Lesson 8: Risk Management and Hedging Strategies

🎧 Lesson Podcast

🎬 Video Overview

Lesson 8: Risk Management and Hedging Strategies

🎯 Core Concept: Protect Capital First

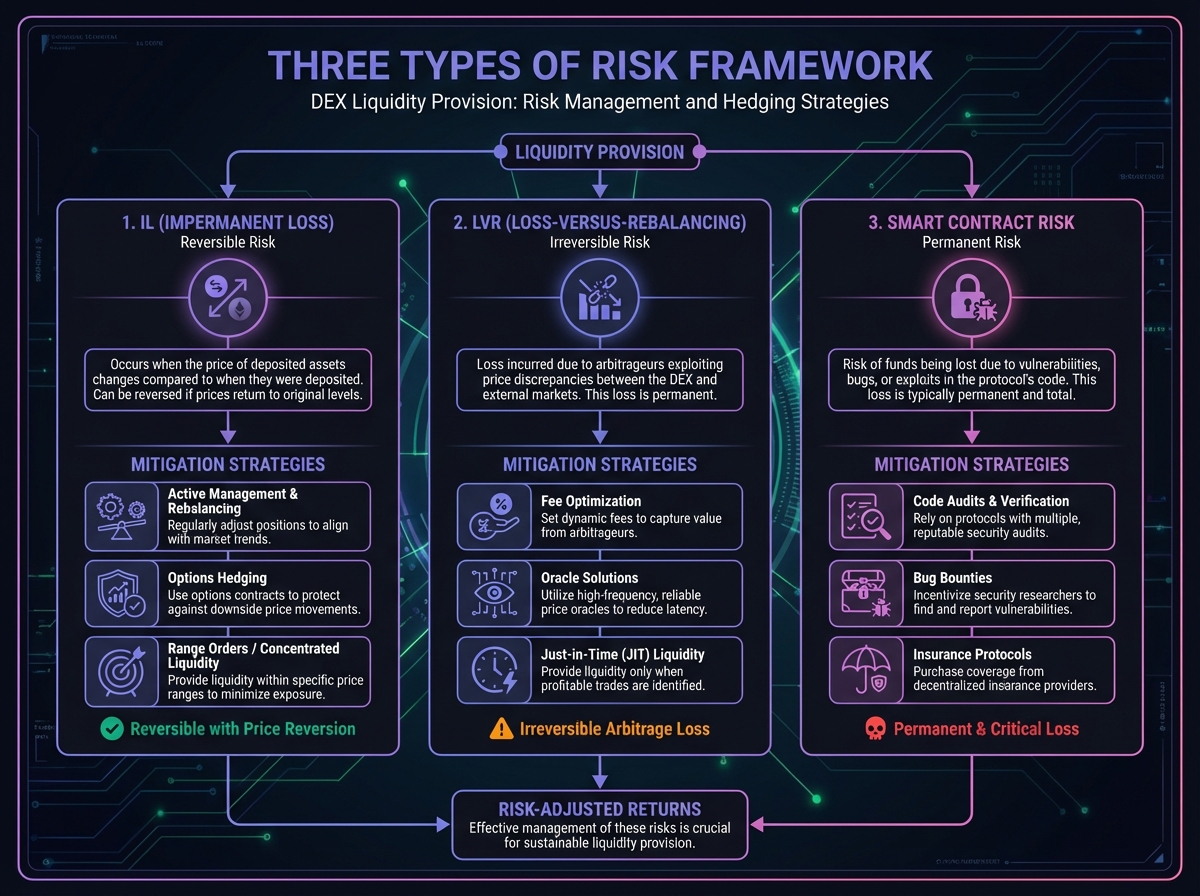

🛡️ The Risk Management Framework

Three Types of Risk

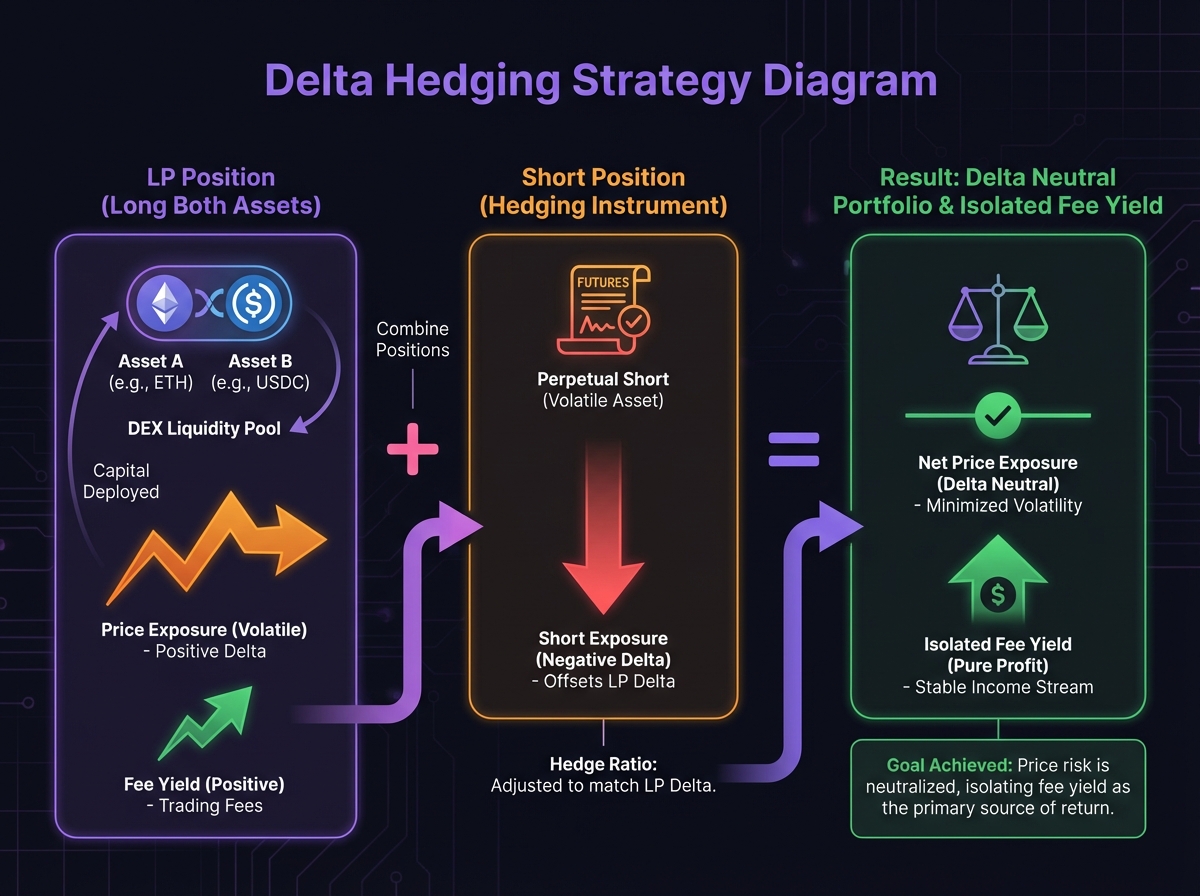

📊 Delta Hedging Strategy

The Concept

