Lesson 7: Drift Protocol - Solana's Hybrid Architecture

🎧 Lesson Podcast

🎬 Video Overview

Lesson 7: Drift Protocol - Solana's Hybrid Architecture

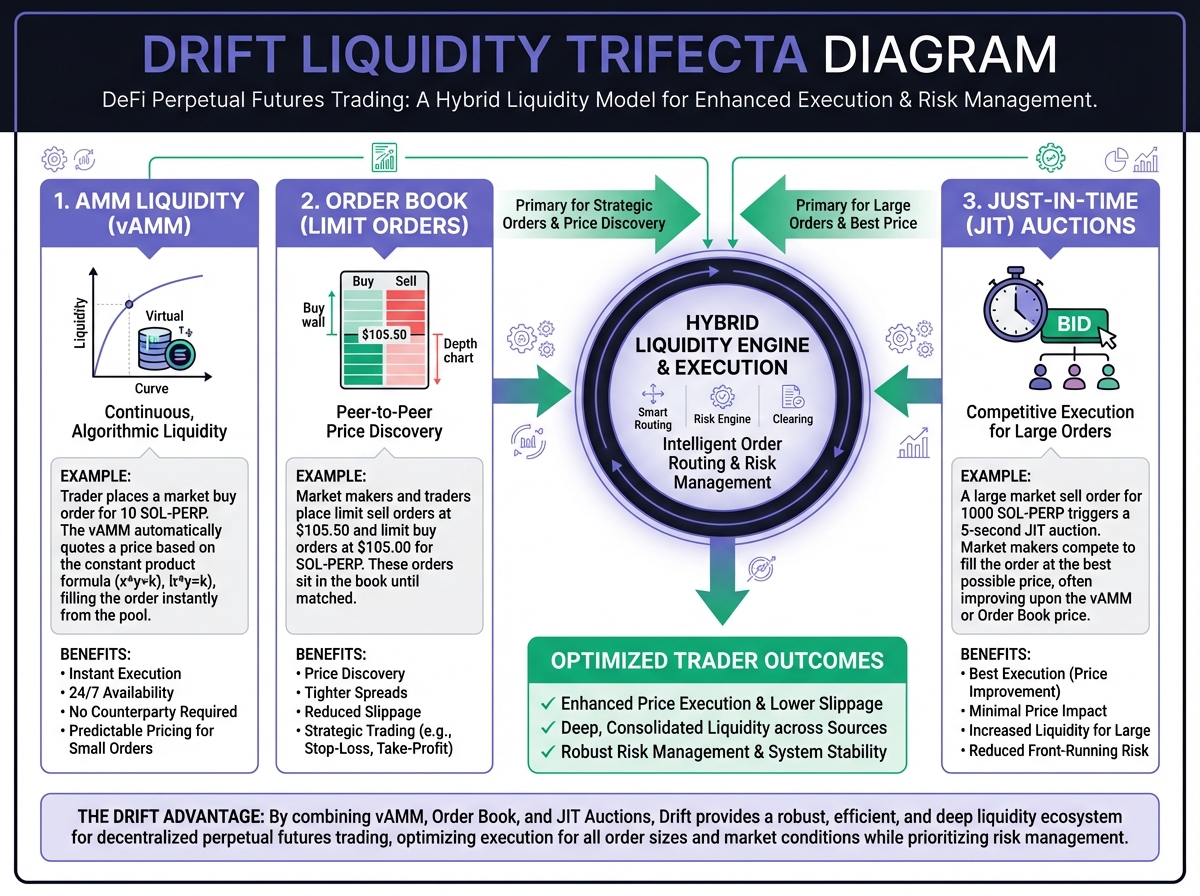

🎯 Core Concept: The Liquidity Trifecta

Why Drift Matters

🏗️ The Liquidity Trifecta Architecture

Layer 1: Just-In-Time (JIT) Auction

Layer 2: Decentralized Limit Orderbook (DLOB)

