Lesson 2: The Mathematics of Liquidity Provision

🎧 Lesson Podcast

🎬 Video Overview

Lesson 2: The Mathematics of Liquidity Provision

🎯 Core Concept: Math is Your Protection

Understanding the mathematics behind AMMs isn't just academic—it's your primary defense against losses. The formulas determine:

How much you'll receive when swapping

What price impact your trade will have

How fees are calculated and distributed

Why impermanent loss occurs

Master these calculations, and you'll make better decisions, avoid costly mistakes, and optimize your returns.

📐 The Constant Product Formula: Deep Dive

The Fundamental Equation

x⋅y=k

This simple equation governs every trade in a constant product AMM. Let's break it down:

Variables:

x: Reserve of token X (e.g., ETH)

y: Reserve of token Y (e.g., USDC)

k: Constant product (must remain unchanged after fees)

Rule: After any trade (excluding fees), x × y must equal k.

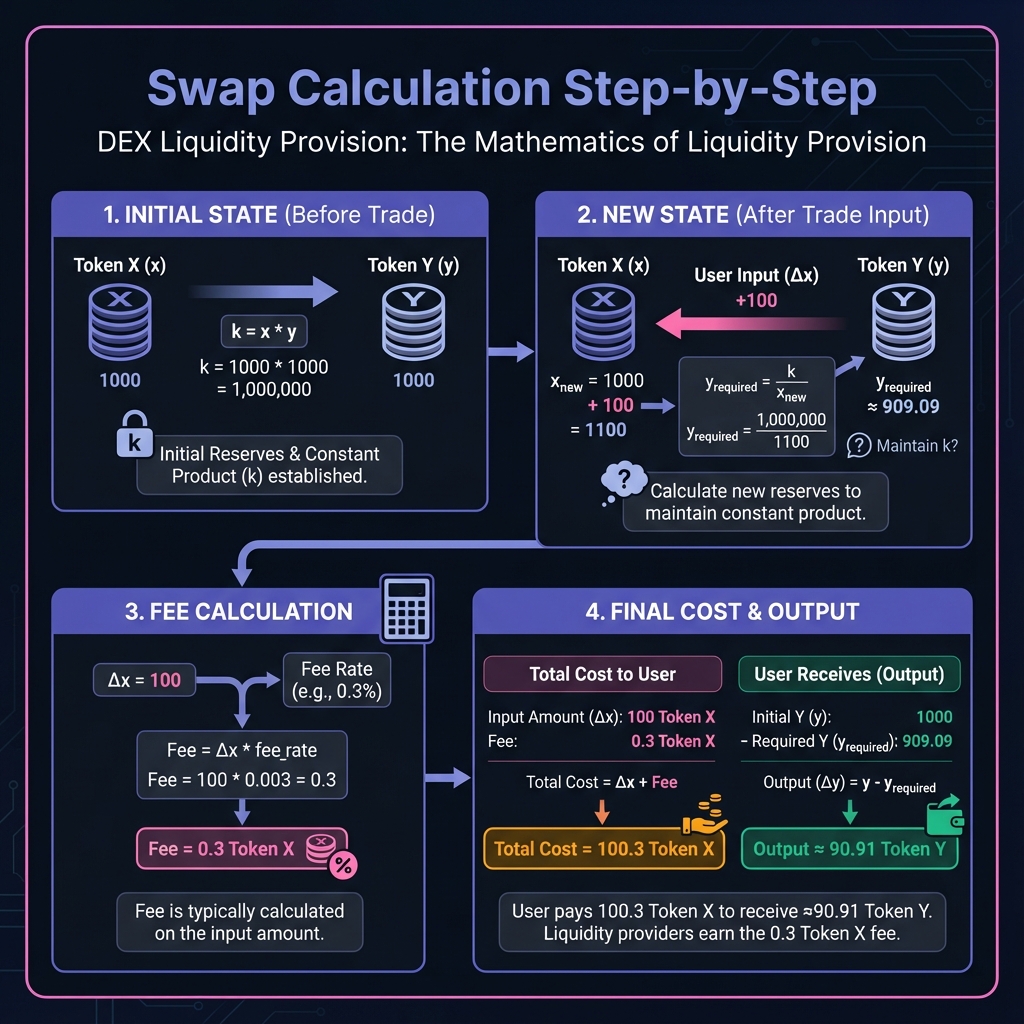

Calculating Swap Amounts

When you want to swap Δx tokens of X for tokens of Y:

