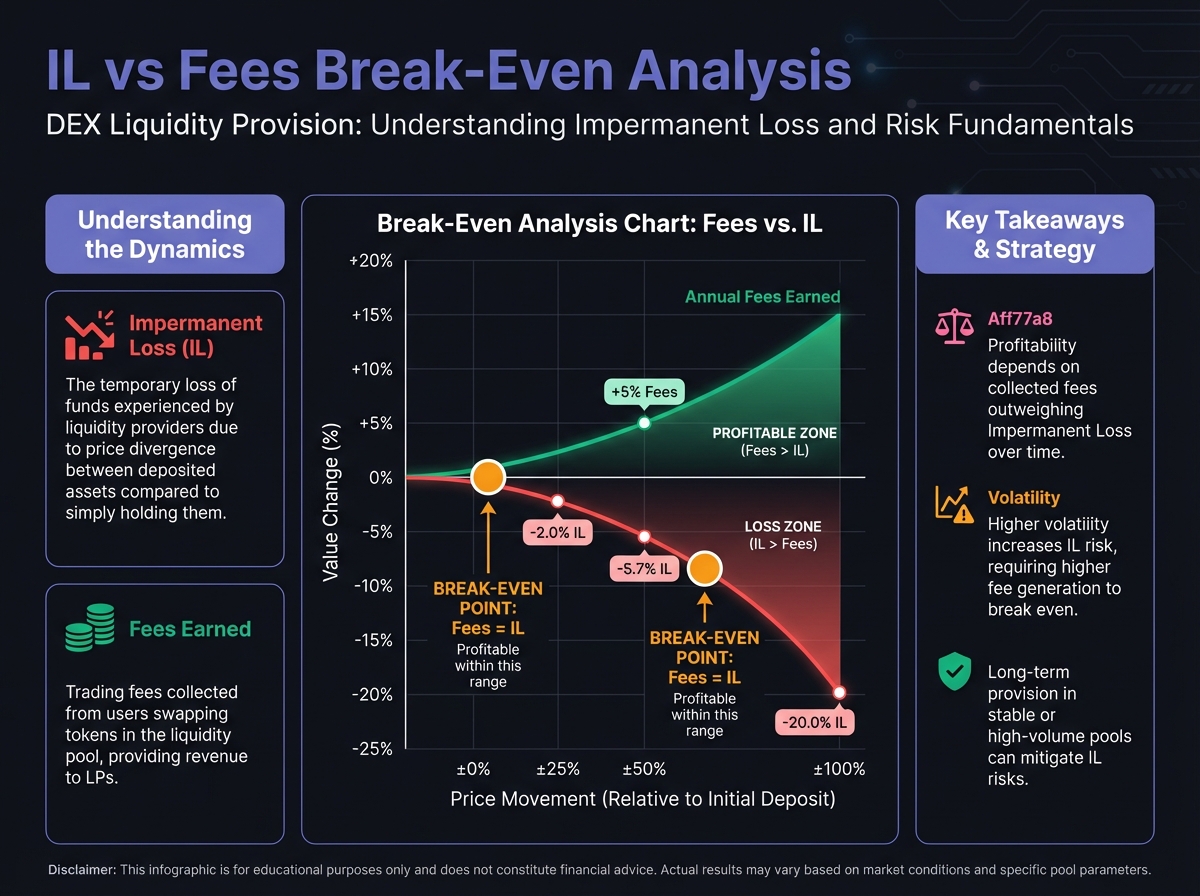

🔄 IL vs. Fees: The Break-Even Analysis

The Critical Question

Break-Even Calculation

🎯 Risk Factors That Increase IL

1. High Volatility

2. Low Correlation

3. Long Time Horizons

💡 Strategies to Minimize IL

1. Choose Stable Pairs

2. Use Narrow Ranges (V3)

3. Hedge Your Position

4. Active Rebalancing

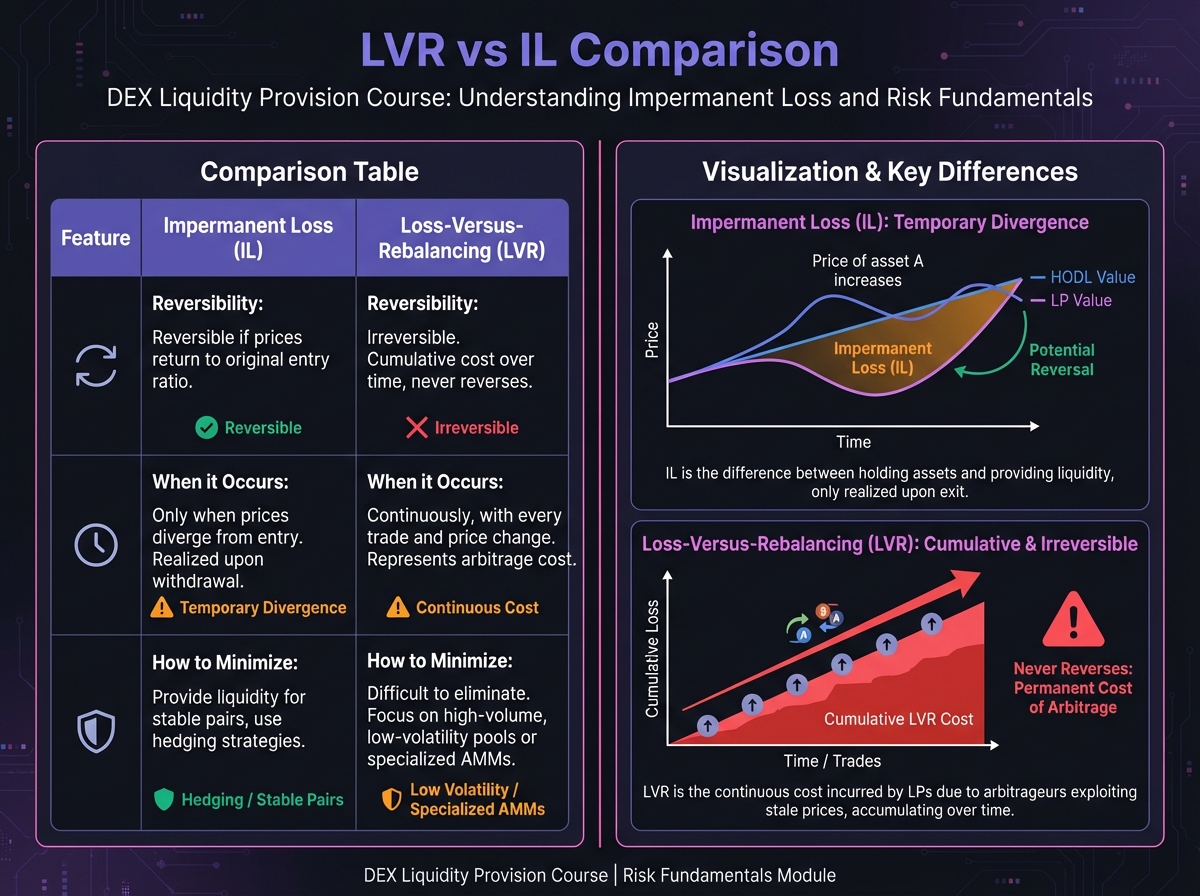

🔬 Advanced Deep-Dive: Loss Versus Rebalancing (LVR)

Beyond Impermanent Loss

The LVR Concept

LVR Formula

LVR vs. IL

Metric

What It Measures

Reversibility

Real-World Impact

🎓 Beginner's Corner: IL Myths Debunked

📊 Risk Assessment Framework

Before Providing Liquidity, Ask:

Interactive Pool Health Analyzer

🔑 Key Takeaways

🚀 Next Steps

PreviousExercise 2: Mathematical Calculations and AnalysisNextExercise 3: Risk Assessment and IL Analysis

Last updated