How It Works

Complete Example

When to Hedge

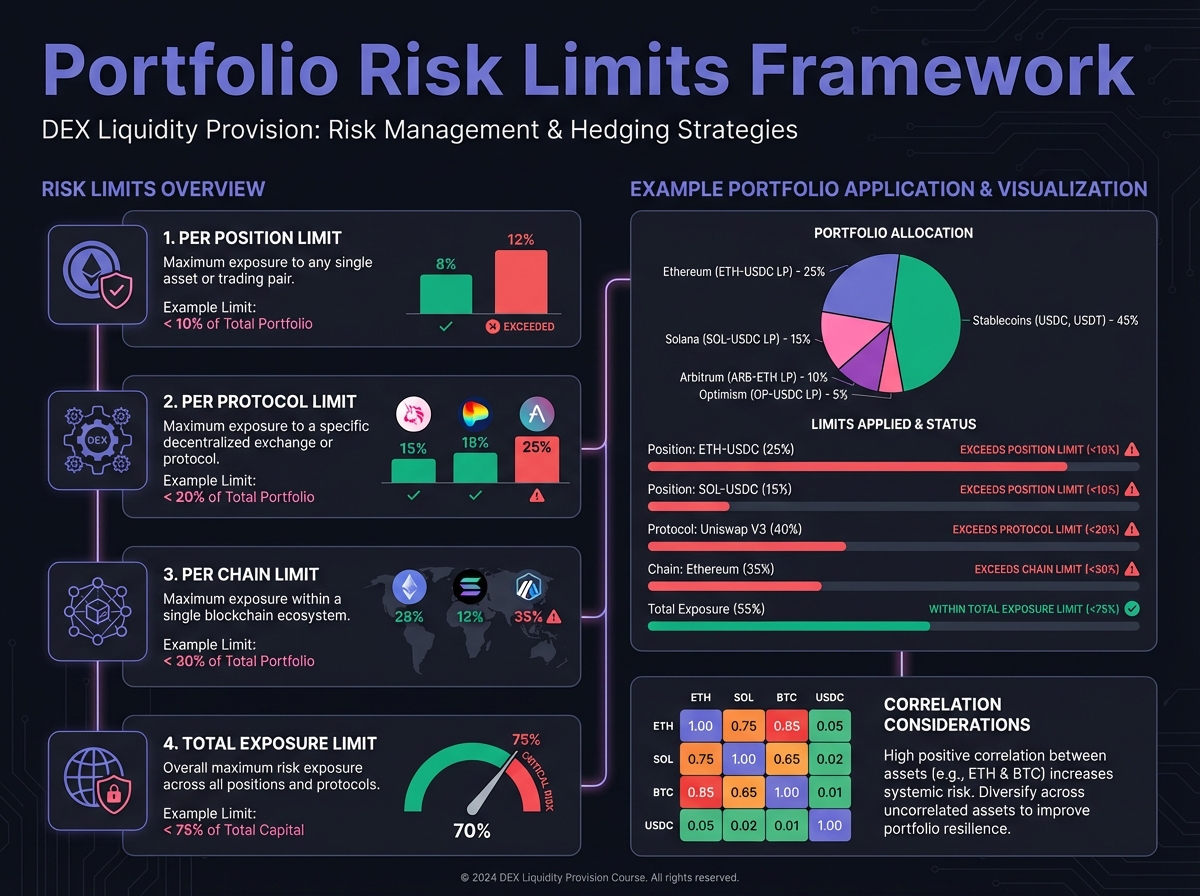

🔄 Portfolio Risk Management

Position Sizing

Correlation Matrix

Risk Limits

🎯 LVR Mitigation Strategies

Strategy 1: Lower Volatility Pairs

Strategy 2: Faster Chains

Strategy 3: Dynamic Fees

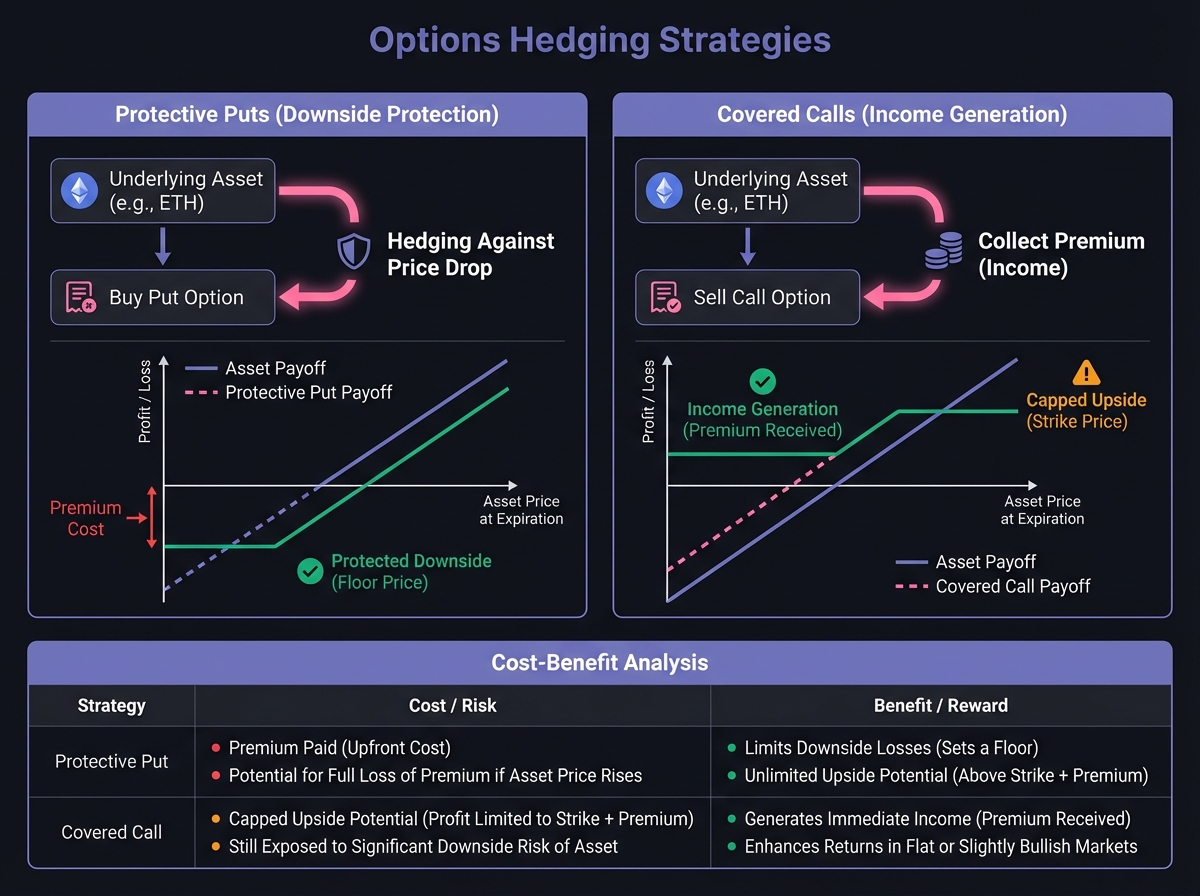

🔬 Advanced Deep-Dive: Options-Based Hedging

Protective Puts

Covered Calls

📈 Risk Monitoring Dashboard

Key Metrics to Track

Risk Alerts

🎓 Beginner's Corner: Risk Management Basics

Interactive Rebalancing Strategy Planner

🔑 Key Takeaways

🚀 Next Steps

PreviousExercise 7: Fee Tier Selection and Gas OptimizationNextExercise 8: Advanced Risk Management Framework

Last updated