Without fees: (x+Δx)⋅(y−Δy)=k

With fees (fee rate φ, e.g., 0.003 for 0.3%): (x+Δx⋅(1−ϕ))⋅(y−Δy)=k

The fee is deducted from the input amount before the swap calculation.

Step-by-Step Calculation

Example: Pool has 10 ETH (x) and 20,000 USDC (y)

k = 10 × 20,000 = 200,000

Fee rate: 0.3% (φ = 0.003)

You want to buy 1 ETH with USDC

Step 1: Calculate new x after your trade

x_new = 10 + 1 = 11 ETH

Step 2: Calculate required y to maintain k

y_new = k ÷ x_new = 200,000 ÷ 11 = 18,181.82 USDC

Step 3: Calculate how much USDC you need to deposit

Δy = 20,000 - 18,181.82 = 1,818.18 USDC

Step 4: Add fee (0.3% of input)

Fee = 1,818.18 × 0.003 = 5.45 USDC

Total you pay = 1,818.18 + 5.45 = 1,823.63 USDC

Result: You pay 1,823.63 USDC to receive 1 ETH

Effective price: 1,823.63 USDC per ETH

Original price: 2,000 USDC per ETH

Price impact: (1,823.63 - 2,000) ÷ 2,000 = -8.8%

Price Impact Formula

The larger your trade relative to the pool, the more price impact:

Price Impact=xΔx×100%

For the example above:

Δx = 1 ETH, x = 10 ETH

Price impact ≈ 10% (simplified calculation)

Key Insight: Trade size matters. A $100,000 trade in a $1M pool will have significant impact. A $100 trade in the same pool will have minimal impact.

