Lesson 10: Risk Management and Position Protection

🎧 Lesson Podcast

🎬 Video Overview

Lesson 10: Risk Management and Position Protection

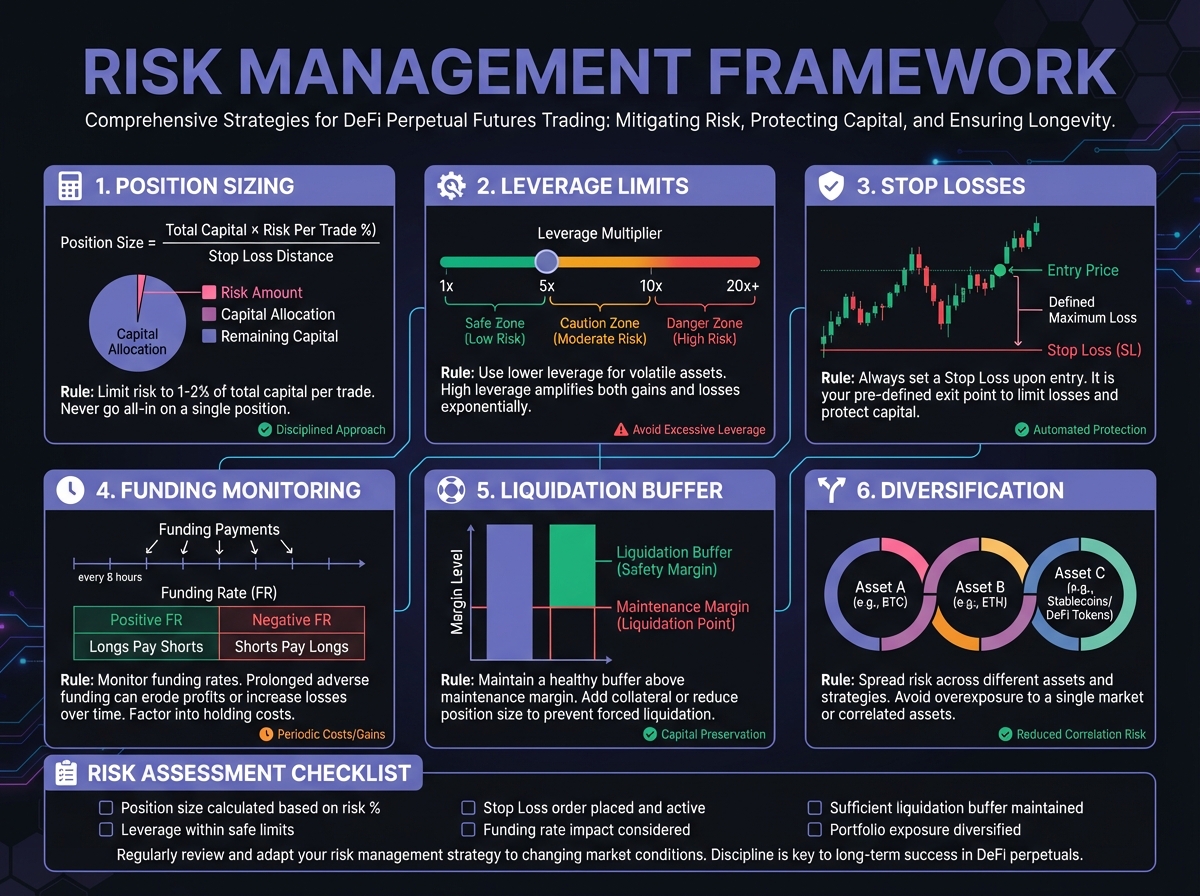

🎯 Core Concept: Risk Management is Non-Negotiable

Why Risk Management Matters

⚠️ Common Mistakes and How to Avoid Them

Mistake 1: Funding Rate Neglect

Mistake 2: Misunderstanding Liquidation Buffers

Mistake 3: Cross-Margin Contagion

Mistake 4: Chasing the Liquidity Mirage

