Lesson 3: Architecture Types and Market Structure

🎧 Lesson Podcast

🎬 Video Overview

Lesson 3: Architecture Types and Market Structure

🎯 Core Concept: Architecture Determines Everything

🏗️ The Three Architectural Models

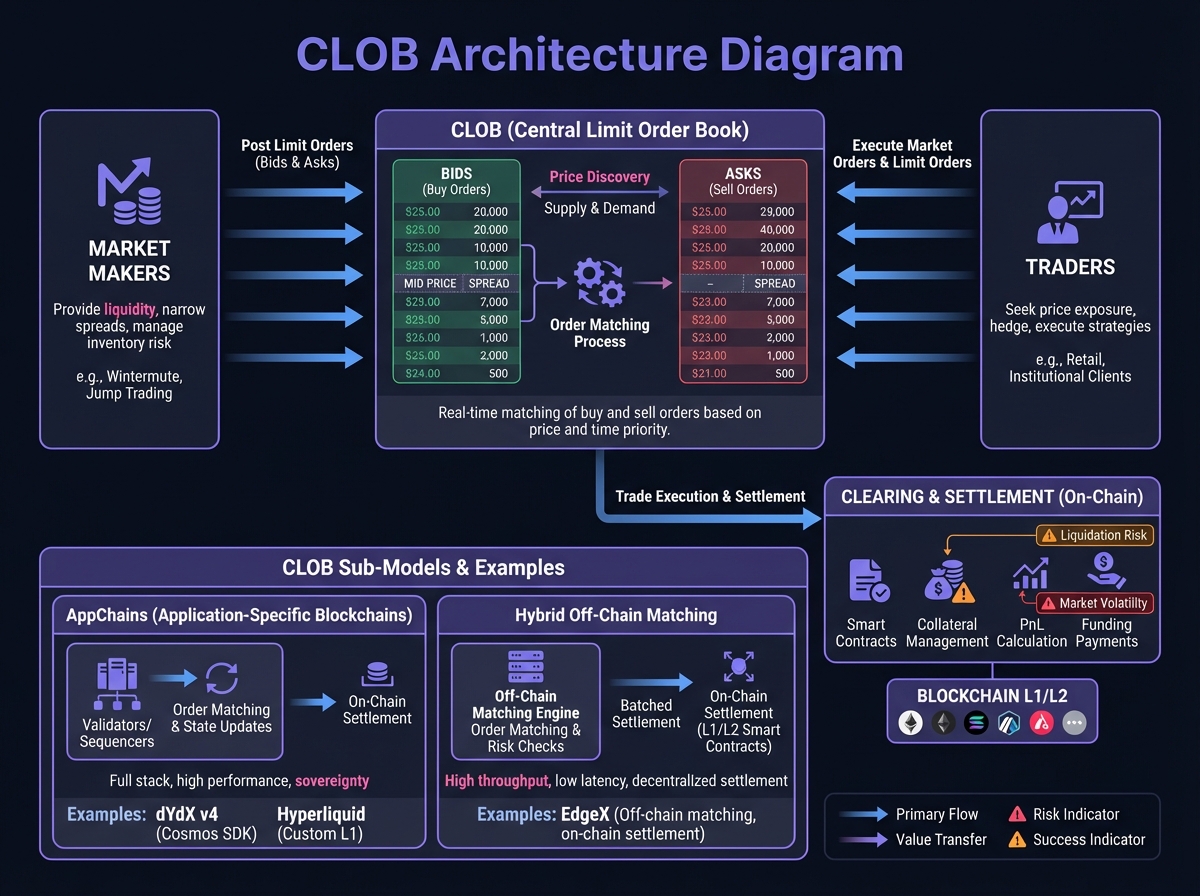

📚 Model 1: Central Limit Order Book (CLOB)