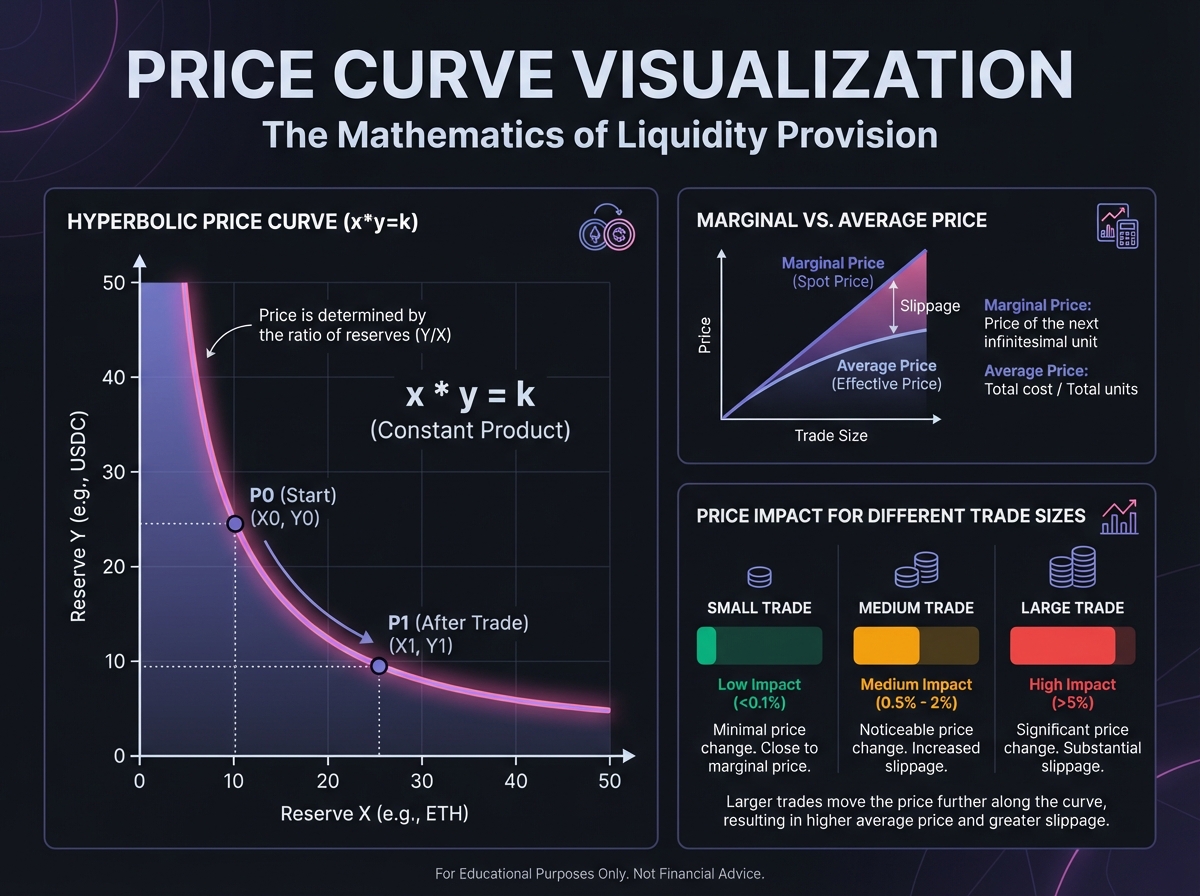

📊 Understanding Price Curves

The Hyperbolic Price Curve

The constant product formula creates a hyperbolic price curve:

Characteristics:

As x approaches 0, price approaches infinity

As y approaches 0, price approaches 0

The curve is always decreasing (more X = lower price of X)

Price changes smoothly with each trade

Price Calculation

The current price of token X in terms of token Y:

P=xy

Example:

Pool: 10 ETH, 20,000 USDC

Price: 20,000 ÷ 10 = 2,000 USDC per ETH

After buying 1 ETH:

Pool: 11 ETH, 18,181.82 USDC

New price: 18,181.82 ÷ 11 = 1,653 USDC per ETH

The price moved down because ETH supply increased (you added ETH to the pool by buying it).

Marginal Price vs. Average Price

Marginal Price: The price for the next infinitesimal trade

Formula: P = y/x

This is what you see on interfaces

Average Price: The price you actually pay for your trade

Formula: (Total USDC paid) ÷ (ETH received)

Always worse than marginal price due to slippage

Example:

Marginal price: 2,000 USDC/ETH

You buy 1 ETH for 1,823.63 USDC

Average price: 1,823.63 USDC/ETH

Difference: 176.37 USDC (8.8% worse)

