Lesson 4: Building Your First LP Position

🎧 Lesson Podcast

🎬 Video Overview

Lesson 4: Building Your First LP Position

🎯 Core Concept: Start Simple, Start Safe

The First-Time LP Checklist

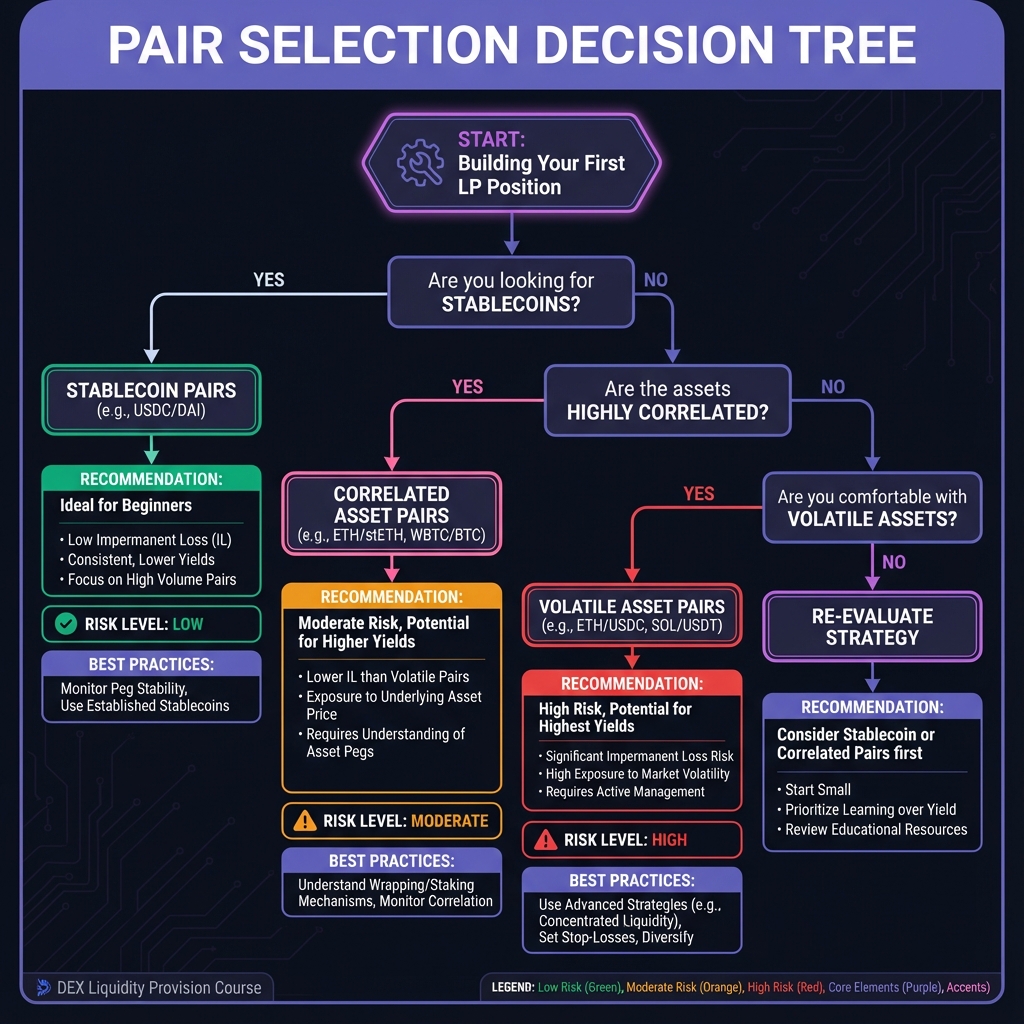

🏁 Step 1: Choose Your Pair Wisely

Beginner-Friendly Pairs (Lowest Risk)

