Lesson 5: Hyperliquid - The L1 Performance Leader

🎧 Lesson Podcast

🎬 Video Overview

Lesson 5: Hyperliquid - The L1 Performance Leader

🎯 Core Concept: Purpose-Built for Trading

Hyperliquid is not just another perpetual DEX—it's a vertically integrated Layer 1 blockchain engineered from first principles to solve the specific demands of high-frequency derivatives trading. By building a custom consensus mechanism, dual-state architecture, and zero-gas trading model, Hyperliquid delivers CEX-like performance while maintaining non-custodial sovereignty.

Why Hyperliquid Matters

Hyperliquid represents a paradigm shift in DeFi infrastructure:

Sub-second latency: 0.2s median end-to-end (rivals CEXs)

Zero-gas trading: No gas fees for orders (only trading fees on execution)

Fully on-chain order book: Transparent and verifiable

200,000 orders/second: Institutional-grade throughput

HLP vault: Democratized market making for retail

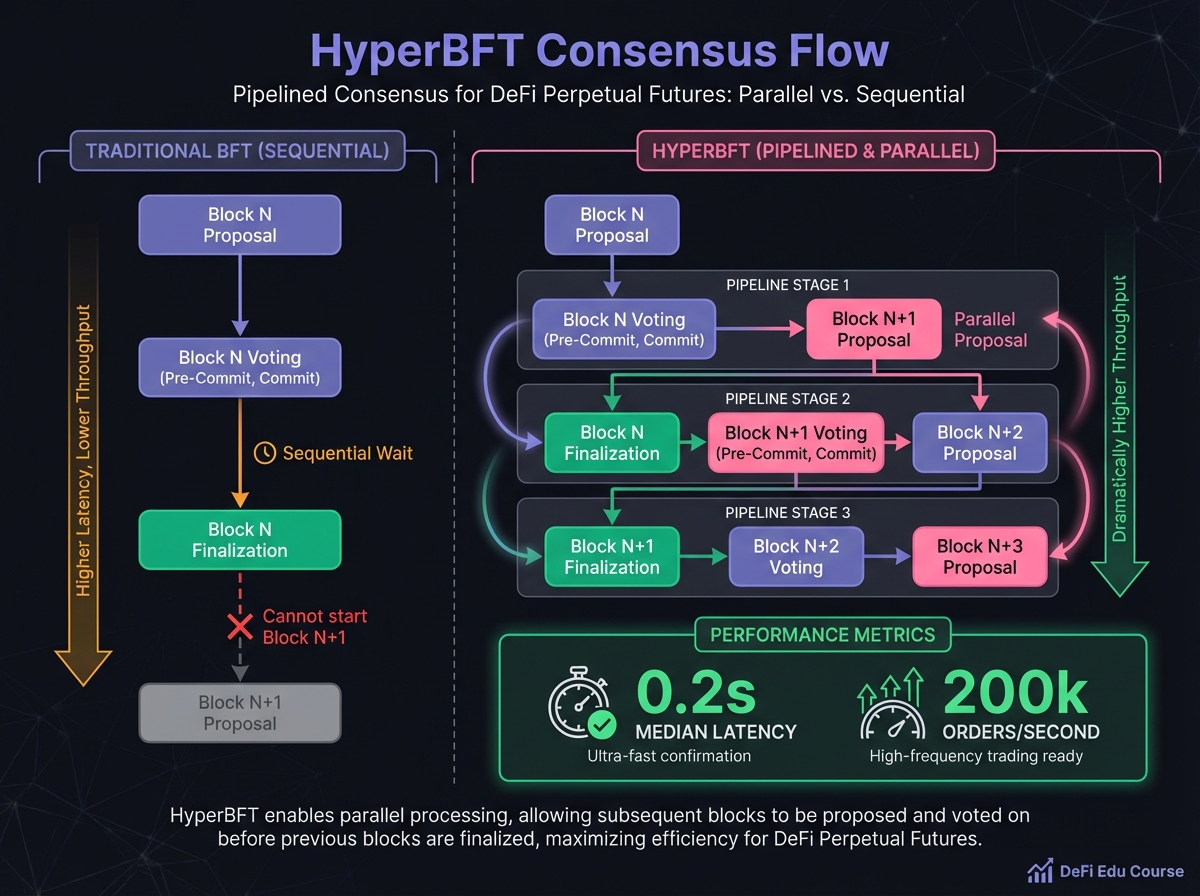

🏗️ The HyperBFT Consensus Mechanism

Understanding HyperBFT

HyperBFT is Hyperliquid's custom consensus algorithm derived from HotStuff protocol. Unlike traditional BFT (Byzantine Fault Tolerance) mechanisms that process consensus sequentially, HyperBFT uses pipelined consensus.

