Lesson 1: Understanding Perpetual Futures Fundamentals

🎧 Lesson Podcast

🎬 Video Overview

Lesson 1: Understanding Perpetual Futures Fundamentals

🎯 Core Concept: What is a Perpetual Future?

A perpetual future (or "perp") is a derivative contract that allows you to speculate on the price of an asset without an expiration date. Unlike traditional futures that settle on a specific date, perpetuals use a "funding rate" mechanism to keep the contract price aligned with the spot price indefinitely.

Why Perpetual Futures Matter

Before perpetual futures, if you wanted to trade with leverage:

You needed centralized exchanges (like Binance or BitMEX)

You had to trust the exchange to hold your funds

You were exposed to counterparty risk (as seen with FTX collapse)

You had limited transparency into order matching

Perpetual futures on decentralized exchanges changed everything by:

Eliminating counterparty risk: Self-custody of funds via smart contracts

Enabling permissionless trading: Trade any asset, anywhere, anytime

Providing transparency: All trades and prices are on-chain, verifiable

Offering leverage: Amplify your position size with borrowed capital

Creating composability: Integrate with other DeFi protocols

📚 The Evolution: From CEX to DEX Perpetuals

Traditional Futures (CEX Model)

Traditional futures contracts have:

Expiration dates: Contracts settle on a specific date (weekly, monthly, quarterly)

Physical or cash settlement: You must close or roll positions before expiry

Centralized matching: Orders matched by exchange servers

Custodial risk: Exchange holds your funds

Example: A BTC futures contract expiring on December 31st must be closed or rolled to the next contract before that date.

The Perpetual Revolution

Perpetual futures eliminate expiration dates by using a funding rate mechanism:

No expiry: Hold positions indefinitely (as long as you maintain margin)

Funding payments: Long and short positions pay/receive funding to keep price aligned

Continuous trading: No need to roll contracts

On-chain settlement: Smart contracts handle everything

Key Innovation: Instead of forcing price convergence through expiration, perpetuals use periodic funding payments to incentivize arbitrage and maintain price parity with spot markets.

