Lesson 11: Advanced Topics and Emerging Trends

🎧 Lesson Podcast

🎬 Video Overview

Lesson 11: Advanced Topics and Emerging Trends

🎯 Core Concept: The Future of Perpetual Trading

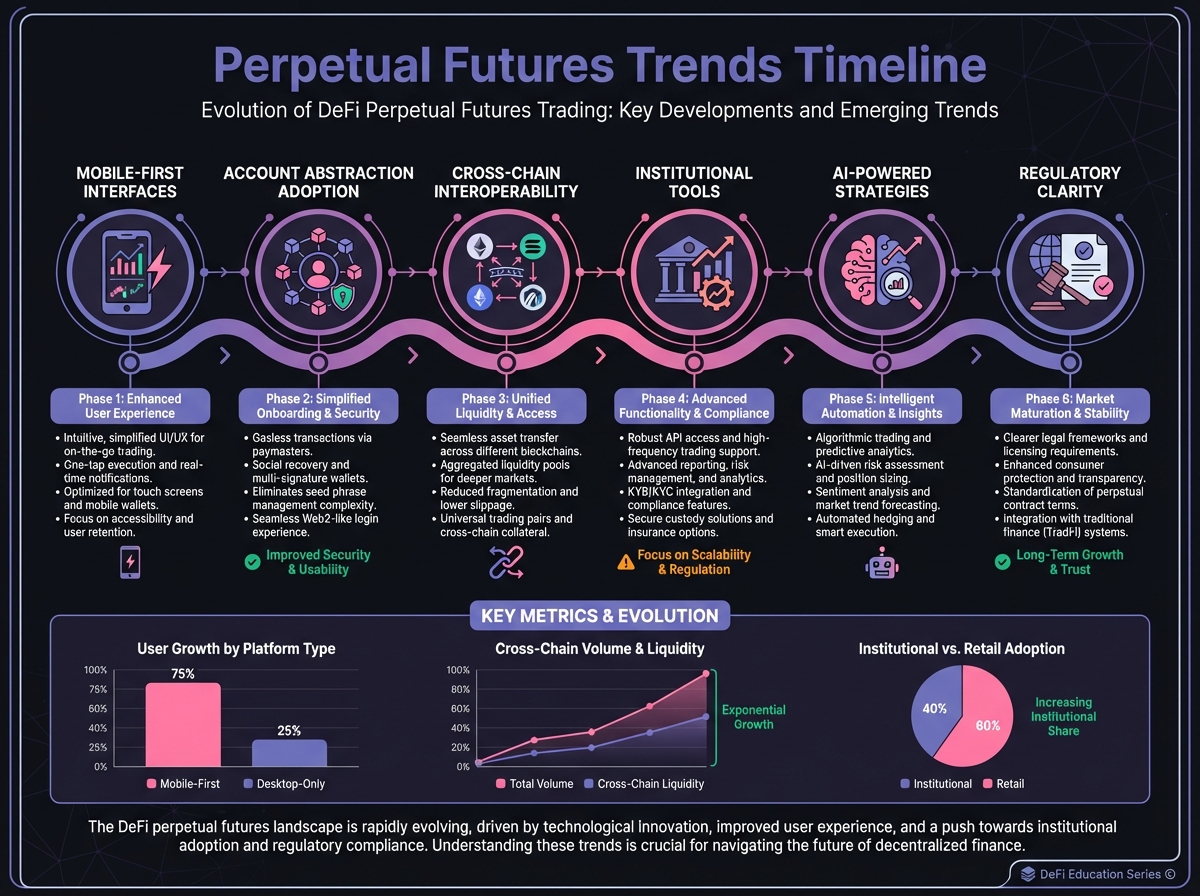

Why Emerging Trends Matter

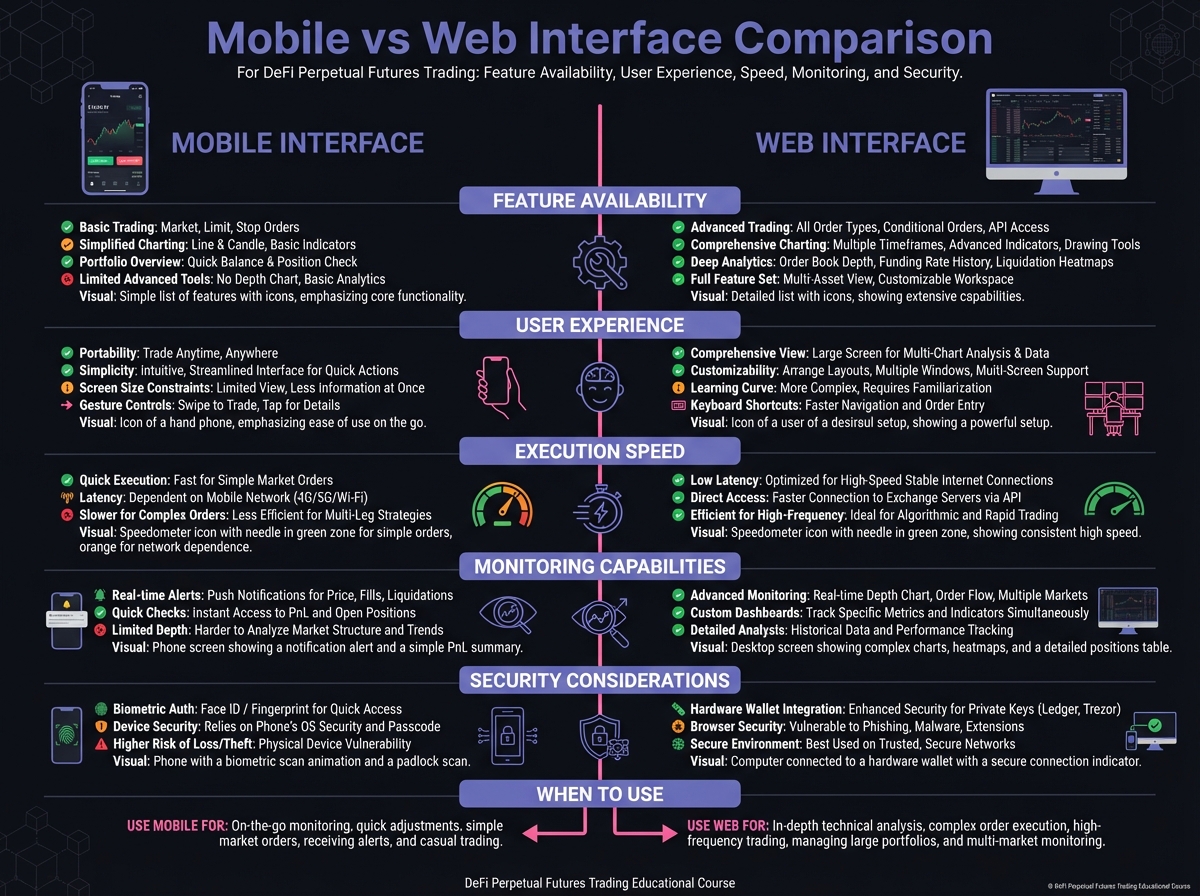

📱 Mobile-First Trading Revolution

The Mobile Trading Shift

Native Apps vs. Mobile Web

Impact on Trading

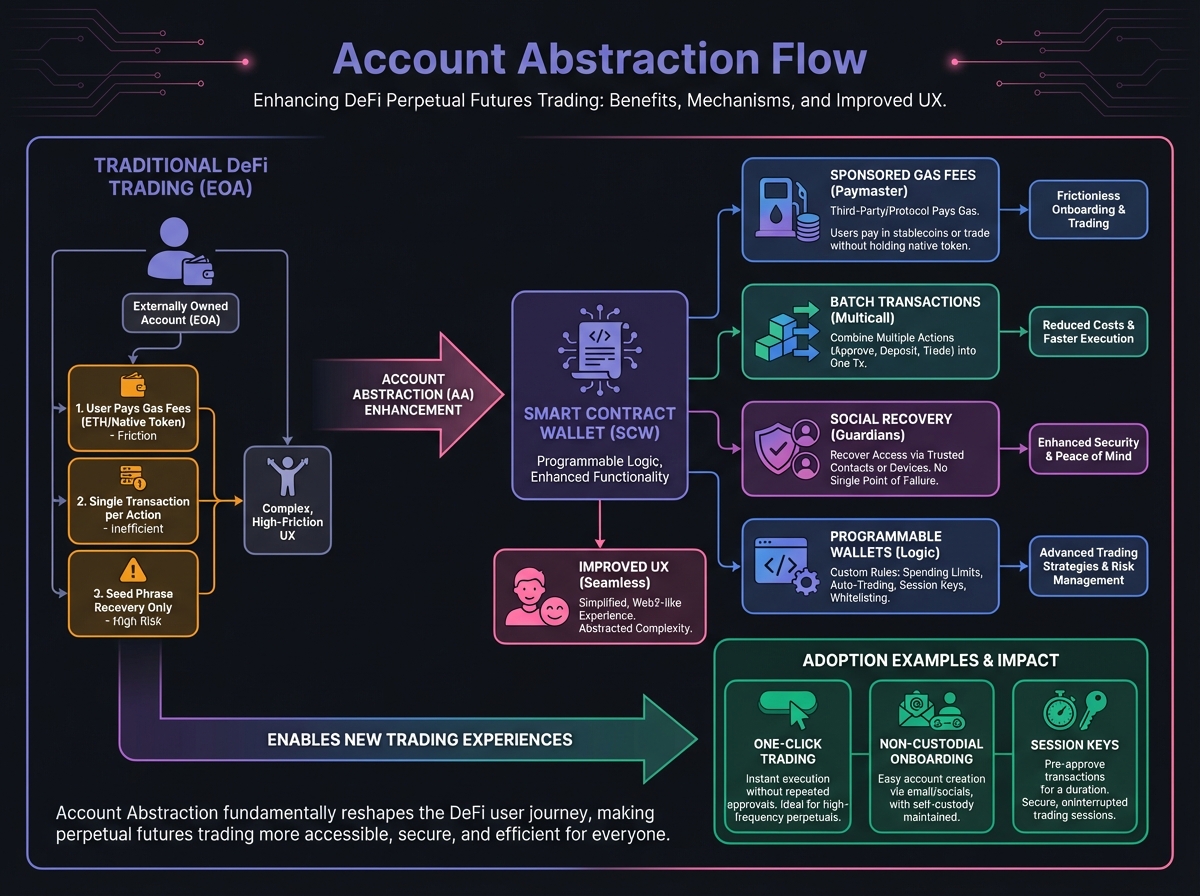

🔐 Account Abstraction and UX Innovation