How Pipelining Works:

Traditional BFT: Wait for Block N to finalize → Propose Block N+1

HyperBFT: Propose Block N+1 while Block N is still voting

Result: Parallel processing = dramatically higher throughput

Performance Characteristics

Latency Profile:

Median: 0.2 seconds (end-to-end)

99th Percentile: 0.9 seconds

Comparison: Ethereum = 12s, Solana = 400ms (with jitter)

Throughput Capacity:

200,000 orders per second (practical, not theoretical)

Achieved because order matching is native (not smart contract)

Why This Matters: For market makers managing delta-neutral portfolios, 200ms is the difference between capturing a spread and suffering toxic flow. This performance allows automated strategies from CEXs to operate with minimal modification.

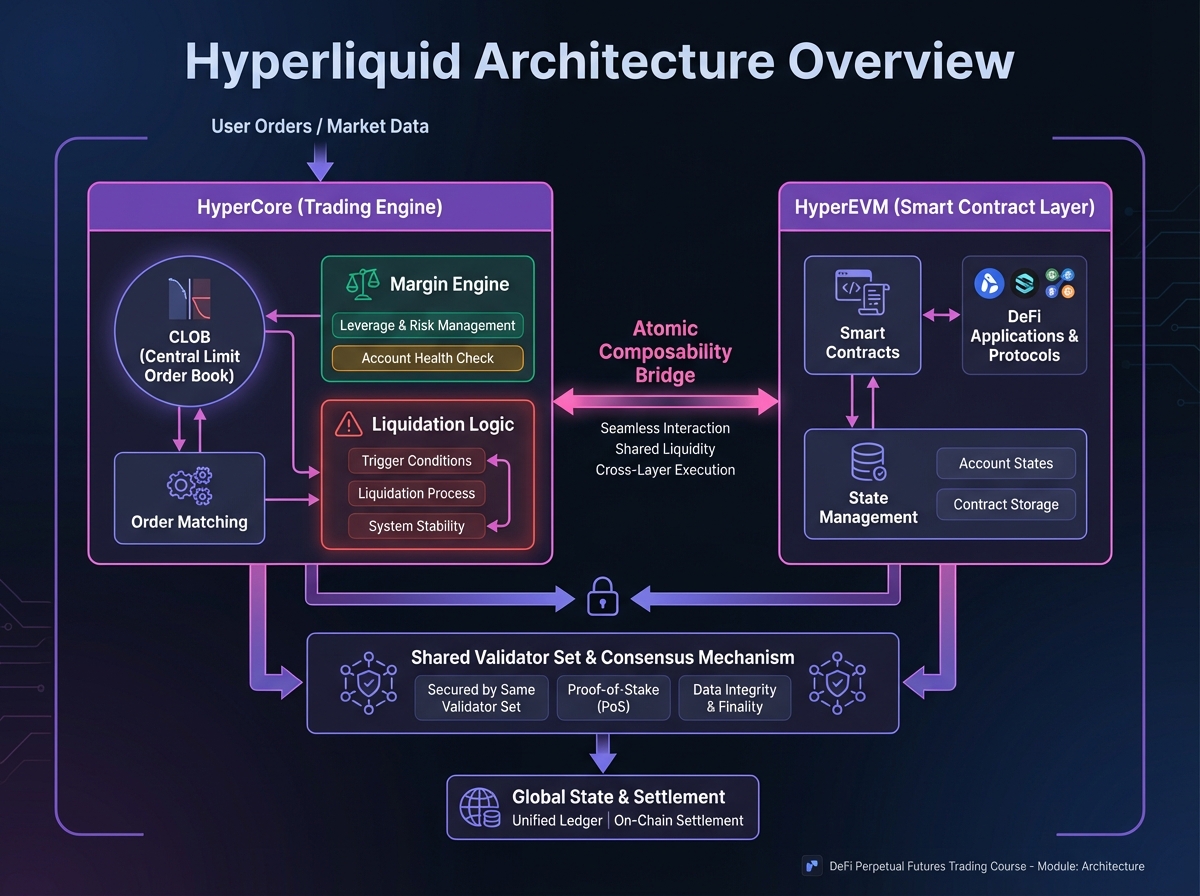

🔄 Dual-State Architecture: HyperCore and HyperEVM

The Innovation

Hyperliquid splits its state into two layers:

HyperCore: Specialized trading engine (fast)

HyperEVM: General-purpose smart contracts (flexible)

Both secured by the same validator set, maintaining atomic composability.

HyperCore: The Trading Engine

What It Contains:

Central Limit Order Book (CLOB)

Margin engine

Liquidation logic

Order matching (native Rust code)

Key Features:

Fully On-Chain: Every order placement, cancellation, and execution is on-chain

No Off-Chain Matching: Unlike dYdX v3, matching happens on-chain

Transparency: Complete order book state is verifiable

Why Native Code Matters: On general-purpose chains, order matching requires:

Gas metering

EVM opcode processing

State trie updates

In HyperCore, matching is a native primitive—stripped of overhead, enabling speeds comparable to NASDAQ.

HyperEVM: The Smart Contract Layer

Purpose: Support broader ecosystem (yield aggregators, stablecoins, governance)

Dual-Block Architecture:

Fast Blocks (Small Blocks):

Frequency: ~1 second

Gas Limit: 2 million

Purpose: High-speed interactions, simple transfers

Slow Blocks (Big Blocks):

Frequency: ~1 minute

Gas Limit: 30 million