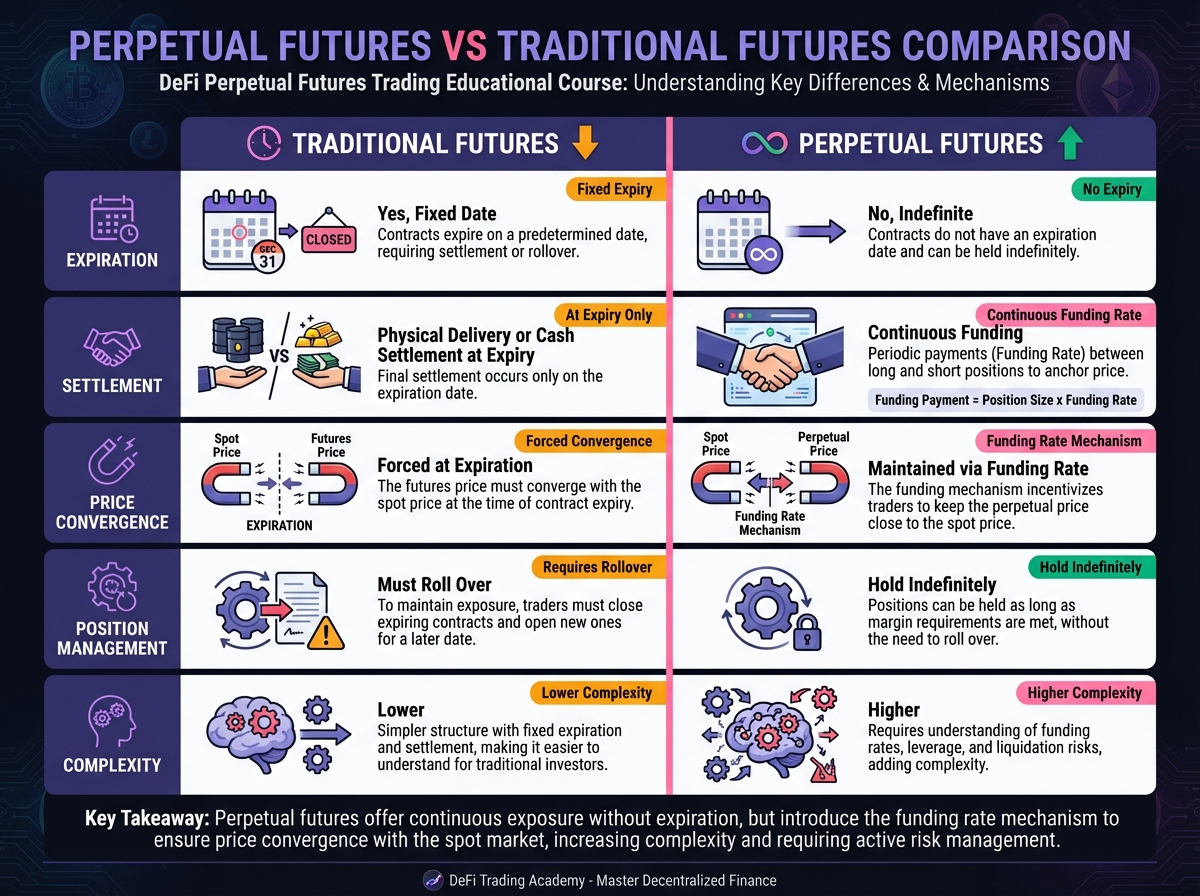

🔄 Perpetual Futures vs Traditional Futures

Expiration

Yes (weekly/monthly)

No (perpetual)

Settlement

Physical or cash on expiry

Continuous funding payments

Price Convergence

Forced at expiration

Maintained via funding rate

Position Management

Must roll before expiry

Hold indefinitely

Complexity

Lower (simple expiry)

Higher (funding mechanics)

💰 Core Concepts: The Foundation

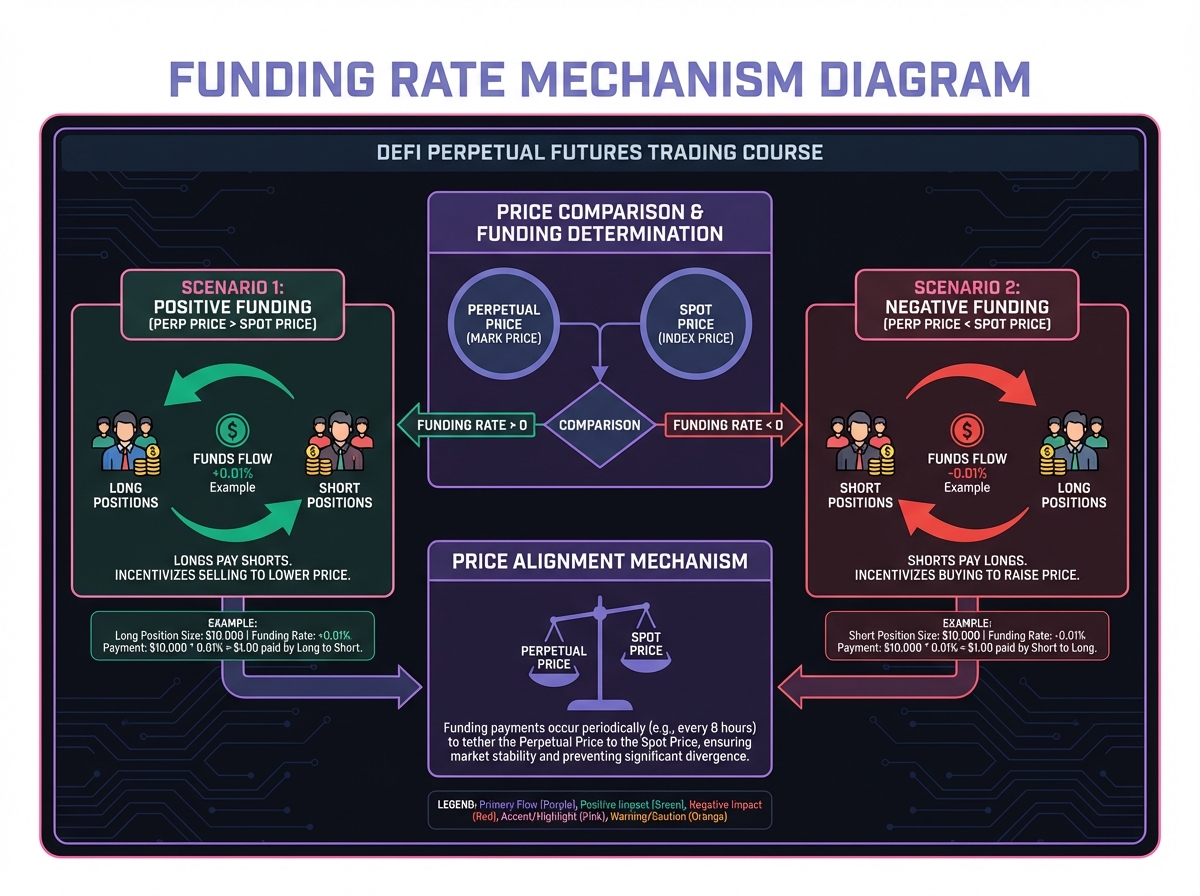

Funding Rates

The funding rate is the mechanism that keeps perpetual prices aligned with spot prices:

Positive Funding: When perpetual price > spot price

Long positions pay short positions

Discourages buying, encourages selling

Drives perpetual price down toward spot

Negative Funding: When perpetual price < spot price

Short positions pay long positions

Discourages selling, encourages buying

Drives perpetual price up toward spot

Frequency: Most protocols calculate funding every hour or every 8 hours. High-performance chains like Hyperliquid calculate funding continuously or every block.