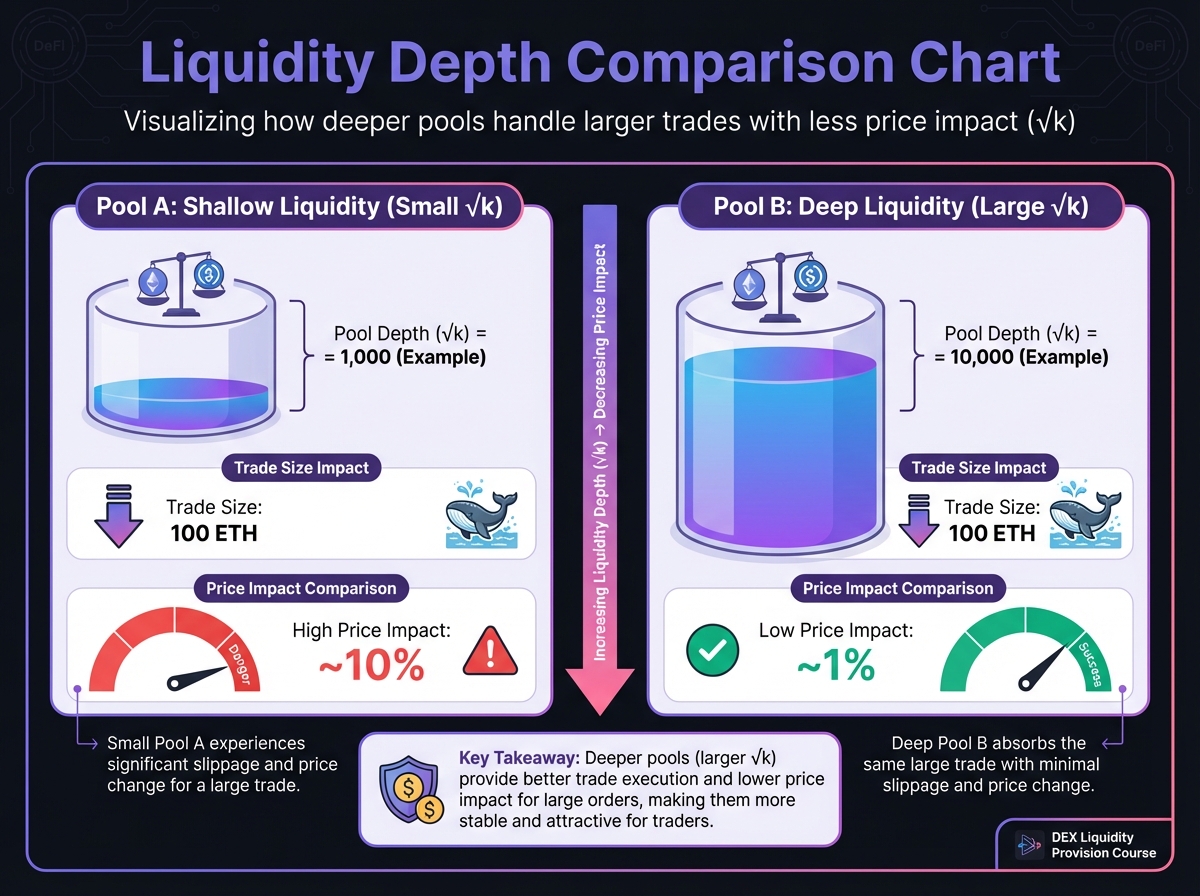

💧 Liquidity Depth and Capital Efficiency

Measuring Pool Depth

Pool depth determines how much you can trade before significant price impact:

D=x⋅y=k

Deeper pools (larger k):

Can handle larger trades

Less price impact per trade

More stable prices

Shallow pools (smaller k):

Large trades cause significant slippage

Prices move dramatically

Higher risk for LPs

Capital Efficiency Problem

In Uniswap V2, liquidity is distributed across the entire price curve (0 to ∞). For a stablecoin pair trading at $1.00:

99.9% of liquidity sits at prices like $0.01 or $100.00

Only 0.1% is active near the current price

This means 99.9% of capital earns no fees

Example:

Pool: 1,000,000 USDC + 1,000,000 DAI (trading at 1:1)

Active liquidity: ~$2,000 (0.1% of $2M)

Idle liquidity: $1,998,000 (99.9%)

This inefficiency led to Uniswap V3's concentrated liquidity (Lesson 5).