Purpose: Complex contracts, heavy computations

Why Two Block Types: Prevents a single complex deployment from clogging the mempool and causing latency spikes for traders.

Interoperability: Read Precompiles

How They Connect:

HyperEVM contracts can query HyperCore state (prices, funding rates, OI)

No external oracles needed

Contracts can trigger trades on HyperCore

Atomic composability enables DeFi-native algorithmic strategies

Example: A vault contract on HyperEVM can programmatically execute a trade on HyperCore CLOB in response to an on-chain trigger.

⚡ Zero-Gas Trading Model

The Innovation

Users pay zero gas for:

Placing orders

Canceling orders

Modifying orders

Users only pay trading fees (maker/taker) upon successful execution.

Why This Matters

On Gas-Based Chains:

Market makers pay gas to update quotes

"Cost to cancel" incentivizes wider spreads

High-frequency trading becomes expensive

On Hyperliquid:

No gas cost to update quotes

Tighter spreads

Deeper liquidity

Better execution for traders

Spam Mitigation: The "Pay-to-Play" Model

Without gas as Sybil resistance, Hyperliquid uses sophisticated rate limiting:

1. Volume-Based Rate Limiting:

~1 request per 1 USDC traded (cumulatively)

Initial burst buffer: 10,000 requests

After buffer depleted: Must generate trading volume

Spammers get throttled to 1 request per 10 seconds

2. Stake-Weighted Priority:

During congestion, priority based on HYPE staking

Can purchase "Request Weight" directly

Capital commitment = priority (not transient gas)

3. Open Order Caps:

Default: 1,000 open orders

Scales up to 5,000 based on volume

Prevents order book spam

Economic Sustainability

Why Zero-Gas Works:

Sovereign L1 (no "rent" to parent chain)

Validators compensated via HYPE token appreciation

Trading fees accumulate in ecosystem

No need for ETH for gas

Comparison to L2 "Gasless" Models:

L2s: Usually subsidized (may not be sustainable)

dYdX v4: Off-chain matching (less transparent)

Hyperliquid: Native zero-gas (sustainable)

