Lesson 10: MEV, JIT Liquidity, and Advanced Tactics

🎧 Lesson Podcast

🎬 Video Overview

Lesson 10: MEV, JIT Liquidity, and Advanced Tactics

🎯 Core Concept: The Dark Forest of DeFi

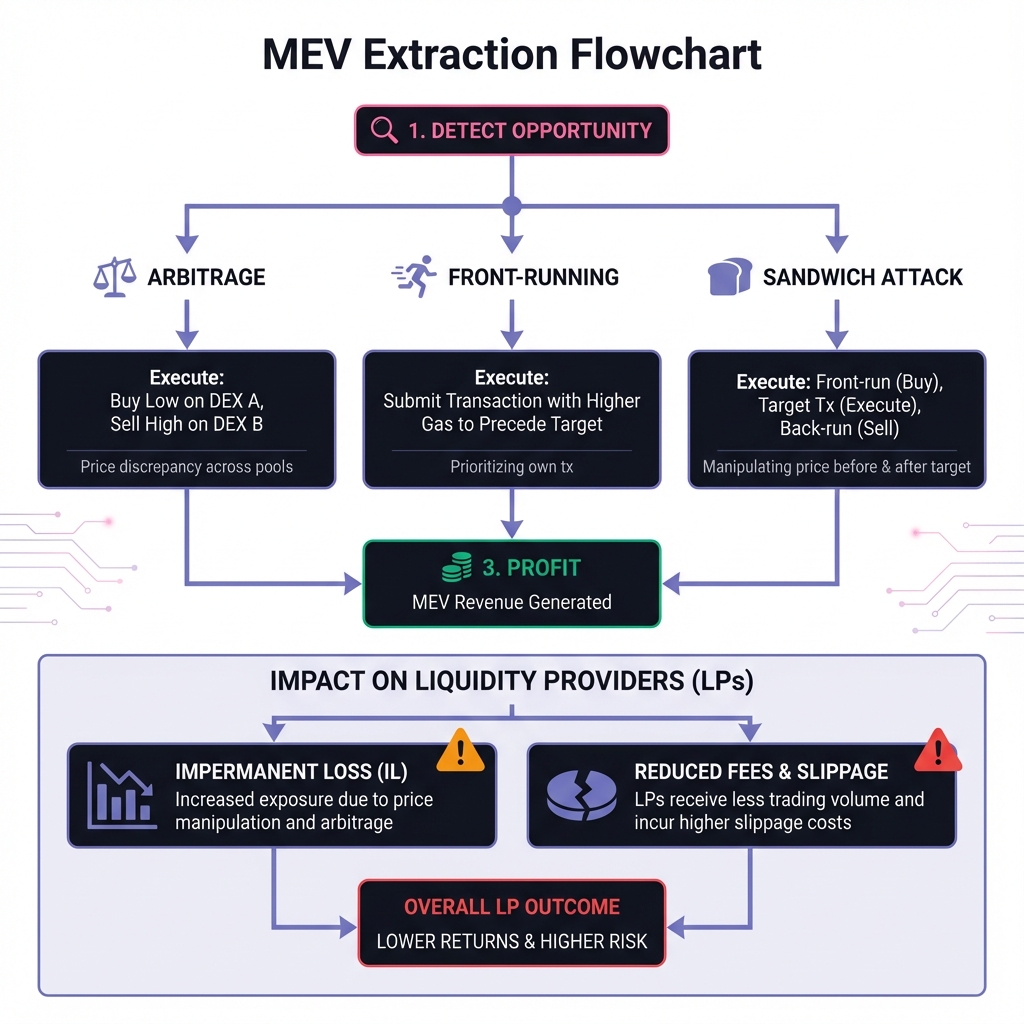

🔍 Understanding MEV

What is MEV?

