Lesson 8: Alternative Chain Protocols

🎧 Lesson Podcast

🎬 Video Overview

Lesson 8: Alternative Chain Protocols

🎯 Core Concept: The Multi-Chain Perpetual Landscape

Why Alternative Protocols Matter

🌐 Cosmos Ecosystem: dYdX v4

Architecture Overview

How It Works

Use Cases

📱 Arbitrum Ecosystem: EdgeX

Architecture Overview

Mobile-First Advantage

Fee Structure and VIP System

Use Cases

🔷 Starknet Ecosystem: Extended

Architecture Overview

The "No-Bridge" Solution

Unified Margin and Yield-Bearing Collateral

Use Cases

🪐 Solana Ecosystem: Jupiter

Architecture Overview

JLP Pool Mechanics

Atomic Composability

Use Cases

🔶 BNB Chain: Aster Protocol

Architecture Overview

Simple Mode vs. Pro Mode

Trade & Earn Economy

Use Cases

🔷 StarkEx Ecosystem: ApeX Protocol

Architecture Overview

Validium vs. ZK-Rollup

ApeX Omni Evolution

Use Cases

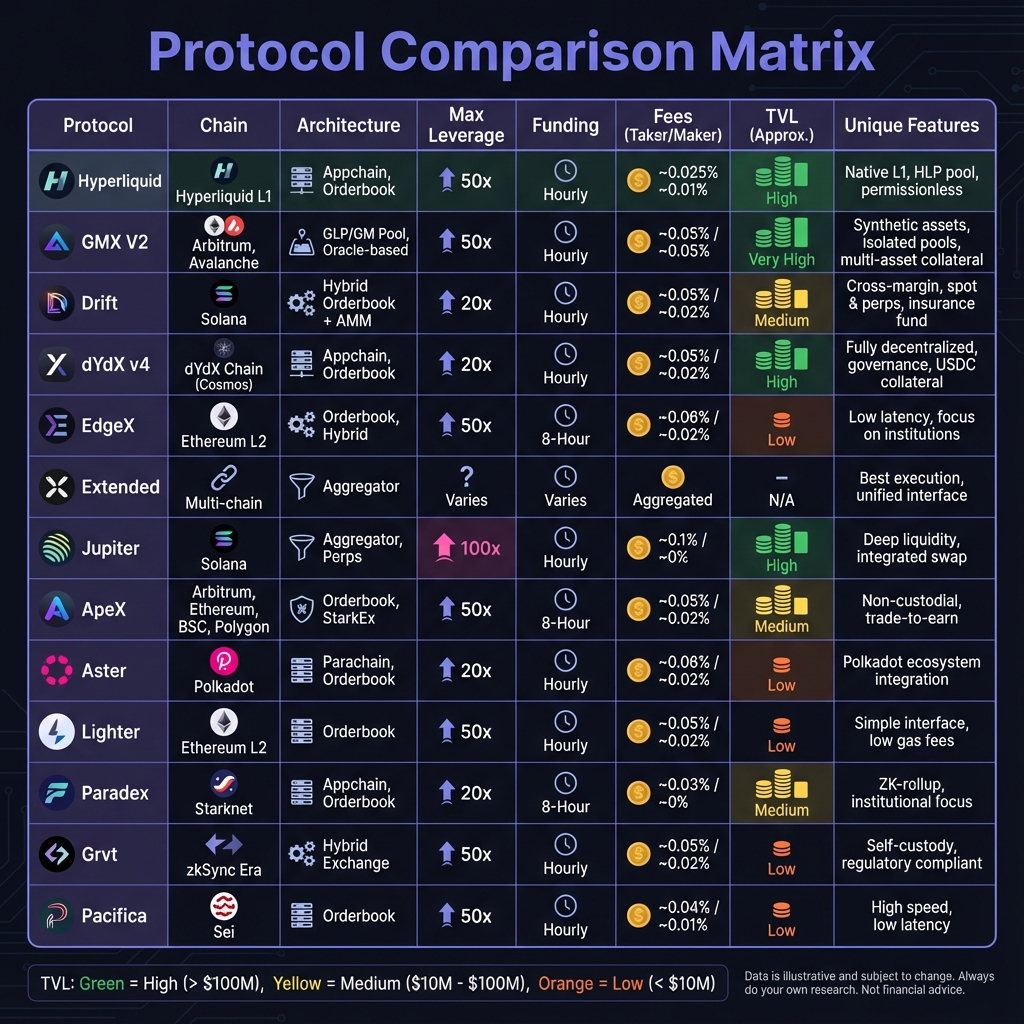

📊 Protocol Comparison Matrix

Protocol

Chain

Architecture

Key Feature

Best For

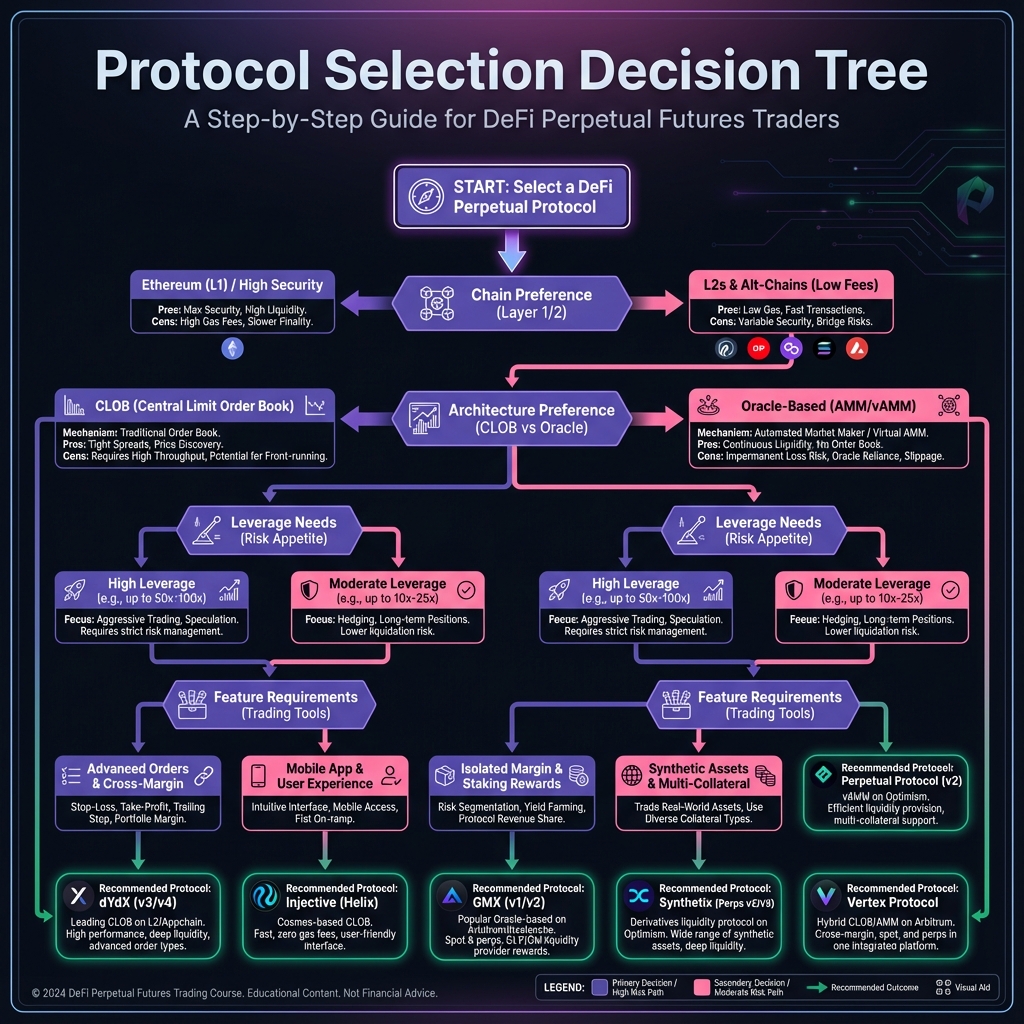

🎓 Beginner's Corner: Choosing an Alternative Protocol

Decision Framework

Risk Considerations

🔬 Advanced Deep-Dive: Emerging Protocols

Lighter.xyz

Paradex

Grvt (ZKsync)

