Lesson 6: GMX V2 - Oracle-Based Liquidity Pools

🎧 Lesson Podcast

🎬 Video Overview

Lesson 6: GMX V2 - Oracle-Based Liquidity Pools

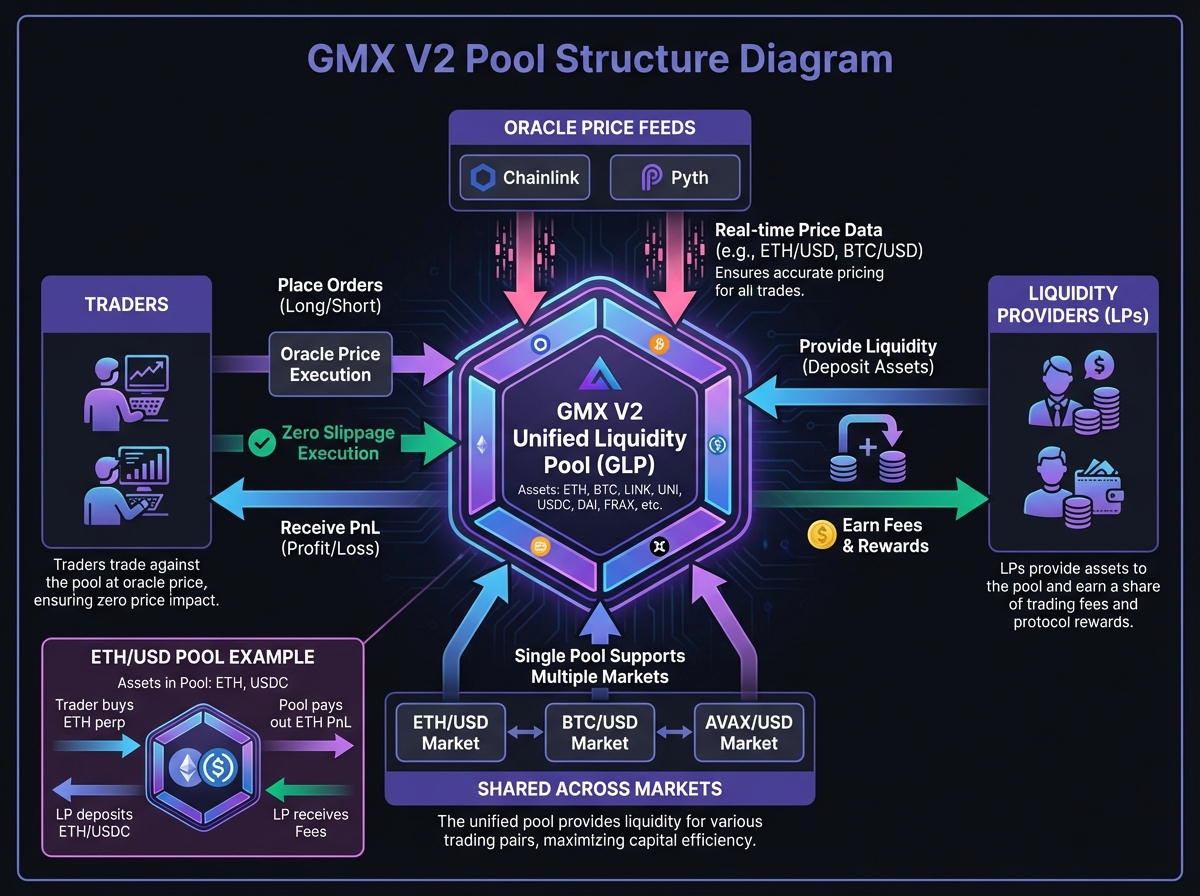

🎯 Core Concept: Zero Slippage Through Oracle Pricing

GMX V2 represents the evolution from a unified liquidity pool (GLP) to isolated market pools (GM), while maintaining the core innovation: zero price impact execution at oracle prices. This model eliminates order books entirely, allowing traders to execute any size at the oracle price, provided the pool has sufficient depth.