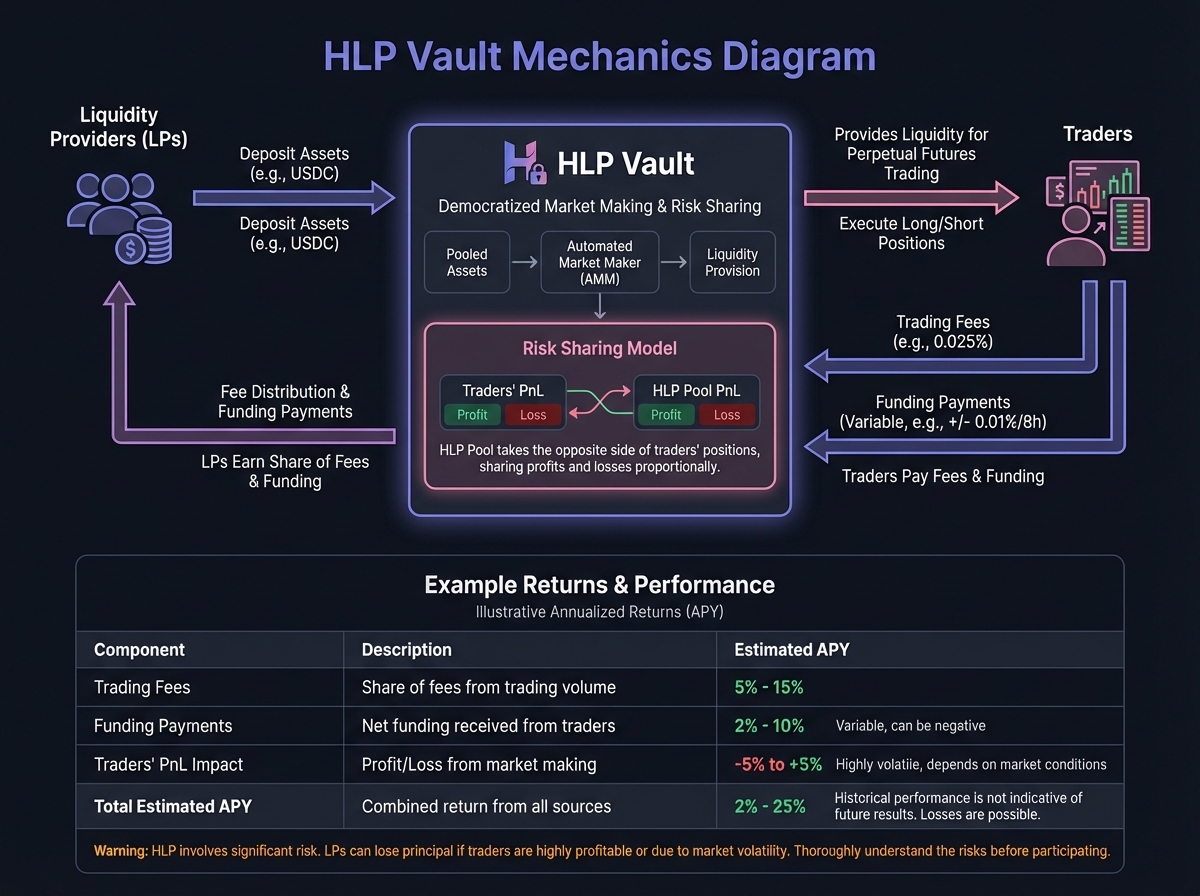

💰 The HLP (Hyperliquidity Provider) Vault

What Is HLP?

The HLP vault is Hyperliquid's unified liquidity pool that:

Acts as automated market maker on the CLOB

Provides liquidity algorithmically

Functions as liquidation backstop

Allows retail to participate in market making

How HLP Works

Quoting Strategy:

Algorithmically places bid/ask orders around mid-price

Spread based on volatility and inventory risk

Takes directional risk (not delta-neutral)

Inventory Skew:

If vault accumulates long position (traders selling):

Widens bid spread (cheaper to buy)

Tightens ask spread (attractive to sell)

Incentivizes market to rebalance vault

Liquidation Backstop:

When trader position breaches maintenance margin

HLP "buys" the distressed position

Attempts to unwind in market

Earns liquidation fees (high yield)

Exposed to "toxic flow" risk

HLP Performance

Historical Fee Generation:

Q4 2024: $281,005

Q1 2025: $3.57 million

Q2 2025: $5.25 million

Q3 2025: $7.25 million

Risk-Adjusted Returns:

