Lesson 2: The Mathematics of Lending and Borrowing

🎧 Lesson Podcast

🎬 Video Overview

Lesson 2: The Mathematics of Lending and Borrowing

🎯 Core Concept: Math is Your Protection

Understanding the mathematics behind money markets isn't just academic—it's your primary defense against losses. These formulas determine:

How much you can borrow safely

When your position becomes vulnerable to liquidation

What interest rates you'll earn or pay

Whether a position is profitable or dangerous

Master these calculations, and you'll make informed decisions, avoid costly mistakes, and optimize your returns.

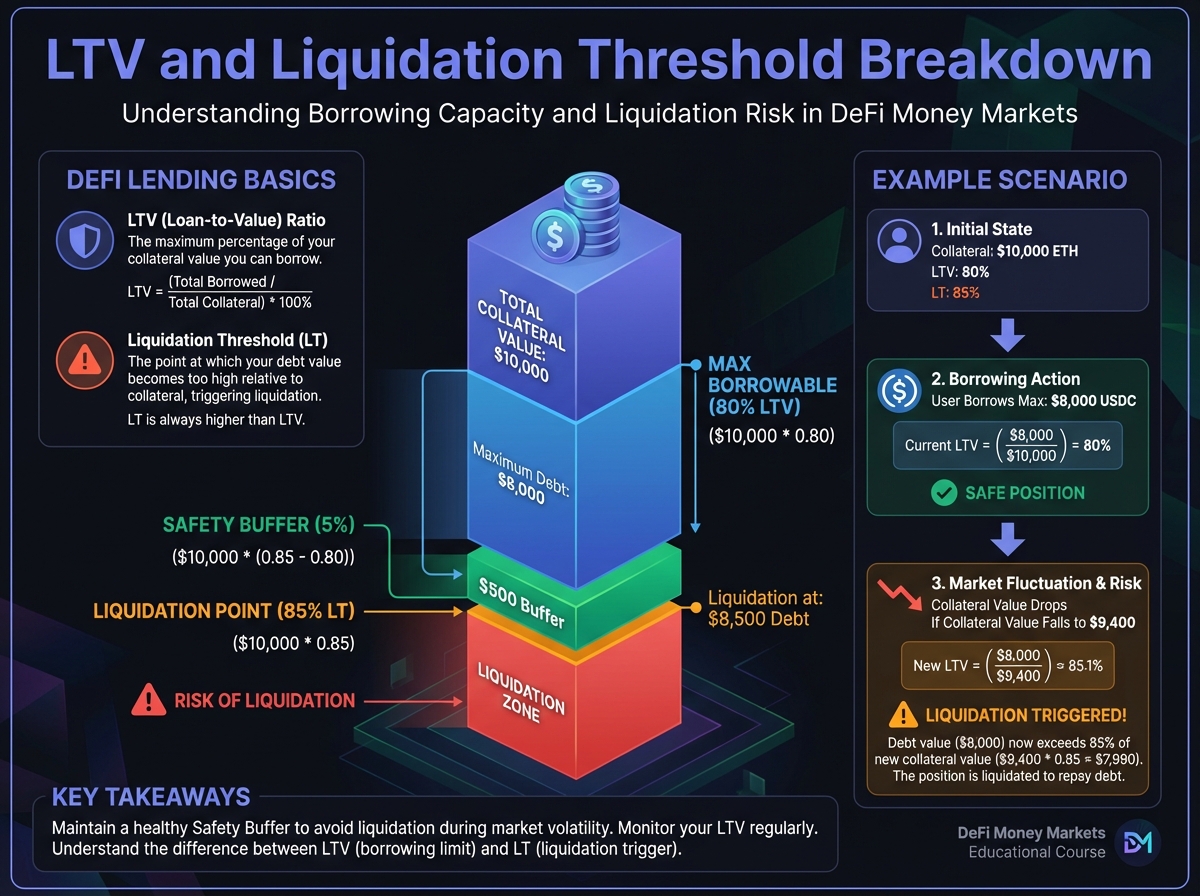

📐 Loan-to-Value (LTV) and Liquidation Threshold (LT)

The Fundamental Metrics

Loan-to-Value (LTV): The maximum borrowing capacity as a percentage of collateral value.

