Lesson 7: Fee Optimization and Gas Economics

🎧 Lesson Podcast

🎬 Video Overview

Lesson 7: Fee Optimization and Gas Economics

🎯 Core Concept: Fees Must Exceed Costs

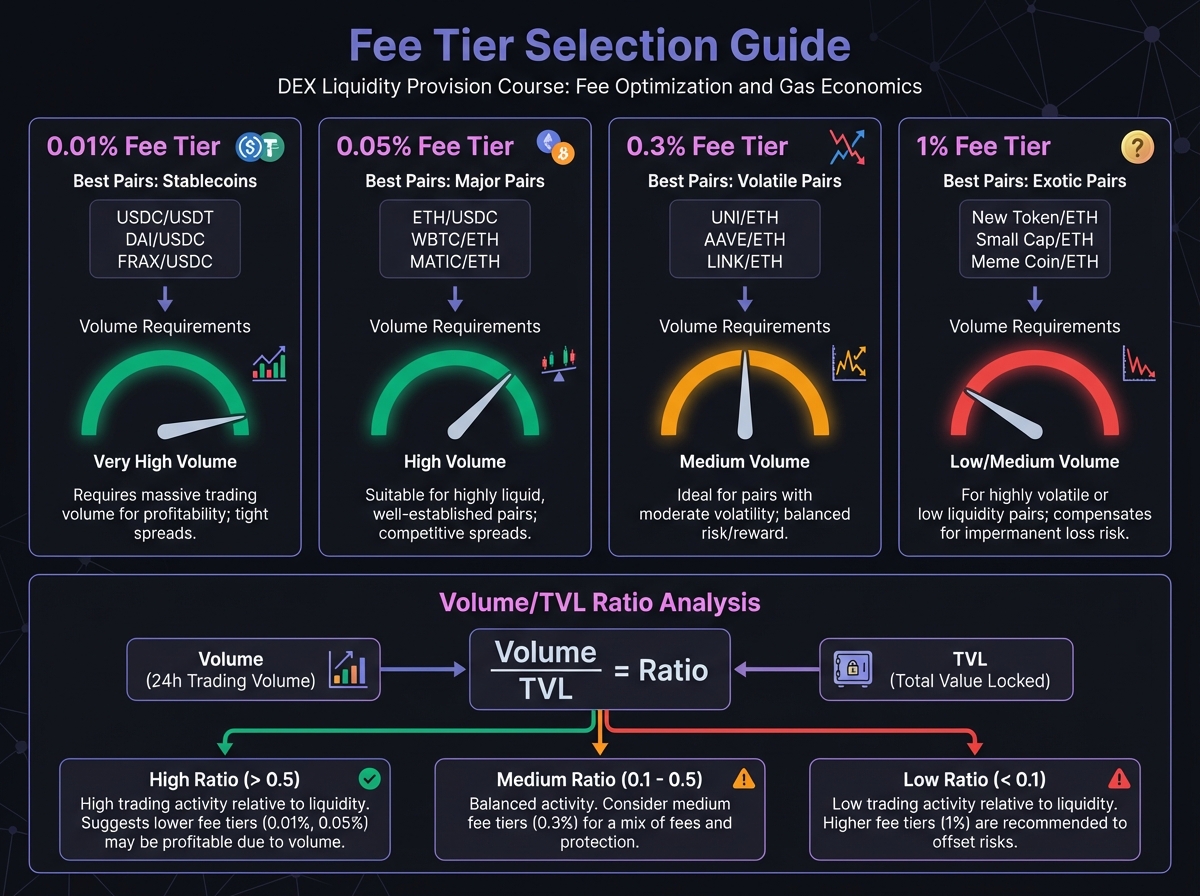

💸 Understanding Fee Tiers

Uniswap Fee Tiers

Fee Tier Selection Framework

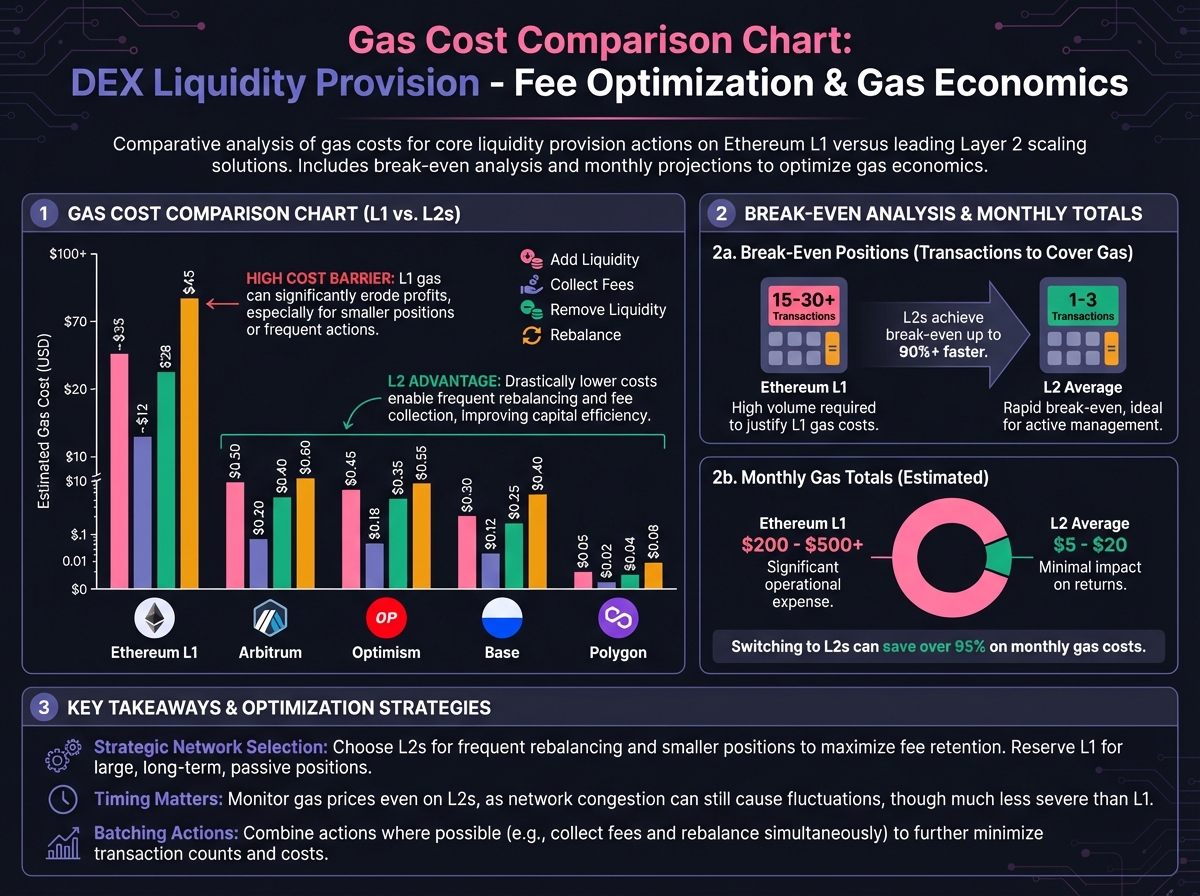

⛽ Gas Economics: L1 vs L2

Ethereum Mainnet (L1) Costs

