Lesson 4: Your First Perpetual Position

🎧 Lesson Podcast

🎬 Video Overview

Lesson 4: Your First Perpetual Position

🎯 Core Concept: Start Simple, Start Safe

Your first perpetual position should be a learning experience, not a high-stakes gamble. This lesson walks you through setting up a safe, low-leverage position that minimizes risk while teaching you the mechanics.

The First-Time Trader Checklist

Before you open a single position, ensure you:

✅ Understand funding rates (Lesson 1)

✅ Can calculate liquidation prices (Lesson 2)

✅ Know the difference between isolated and cross margin

✅ Have funds on the correct network (L2 or AppChain)

✅ Know how to close positions (practice on testnet first!)

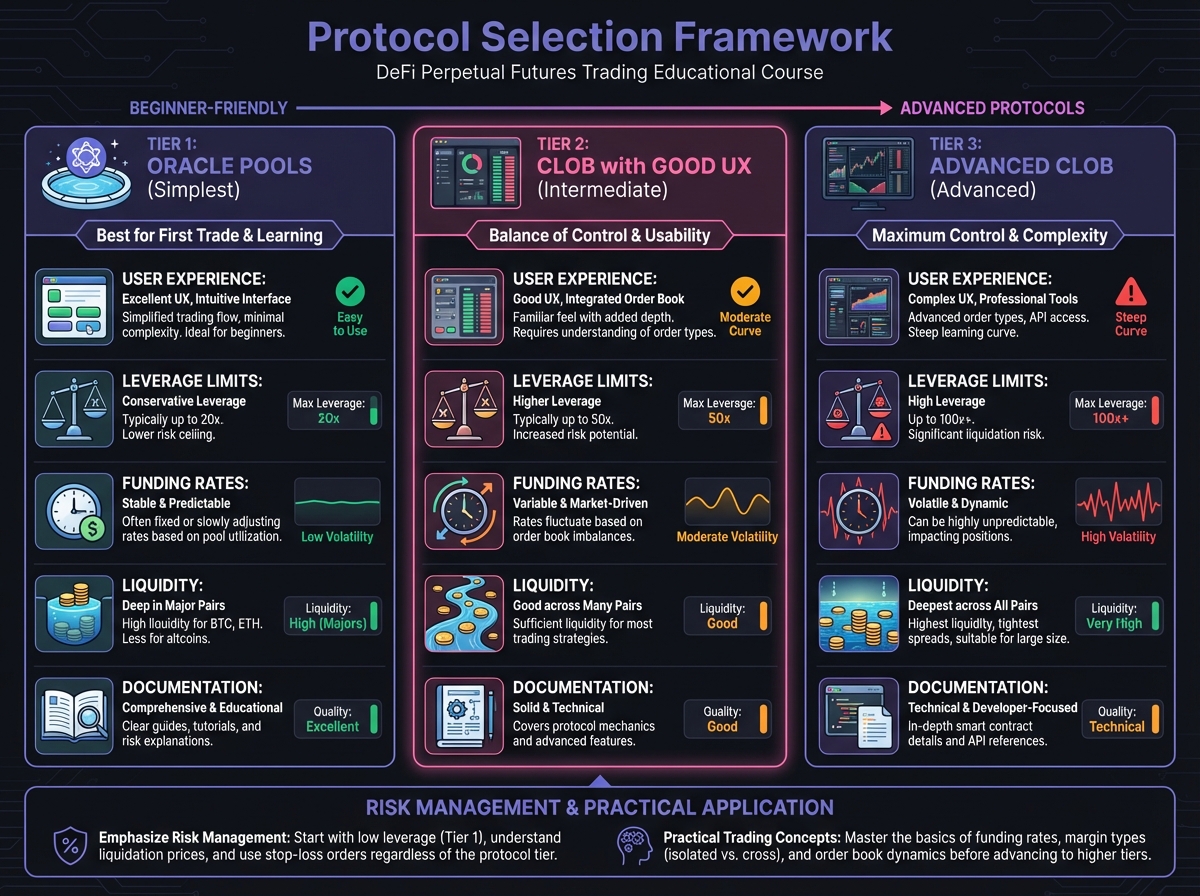

🏁 Step 1: Choose Your Protocol

Beginner-Friendly Protocols

Tier 1: Oracle Pools (Simplest) ⭐ Best for beginners

GMX V2 (Arbitrum)

Gains Network (Polygon)

Why: Simple swap-like interface, zero slippage, no order book complexity

Tier 2: CLOB with Good UX ⭐⭐ Good for learning

Hyperliquid (AppChain)

Drift (Solana)

Why: CEX-like experience, limit orders, but requires understanding order books

Tier 3: Advanced CLOB ⭐⭐⭐ For experienced traders

dYdX v4 (Cosmos)

EdgeX (Starknet)

Why: More features, but more complexity

Avoid for First Position:

❌ Protocols with very high leverage (50x+)

❌ Protocols with unclear liquidation mechanics

❌ Protocols with poor documentation

❌ Protocols on unfamiliar chains

Protocol Selection Framework

Ask yourself:

What's the user experience?