How CLOB Works

CLOB Sub-Models

CLOB Characteristics

Feature

Description

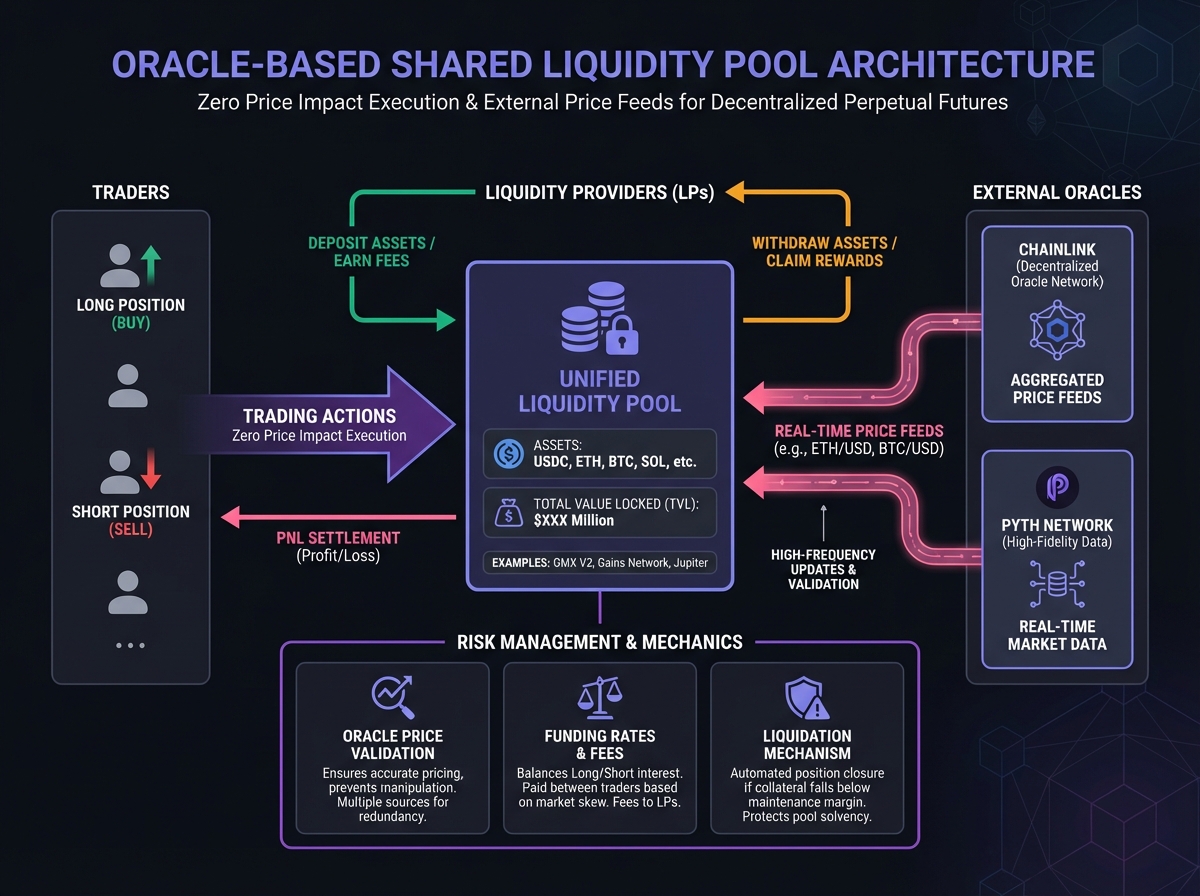

💧 Model 2: Oracle-Based Shared Liquidity Pools

How Oracle Pools Work