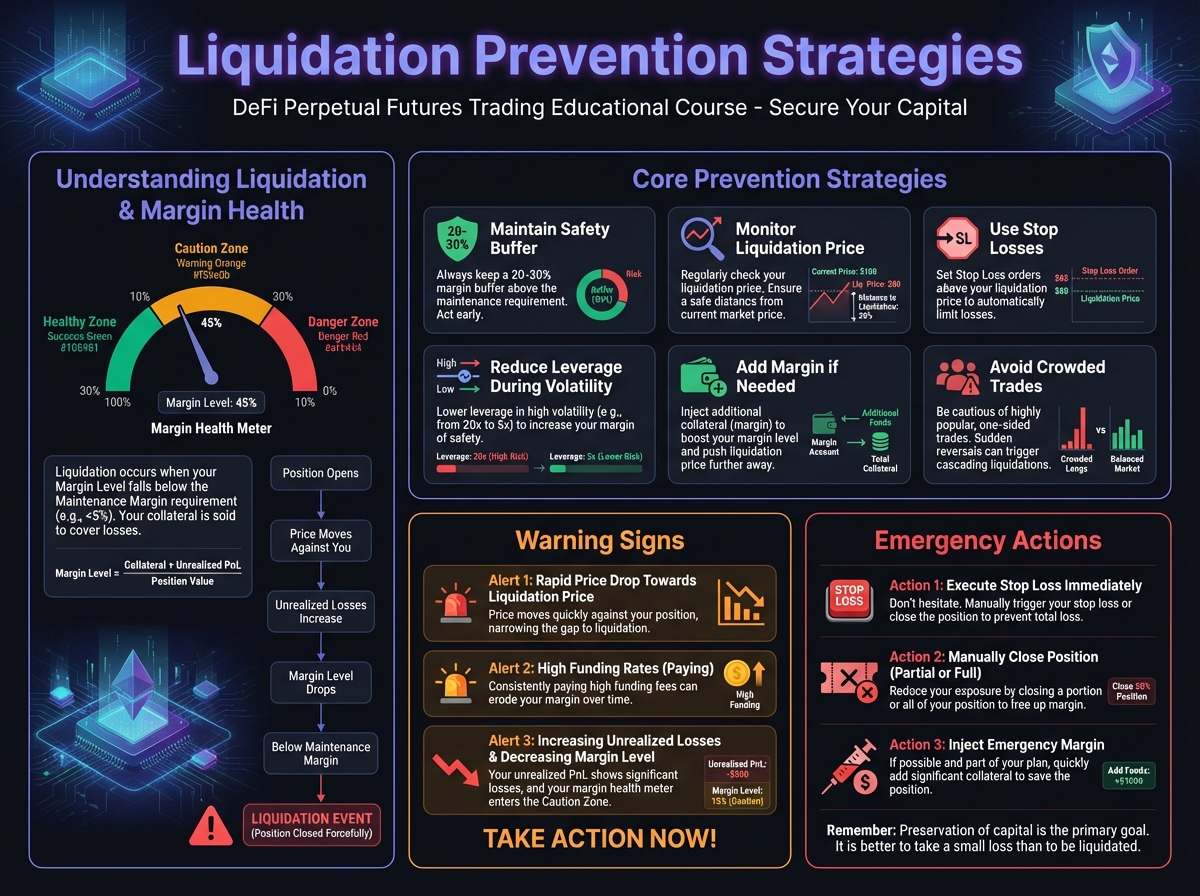

🛡️ Liquidation Prevention Strategies

Strategy 1: Maintain Safety Buffers

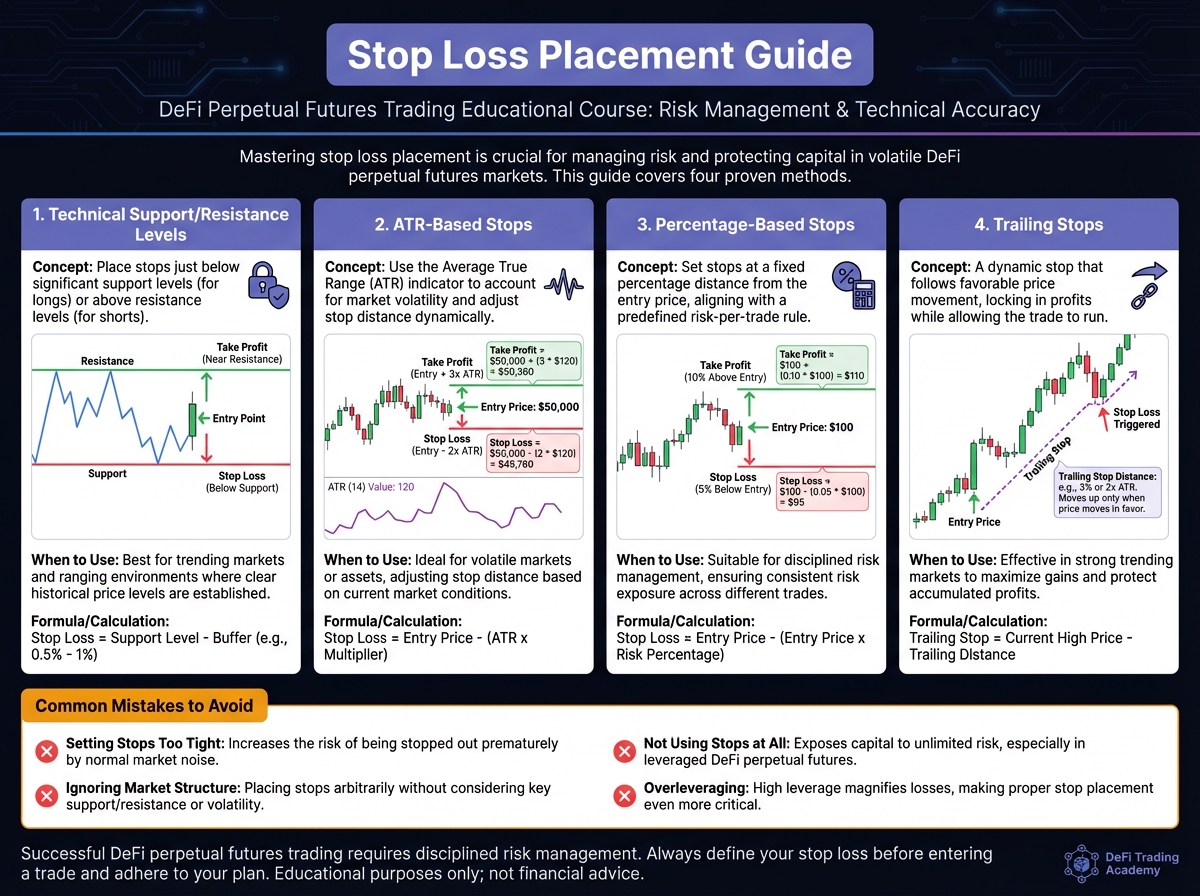

Strategy 2: Use Stop Losses Religiously

Strategy 3: Position Sizing

Strategy 4: Add Margin Proactively

🔒 Systemic Risk Protection

Oracle Risk Mitigation

Bridge Risk Mitigation

Smart Contract Risk Mitigation

📊 Margin Management Best Practices

Isolated vs. Cross Margin Decision Tree

Portfolio Health Monitoring

🎓 Beginner's Corner: Your Risk Management Checklist

Pre-Trade Checklist

During-Trade Checklist

Emergency Response Plan

🔬 Advanced Deep-Dive: Professional Risk Systems

Multi-Position Risk Management

Automated Risk Management

Insurance and Hedging

📊 Real-World Example: Complete Risk Management

✅ Pre-Trade Risk Assessment Tool

🔑 Key Takeaways

🚀 Next Steps

PreviousExercise 9: Funding Rate Arbitrage FrameworkNextExercise 10: Risk Management Framework Design

Last updated