Why GMX V2 Matters

GMX V2 solved critical limitations of V1:

Risk Isolation: Each market has its own pool (no contagion)

Permissionless Listings: Can list volatile assets without threatening core markets

Dynamic Fees: Price impact fees balance Open Interest

Chainlink Data Streams: Low-latency oracle integration

Capital Efficiency: LPs choose exposure (not forced into all assets)

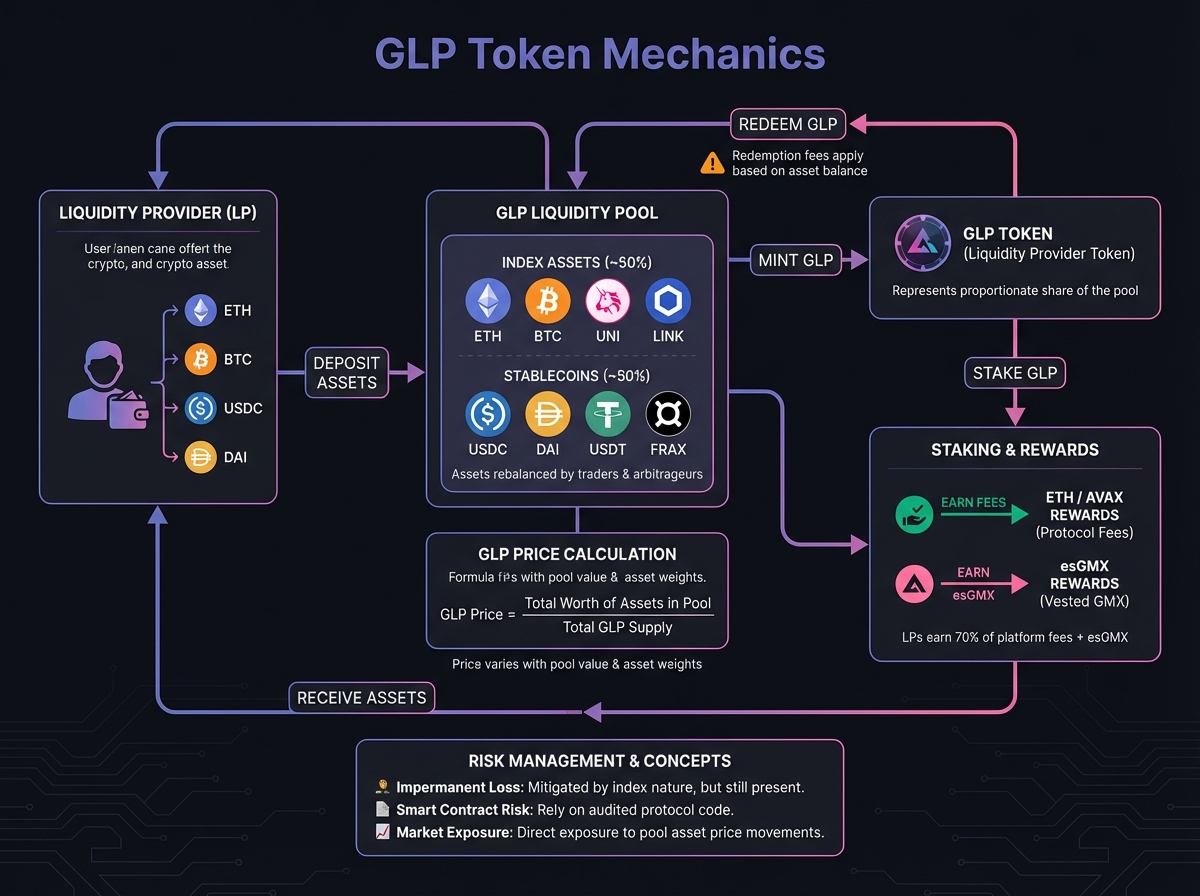

📚 The Evolution: GLP to GM Pools

GMX V1: The GLP Model

How It Worked:

Single unified pool (GLP token)

~50% stablecoins, ~50% volatile assets

All markets shared same liquidity

Zero price impact execution

Strengths:

✅ Deep liquidity (all assets pooled)

✅ Simple for LPs (one token: GLP)

✅ Zero slippage execution

Weaknesses:

❌ Risk contagion (one asset failure affects all)

❌ Limited asset listings (couldn't list risky assets)

❌ OI imbalances (no sophisticated rebalancing)

❌ Forced exposure (LPs exposed to all assets)

GMX V2: The GM Pool Model

How It Works:

Each market has dedicated pool (GM-ETH-USDC, GM-BTC-USDC, etc.)