Oracle Pool Mechanism

Oracle Pool Characteristics

Feature

Description

Benefits of Oracle Pools

Risks of Oracle Pools

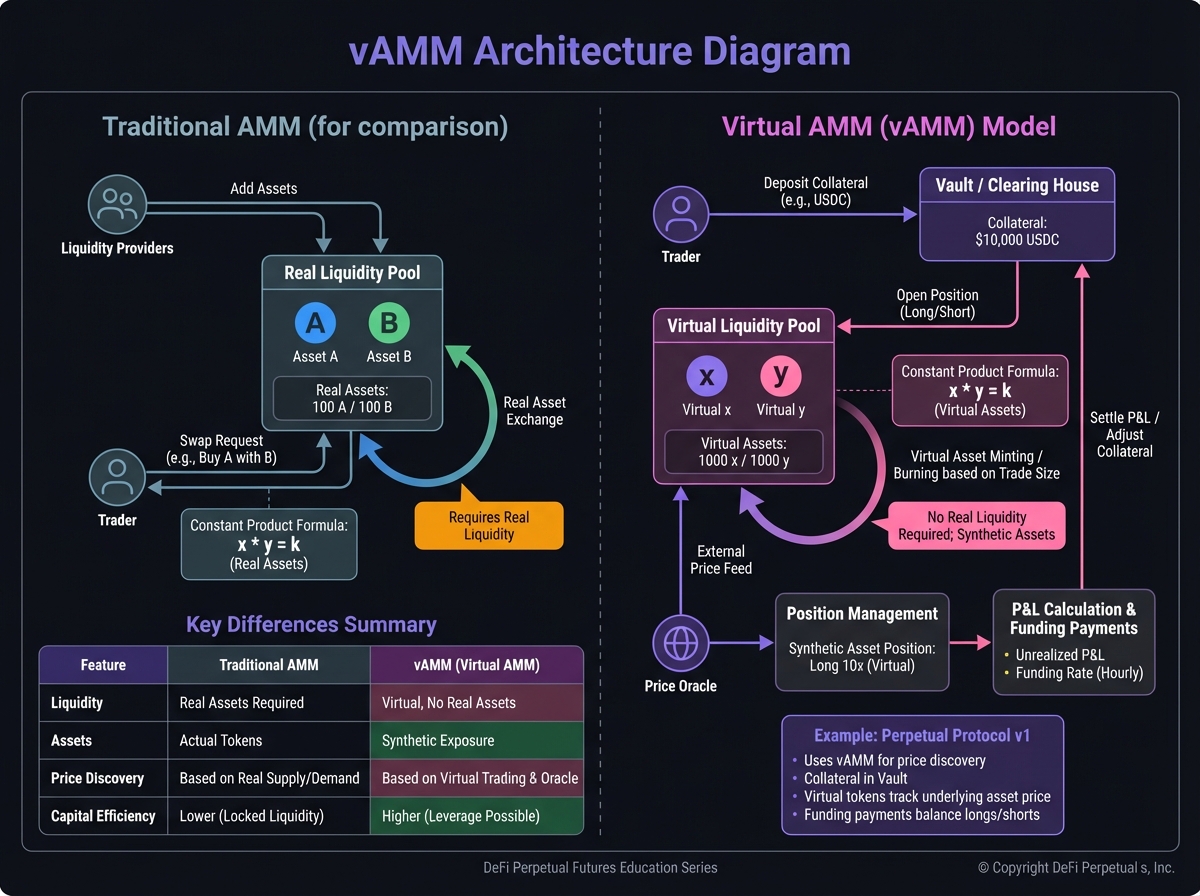

🔄 Model 3: Virtual AMM (vAMM)