Layer 2 Costs

Gas Optimization Strategies

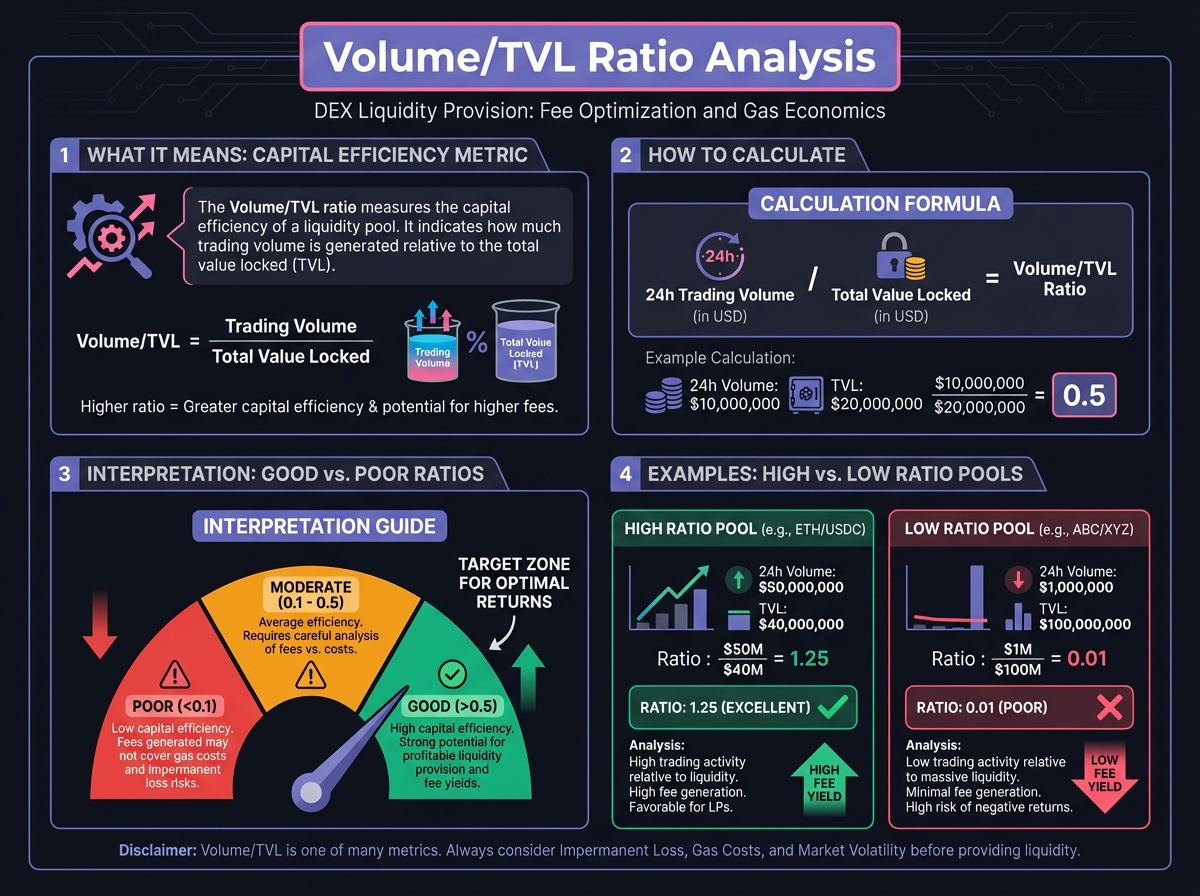

📊 Volume/TVL Ratio Analysis

The Critical Metric

Real-World Example

💰 Fee Calculation Framework

Expected Fee Formula

Complete Example

🎯 Fee Optimization Strategies

Strategy 1: High Volume Pools

Strategy 2: Emerging Pools

Strategy 3: Fee Tier Arbitrage

Strategy 4: Cross-Protocol Optimization

🔬 Advanced Deep-Dive: Dynamic Fee Models

Meteora's Dynamic Fees

Uniswap V4 Hooks (Future)

🎓 Beginner's Corner: Fee Optimization Mistakes

📈 Real-World Optimization Example

Interactive Fee Accumulation Calculator

🔑 Key Takeaways

🚀 Next Steps

PreviousExercise 6: Cross-Protocol Analysis and SelectionNextExercise 7: Fee Tier Selection and Gas Optimization

Last updated