Liquidation Threshold (LT): The safety line—the collateral-to-debt ratio at which liquidation is triggered.

Understanding the Difference

This distinction is critical and often misunderstood by beginners:

LTV = Maximum Borrowing Capacity

If LTV = 80%, you can borrow up to $80 for every $100 of collateral

This is NOT the liquidation point

LT = Liquidation Trigger Point

If LT = 85%, liquidation occurs when your debt equals 85% of collateral value

This is the actual danger line

The Safety Buffer = LT - LTV

Example: ETH Collateral Position

Initial Setup:

Collateral: $10,000 worth of ETH

Maximum LTV: 80%

Liquidation Threshold: 85%

Maximum Borrowing:

Maximum borrow = $10,000 × 0.80 = $8,000

Safety Buffer:

Buffer = $10,000 × (0.85 - 0.80) = $500

This means you have a $500 cushion before liquidation

What Happens as Price Moves:

If ETH drops to $9,500: Collateral value = $9,500, debt = $8,000

Debt ratio = $8,000 ÷ $9,500 = 84.2% (still safe)

If ETH drops to $9,411: Collateral value = $9,411, debt = $8,000

Debt ratio = $8,000 ÷ $9,411 = 85% (LIQUIDATION TRIGGERED)

Why Two Different Numbers?

Protocols use two thresholds to:

Prevent over-borrowing (LTV limit)

Provide liquidation buffer (LT allows for price movement between checks)

The gap between LTV and LT gives liquidators time to act before the protocol becomes insolvent.