Strategic Implication: Funding rates can be significant. In strong trends, annualized funding rates can exceed 100%. Holding a position against the funding rate can erode capital, turning a profitable price move into a net loss.

Leverage

Leverage allows you to control a larger position with less capital:

Example: With 10x leverage, $1,000 controls a $10,000 position

Amplification: Profits and losses are multiplied by the leverage factor

Risk: Higher leverage = higher liquidation risk

Common Leverage Levels:

Conservative: 2-5x (recommended for beginners)

Moderate: 5-10x (intermediate traders)

Aggressive: 10-50x+ (advanced traders, high risk)

Margin

Margin is the collateral you deposit to open and maintain a position:

Initial Margin: Required to open a position (e.g., 10% for 10x leverage)

Maintenance Margin: Minimum required to keep position open (e.g., 5%)

Margin Call: When margin falls below maintenance, position is liquidated

Example:

Open 10x long BTC with $1,000 margin

Position size: $10,000

If BTC drops 10%, you lose $1,000 (100% of margin)

If BTC drops 11%, you're liquidated (below maintenance margin)

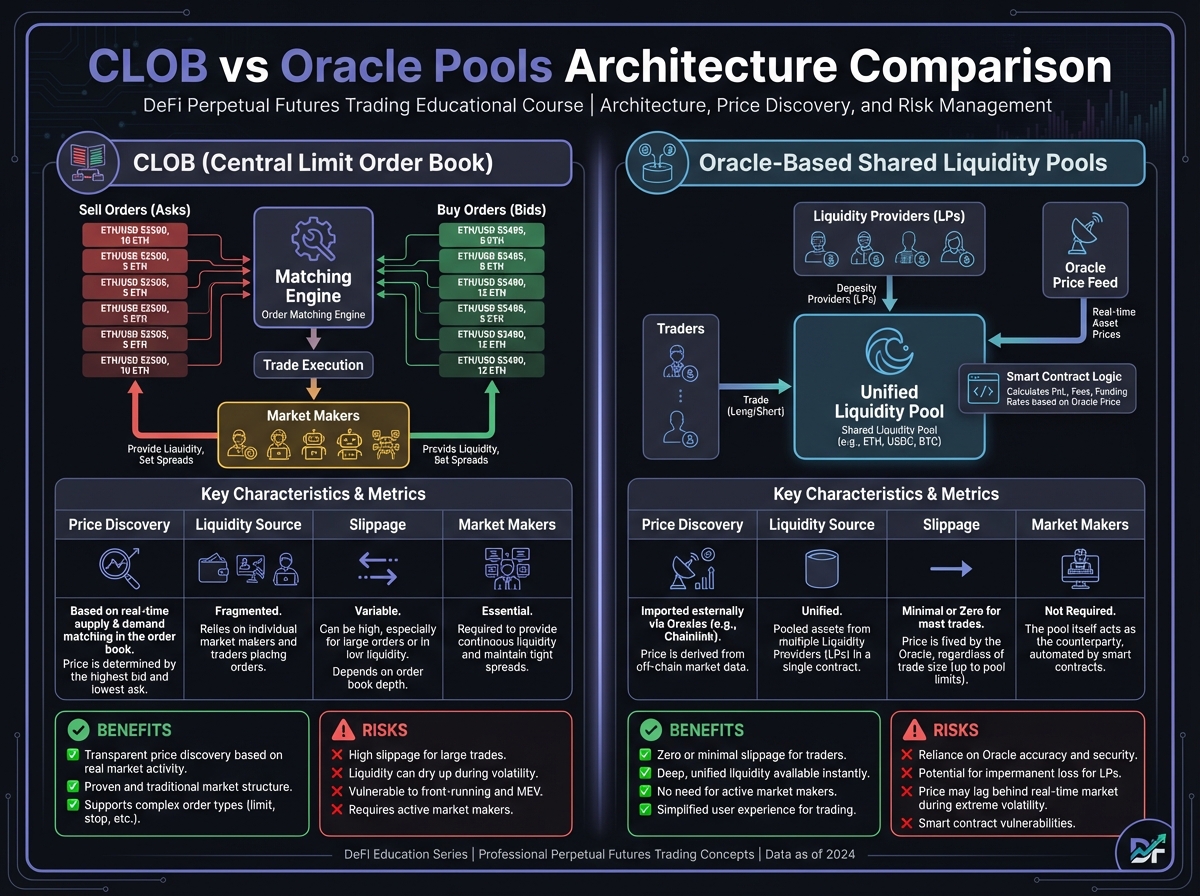

🏗️ The Two Main Models: CLOB vs Oracle Pools

Understanding the architecture of a perpetual DEX is critical for risk assessment and strategy selection.