Pacifica Finance

⚠️ Critical Considerations

Liquidity Fragmentation

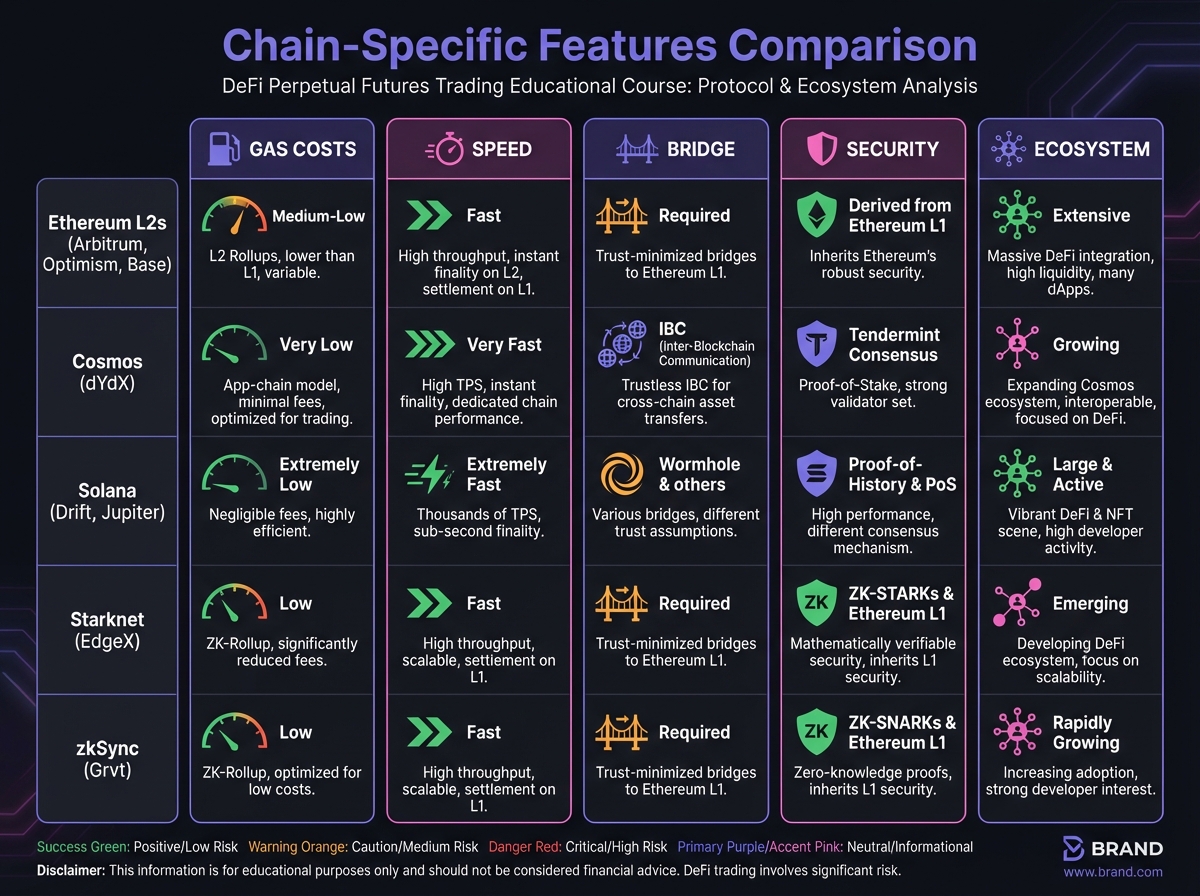

Chain-Specific Risks

Feature Differentiation

📊 Real-World Example: Multi-Protocol Strategy

⚖️ Compare All Protocols

🔑 Key Takeaways

🚀 Next Steps

PreviousExercise 7: Drift Market Creation and Strategy AnalysisNextExercise 8: Multi-Protocol Comparison and Selection

Last updated