How MEV Affects LPs

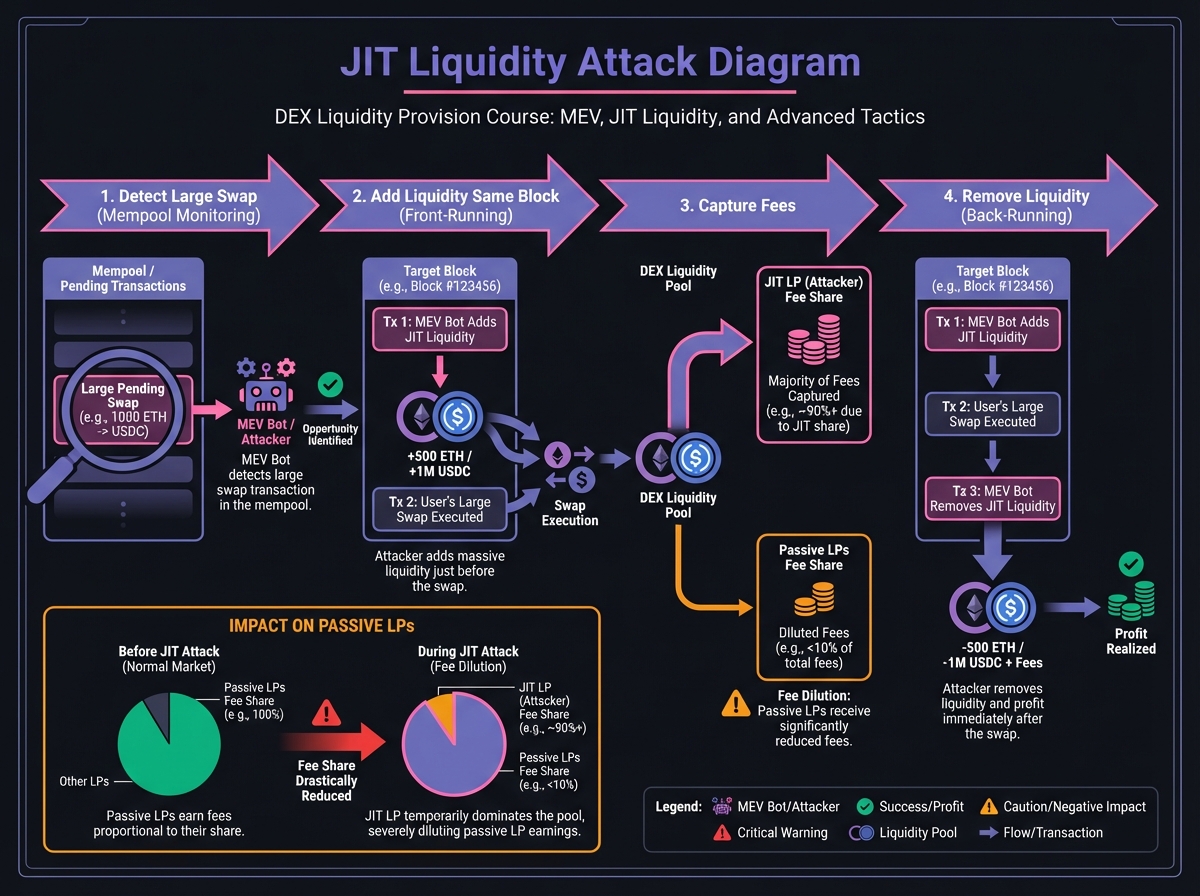

⚡ Just-In-Time (JIT) Liquidity

The JIT Attack

JIT Example

JIT Frequency

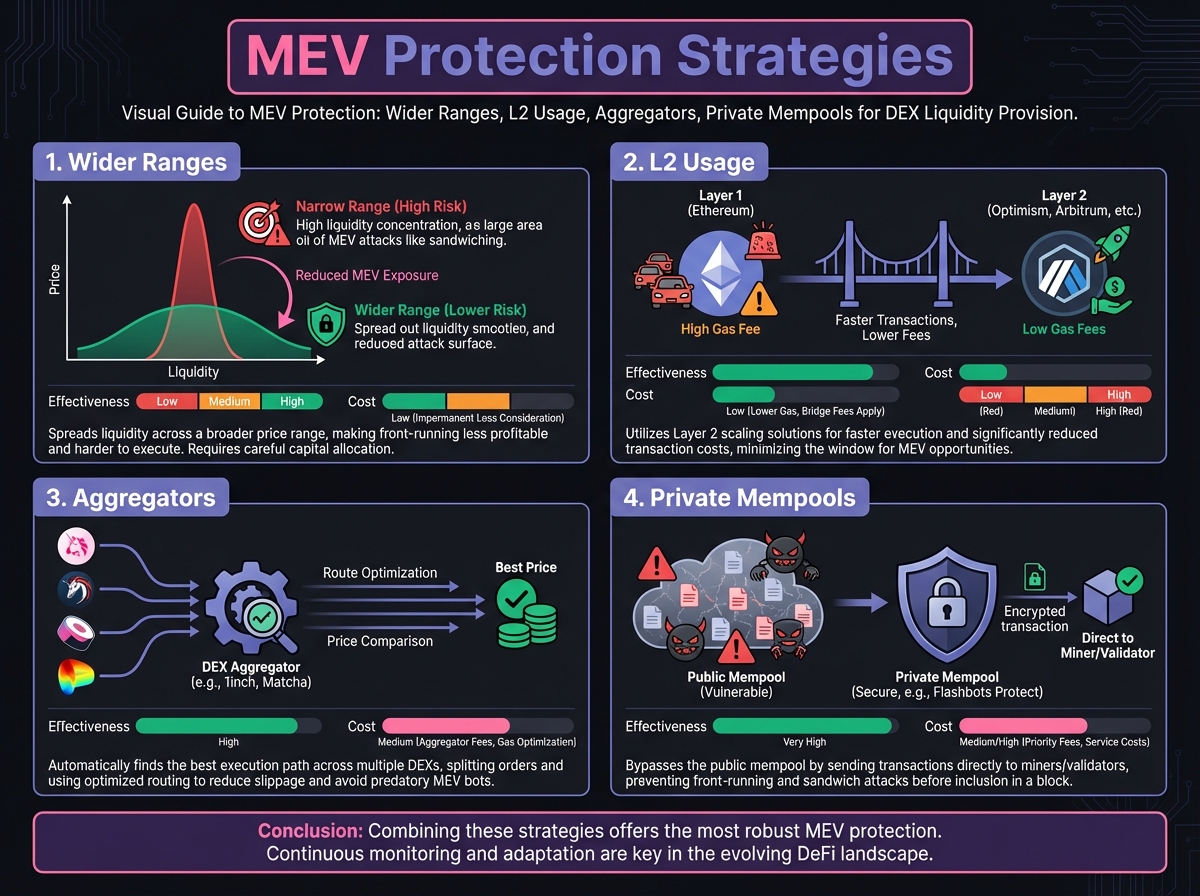

🛡️ Protecting Against MEV/JIT

Strategy 1: Use Private Pools

Strategy 2: Use DEX Aggregators

Strategy 3: Wider Ranges (V3)

Strategy 4: Use L2s or Alternative Chains