Sharpe ratio improved from ~2.89 to ~5.2

Lower volatility than holding BTC

But exposed to tail risk (black swan events)

HLP Risks: POPCAT and JELLY Incidents

POPCAT Incident (November 2025):

Attack: Buy wall manipulation → triggered copy-traders → HLP went short

Result: Attacker pulled wall, price collapsed, HLP left holding long positions

Loss: $4.9 million

Lesson: Algorithmic quoting can be gamed by manipulation

JELLY Incident:

Attack: Whale accumulated massive position, manipulated price

Result: HLP became short while price skyrocketed

Crisis: Potential $4M+ bad debt

Intervention: Validators executed "Oracle Override" (controversial)

Lesson: Hyperliquid has social consensus layer (not pure "code is law")

Structural Changes After Incidents:

Open Interest caps for low-liquidity assets

Leverage reductions (50x → 25x-40x for majors)

Updated liquidation logic to protect HLP

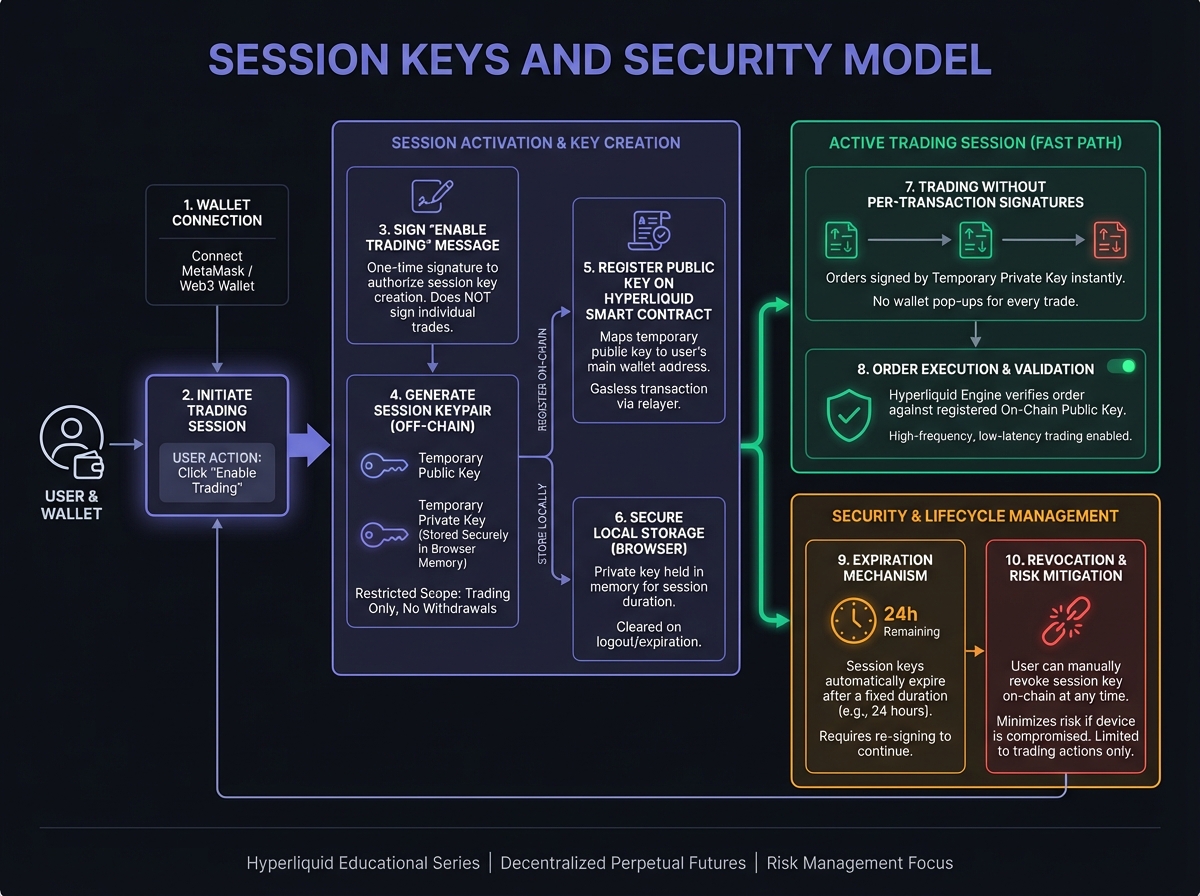

🎓 Beginner's Corner: Using Hyperliquid

Getting Started

Step 1: Connect Wallet

Navigate to Hyperliquid interface

Connect MetaMask (Arbitrum network)

