Lesson 7: Euler and Advanced Customization

🎧 Lesson Podcast

🎬 Video Overview

Lesson 7: Euler and Advanced Customization

🎯 Core Concept: The Resilient Toolkit

📜 The Evolution: v1 to v2

Euler v1: The Monolithic Era

Euler v2: The Modular Rebirth

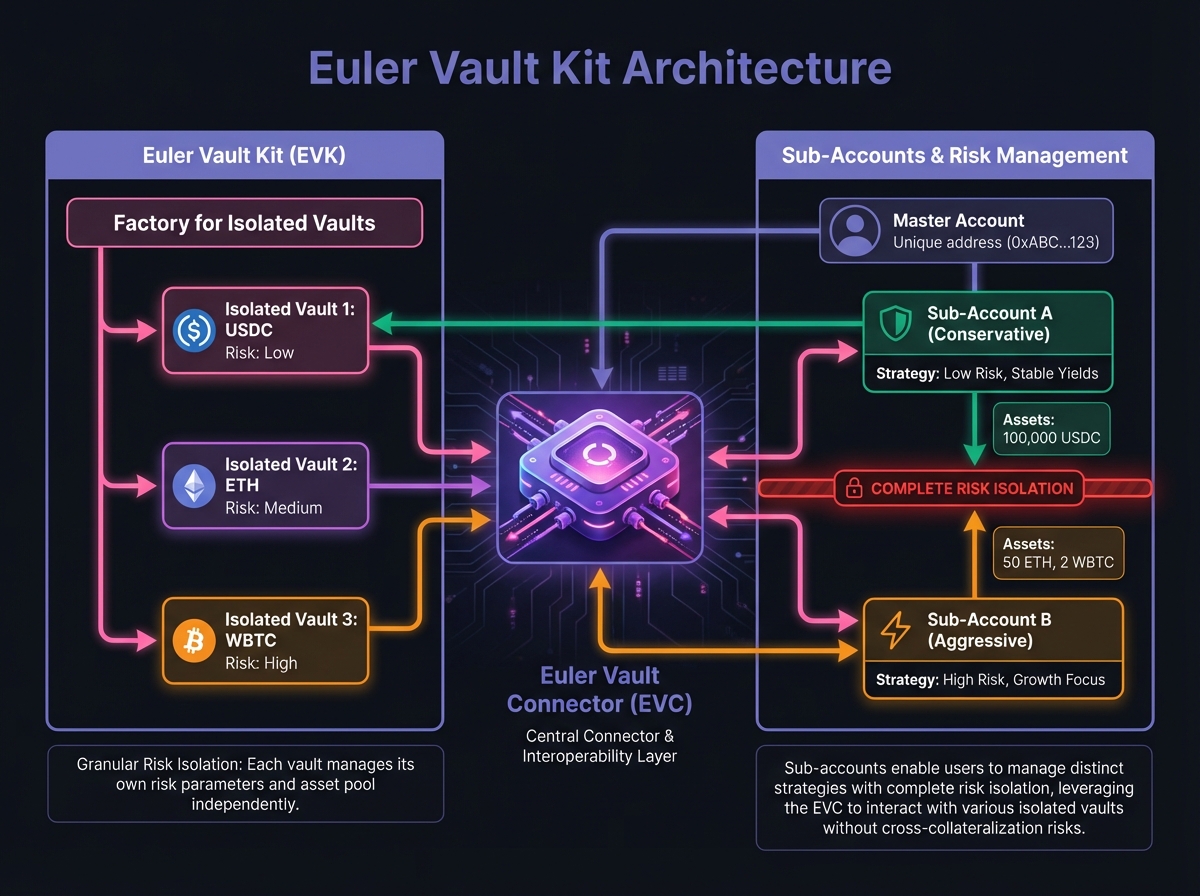

🏗️ The Architecture: EVK and EVC

Euler Vault Kit (EVK)

Ethereum Vault Connector (EVC)