Layer 3: Dynamic AMM (DAMM)

🔄 Trade Execution Lifecycle

The Waterfall Process

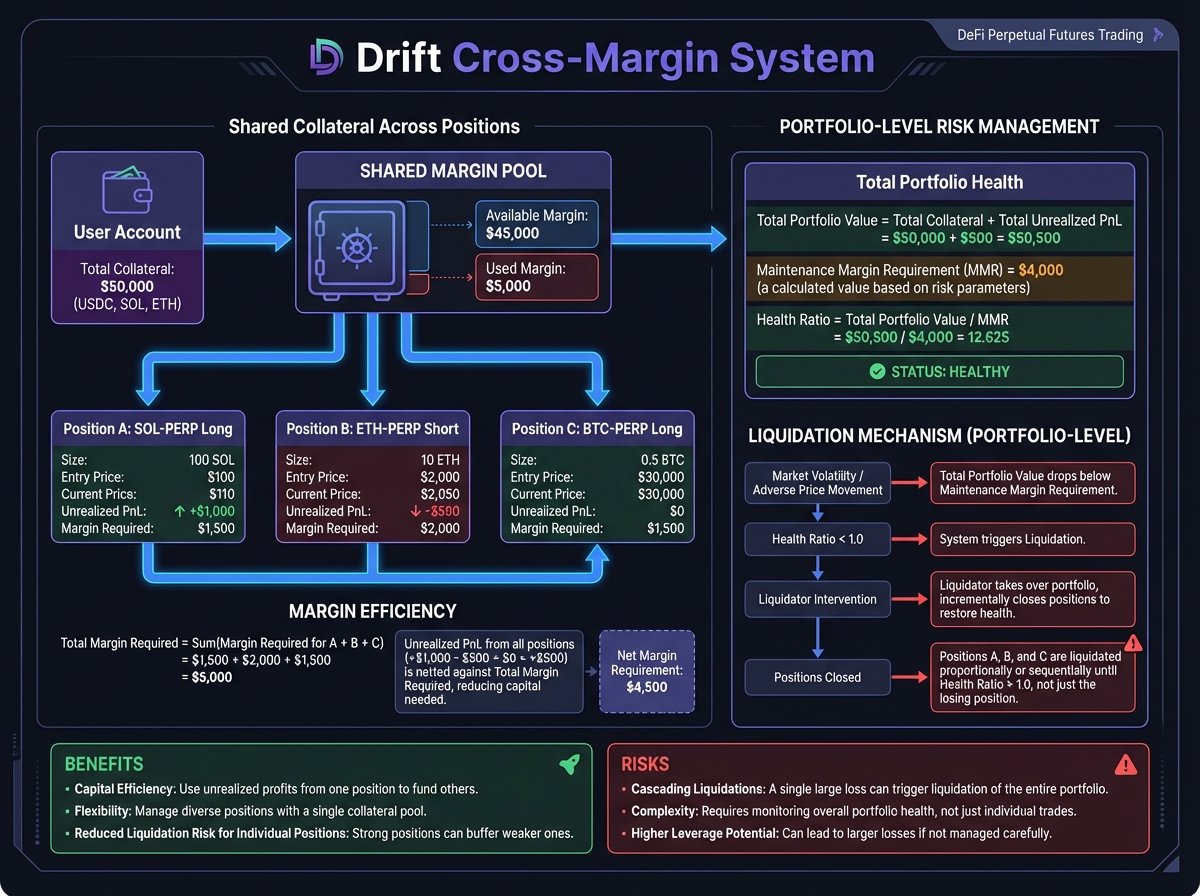

💰 Cross-Margin System

Unified Margin Across Products

Asset Weightings

Asset Type

Example

Initial Weight

Maintenance Weight

Cross-Margin Benefits

🎓 Beginner's Corner: Using Drift

Getting Started

Opening a Position

🔬 Advanced Deep-Dive: JIT Auction Mechanics

