Lesson 6: Multi-Protocol Strategy Development

🎧 Lesson Podcast

🎬 Video Overview

Lesson 6: Multi-Protocol Strategy Development

🎯 Core Concept: One Size Doesn't Fit All

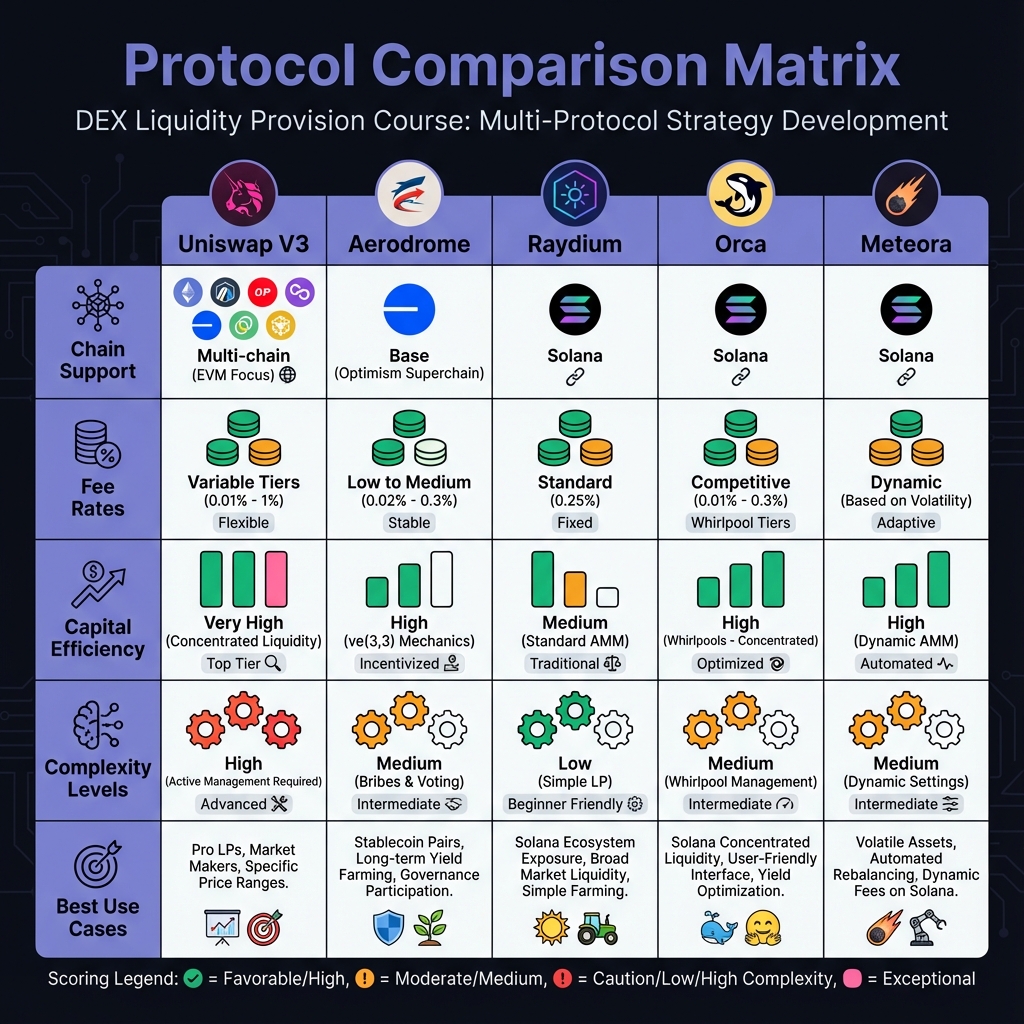

🏛️ Protocol Comparison Framework

When to Use Each Protocol

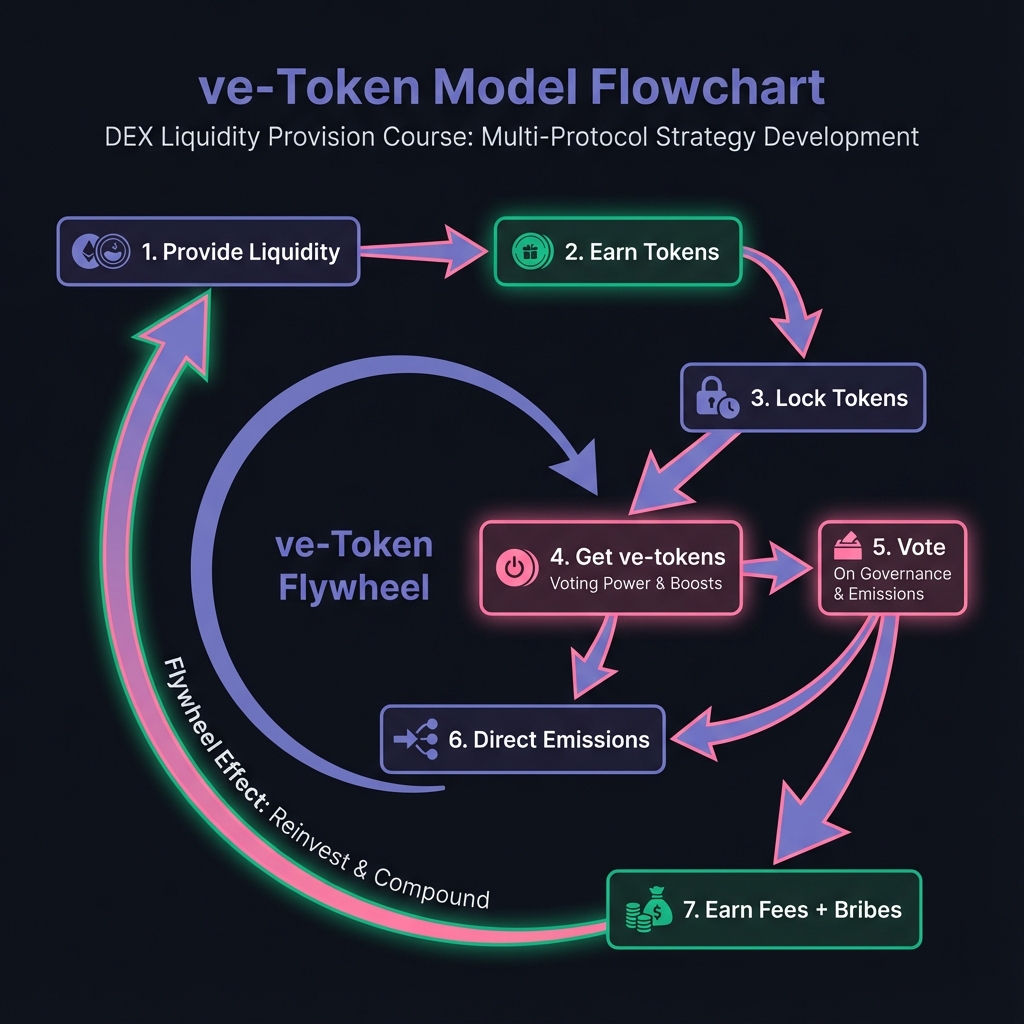

💰 Aerodrome: The ve-Token Model

Understanding ve(3,3) Economics

Strategy for LPs