🔬 Advanced Deep-Dive: Participating in MEV

Can LPs Participate in MEV?

MEV Bot Requirements

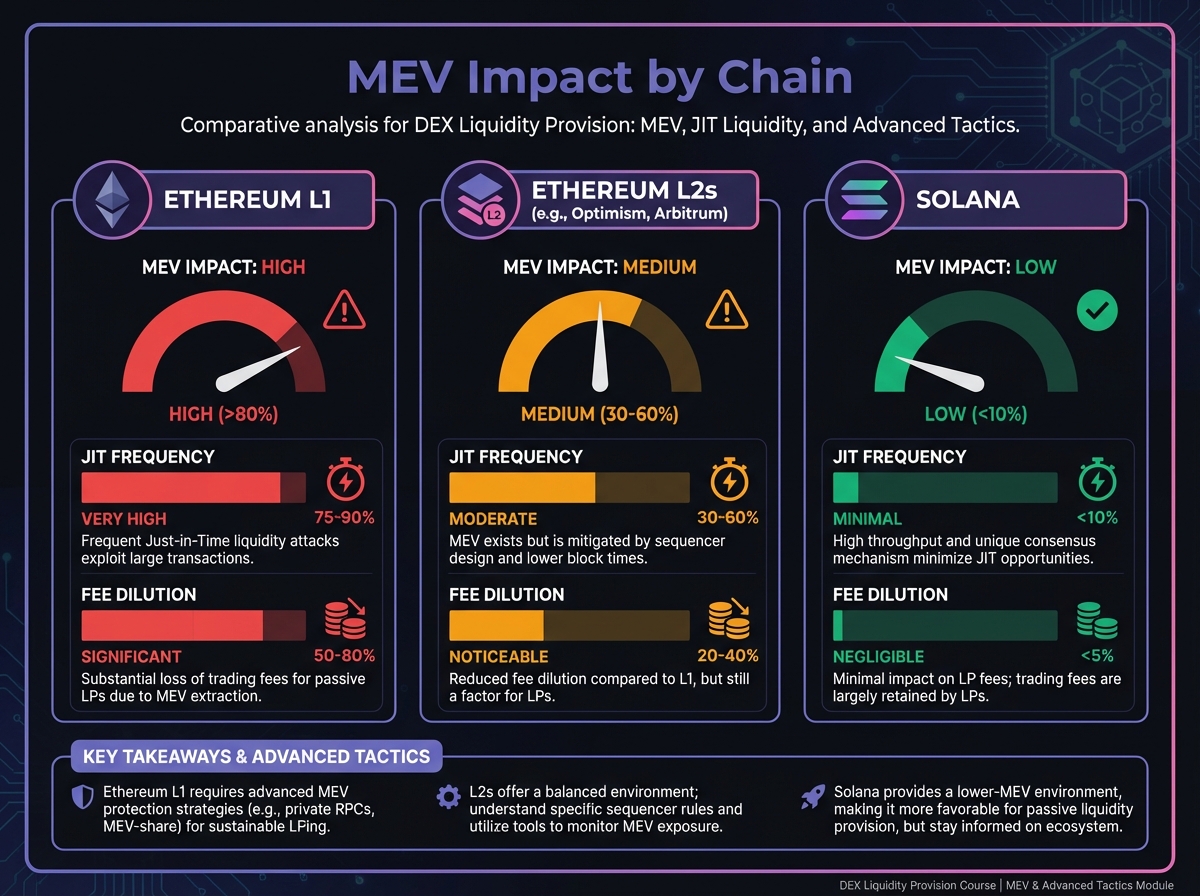

📊 MEV Impact Analysis

Measuring MEV Impact

Typical Impact

🎓 Beginner's Corner: MEV Basics

🔑 Key Takeaways

🚀 Next Steps

PreviousExercise 9: V4 Hooks and ALM IntegrationNextExercise 10: MEV Analysis and Protection Strategies

Last updated