Lesson 12: Building Your Professional Trading System

🎯 Core Concept: Systems Over Trades

Why Systems Matter

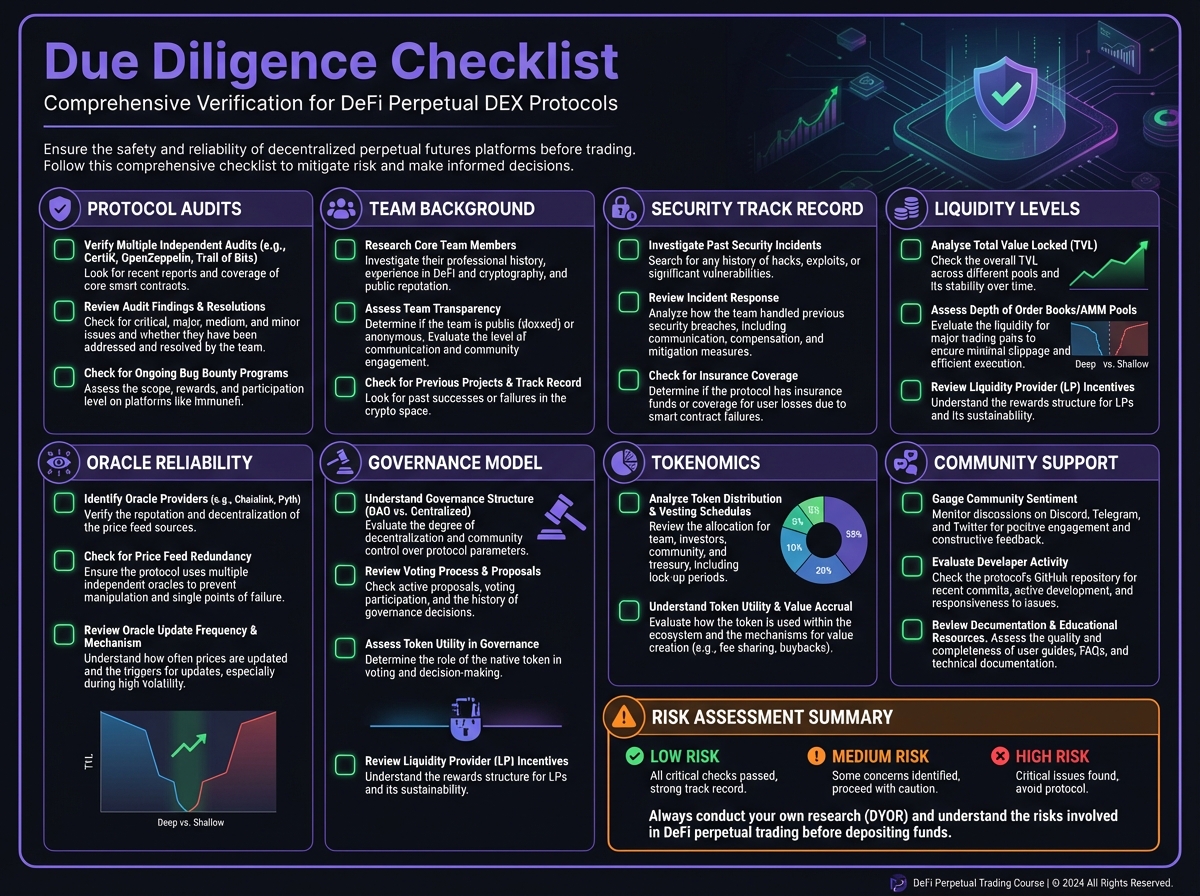

📋 Due Diligence Framework

Protocol Evaluation Checklist

Due Diligence Scorecard

🎧 Lesson Podcast

🎬 Video Overview

🎯 Protocol Selection Framework

Decision Matrix

Protocol

Execution

Liquidity

Fees

Features

Chain

Risk