Central Limit Order Book (CLOB)

How It Works:

Market makers post buy/sell orders at specific prices

Traders execute against the order book

Price discovery happens through supply and demand

Examples: Hyperliquid, dYdX v4, EdgeX

Benefits:

✅ CEX-like experience (limit orders, stop losses)

✅ Transparent price discovery

✅ Deep liquidity (if market makers are active)

Risks:

❌ Slippage on large orders

❌ Front-running risk

❌ Requires active market makers

Oracle-Based Shared Liquidity Pools

How It Works:

Traders trade against a unified liquidity pool (not other traders)

Prices come from external oracles (Chainlink, Pyth)

Zero price impact (executed at oracle price)

Examples: GMX V2, Gains Network, Jupiter

Benefits:

✅ Zero slippage (executed at oracle price)

✅ Simple execution (swap-like interface)

✅ No need for market makers

Risks:

❌ Oracle latency arbitrage

❌ Pool insolvency risk

❌ Limited price discovery

🎓 Beginner's Corner: Common Questions

Q: What's the difference between perpetuals and spot trading? A: Spot trading means you own the asset. Perpetuals let you speculate on price without owning it, using leverage. You can go long (bet price goes up) or short (bet price goes down).

Q: Why do I pay funding rates? A: Funding rates keep the perpetual price aligned with the spot price. If you're long and funding is positive, you pay shorts. This prevents the perpetual from trading too far above spot.

Q: Can I lose more than I deposit? A: With isolated margin, your maximum loss is limited to your margin. With cross margin, one losing position can drain your entire account.

Q: What happens if I get liquidated? A: The protocol automatically closes your position and seizes your remaining collateral. You lose your margin (minus liquidation fees).

Q: Are perpetuals safer than CEX trading? A: Perpetuals on DEXs eliminate counterparty risk (no exchange can steal your funds), but you still face liquidation risk, smart contract risk, and oracle risk.

⚠️ Critical Differences from Spot Trading

Ownership

You own the asset

You speculate on price

Leverage

1x (no leverage)

2x-100x+ available

Funding Costs

None

Periodic funding payments

Liquidation Risk

None (you own it)

High (if margin insufficient)

Short Selling

Difficult/expensive

Easy (just open short)

Capital Efficiency

Low (need full value)

High (need only margin)

🔬 Advanced Deep-Dive: The Economics of Perpetuals

Why Perpetuals Exist

Traditional futures require expiration because:

Physical delivery forces price convergence

Cash settlement forces price convergence

Without convergence, arbitrage opportunities emerge

Perpetuals solve this by:

Using funding rates to incentivize arbitrage

Making funding payments continuous (not just at expiry)

Allowing positions to exist indefinitely

The Funding Rate Formula

Most protocols calculate funding as:

Positive: Perp > Spot → Longs pay shorts

Negative: Perp < Spot → Shorts pay longs

The adjustment factor varies by protocol and market conditions.

Market Maker vs Trader Dynamics

In CLOB models:

Market makers provide liquidity (earn spread)

Traders pay spread + funding

Competition tightens spreads

In Oracle pool models:

LPs provide liquidity (earn fees)

Traders pay fees + funding

Pool absorbs all risk

📊 Real-World Example: Opening a Position

Scenario: You want to go long ETH at $2,500 with 5x leverage

Deposit Margin: $1,000 USDC

Position Size: $5,000 (5x leverage)

Entry Price: $2,500

Liquidation Price: ~$2,000 (depends on maintenance margin)

If ETH goes to $3,000:

Profit: ($3,000 - $2,500) × 5 = $2,500

ROI: 250% on your $1,000 margin

If ETH goes to $2,000:

Loss: ($2,500 - $2,000) × 5 = $2,500

But you only have $1,000 margin → LIQUIDATED

Key Takeaway: Leverage amplifies both profits and losses. A 20% price move against you with 5x leverage = 100% loss.

🔑 Key Takeaways

Perpetual futures are derivative contracts without expiration dates

Funding rates keep perpetual prices aligned with spot prices

Leverage amplifies both profits and losses

Two main architectures: CLOB (order book) and Oracle pools

Margin requirements protect the protocol from insolvency

Liquidation risk is real and can result in total loss

🚀 Next Steps

Proceed to Lesson 2 to dive deeper into the mathematics of funding rates, margin, and liquidations

Explore a perpetual DEX interface (Hyperliquid, GMX, or Drift) to see these concepts in action

Start with small positions and low leverage to learn safely

Last updated