Risk completely isolated

LPs choose which pools to deposit into

Permissionless market creation

Key Innovation: Moving from "communal" to "siloed" liquidity model.

🏗️ GM Pool Architecture

Structural Isolation

Example Markets:

ETH/USD → GM-ETH-USDC pool (ETH + USDC)

BTC/USD → GM-BTC-USDC pool (BTC + USDC)

SOL/USD → GM-SOL-USDC pool (SOL + USDC)

Isolation is Absolute:

Assets in ETH pool cannot settle SOL trades

If SOL pool fails, ETH pool unaffected

Each pool operates independently

Standard vs. Synthetic Markets

Standard Markets (Fully Backed)

How It Works:

Pool holds actual tokens being traded

ETH/USD pool holds ETH (Long Token) + USDC (Short Token)

Trader opens Long ETH = "rents" upside of pool's ETH

Example:

Pool has 1,000 ETH and 2,500,000 USDC

Trader opens $10,000 Long ETH position

If ETH rises 10%, trader profits from pool's ETH reserves

Use Cases: Blue-chip assets (BTC, ETH) with deep on-chain liquidity

Synthetic Markets (Partially Backed)

How It Works:

Pool backing doesn't match index token

DOGE/USD market backed by ETH + USDC (not DOGE)

Oracle tracks DOGE price, but settles using ETH/USDC

Example:

DOGE/USD market backed by ETH and USDC

Trader opens Long DOGE

If DOGE pumps 50% but ETH stays flat, pool faces delta mismatch

Risk Profile:

Higher risk (delta mismatch)

Stricter OI caps

Higher fees to discourage manipulation

Use Cases: Assets not native to chain, low on-chain liquidity

GM Token Valuation

GM Token Components:

Asset Value: Real-time value of Long + Short tokens in pool

Pending PnL: Net profit/loss of all open positions

If traders have $1M unrealized profit → GM token value decreases

If traders have $1M unrealized loss → GM token value increases

Accrued Fees: Auto-compounded trading fees

Key Insight: GM token holders are the "house" for that market—they earn fees but absorb trader PnL volatility.