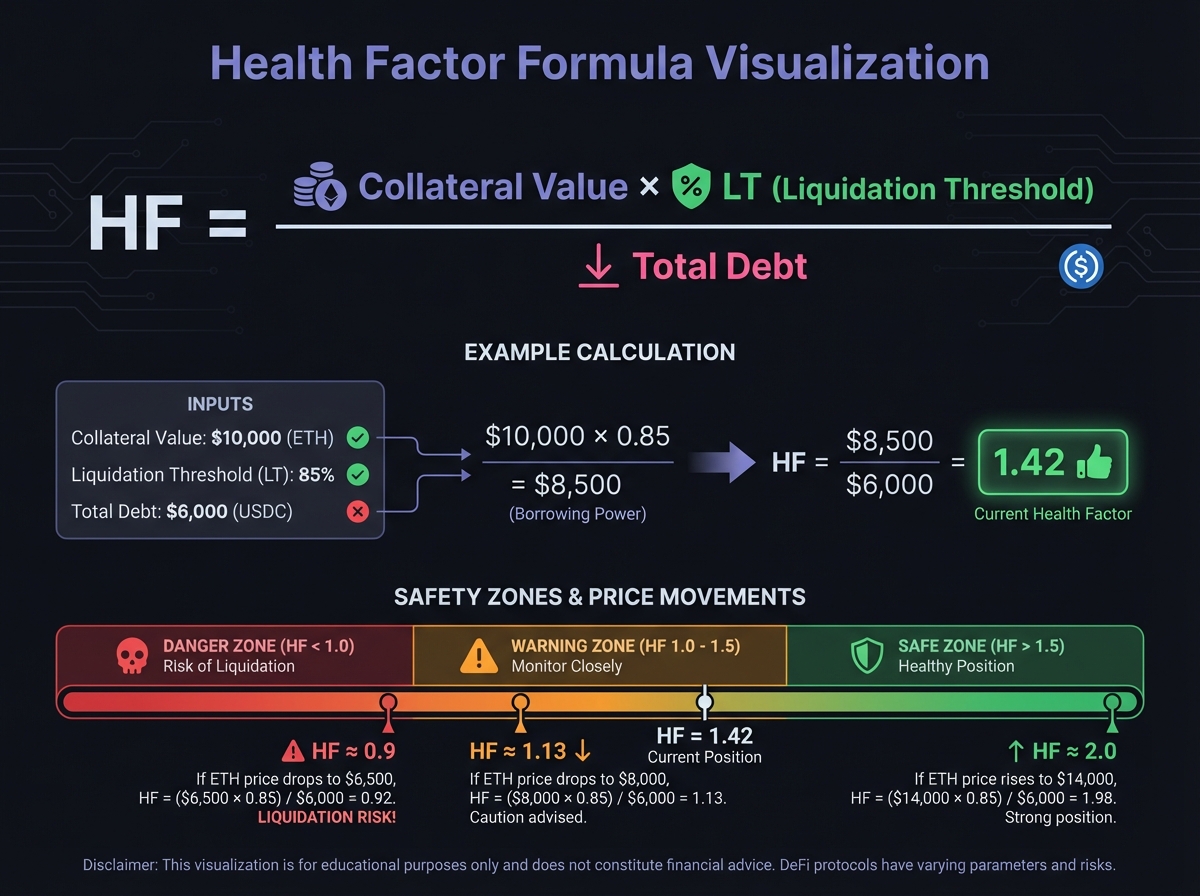

🔢 Health Factor: Your Safety Score

The Health Factor Formula

The Health Factor (HF) is the single most important metric when borrowing:

HealthFactor=TotalDebtCollateralValue×LiquidationThreshold

Interpreting Health Factor

HF > 1.0: Position is safe

HF = 2.0: Can withstand ~50% collateral price drop

HF = 1.5: Can withstand ~33% collateral price drop

HF = 1.1: Danger zone—any small price movement risks liquidation

HF ≤ 1.0: Position is liquidatable

HF = 1.0: Exactly at liquidation threshold

HF < 1.0: Position is underwater (should have been liquidated)

Strategic Health Factor Targets

For Beginners: HF > 2.0

Provides substantial buffer against volatility

Allows you to sleep at night

Reduces stress and monitoring frequency

For Active Traders: HF = 1.5 - 2.0

Higher capital efficiency

Requires active monitoring

Acceptable for experienced users

Danger Zone: HF < 1.3

High liquidation risk

Requires constant vigilance

Not recommended for beginners

Calculating Health Factor: Step-by-Step

Scenario: You deposit ETH and borrow USDC

Initial Position:

Collateral: 5 ETH @ $2,000/ETH = $10,000

Borrowed: $6,000 USDC

Liquidation Threshold: 85%

Health Factor Calculation: HF=$6,000$10,000×0.85=$6,000$8,500=1.42

Interpretation: HF = 1.42 means the collateral can drop ~30% before liquidation.

What Happens if ETH Drops to $1,500?

New collateral value: 5 ETH × $1,500 = $7,500

Debt remains: $6,000 (plus accrued interest)

New HF = ($7,500 × 0.85) ÷ $6,000 = $6,375 ÷ $6,000 = 1.06

Status: Still safe but approaching danger zone. You should consider adding collateral or repaying debt.

Health Factor with Multiple Collaterals

When you have multiple collateral types, the formula aggregates:

HF=TotalDebt∑(Collaterali×LTi)

Example:

Collateral 1: 3 ETH @ $2,000, LT = 85% → $5,100 effective

Collateral 2: $4,000 USDC, LT = 90% → $3,600 effective

Total Debt: $7,000 USDC

HF=$7,000$5,100+$3,600=$7,000$8,700=1.24

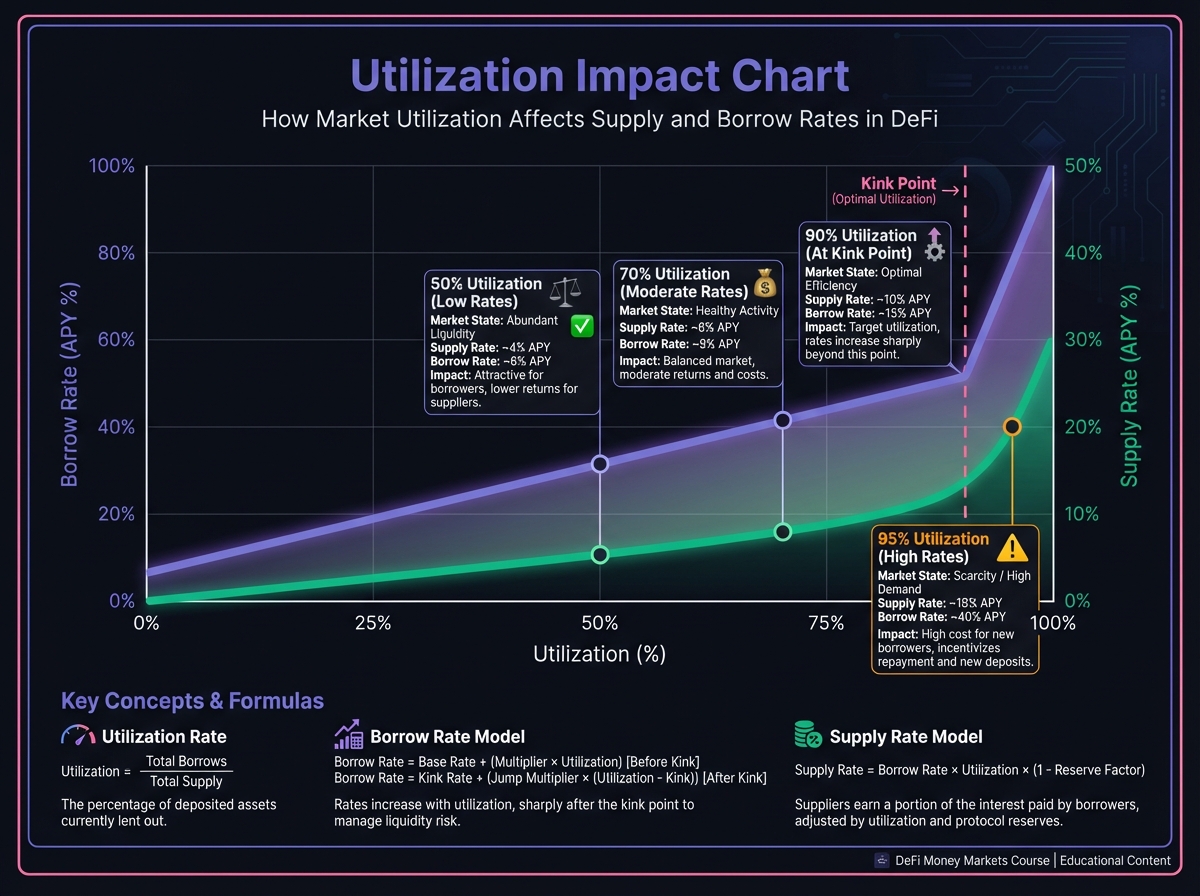

💧 Utilization Rate and Interest Rate Curves

What is Utilization Rate?

Utilization Rate (U) = The percentage of supplied assets currently borrowed:

U=TotalSuppliedTotalBorrowed×100%

Example:

Pool has 100 USDC supplied

60 USDC is borrowed

Utilization = 60 ÷ 100 = 60%

Why Utilization Matters

Utilization directly drives interest rates through the interest rate model:

Low utilization (< 50%): Lower rates (less demand, more supply)

Medium utilization (50-80%): Moderate rates (balanced)

High utilization (> 80%): Higher rates (high demand, low supply)

Very high utilization (> 90%): Extremely high rates (liquidity crisis warning)