Is the interface intuitive?

Are there tutorials or guides?

What's the leverage limit?

Start with protocols that cap leverage at 10x

Avoid 50x+ for first trades

What's the funding rate?

Check current funding rates

High funding = expensive to hold

What's the liquidity?

More liquidity = better execution

Check TVL and open interest

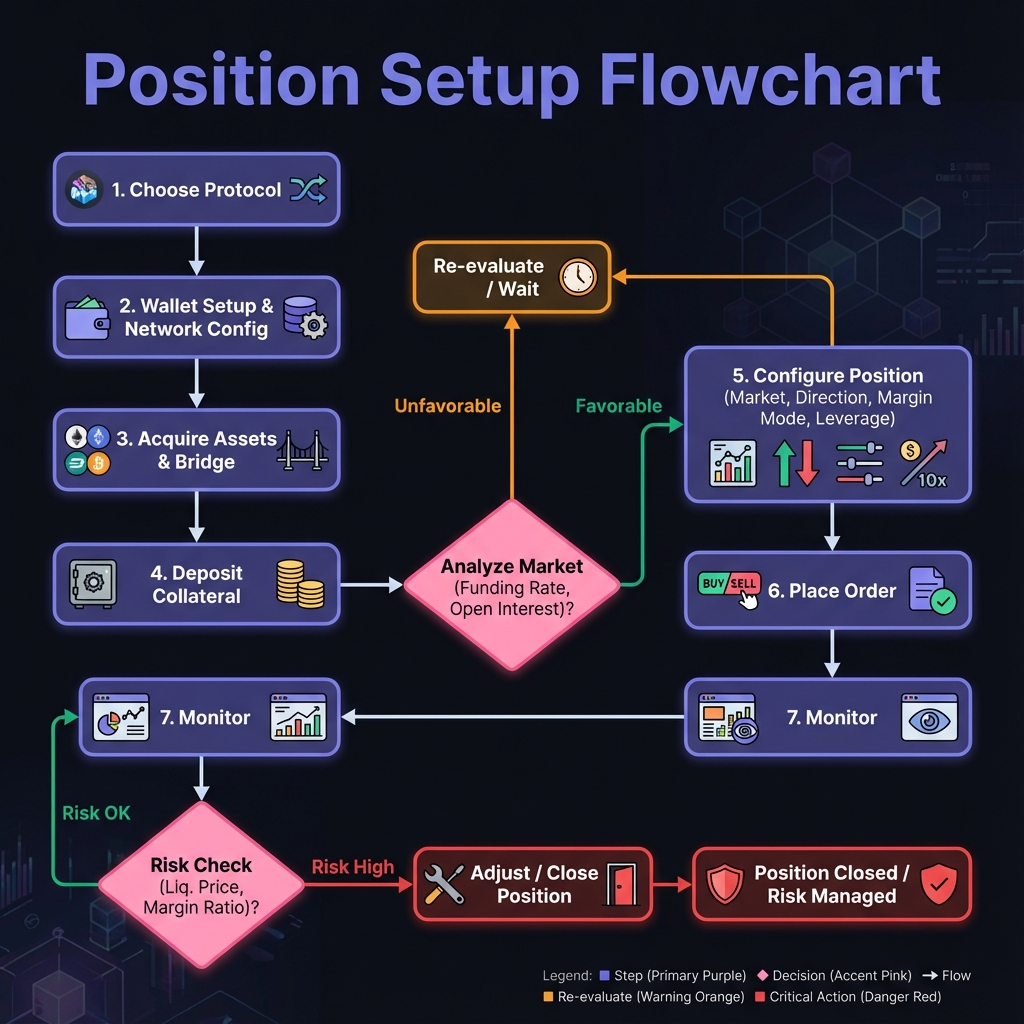

🌐 Step 2: Wallet Setup and Network Configuration

Choose Your Wallet

EVM-Compatible (for Arbitrum, Optimism, Base):

MetaMask (most popular)

Rabby (multi-chain optimized)