Sign message to enable trading (session keys)

Step 2: Deposit

Click "Deposit"

Bridge USDC.e from Arbitrum to Hyperliquid L1

Approve bridge transaction

Wait for confirmation

Important: The bridge is a trust point—funds are locked in bridge contract.

Step 3: Enable Trading

Protocol prompts for "Enable Trading" signature

Generates session keys (stored locally in browser)

Allows one-click trading without wallet popup

Master key remains secure

Trading on Hyperliquid

Order Types:

Market: Execute immediately at best available price

Limit: Execute only at your specified price

Stop Loss: Triggered when price hits level

Take Profit: Close position at target

Session Keys Benefit: No wallet popup for every order (faster execution)

Zero-Gas Benefit: Update quotes freely without cost

🔬 Advanced Deep-Dive: Technical Architecture

HyperCore State Machine

Native Primitives:

Order matching (Rust)

Margin calculations

Liquidation logic

Funding rate settlement

On-Chain Order Book:

Every order is on-chain

Complete transparency

Verifiable execution sequence

No hidden matching logic

HyperEVM Composability

Read Precompiles:

Query CLOB state from smart contracts

Access mark prices, funding rates, OI

No external oracles needed

Event Passing:

Contracts can trigger HyperCore actions

Enables algorithmic trading strategies

Atomic composability

Example Use Case: Vault contract automatically hedges exposure by trading on HyperCore when certain conditions are met.

⚠️ Risks and Considerations

Bridge Risk

The Trust Point:

Hyperliquid L1 bridge on Arbitrum is a multisig wallet

If signers collude or are compromised, funds could be drained

This is the primary custody risk

Mitigation:

Monitor bridge security

Consider bridge insurance if available

Understand this is different from trading risk

Validator Centralization

Current State:

Validator set is permissioned (not fully decentralized)

Validators can intervene (Oracle Override in JELLY incident)

Moves toward "CeDeFi" model

Implications:

Not pure "code is law"

Social consensus layer exists

Validators can protect protocol (or abuse power)

HLP Risk

Toxic Flow Exposure:

HLP absorbs liquidations

During cascading crashes, can accumulate large positions

Tail risk during black swan events

Mitigation:

Diversify across multiple protocols

Monitor HLP performance

Understand you're counterparty to traders

📊 Real-World Example: Trading on Hyperliquid

Setup:

Protocol: Hyperliquid

Market: ETH/USD

Strategy: Scalping (many small trades)

Advantages for This Strategy:

Zero gas = can update quotes frequently

Low latency = fast execution

Session keys = one-click trading

Deep liquidity = tight spreads

Example Trade:

Connect wallet, enable trading

Deposit $1,000 USDC

Place limit buy at $2,499 (below market)

Order fills instantly (no gas paid)

Place limit sell at $2,501 (above market)

Order fills, profit captured

Repeat without gas costs

ROI Calculation:

Profit per trade: $2 (0.08% on $2,500 position)

Gas saved: $0 (would be $0.50-2.00 on L2)

Net advantage: Can make many small trades profitably

⚖️ Compare Protocols

See how Hyperliquid stacks up against other perpetual DEXs:

🔑 Key Takeaways

Hyperliquid is a purpose-built L1 optimized for trading

HyperBFT enables sub-second latency and high throughput

Dual-state architecture (HyperCore + HyperEVM) offers both speed and flexibility

Zero-gas trading removes friction for market makers

HLP vault democratizes market making but carries risks

Bridge and validator centralization are trust points to consider

Best for: Active traders, scalpers, market makers

🚀 Next Steps

Proceed to Lesson 6 to learn about GMX V2's oracle-based model

Complete Exercise 5 to practice Hyperliquid position setup

Explore Hyperliquid interface to see zero-gas trading in action

Consider HLP vault for passive market making exposure

Last updated