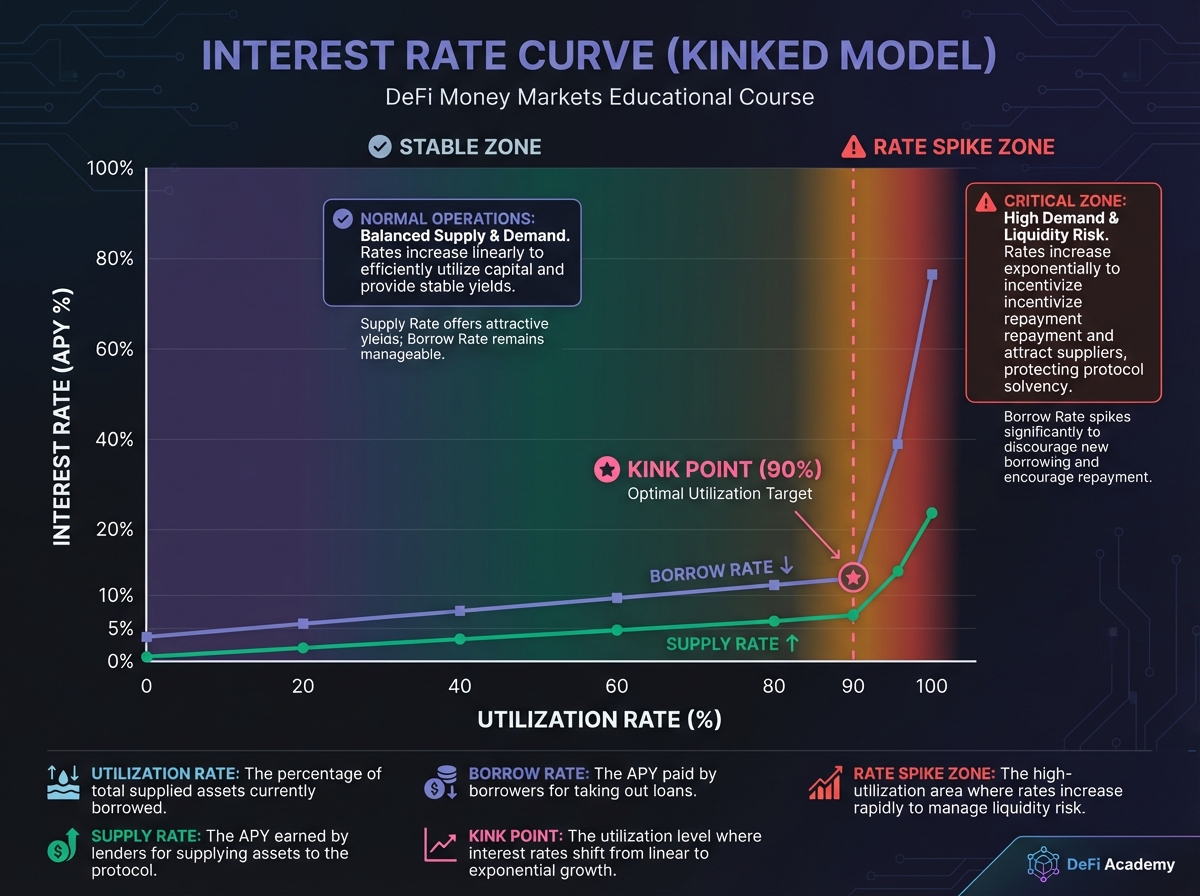

The "Kinked" Interest Rate Model

Most protocols use a kinked curve with two distinct phases:

Phase 1: Below the Kink (e.g., U < 90%)

Linear or gentle slope

Supply rate: 2-5% APY

Borrow rate: 5-8% APY

Stable and predictable

Phase 2: Above the Kink (U > 90%)

Exponential spike

Supply rate: 10-50%+ APY

Borrow rate: 50-200%+ APY

Designed to incentivize repayments

Example: Interest Rate Curve

Below Kink (U = 70%):

Supply rate: 4% APY

Borrow rate: 6% APY

Spread: 2% (to protocol reserves)

At Kink (U = 90%):

Supply rate: 5% APY

Borrow rate: 8% APY

Spread increases

Above Kink (U = 95%):

Supply rate: 15% APY

Borrow rate: 50% APY

Massive spread to attract liquidity

The Liquidity Freeze Risk

Critical Risk: If utilization reaches 100%, lenders cannot withdraw until borrowers repay.

