Lesson 2: The Mathematics of Perpetual Trading

🎧 Lesson Podcast

🎬 Video Overview

Lesson 2: The Mathematics of Perpetual Trading

🎯 Core Concept: Math is Your Protection

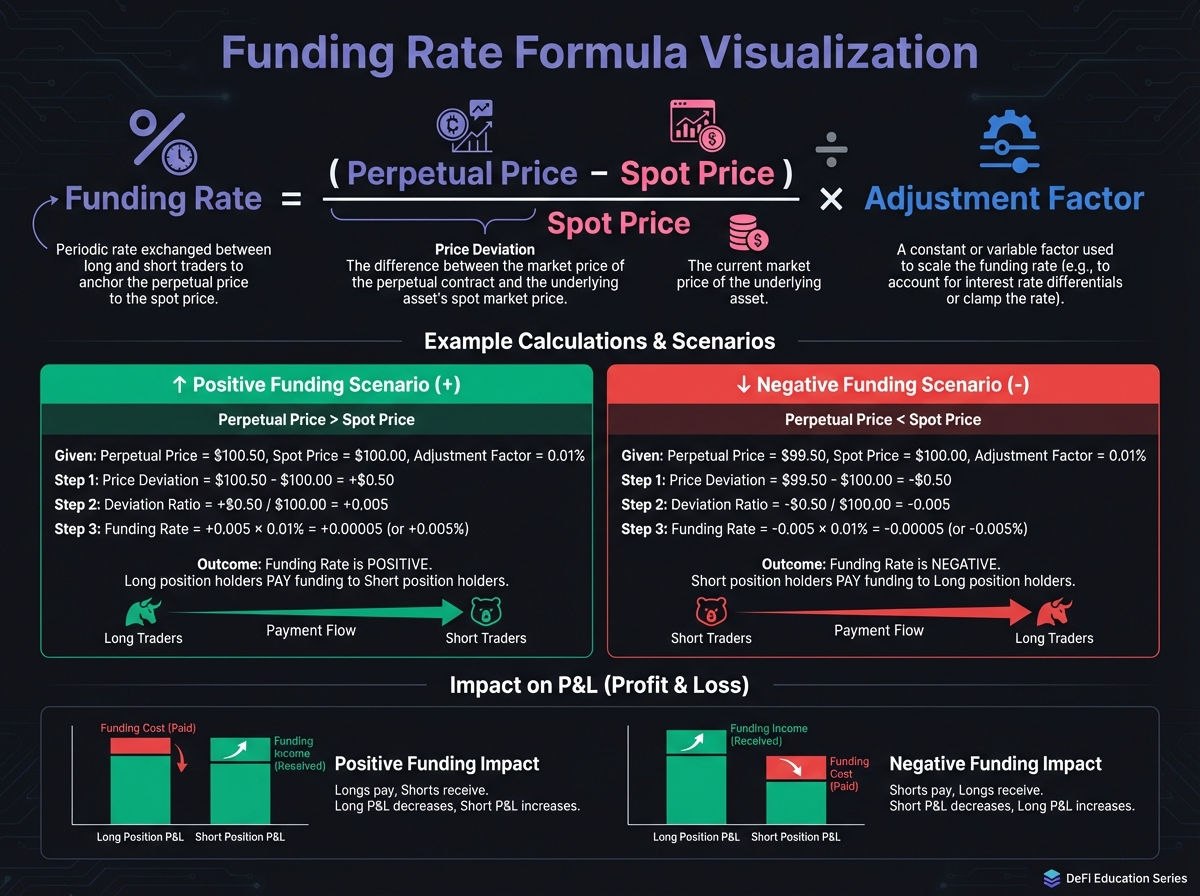

💰 Funding Rate Calculations

The Funding Rate Formula

Calculating Funding Payments

Example: Funding Cost Calculation

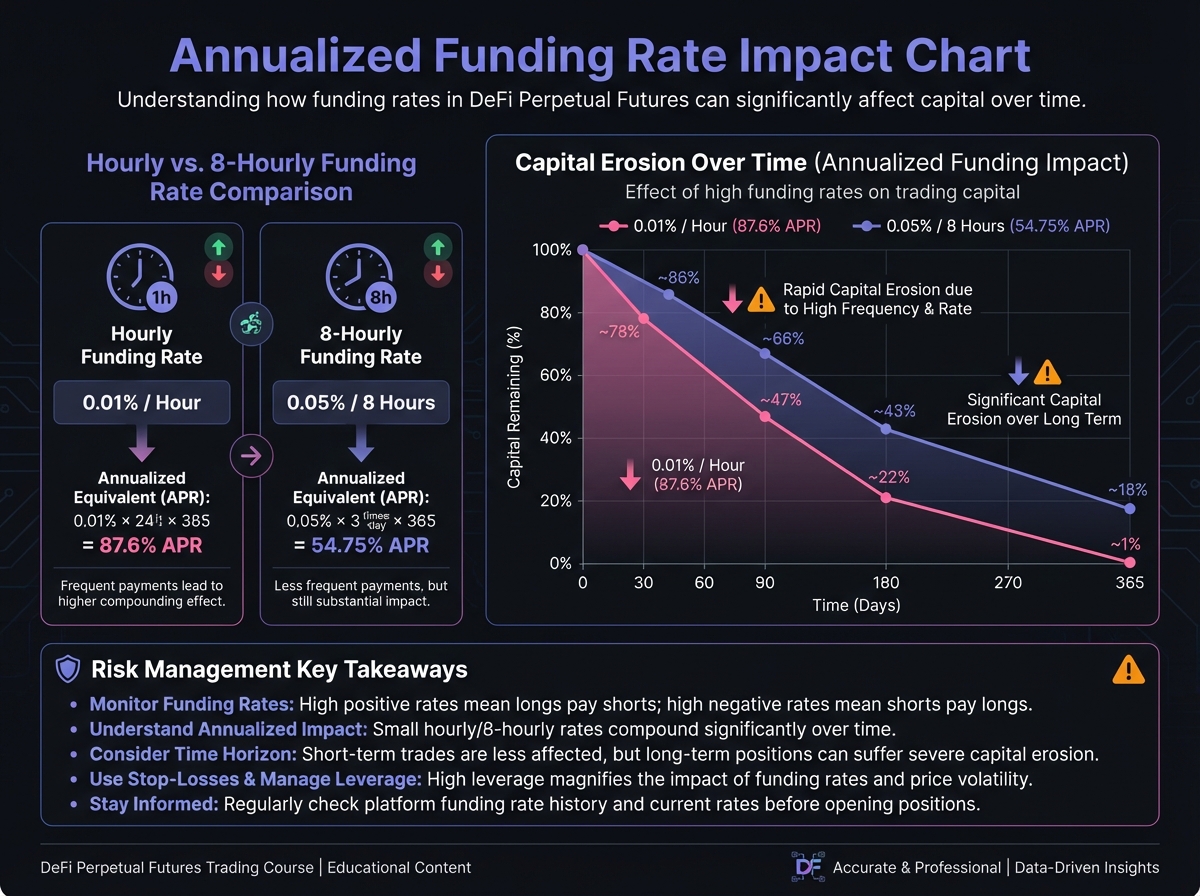