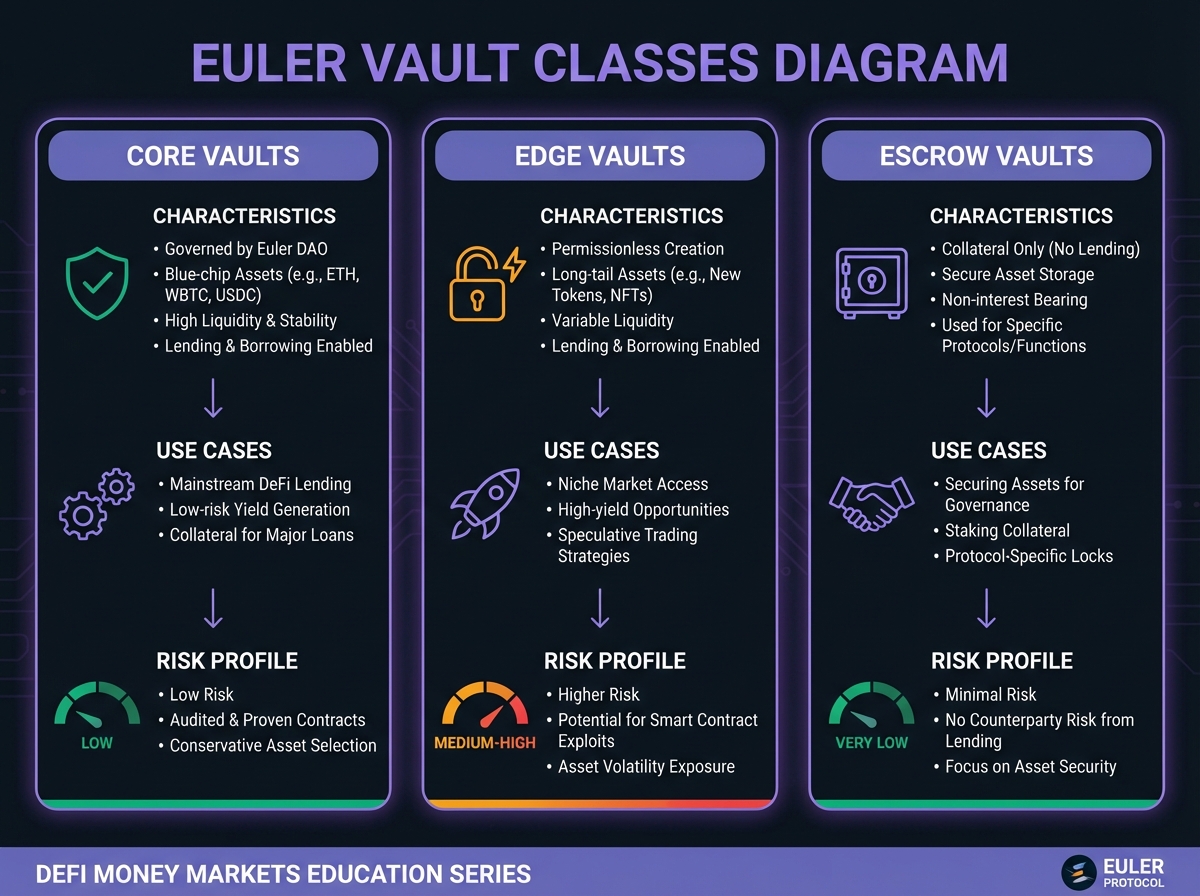

🎛️ Vault Classes: Risk Segmentation

Core Vaults

Edge Vaults

Escrow Vaults

🔒 Managed vs Trustless Vaults

Trustless Vaults

Managed Vaults

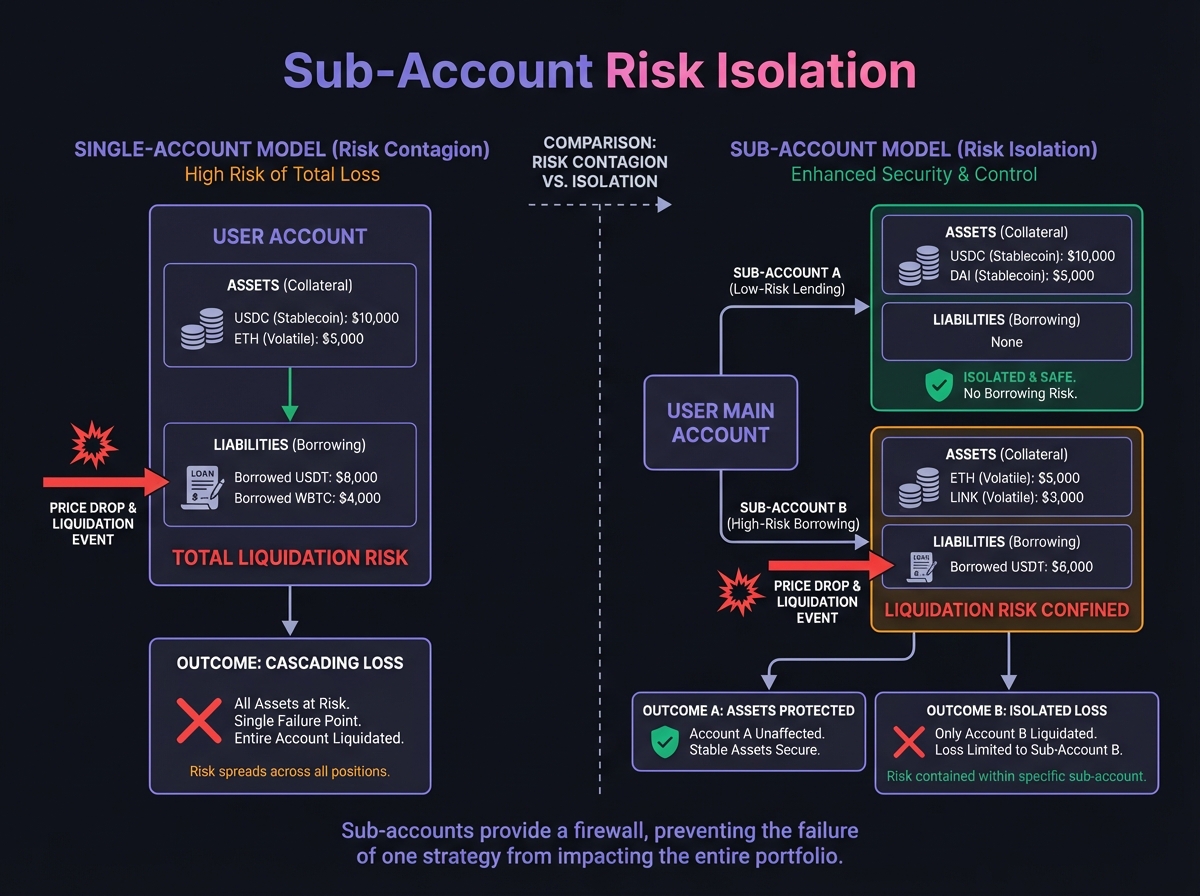

🔐 Sub-Accounts: Granular Risk Isolation

How Sub-Accounts Work

EulerSwap Integration

🛡️ Oracle Freedom

Oracle Agnosticism

⚠️ Operational Considerations

Verified vs Ungoverned Vaults

Due Diligence Checklist

📊 Euler vs Competitors

Feature

Aave

Morpho

Euler v2

🎯 When to Use Euler

Best For:

Not Ideal For:

🚀 Getting Started with Euler

Step 1: Choose a Vault

Step 2: Understand the Vault

Step 3: Use Sub-Accounts

Step 4: Monitor

🎓 Beginner's Corner

🔬 Advanced Deep-Dive: Nested Vaults

How Nesting Works

📈 Real-World Example

🔑 Key Takeaways

🚀 Next Steps

PreviousExercise 6: Morpho Market Analysis and SelectionNextExercise 7: Euler Market Creation and Risk Analysis

Last updated