Coinbase Wallet

Cosmos (for dYdX v4):

Keplr (recommended)

MetaMask (with Cosmos support)

Solana (for Drift):

Phantom

Solflare

Network Configuration

For GMX (Arbitrum):

Open MetaMask

Click network dropdown

Add network manually or use Chainlist.org

Network details:

Network Name: Arbitrum One

RPC URL: https://arb1.arbitrum.io/rpc

Chain ID: 42161

Currency: ETH

Block Explorer: https://arbiscan.io

For Hyperliquid:

Connect MetaMask (Arbitrum network)

Navigate to Hyperliquid interface

Click "Connect Wallet"

Sign message to enable trading (session keys)

Acquire Assets

Option 1: Bridge from CEX

Buy USDC on centralized exchange

Withdraw to Ethereum Mainnet

Bridge to target network (Arbitrum, Optimism, etc.)

Use official bridge or third-party (Synapse, Stargate)

Option 2: Swap on DEX

Have ETH on target network

Swap ETH for USDC on Uniswap or similar

Use USDC as collateral

Gas Considerations:

Keep some ETH/native token for gas

L2s require minimal gas ($0.10-1.00)

AppChains may have zero gas (Hyperliquid)

💰 Step 3: Deposit Collateral

For Oracle Pools (GMX)

Navigate to GMX interface

Click "Connect Wallet"

Select "Deposit" tab

Choose asset (USDC recommended for beginners)

Enter amount (start small: $100-500)

Click "Deposit"

Approve transaction in wallet

Wait for confirmation

For CLOB (Hyperliquid)

Navigate to Hyperliquid interface

Connect wallet

Enable trading (sign message for session keys)

Click "Deposit"

Enter amount (USDC.e from Arbitrum)

Approve bridge transaction

Wait for confirmation (may take a few minutes)

Important: Hyperliquid uses a bridge—this is a trust point. Funds are locked in bridge contract.

📊 Step 4: Analyze Before You Trade

Check Funding Rate

Why It Matters: High funding rates can eat your profits

How to Check:

Navigate to market page

Look for "Funding Rate" or "Funding"

Check if positive (you pay) or negative (you receive)

Calculate annualized rate

Red Flags:

Funding rate > 0.05% per hour (very expensive)

Annualized > 50% (extremely expensive)

Consider waiting or choosing different market

Check Open Interest

Why It Matters: High OI = active market, low OI = risky

How to Check:

Look for "Open Interest" or "OI" metric

Compare to historical averages

Check OI trend (increasing = healthy)

Warning Signs:

OI suddenly dropping (liquidity leaving)

OI very low (illiquid market)

OI extremely high (crowded trade, high funding)

Check Liquidation Price

Before Opening Position:

Use protocol's liquidation calculator

Enter your planned margin and leverage

Note the liquidation price

Check if you have 20-30% buffer

Example:

Entry: $2,500

Leverage: 5x

Liquidation: ~$2,000

Buffer: 20% (safe)

🎯 Step 5: Configure Your Position

Choose Market

For Beginners: Start with major pairs

ETH/USD

BTC/USD

Why: Most liquid, lowest funding rates, most stable

Avoid:

Meme coins

Low-liquidity pairs

Exotic assets

Choose Direction

Long: Betting price goes up

Use when bullish

Pay funding if rate is positive

Short: Betting price goes down

Use when bearish

Receive funding if rate is positive

For First Trade: Choose direction based on clear technical or fundamental analysis, not emotion.

Choose Margin Mode

Isolated Margin (Recommended for beginners):

✅ Limited risk (only margin at risk)

✅ Easy to understand

✅ Safe for learning

Cross Margin (Advanced):

❌ Entire account at risk

❌ Can liquidate all positions

✅ Better for hedging strategies

For First Trade: Always use isolated margin.

Choose Leverage

Beginner Leverage:

2x-3x: Very safe, low risk

4x-5x: Moderate risk, recommended

6x-10x: Higher risk, for experienced

Calculation:

5x leverage = 20% price move = liquidation

10x leverage = 10% price move = liquidation

For First Trade: Start with 3x-5x maximum.

Set Position Size

Rule of Thumb: Risk only 1-5% of total capital per trade

Example:

Total Capital: $10,000

Risk Per Trade: 2% = $200

Margin: $200

Leverage: 5x

Position Size: $1,000

Why Small: First trades are for learning, not profit maximization.