The Dutch Auction Formula

MEV Internalization

⚠️ Risks and Considerations

Solana-Specific Risks

Cross-Margin Risks

Keeper Network Risk

📊 Real-World Example: Trading on Drift

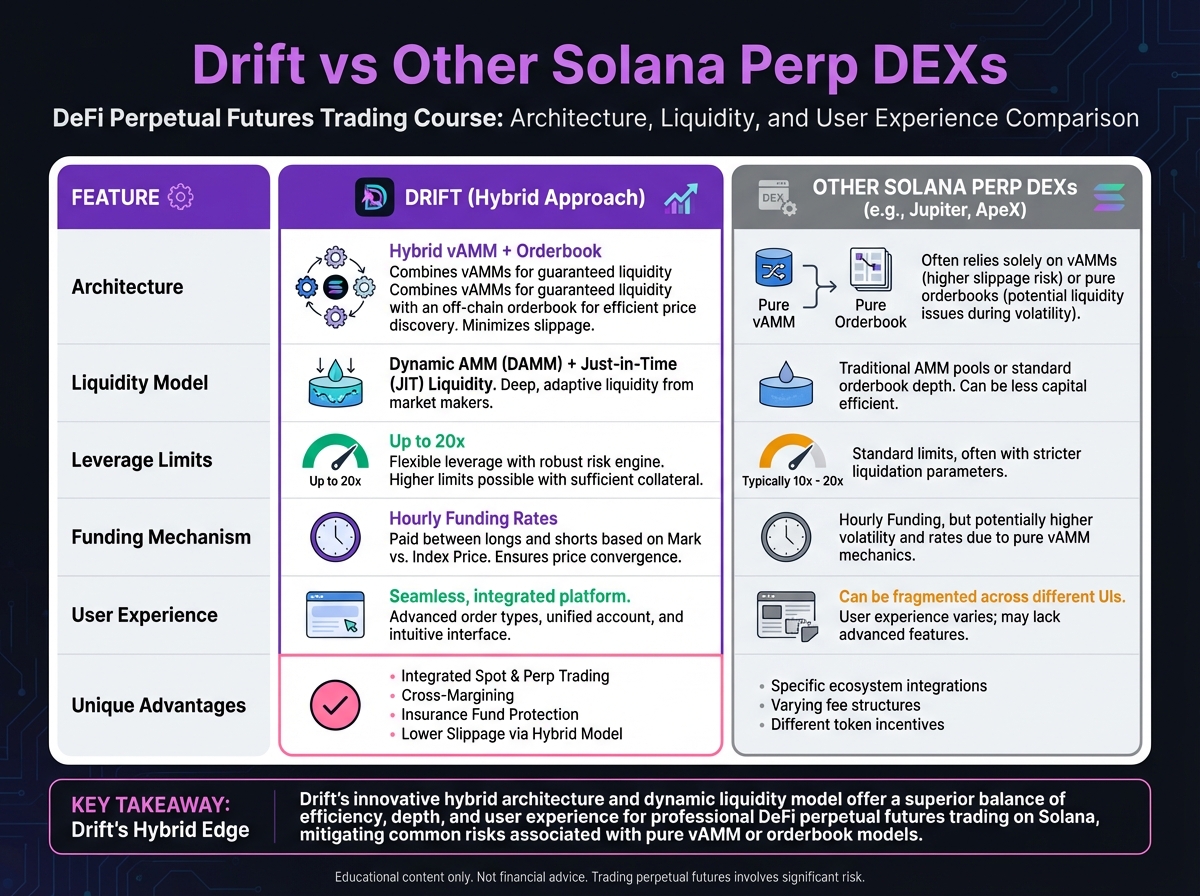

⚖️ Compare Protocols

🔑 Key Takeaways

🚀 Next Steps

PreviousExercise 6: GMX V2 Market Analysis and SelectionNextExercise 7: Drift Market Creation and Strategy Analysis

Last updated