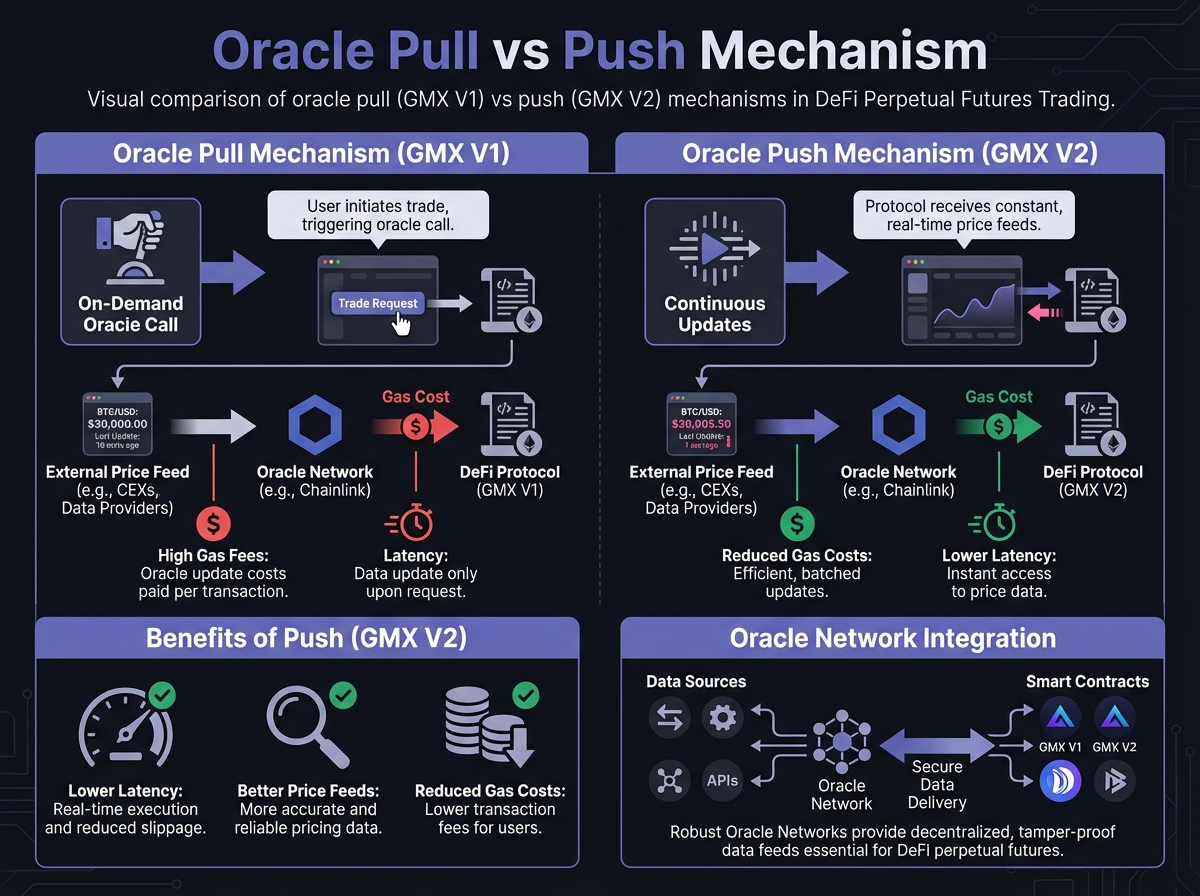

🔗 The Oracle Engine: Chainlink Data Streams

Push vs. Pull Architecture

V1 Push Model:

Chainlink nodes push updates when price deviates 0.1% or heartbeat expires

Creates latency gap (on-chain price can lag CEX)

Toxic arbitrageurs exploit stale prices

V2 Pull Model (Data Streams):

Chainlink aggregates prices off-chain at sub-second intervals

When trade occurs, latest price is "pulled" on-chain

Price data is seconds old (not hours)

Gas efficient (only updates when needed)

Two-Step Execution Process

Step 1: Order Submission

Trader submits transaction to "request" trade

Request queued in smart contract

Step 2: Order Execution

Keeper network monitors request queue

Keeper fetches latest Chainlink price signature

Keeper submits execution transaction

Trader pays execution fee (covers keeper gas)

Verification: Smart contract verifies Chainlink signature and timestamp. If stale or invalid, transaction reverts.

Zero Price Impact: Reality vs. Perception

What "Zero Price Impact" Means:

Trade executes at oracle Index Price

No spread widening due to order book depth

$10M order executes at same base price as $10 order

What It Doesn't Mean:

Total cost is not zero

Price Impact Fees apply (simulated slippage)

Large trades that unbalance pool pay higher fees

Key Distinction: GMX V2 simulates market depth via fees, not price spread.