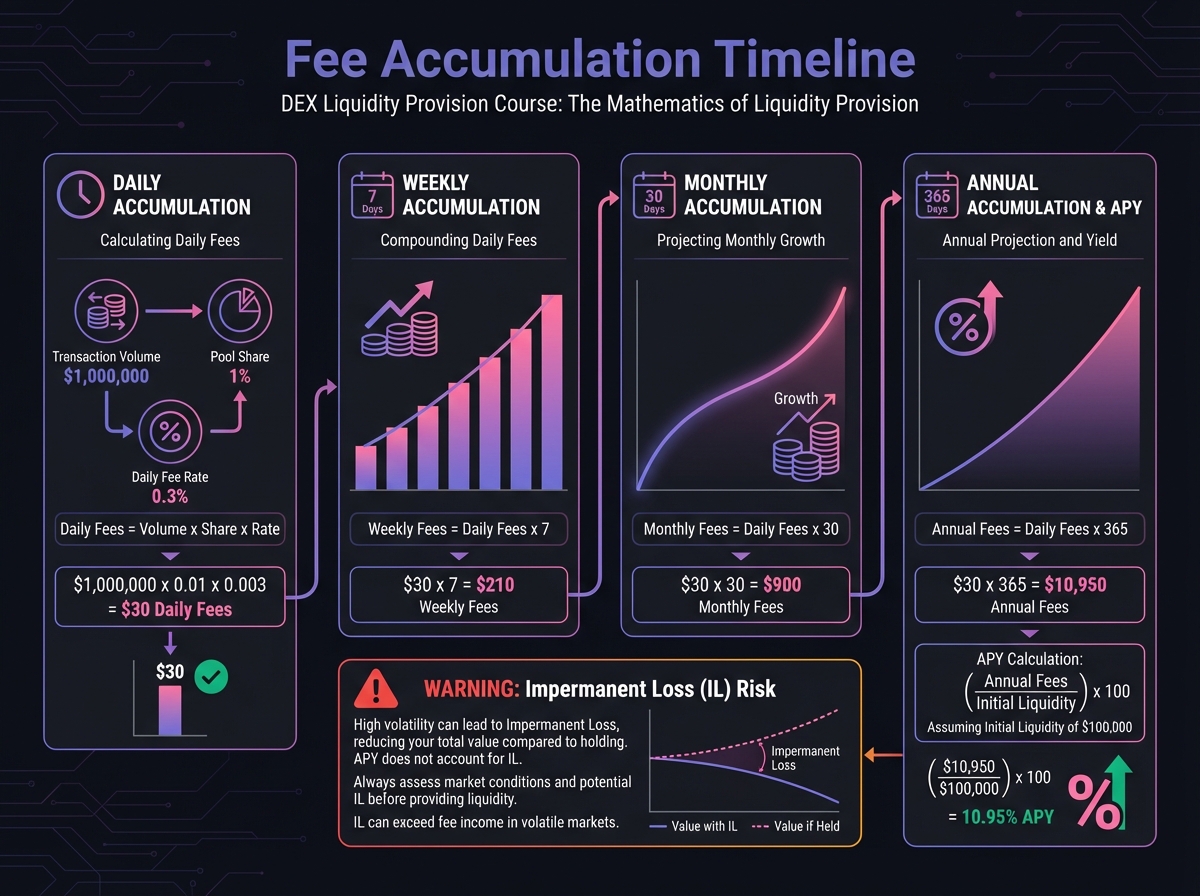

🧮 Fee Mathematics

How Fees Accumulate

Fees are added to the pool, increasing the value of LP tokens:

Before trade:

Pool: 10 ETH, 20,000 USDC

Your share: 10% (1 ETH, 2,000 USDC)

Trade occurs: Someone swaps 1 ETH for 1,823.63 USDC

Fee: 5.45 USDC added to pool

New pool: 11 ETH, 18,181.82 + 5.45 = 18,187.27 USDC

Pool value increased by 5.45 USDC

Your new position:

Still 10% of pool

Value: 1.1 ETH + 1,818.73 USDC

Gained: 0.1 ETH worth of fees (increased share)

Fee Distribution

Fees are distributed proportionally to LP token holders:

Your Fee Share=Total LP TokensYour LP Tokens×Total Fees

Example:

Total fees this week: 1,000 USDC

Your LP tokens: 100

Total LP tokens: 10,000

Your share: (100 ÷ 10,000) × 1,000 = 10 USDC

APY Calculation (Simplified)

Daily Fee Calculation: Daily Fees=Daily Volume×Fee Rate

Your Daily Earnings: Your Earnings=Daily Fees×Total TVLYour Capital

Annualized: APY=(Your CapitalYour Earnings×365)×100%

Example:

Daily volume: $1,000,000

Fee rate: 0.3%

Daily fees: $3,000

Your capital: $10,000

Total TVL: $1,000,000

Your daily earnings: $3,000 × ($10,000 ÷ $1,000,000) = $30

APY: ($30 ÷ $10,000) × 365 × 100% = 109.5%

⚠️ Critical Warning: This APY doesn't account for impermanent loss, which can easily exceed 100% in volatile markets!