Total

Multi-Protocol Strategy

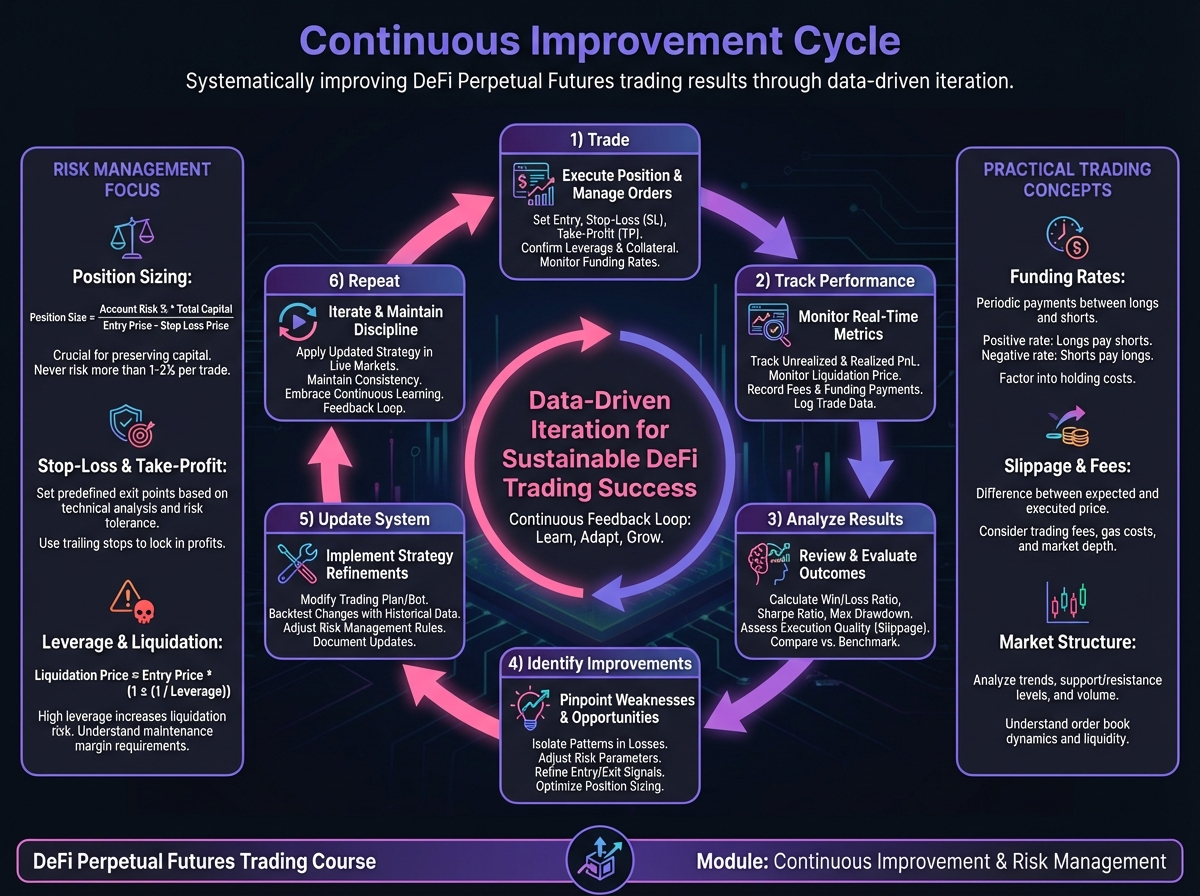

💰 Risk Management Framework

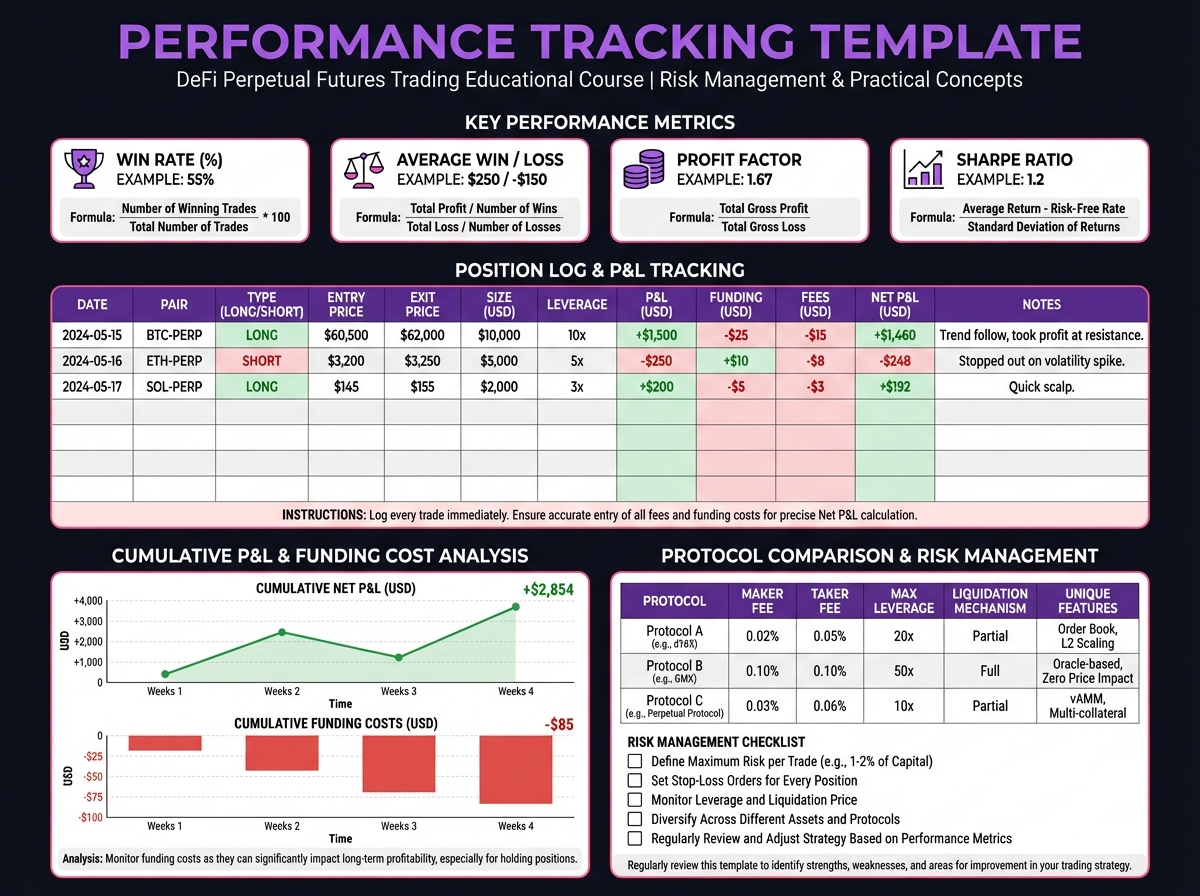

Position Sizing Rules

Leverage Guidelines

Stop Loss Rules

📊 Portfolio Construction

Diversification Strategy

Correlation Management

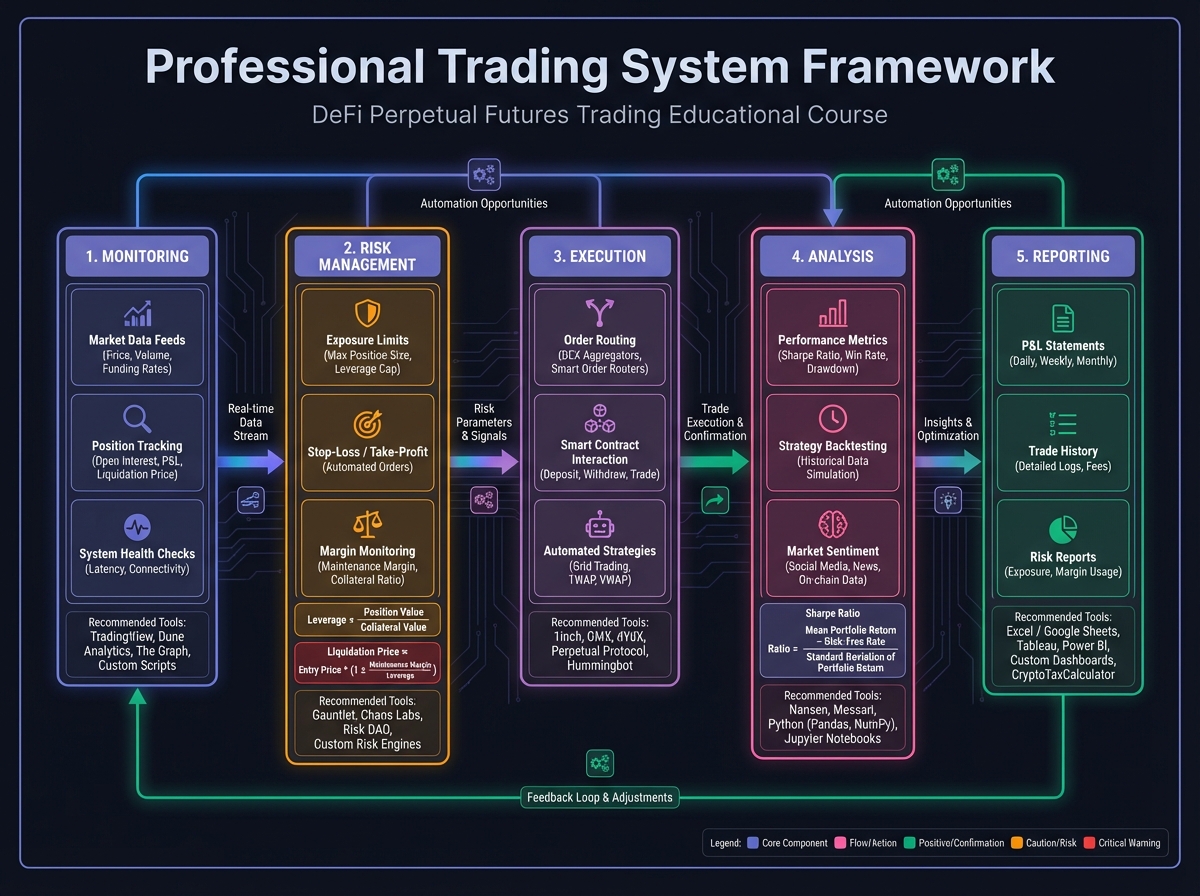

📈 Monitoring and Analytics

Key Metrics to Track

Monitoring Schedule

Alert System

🔄 Continuous Improvement Process

Trade Journal

Performance Review

System Refinement

🎓 Beginner's Corner: Your First System

Simple Starter System

🔬 Advanced Deep-Dive: Professional Systems

Multi-Strategy Framework

Automated Systems

Institutional-Grade Monitoring

📊 Real-World Example: Complete System

🔑 Key Takeaways

🚀 Next Steps

Last updated