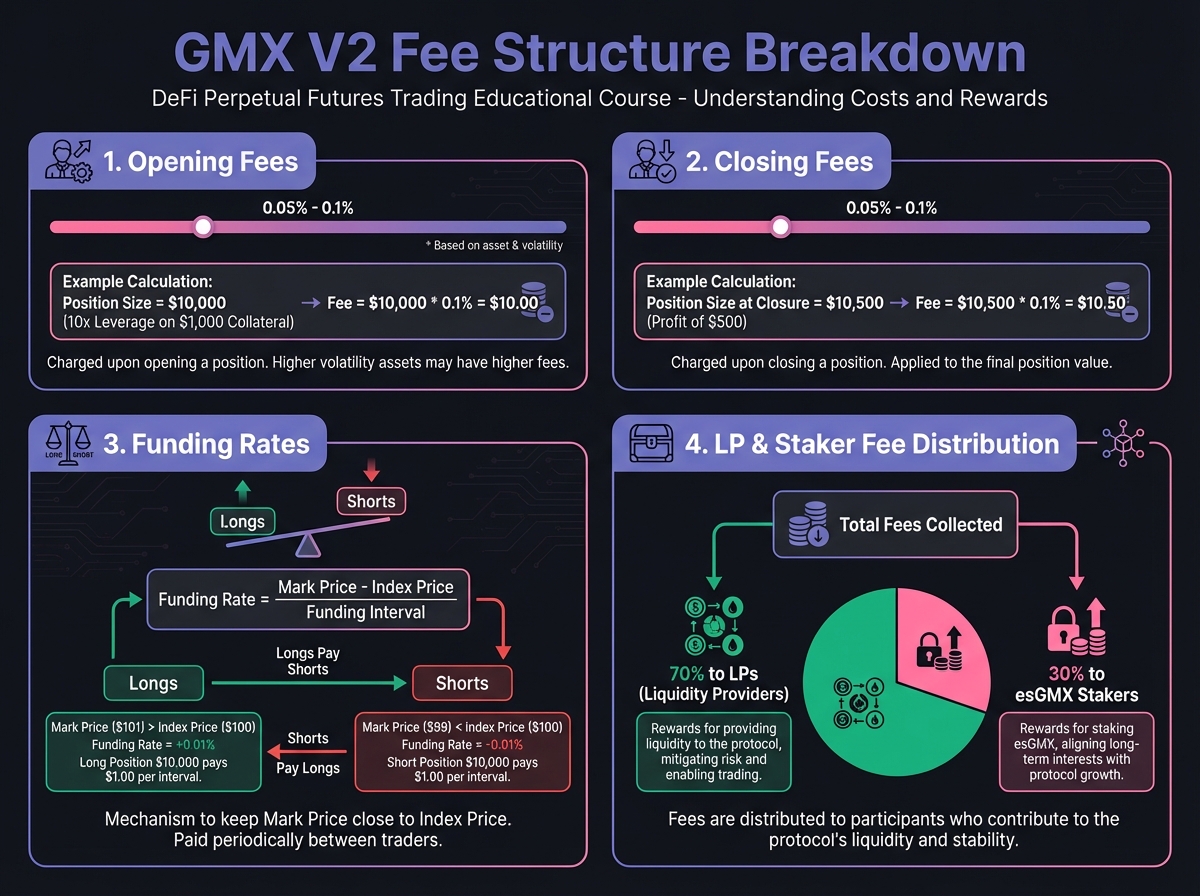

💰 The Multi-Layered Fee Structure

Base Trading Fees

V1: Flat 0.1% (10 bps)

V2: Dynamic 0.05% - 0.07% (5-7 bps)

Rebate Logic: Fee depends on trade's impact on pool balance

If trade increases imbalance (adds Longs to Long-heavy pool): 0.07%

If trade decreases imbalance (adds Shorts to Long-heavy pool): 0.05%

Purpose: Incentivize trades that rebalance the pool.

Price Impact Fee

The Innovation: Simulates market depth without order book.

How It Works:

Function of initial imbalance and target imbalance after trade

Large trades that unbalance pool pay higher fees

Small trades or rebalancing trades pay lower fees

Example:

Pool is 80% Long, 20% Short

Trader opens large Long position → High price impact fee

Trader opens Short position → Low price impact fee (rebalancing)

Purpose: Discourage toxic flow, reward arbitrageurs.

Funding Rate

V1: No funding rate (only borrow fee paid by both sides)

V2: Velocity-based funding rate

Responds to OI imbalance velocity

Fast imbalance growth → Higher funding

Encourages contrarian traders to rebalance

Borrow Fee

How It Works:

Utilization-based fee

High pool utilization → Higher borrow fee

Encourages LPs to deposit more capital

🎓 Beginner's Corner: Using GMX V2

Getting Started

Step 1: Network Configuration

Set MetaMask to Arbitrum One network

Add network if needed (Chainlist.org)

Step 2: Acquire Assets

Buy USDC on CEX or swap on DEX

Bridge to Arbitrum (official bridge or Synapse/Stargate)

Keep some ETH for gas

Step 3: Navigate to GMX

Go to GMX V2 interface

Connect wallet

Select "Trade" tab

Opening a Position

Step-by-Step:

Select Market: Choose ETH/USD (or other)

Check Pool: View pool depth and current OI

Choose Direction: Long or Short

Set Size: Enter collateral amount

Review Fees: See price impact fee estimate

Check Funding: Review current funding rate

Execute: Click "Open Position"

Approve: Sign transaction in wallet

Wait for Keeper: Keeper executes (usually <1 minute)

Key Metrics to Check:

Pool depth (sufficient liquidity?)