Interactive Fee Accumulation Calculator

Use this calculator to estimate your potential fee earnings and accumulation over time based on position size, pool TVL, volume, and fee tier:

Launch Fee Accumulation Calculator →

🔬 Advanced Deep-Dive: Mathematical Properties

Invariant Preservation

The constant product formula ensures the invariant k is preserved:

Proof: After a trade of Δx for Δy: (x+Δx)⋅(y−Δy)=x⋅y+Δx⋅y−Δy⋅x−Δx⋅Δy

For small trades, Δx · Δy ≈ 0, so: (x+Δx)⋅(y−Δy)≈x⋅y=k

Price Elasticity

The price elasticity of the pool determines how sensitive prices are to trades:

ϵ=%ΔQ%ΔP

Where:

ε = elasticity

%ΔP = percentage change in price

%ΔQ = percentage change in quantity

For constant product AMMs, elasticity is always negative (price decreases as quantity increases).

Optimal Trade Size

To minimize price impact, traders should split large orders:

Single large trade: 10 ETH

Price impact: ~50%

Average price: 1,500 USDC/ETH

10 smaller trades: 1 ETH each

Price impact per trade: ~5%

Average price: ~1,900 USDC/ETH

Better execution by ~27%

This is why aggregators like 1inch split orders across multiple pools.

📈 Real-World Calculation: Complete Example

Let's work through a complete example:

Pool State:

ETH reserves: 100 ETH

USDC reserves: 200,000 USDC

k = 100 × 200,000 = 20,000,000

Current price: 2,000 USDC/ETH

You want to: Buy 5 ETH

Step 1: Calculate new ETH reserves

x_new = 100 + 5 = 105 ETH

Step 2: Calculate required USDC to maintain k

y_new = 20,000,000 ÷ 105 = 190,476.19 USDC

Step 3: Calculate USDC needed

Δy = 200,000 - 190,476.19 = 9,523.81 USDC

Step 4: Add 0.3% fee

Fee = 9,523.81 × 0.003 = 28.57 USDC

Total cost = 9,523.81 + 28.57 = 9,552.38 USDC

Results:

You pay: 9,552.38 USDC

You receive: 5 ETH

Effective price: 1,910.48 USDC/ETH

Price impact: (1,910.48 - 2,000) ÷ 2,000 = -4.5%

New pool price: 190,476.19 ÷ 105 = 1,814.06 USDC/ETH

🎓 Beginner's Corner: Common Math Mistakes

Mistake 1: Assuming linear price relationships

Wrong: "If 1 ETH = 2,000 USDC, then 10 ETH = 20,000 USDC"

Right: Price changes with each ETH bought. 10 ETH might cost 25,000 USDC due to slippage.

Mistake 2: Ignoring fees in calculations

Wrong: Calculating swap amount without fees

Right: Always include fees (typically 0.3%) in your calculations

Mistake 3: Using average price as marginal price

Wrong: "The price is 2,000, so I'll get 1 ETH for 2,000 USDC"

Right: You'll pay more than 2,000 due to price impact and fees

Mistake 4: Not accounting for pool depth

Wrong: "I'll trade $100k in this $10k pool"

Right: Check pool depth first. Your trade might move price 50%+.

🔑 Key Takeaways

x · y = k governs all trades in constant product AMMs

Price = y/x determines the current exchange rate

Larger trades = more price impact due to the hyperbolic curve

Fees compound by increasing pool reserves

Pool depth (√k) determines how much you can trade

APY calculations are misleading without impermanent loss

🚀 Next Steps

Now that you understand the mathematics, Lesson 3 will show you the dark side: Impermanent Loss. This is where many LPs lose money despite earning fees.

Complete Exercise 2 to practice these calculations and build your mathematical intuition.

Remember: Math protects your capital. Master these formulas, and you'll make informed decisions. Ignore them, and you'll lose money to traders who understand them better.

← Back to Summary | Next: Exercise 2 → | Previous: Lesson 1 ←

Last updated