Pair Selection Framework

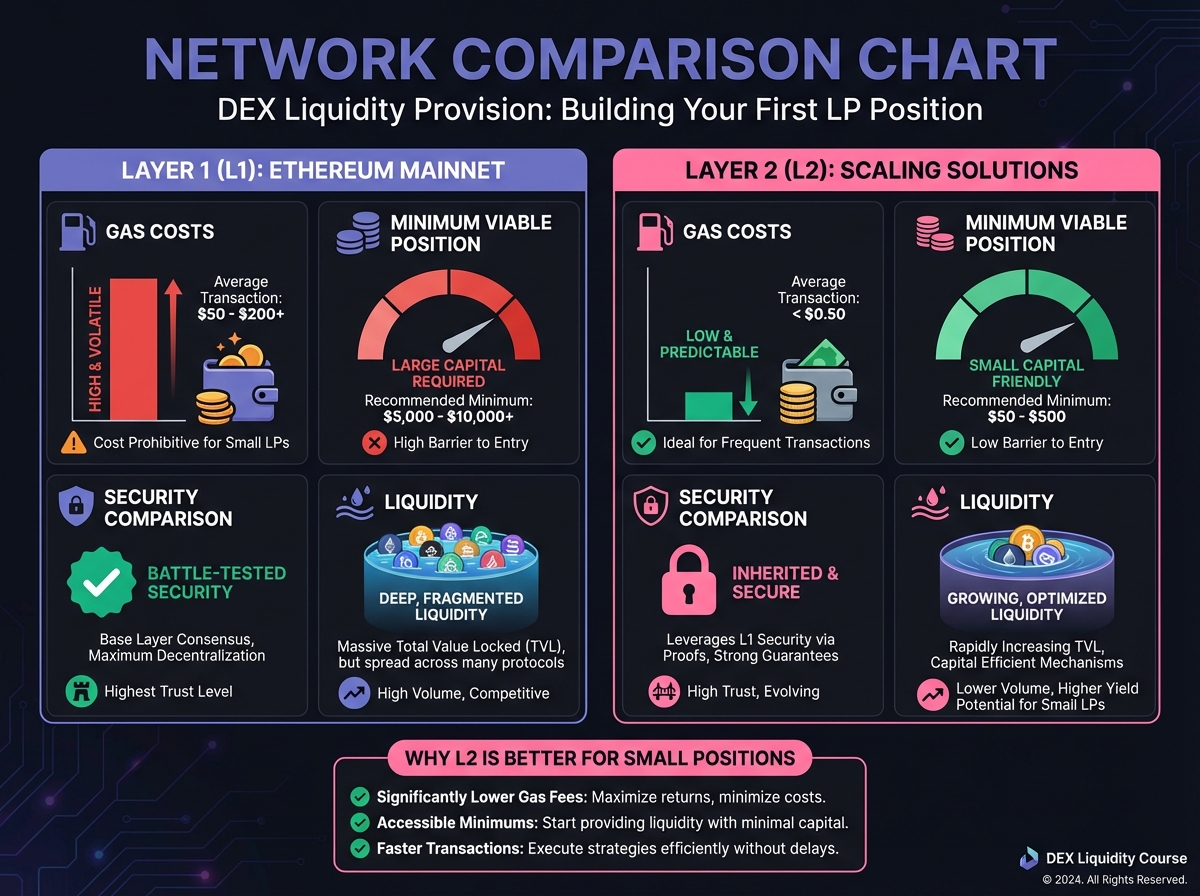

🌐 Step 2: Choose Your Network

Layer 2 vs. Layer 1

Recommended L2s for LPing

💰 Step 3: Calculate Your Position Size

The 1% Rule (Beginners)

Minimum Viable Position

Position Size Calculator

🔧 Step 4: Set Up Your Wallet

Required Setup

Security Checklist

📱 Step 5: Navigate Uniswap Interface

Finding the Pool

For Your First Position: Use V2

Understanding the Interface

💸 Step 6: Execute Your Deposit

Pre-Deposit Checklist

Transaction Steps

Gas Optimization Tips

📊 Step 7: Monitor Your Position

What to Track

Monitoring Tools

🔄 Step 8: Withdrawing Your Position

When to Withdraw

Withdrawal Process

🎓 Beginner's Corner: Common First-Time Mistakes

🔬 Advanced Deep-Dive: Optimizing Your First Position

Fee Tier Selection

Volume/TVL Ratio Analysis

Timing Your Entry

📈 Real-World Example: Complete First Position

Interactive LP Position Simulator

🔑 Key Takeaways

🚀 Next Steps

PreviousExercise 3: Risk Assessment and IL AnalysisNextExercise 4: First Position Setup and Management

Last updated