Open Interest (balanced or skewed?)

Funding rate (acceptable?)

Price impact fee (reasonable for your size?)

🔬 Advanced Deep-Dive: LP Strategy

Pool Selection

For Conservative LPs:

Standard markets (ETH, BTC)

Large pool depth

Balanced OI

Lower fees but safer

For Aggressive LPs:

Synthetic markets (higher risk/reward)

Smaller pools (higher fee share)

Volatile assets (more trading = more fees)

Delta-Neutral Strategies

The Concept: Eliminate price exposure while earning fees.

How It Works:

Deposit into GM pool (e.g., GM-ETH-USDC)

Hedge ETH exposure on CEX or spot market

Earn GM fees while price-neutral

Example:

Deposit $10,000 into GM-ETH-USDC pool

Short $10,000 ETH on CEX

Net exposure: ~0 (delta neutral)

Earn: GM trading fees + funding (if favorable)

Risk: Basis risk (GM price vs CEX price divergence)

GMX Liquidity Vaults (GLV)

What They Are: Automated vaults that manage GM exposure.

How They Work:

Deposit into GLV

Vault automatically:

Selects pools

Manages delta exposure

Rebalances as needed

Benefits:

Passive management

Professional strategies

Diversification

Risks:

Vault manager risk

Strategy risk

Fees (management + performance)

⚠️ Risks and Considerations

Oracle Risk

Latency Arbitrage:

Even with Data Streams, small latency exists

Sophisticated arbitrageurs can exploit

LPs bear the cost (toxic flow)

Oracle Manipulation:

Rare but possible

Chainlink has safeguards

Monitor for unusual price movements

Pool Insolvency Risk

When It Happens:

Traders win big (pool pays out)

Pool assets insufficient to cover

GM token value decreases

Mitigation:

OI caps prevent excessive exposure

Price impact fees discourage large imbalanced trades

Funding rates incentivize rebalancing

Keeper Centralization

Risk: If keeper network is centralized or colludes:

Could censor transactions

Could delay execution

Could manipulate timing

Mitigation:

Multiple keeper networks

Decentralization efforts

Monitor keeper performance

📊 Real-World Example: Trading on GMX V2

Scenario: Open $10,000 Long ETH position

Setup:

Protocol: GMX V2 (Arbitrum)

Market: ETH/USD

Collateral: $2,000 USDC

Leverage: 5x

Execution:

Navigate to GMX V2, connect wallet

Select ETH/USD market

Check pool depth: $50M (sufficient)

Check OI: 60% Long, 40% Short (slightly imbalanced)

Check funding: 0.01% per hour (acceptable)

Enter $2,000 collateral, 5x leverage

Review price impact fee: 0.02% ($2)

Click "Open Position"

Approve transaction

Keeper executes within 30 seconds

Position opened at oracle price ($2,500)

Advantages:

Zero slippage (executed at oracle price)

Simple execution (no order book)

Large size capability (pool has depth)

Costs:

Trading fee: 0.06% ($6)

Price impact fee: 0.02% ($2)

Funding: 0.01% per hour

Total upfront: $8

⚖️ Compare Protocols

See how GMX V2 compares to other perpetual DEXs:

🔑 Key Takeaways

GMX V2 uses isolated pools (no risk contagion)

Zero price impact execution at oracle prices

Chainlink Data Streams enable low-latency pricing

Dynamic fees (price impact, funding, borrow) balance OI

Standard markets (backed) vs Synthetic markets (delta mismatch)

GM tokens represent pool equity (asset value + PnL + fees)

Best for: Large position traders, LPs seeking yield, simple execution

🚀 Next Steps

Proceed to Lesson 7 to learn about Drift's hybrid architecture

Complete Exercise 6 to practice GMX V2 market analysis

Explore GMX V2 interface to see oracle-based execution

Consider GM pools for liquidity provision strategies

Last updated