Exercise 11: Governance Participation and Yield Maximization

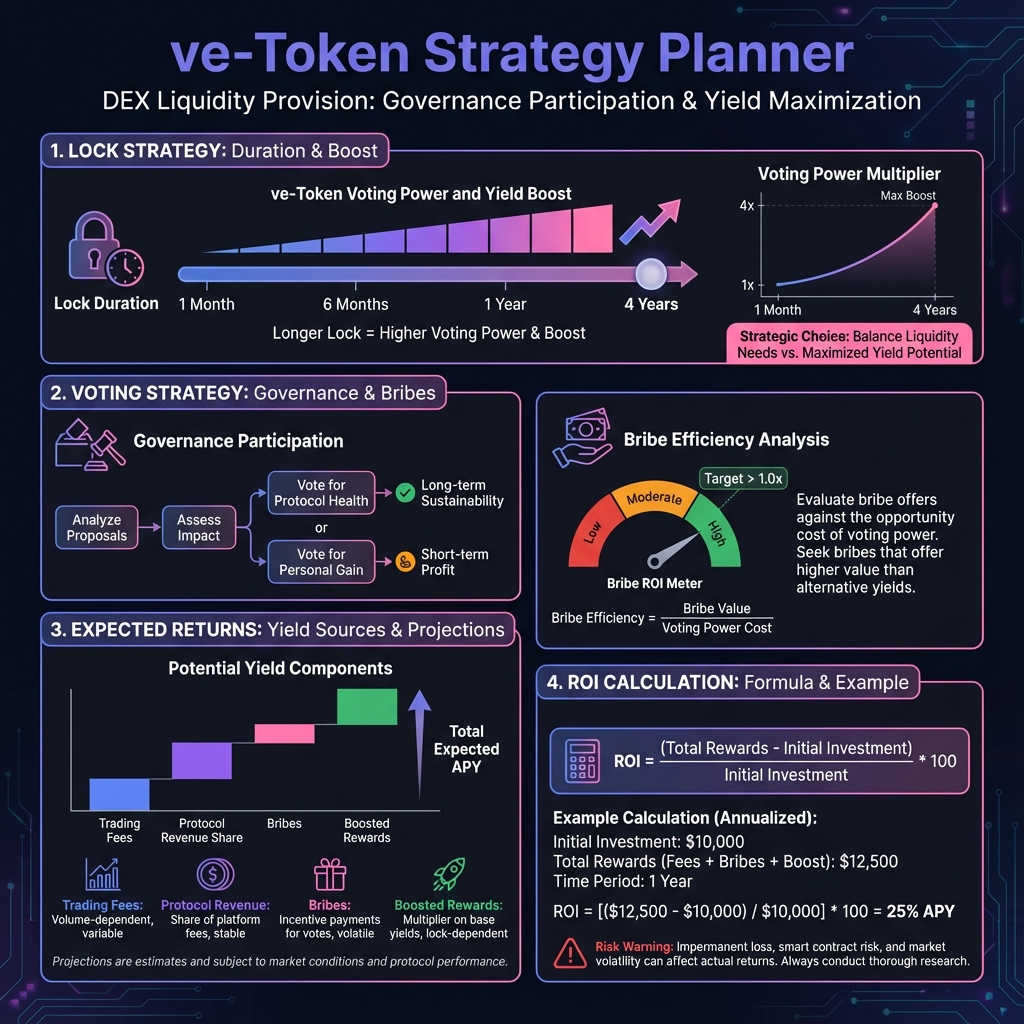

🗳️ Phase 1: ve-Token Strategy Design (20 minutes)

Lock Strategy

Voting Strategy

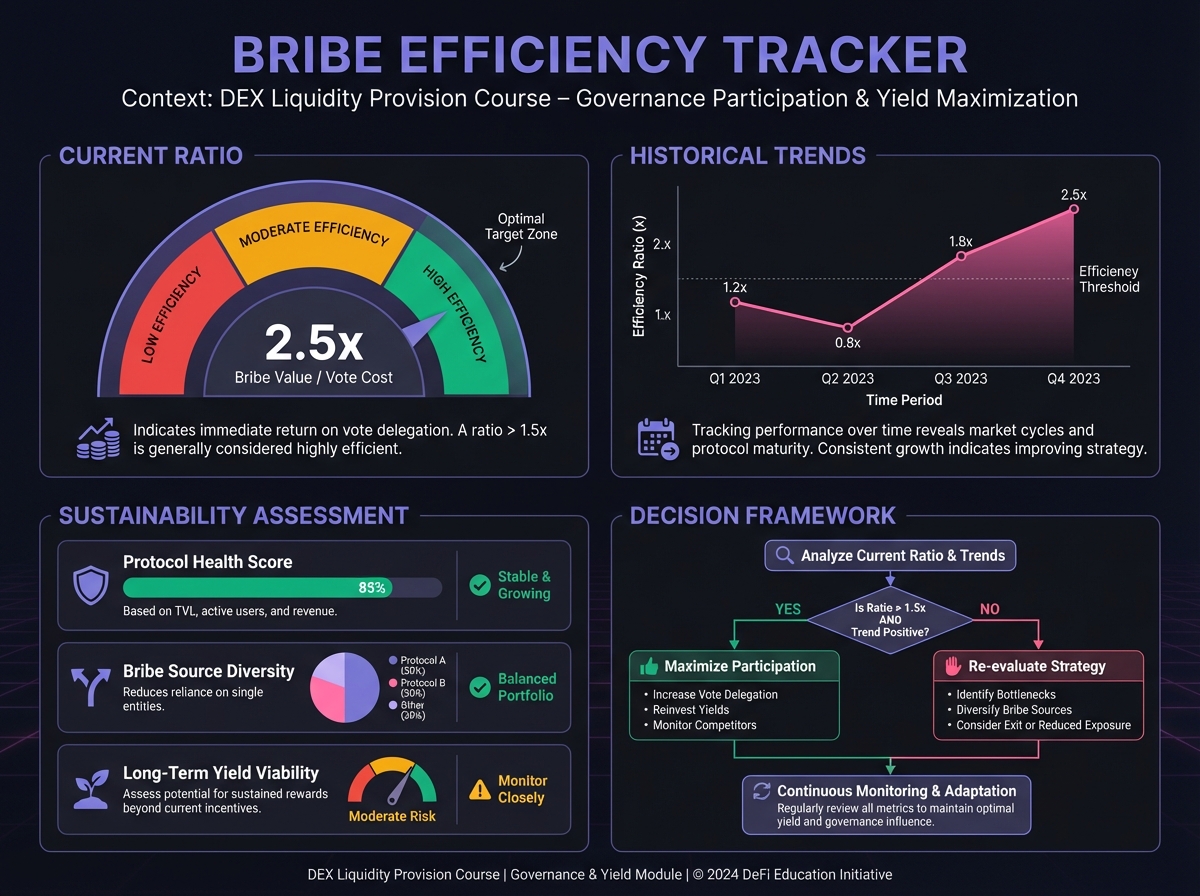

💰 Phase 2: Bribe Efficiency Analysis (20 minutes)

Bribe Market Assessment

Bribe ROI Calculation

📊 Phase 3: Multi-Protocol Governance (15 minutes)

Cross-Protocol Strategy

Governance Time Commitment

🎯 Phase 4: Complete Governance Plan (10 minutes)

Your Governance Strategy

📚 Next Steps

PreviousLesson 11: Governance and Incentive OptimizationNextLesson 12: Building Your Professional LP System

Last updated