Example Scenario:

Pool has $1M USDC supplied

$1M USDC borrowed

Utilization = 100%

You try to withdraw $10,000

Result: Transaction fails—no liquidity available

Protection Mechanisms:

Interest rate spikes incentivize repayments

High rates attract new deposits

Reserve funds (if protocol has them)

Utilization caps (max borrowing limits)

📊 Interest Rate Calculations

How Supply Rates Work

When you lend assets, you earn interest based on:

Utilization rate (how much is borrowed)

Borrow rate (what borrowers pay)

Reserve factor (protocol's cut)

Simplified Formula: SupplyRate=BorrowRate×Utilization×(1−ReserveFactor)

Example:

Borrow rate: 8% APY

Utilization: 75%

Reserve factor: 10% (protocol keeps 10%)

SupplyRate=8%×0.75×0.90=5.4%APY

How Borrow Rates Work

Borrow rates are determined by the interest rate model based on utilization:

Linear Model (simplified): BorrowRate=BaseRate+(Utilization×Slope)

Kinked Model (most common):

Below kink: Lower slope

Above kink: Steeper slope (exponential)

Accrued Interest Calculation

Interest accrues continuously, not daily or monthly.

For Lenders:

Your balance grows automatically

aToken balance increases over time

Compound effect: You earn interest on interest

For Borrowers:

Your debt increases over time

Interest compounds

Must repay principal + accrued interest

Example: Borrowing $10,000 at 6% APY:

After 1 month: Debt = $10,000 × (1 + 0.06/12) = $10,050

After 6 months: Debt = $10,000 × (1 + 0.06/2) = $10,300

After 1 year: Debt = $10,000 × 1.06 = $10,600

Key Insight: If you don't monitor your position, the debt grows even if collateral price stays the same.

🔮 The Role of Oracles

What Are Oracles?

Oracles are bridges between off-chain price data and on-chain smart contracts. They feed real-world price information (like ETH/USD) to the protocol.

Oracle Types

1. Chainlink (Push-Based)

Updates pushed to chain regularly

Industry standard for Ethereum

Highly secure and reliable

Updates every few hours or minutes

2. Pyth Network (Pull-Based)

Updates on-demand when needed

Used for high-frequency chains (Solana, Sui)

Lower latency for fast transactions

More efficient for high-throughput networks

3. Redstone (On-Demand)

Pull-based oracle

Used by some protocols for flexibility

Can provide custom data feeds

Oracle Risk

The Risk: If an oracle provides incorrect price data, the protocol makes decisions based on wrong information.

Attack Vector: Oracle manipulation via flash loans

Attacker takes large flash loan

Manipulates price on low-liquidity DEX

Oracle reads manipulated price

Protocol liquidates positions incorrectly

Attacker profits from liquidations

Protection Mechanisms:

Multiple oracle sources (e.g., Chainlink + Uniswap TWAP)

Price staleness checks (reject old prices)

Confidence intervals (require price consensus)

Circuit breakers (pause if price moves too fast)

Why Oracle Choice Matters

Different protocols use different oracles, which affects risk:

Chainlink: Most secure, but updates may lag during volatility Pyth: Fast updates, good for high-frequency chains TWAP: Smooths out manipulation but may lag behind market

For Beginners: Prefer protocols using established oracles (Chainlink) with multiple data sources.

🧮 Complete Calculation Example

Let's work through a complete example:

Initial Position Setup:

You deposit: 10 ETH @ $2,000/ETH = $20,000 collateral

Protocol parameters:

LTV: 75%

Liquidation Threshold: 80%

Interest: 5% APY borrow rate

Step 1: Calculate Maximum Borrow

Max borrow = $20,000 × 0.75 = $15,000

Step 2: Decide Borrowing Amount

You borrow: $10,000 USDC (conservative, 50% of max)

Step 3: Calculate Initial Health Factor HF=$10,000$20,000×0.80=$10,000$16,000=1.60

Step 4: After 6 Months

Scenario A: ETH Price Stable

Collateral: Still 10 ETH @ $2,000 = $20,000

Debt: $10,000 × (1 + 0.05/2) = $10,250

New HF = ($20,000 × 0.80) ÷ $10,250 = 1.56

Scenario B: ETH Rises 25%

Collateral: 10 ETH @ $2,500 = $25,000

Debt: $10,250

New HF = ($25,000 × 0.80) ÷ $10,250 = 1.95 ✅ Safer

Scenario C: ETH Drops 30%

Collateral: 10 ETH @ $1,400 = $14,000

Debt: $10,250

New HF = ($14,000 × 0.80) ÷ $10,250 = 1.09 ⚠️ Danger zone

Analysis:

Scenario A: Position safe, slight HF decline from interest

Scenario B: Position safer, can borrow more or enjoy buffer

Scenario C: Must take action—add collateral or repay debt

🎓 Beginner's Corner: Common Math Mistakes

Mistake 1: Confusing LTV with liquidation threshold

Wrong: "LTV is 80%, so I'll get liquidated at 80%"

Right: Liquidation occurs at the LT (often 85%), not LTV

Mistake 2: Ignoring accrued interest

Wrong: "My debt stays the same"

Right: Debt grows continuously. A 5% APY borrow rate means ~0.42% monthly increase

Mistake 3: Not accounting for price volatility

Wrong: "ETH won't drop 50%"

Right: Crypto is volatile. A 50% drop in a day is possible. Calculate HF at worst-case scenarios

Mistake 4: Misunderstanding utilization

Wrong: "High utilization means I earn more" (true but risky)

Right: High utilization means higher rates but also higher risk of liquidity freezes

Mistake 5: Not monitoring Health Factor

Wrong: "I'll check it monthly"

Right: Monitor daily or use alerts. Prices can move fast, and interest accrues continuously.

🔬 Advanced Deep-Dive: Dynamic Interest Rates

Adaptive Interest Rate Models

Some protocols (like Morpho) use adaptive curves that adjust automatically:

Target Utilization: The protocol targets a specific utilization (e.g., 90%)

Mechanism:

If utilization > target: Curve shifts up, rates increase

If utilization < target: Curve shifts down, rates decrease

This maintains consistent utilization levels

Formula (simplified): BorrowRate=Base+(Utilization−Target)×Sensitivity

Result: Markets maintain high utilization (efficient capital use) while keeping rates reasonable.

Compounding Frequency

Interest can compound at different frequencies:

Continuous Compounding (most DeFi):

Interest accrues every block

Formula: $A = P \times e^{rt}$

Most accurate representation

Block-by-Block:

Interest calculated per block

Updates continuously

Standard for on-chain protocols

Daily Compounding:

Interest calculated daily

Less accurate but simpler

Rare in modern DeFi

📈 Real-World Calculation: Aave USDC Market

Market State:

Total Supplied: $500,000,000 USDC

Total Borrowed: $350,000,000 USDC

Utilization: 70%

Interest Rates (at 70% utilization):

Supply APY: 4.5%

Borrow APY: 6.5%

Spread: 2% (to Aave reserves)

Your Position:

You supply: $10,000 USDC

Daily earnings: $10,000 × 0.045 ÷ 365 = $1.23/day

Monthly earnings: $1.23 × 30 = $37/month

Annual earnings: $450/year

If Utilization Spikes to 95%:

Supply APY: 12% (estimated)

Borrow APY: 45% (estimated)

Your new daily earnings: $10,000 × 0.12 ÷ 365 = $3.29/day

Trade-off: Higher yields but increased risk of liquidity freeze if utilization hits 100%.

🔧 Interactive Tools

Interactive Health Factor Calculator

Practice calculating Health Factor, LTV, and liquidation prices with this interactive tool:

Launch Lending Borrowing Calculator →

🔑 Key Takeaways

LTV vs LT: LTV is maximum borrowing; LT is liquidation trigger—they're different!

Health Factor is your safety score—keep it > 1.5 (ideally > 2.0)

Utilization drives rates: High utilization = high yields but high risk

Interest accrues continuously: Debt grows even if prices don't move

Oracles are critical: Wrong prices lead to wrong liquidations

Monitor regularly: Prices and interest change constantly

🚀 Next Steps

Now that you understand the mathematics, Lesson 3 will show you the risks in detail—liquidation mechanics, how to protect yourself, and what to avoid.

Complete Exercise 2 to practice these calculations and build your mathematical intuition.

Remember: Math protects your capital. Master these formulas, and you'll make informed decisions. Ignore them, and you'll risk liquidation or miss profitable opportunities.

← Back to Summary | Next: Exercise 2 → | Previous: Lesson 1 ←

Last updated