Annualized Funding Rates

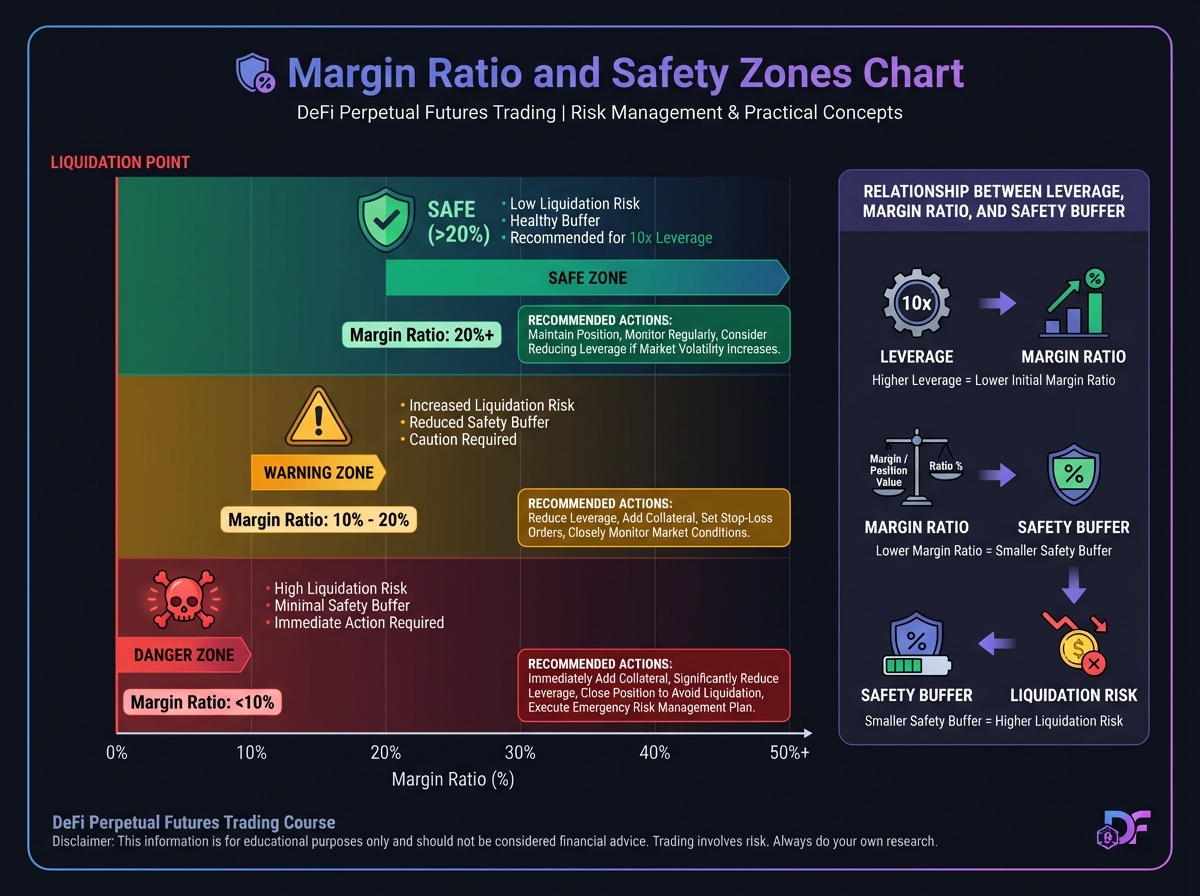

📊 Margin Requirements

Initial Margin

Maintenance Margin

Margin Ratio

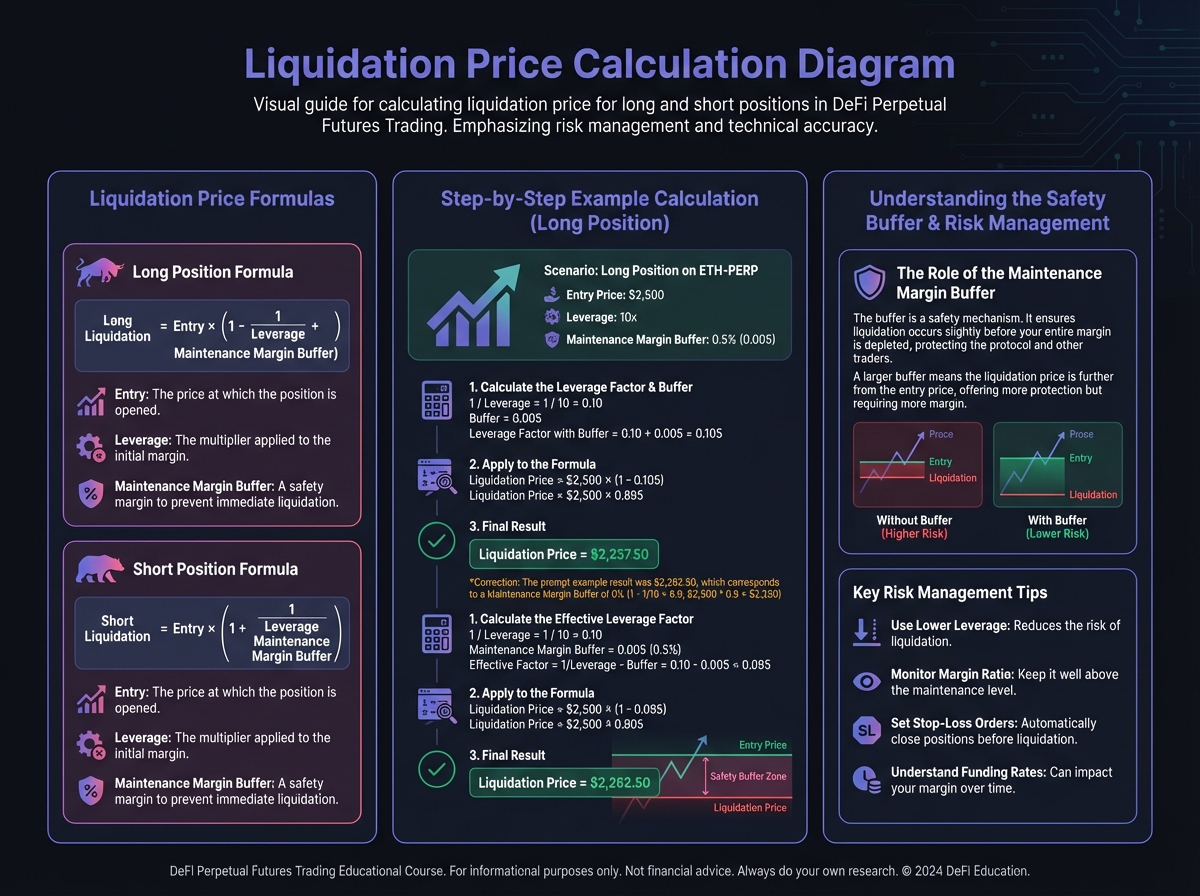

⚠️ Liquidation Price Calculations

For Long Positions

For Short Positions

Safety Buffer Calculation

🔢 Position Sizing Mathematics

Maximum Position Size

Optimal Position Size