📝 Step 6: Place Your Order

Order Types

Market Order (Oracle Pools):

Executes immediately at oracle price

Zero slippage (on oracle pools)

Simple, one-click execution

Limit Order (CLOB):

Executes only at your specified price

May not fill if price doesn't reach your level

Better control, but requires patience

For First Trade: Use market order (simpler) or limit order close to current price.

Set Stop Loss

Why Critical: Limits your maximum loss

How to Set:

Identify technical support/resistance

Set stop loss below support (long) or above resistance (short)

Ensure stop loss is 20-30% away from entry (for 5x leverage)

Example:

Entry: $2,500

Support: $2,400

Stop Loss: $2,390 (below support)

Max Loss: $110 (4.4% of position, 22% of margin)

For First Trade: Always set a stop loss.

Set Take Profit (Optional)

Why Useful: Locks in profits automatically

How to Set:

Identify technical target

Set take profit at target

Consider partial profits (close 50% at first target)

For First Trade: Optional, but good practice.

Review Before Submitting

Final Checklist:

⚡ Step 7: Execute and Monitor

Execute Order

Click "Place Order" or "Open Position"

Approve transaction in wallet

Wait for confirmation

Position appears in "Open Positions"

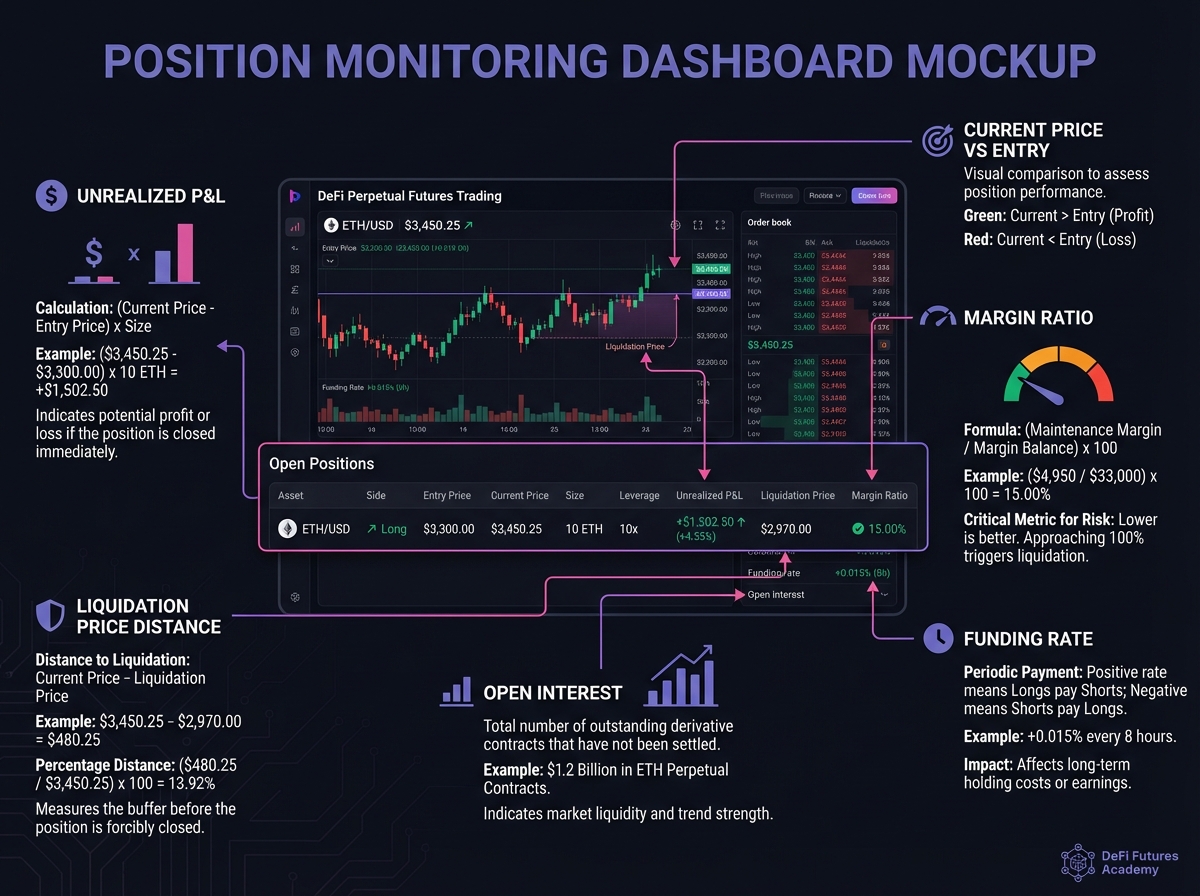

Monitor Your Position

Key Metrics to Watch:

Current Price: How far from entry?