How vAMM Works

vAMM Characteristics

Feature

Description

Benefits of vAMM

Risks of vAMM

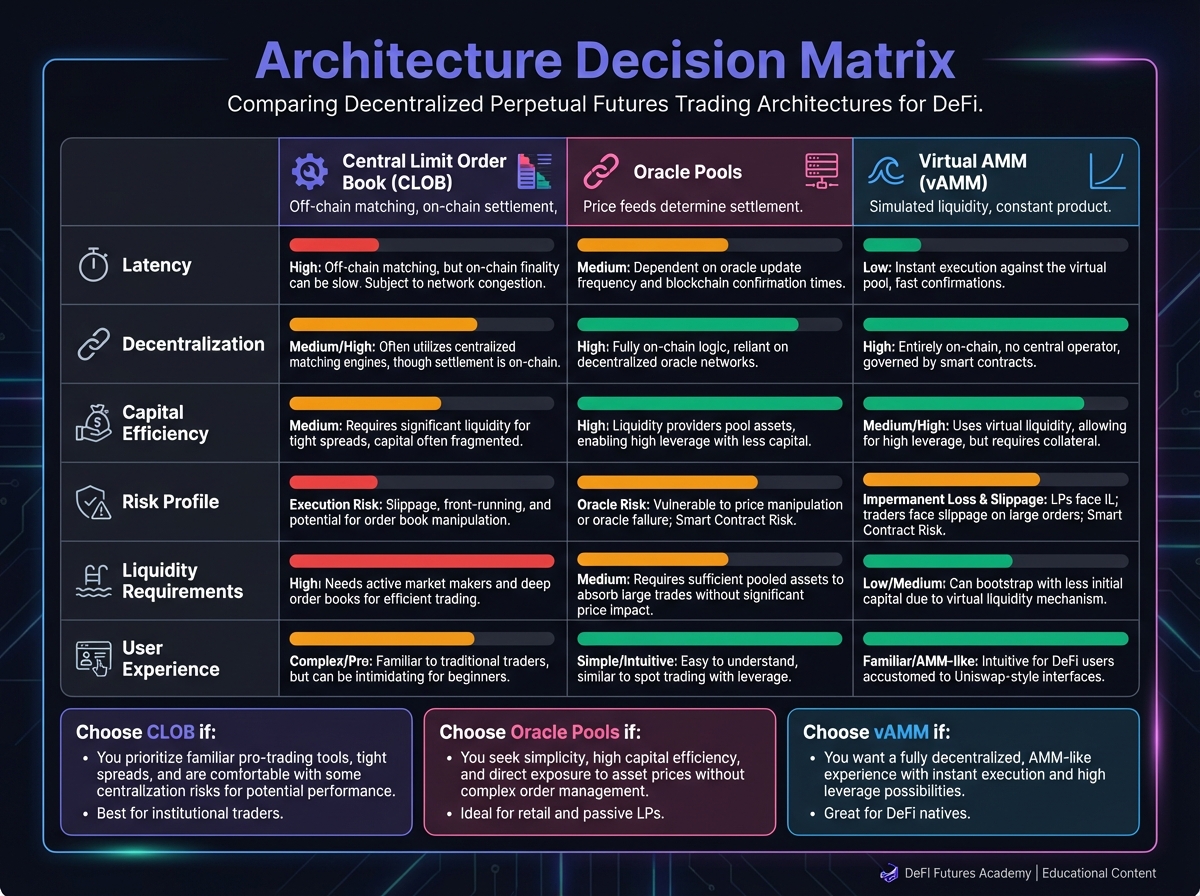

📊 Comparative Analysis Table

Feature

CLOB

Oracle Pools

vAMM

🎓 Beginner's Corner: Which Architecture Should You Choose?

Choose CLOB If:

Choose Oracle Pools If:

Choose vAMM If:

🔬 Advanced Deep-Dive: Hybrid Architectures

Drift Protocol: The Liquidity Trifecta

GMX V2: Isolated Pools

Extended: Unified Margin + CLOB

⚠️ Critical Risk Differences by Architecture

CLOB Risks

Oracle Pool Risks

vAMM Risks

📈 Real-World Examples

Example 1: Large Order on CLOB

Example 2: Large Order on Oracle Pool

Example 3: Funding Rate Arbitrage

🔑 Key Takeaways

🚀 Next Steps

PreviousExercise 2: Calculation Practice and Risk MetricsNextExercise 3: Architecture Analysis and Selection

Last updated