The Account Abstraction Revolution

Unified Margin Systems

💎 Yield-Bearing Collateral

The Capital Efficiency Imperative

Future Expansion

🛡️ MEV Protection Strategies

The MEV Problem

MEV Internalization (Drift's JIT)

Future Solutions

🔮 Prediction Markets Integration

The Convergence Trend

📊 Advanced Order Types

Oracle-Pegged Orders

Advanced Stop Losses

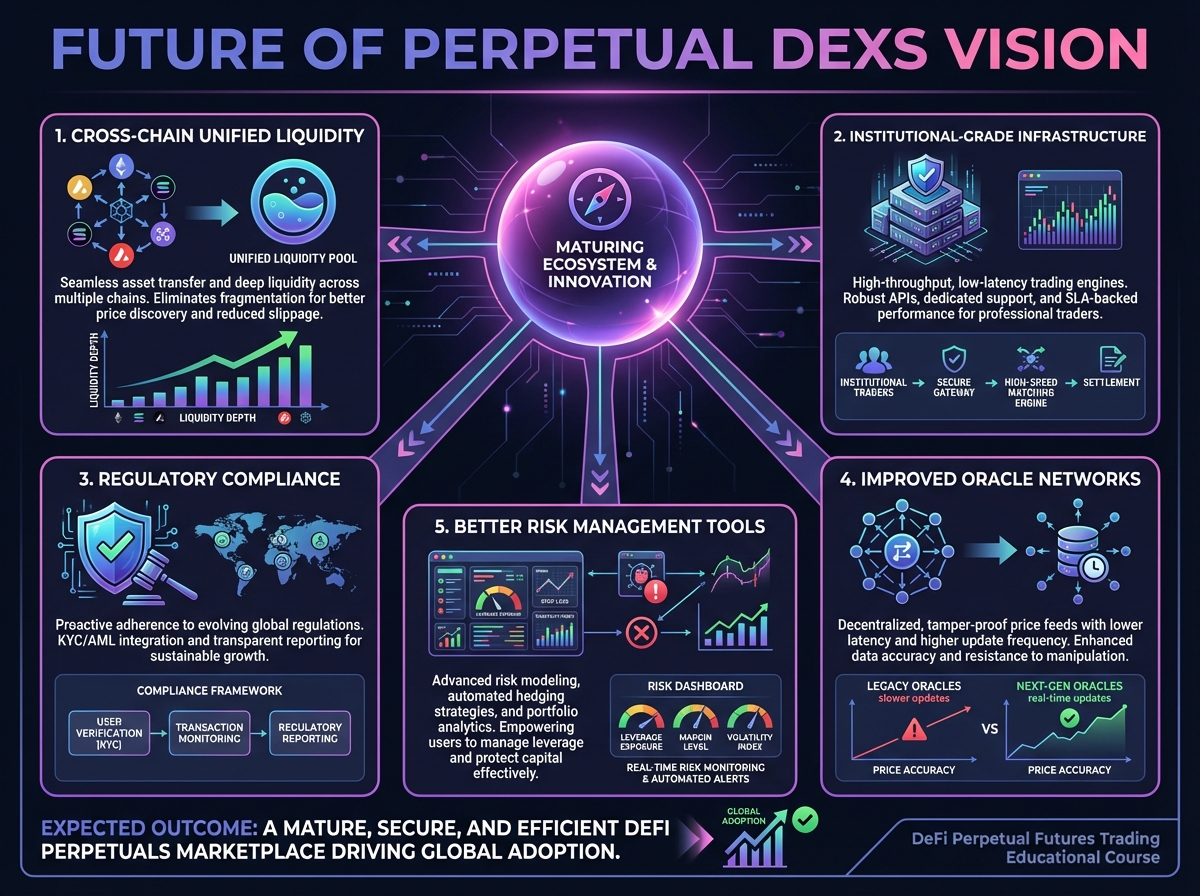

🌐 Multi-Chain and Cross-Chain Innovations

True Multi-Chain Trading

Cross-Chain Arbitrage

🤖 Automation and Bot Strategies

Automated Trading Bots

Vault Strategies

📈 Real Yield and Sustainability

The Shift from Token Emissions

🔒 Privacy and Regulatory Trends

Privacy Features

Regulatory Compliance

🎓 Beginner's Corner: Which Trends Matter?

For Beginners

For Advanced Traders

🔬 Advanced Deep-Dive: The Convergence Thesis

CeFi and DeFi Convergence

Super-App Ecosystems

📊 Real-World Example: Leveraging Trends

🔑 Key Takeaways

🚀 Next Steps

Last updated