Unrealized P&L: Profit or loss?

Liquidation Price: How close?

Margin Ratio: Percentage of margin used

Funding Rate: Current funding cost

Monitoring Frequency:

Active Trading: Check every few minutes

Swing Trading: Check daily

Never: Set and forget (always monitor)

When to Close

Close Immediately If:

Price hits stop loss

Price hits take profit

Funding rate becomes extreme

Market conditions change fundamentally

Consider Closing If:

Position is profitable and you're unsure

Liquidation price getting close

Better opportunity elsewhere

🎓 Beginner's Corner: Common First-Trade Mistakes

Mistake 1: Too Much Leverage

The Error: "I'll use 20x to maximize profits!"

The Reality: 20x leverage = 5% price move = liquidation. Very risky.

The Fix: Start with 3x-5x maximum.

Mistake 2: No Stop Loss

The Error: "I'll just watch it and close if it goes bad."

The Reality: Emotions take over, losses compound, liquidation happens.

The Fix: Always set stop loss before opening position.

Mistake 3: Ignoring Funding Rates

The Error: "Funding is only 0.01%, that's nothing."

The Reality: 0.01% per hour = 87.6% APR. On leveraged position, this is huge.

The Fix: Always check annualized funding rate.

Mistake 4: Cross Margin on First Trade

The Error: "Cross margin is easier, I'll use that."

The Reality: One bad trade can liquidate your entire account.

The Fix: Always use isolated margin for first trades.

Mistake 5: Trading Emotionally

The Error: "ETH is pumping, I need to get in now!"

The Reality: FOMO leads to bad entries, no stop loss, high leverage.

The Fix: Have a plan, stick to it, don't trade on emotion.

🔬 Advanced Deep-Dive: Position Management

Adding Margin

When to Add:

Price moving against you but still confident

Want to lower liquidation price

Want to increase position size

How to Add:

Navigate to position

Click "Add Margin" or "Deposit"

Enter additional amount

Approve transaction

Effect: Lowers liquidation price, increases safety buffer.

Reducing Position Size

When to Reduce:

Taking partial profits

Reducing risk

Market conditions changing

How to Reduce:

Navigate to position

Click "Close" or "Reduce"

Enter amount to close (e.g., 50%)

Approve transaction

Effect: Locks in profits, reduces exposure.

Trailing Stop Loss

Advanced Technique: Stop loss that follows price

How It Works:

If price moves in your favor, stop loss moves up (long) or down (short)

Locks in profits while allowing for more upside

Example:

Entry: $2,500

Initial Stop: $2,400

Price moves to $2,600

Trailing stop moves to $2,500 (break-even)

Price moves to $2,700

Trailing stop moves to $2,600 (locks in $100 profit)

For First Trade: Not necessary, but good to know exists.

📊 Real-World Example: Complete First Trade

Setup:

Protocol: GMX V2 (Arbitrum)

Market: ETH/USD

Direction: Long

Entry: $2,500

Margin: $200 (isolated)

Leverage: 5x

Position Size: $1,000

Pre-Trade Analysis:

Funding Rate: 0.005% per hour (acceptable)

Open Interest: $500M (healthy)

Liquidation Price: $2,000 (20% buffer)

Stop Loss: $2,400 (4% risk)

Execution:

Connect MetaMask (Arbitrum network)

Deposit $200 USDC

Navigate to ETH/USD market

Select "Long", "Isolated Margin", "5x Leverage"

Set stop loss at $2,400

Click "Open Position"

Approve transaction

Position opened

Monitoring (After 24 hours):

Current Price: $2,550

Unrealized P&L: +$50 (2% gain)

Funding Paid: $1.20 (24 hours × 0.005% × $1,000)

Net P&L: +$48.80

ROI: 24.4% on margin

Decision: Price hit first target, close 50% to lock profits, let 50% run with trailing stop.

🛠️ Calculate Your Position

Use this calculator to plan your first position:

🔑 Key Takeaways

Start with simple protocols (Oracle pools) and major pairs (ETH, BTC)

Always use isolated margin and low leverage (3x-5x) for first trades

Check funding rates and open interest before opening

Always set stop loss before executing

Monitor positions actively, don't set and forget

Start small—first trades are for learning, not profit maximization

Have a plan and stick to it—don't trade emotionally

🚀 Next Steps

Complete Exercise 4 to practice position setup

Proceed to Module 2 to learn about specific protocols

Start with a small test position ($50-100) to learn mechanics

Join protocol communities for support and questions

Last updated