Bribe Efficiency Analysis

⚡ Raydium: Solana's Liquidity Hub

Hybrid Architecture Advantage

CLMM on Raydium

Volume Dominance

🌊 Meteora: Dynamic Liquidity Shapes

The Bin System

Liquidity Shapes

Dynamic Fees

📊 Protocol Selection Matrix

Factor

Uniswap V3

Aerodrome

Raydium

Orca

Meteora

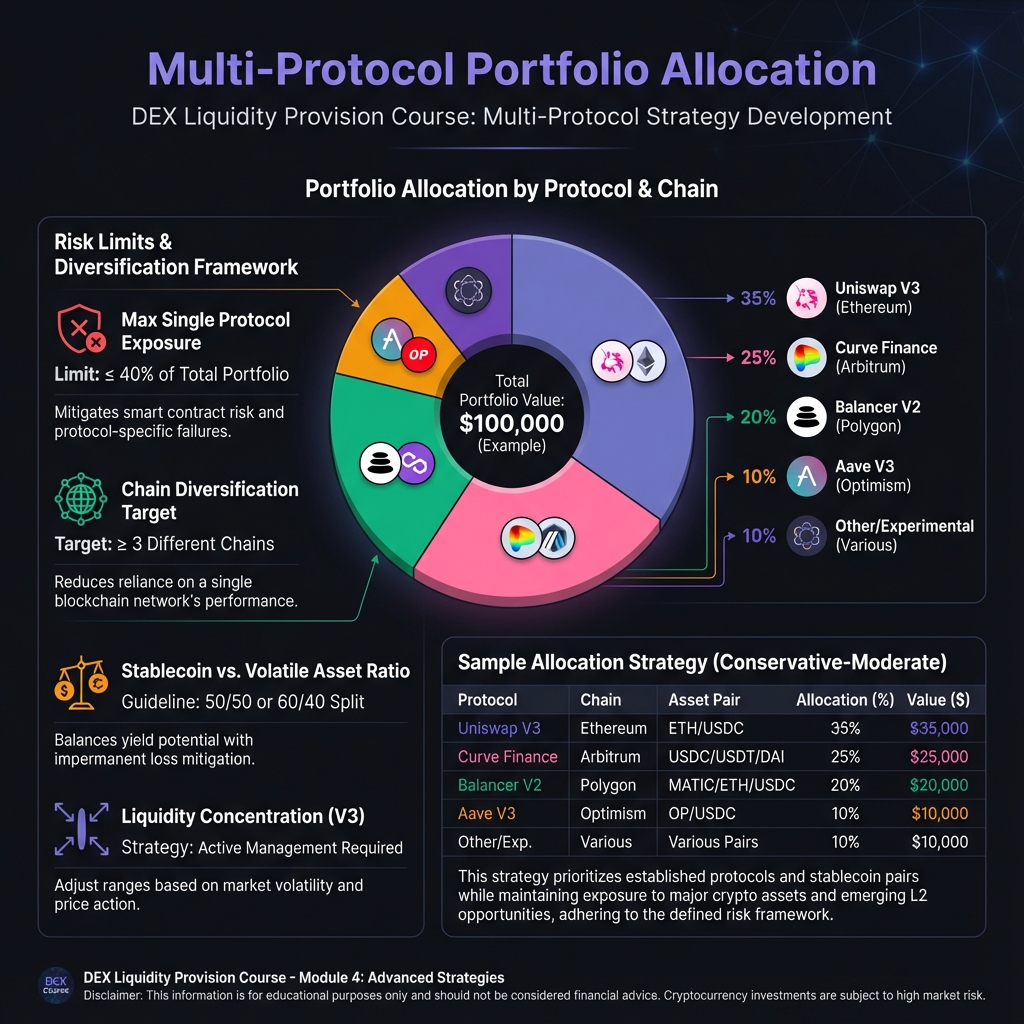

🎯 Multi-Protocol Strategy

Strategy 1: Chain Diversification

Strategy 2: Pair Optimization

Strategy 3: Yield Maximization

🔬 Advanced Deep-Dive: Cross-Chain Arbitrage

The Opportunity

🎓 Beginner's Corner: Which Protocol Should I Start With?

📈 Real-World Multi-Protocol Example

Interactive Pool Health Analyzer

🔑 Key Takeaways

🚀 Next Steps

PreviousExercise 5: V3 Range Selection and ManagementNextExercise 6: Cross-Protocol Analysis and Selection

Last updated