Lesson 5: Concentrated Liquidity Mastery

🎧 Lesson Podcast

🎬 Video Overview

Lesson 5: Concentrated Liquidity Mastery

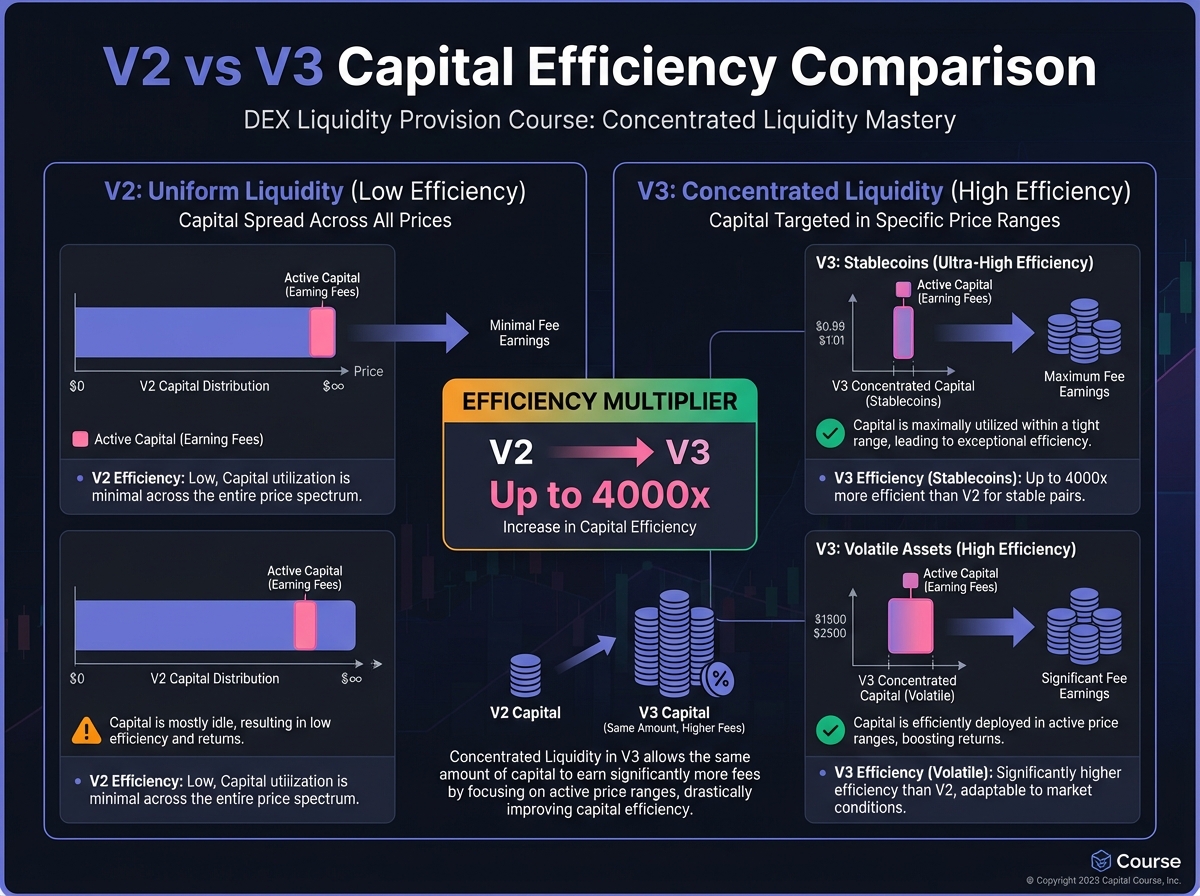

🎯 Core Concept: 4000x Capital Efficiency

The V3 Revolution

📊 Understanding Concentrated Liquidity

The Core Innovation

Capital Efficiency Example

The Double-Edged Sword

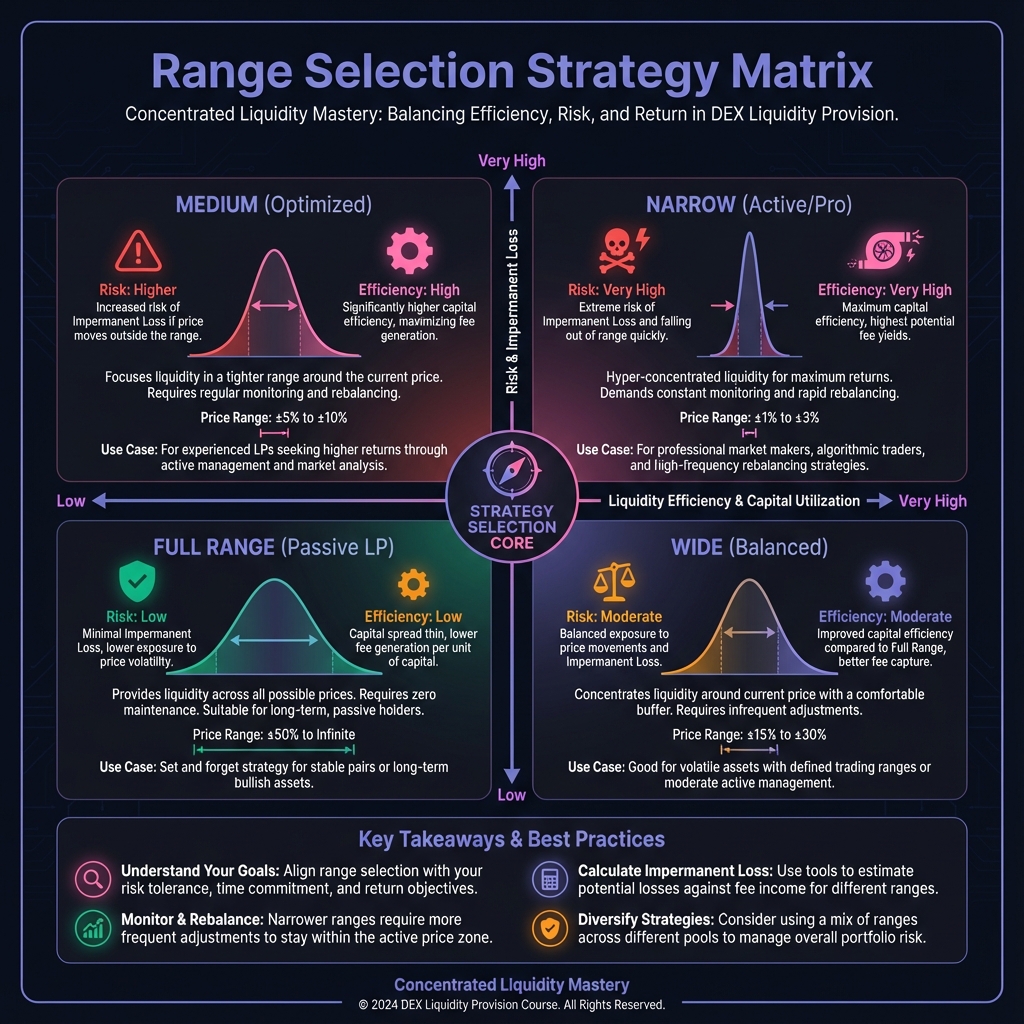

🎯 Range Selection Strategies

Strategy 1: Full Range (V2 Equivalent)

Strategy 2: Wide Range

Strategy 3: Medium Range

Strategy 4: Narrow Range (Advanced)