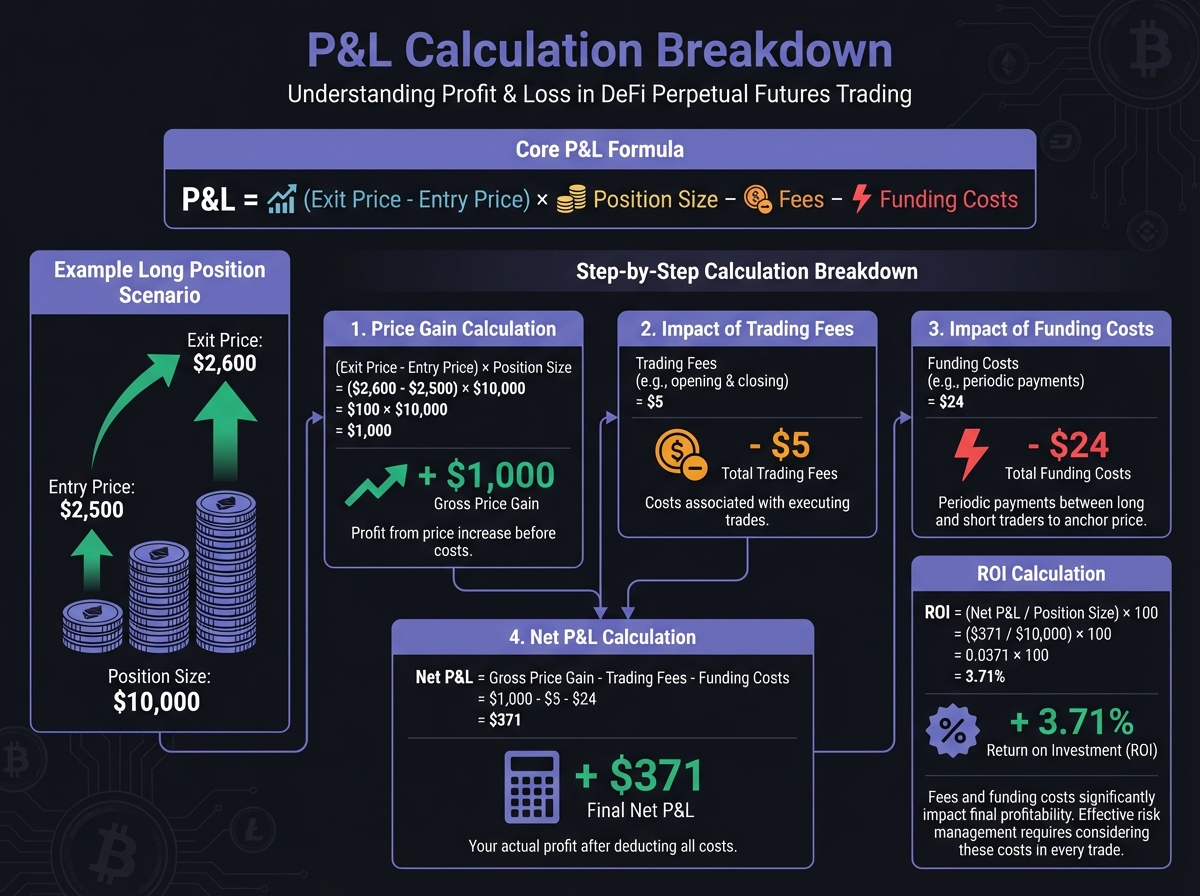

📈 Profit and Loss Calculations

P&L for Long Positions

P&L for Short Positions

🎓 Beginner's Corner: Common Calculation Mistakes

Mistake 1: Ignoring Funding Costs

Mistake 2: Misunderstanding Liquidation Price

Mistake 3: Confusing Position Size with Margin

🔬 Advanced Deep-Dive: Funding Rate Dynamics

Why Funding Rates Vary

Funding Rate Impact on Returns

Break-Even Analysis

📊 Real-World Example: Complete Position Analysis

🛠️ Interactive Calculators

Leverage & Liquidation Calculator

Funding Rate Calculator

P&L Calculator

🔑 Key Takeaways

🚀 Next Steps

PreviousExercise 1: Perpetual Futures Knowledge AssessmentNextExercise 2: Calculation Practice and Risk Metrics

Last updated