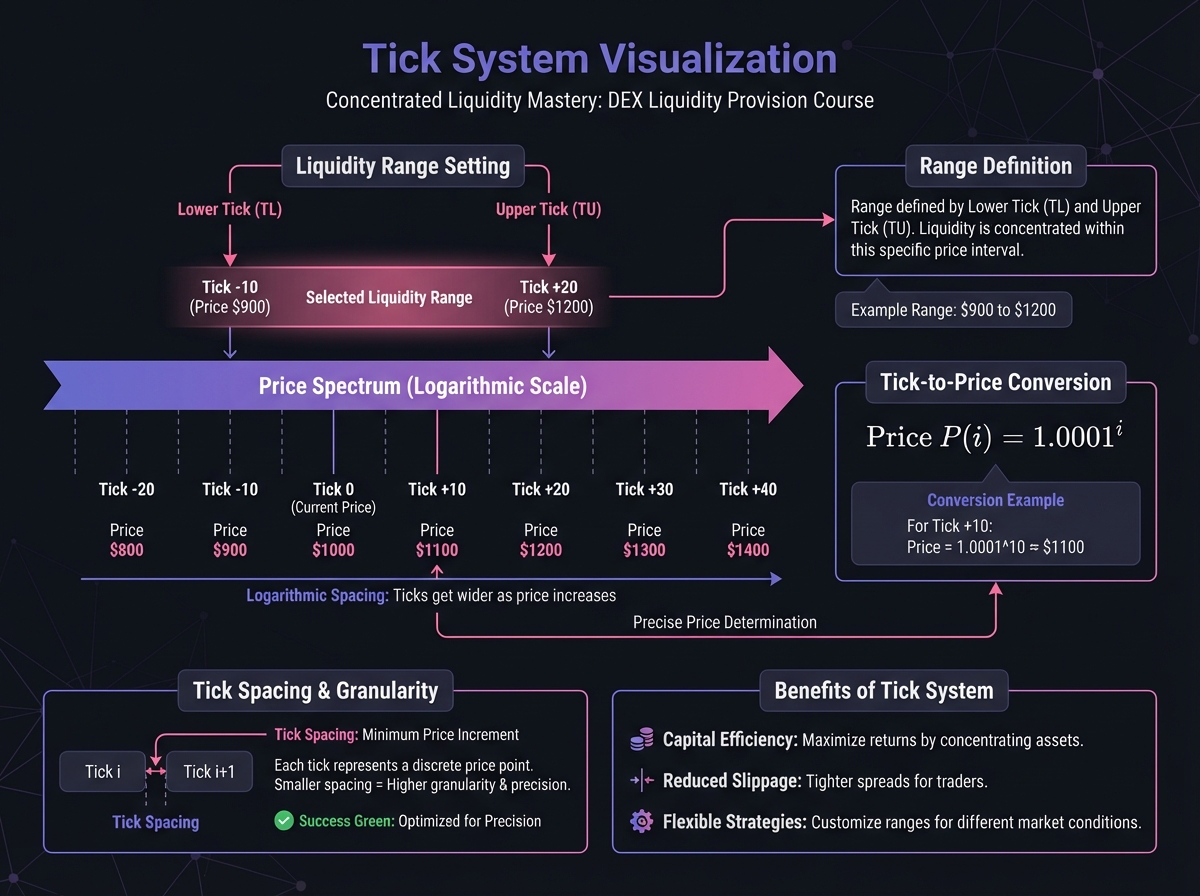

🔢 Understanding Ticks

What Are Ticks?

Tick Spacing

Calculating Your Range in Ticks

💰 Fee Accumulation in V3

How Fees Work Differently

Collecting Fees

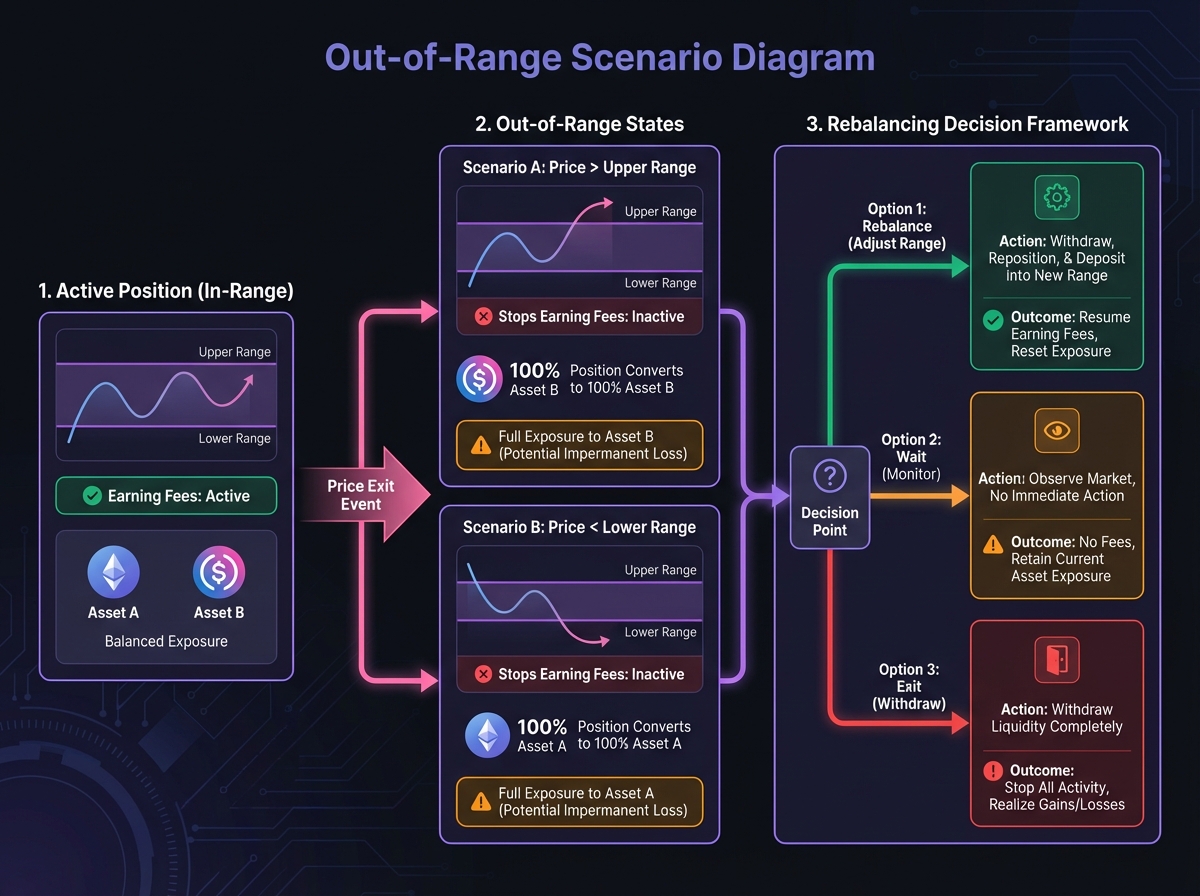

⚠️ The Out-of-Range Problem

What Happens When Price Exits Range

The Panic Trap

Rebalancing Strategy

🎓 Beginner's Corner: V3 Common Mistakes

🔬 Advanced Deep-Dive: Virtual Liquidity Math

The Virtual Reserves Concept

Capital Efficiency Formula

Optimal Range Width

📈 Real-World V3 Strategy

Complete Example: ETH/USDC Position

Interactive Concentrated Liquidity Optimizer

🔑 Key Takeaways

🚀 Next Steps

Last updated